Student loan debt forgiveness has emerged as a contentious issue, igniting a heated debate over its potential consequences and the fairness of relieving borrowers of their financial burdens. This article delves into the complexities of student loan debt forgiveness, examining its impact on borrowers, the economy, and the higher education system.

The staggering statistics surrounding student loan debt paint a grim picture: millions of Americans are burdened with overwhelming debt, hindering their ability to pursue homeownership, start families, and build financial security. This article explores the factors that have contributed to this crisis, including the rising cost of tuition and the decline in government funding for higher education.

Student Loan Debt Crisis Overview: Student Loan Debt Forgiveness

The student loan debt crisis in the United States has reached unprecedented levels, leaving millions of borrowers struggling to repay their loans and facing financial hardship.

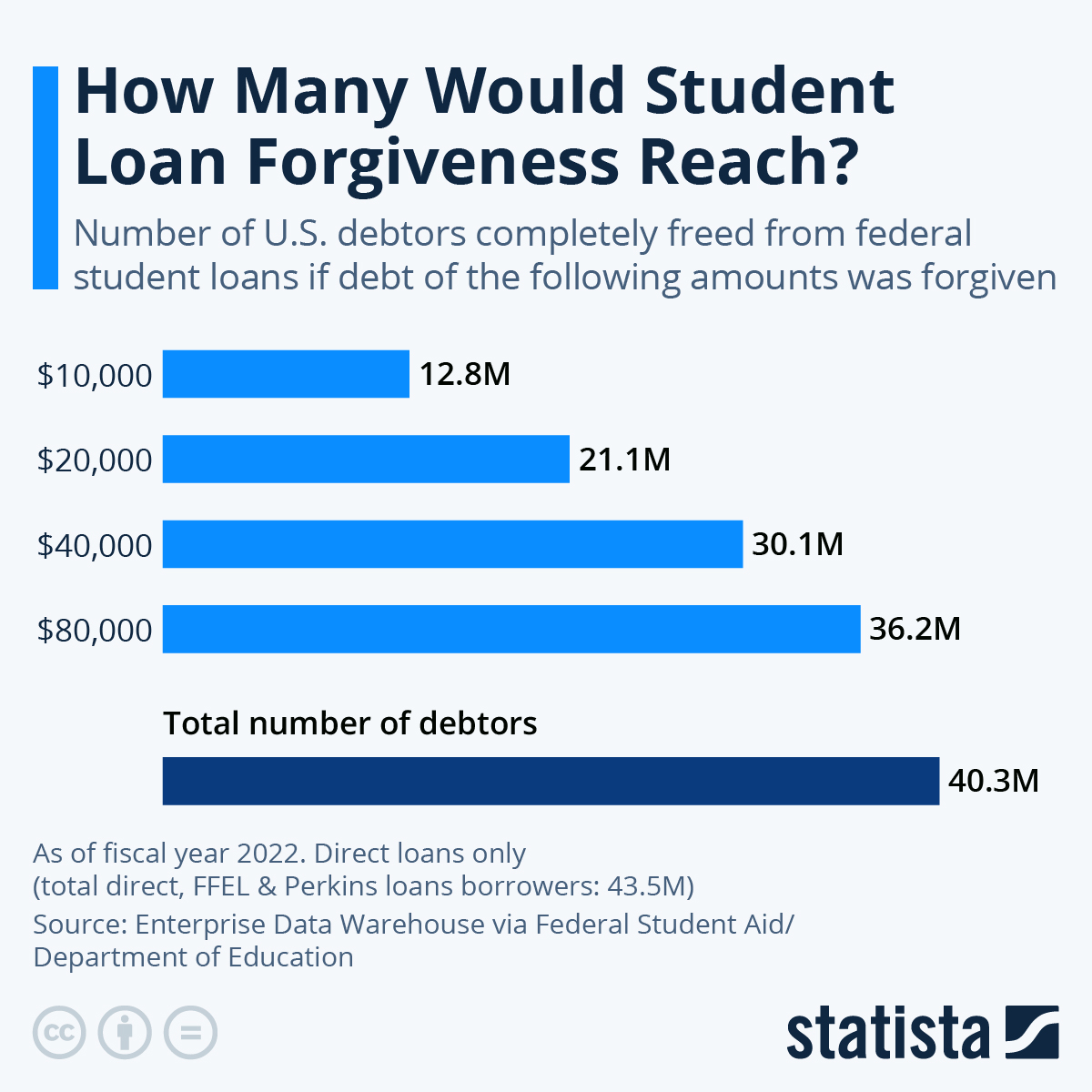

As of 2023, the total outstanding student loan debt in the US exceeds $1.7 trillion, distributed among over 45 million borrowers. The average debt per borrower is approximately $37,000, with many individuals carrying balances of $100,000 or more.

Factors Contributing to the Rise in Student Loan Debt

The surge in student loan debt is attributed to several factors, including:

- Increasing Cost of College Tuition: The cost of attending college has been rising steadily for decades, outpacing inflation and making it more challenging for students to afford higher education without taking on debt.

- Decline in Government Funding for Higher Education: Federal and state governments have reduced their funding for public colleges and universities, leading to higher tuition costs and increased reliance on student loans.

- Expansion of Student Loan Programs: The federal government has expanded student loan programs, making it easier for students to borrow money to cover educational expenses.

Impact of Student Loan Debt on Borrowers

The burden of student loan debt has become a significant financial and emotional challenge for millions of Americans. The weight of these loans can have far-reaching consequences, affecting borrowers’ financial well-being, life decisions, and overall mental health.

The financial impact of student loan debt is undeniable. High interest rates, long repayment terms, and the lack of affordable repayment options make it difficult for many borrowers to repay their loans. This can lead to a cycle of debt, where borrowers struggle to make their monthly payments and end up owing more than they initially borrowed.

Student loan debt forgiveness has been a hot topic in recent years, and the Biden administration has made some progress on this front. While there is still much work to be done, these actions are a step in the right direction towards addressing the burden of student loan debt that many Americans face.

Financial Impact

- High interest rates can significantly increase the total amount of money a borrower owes over time.

- Long repayment terms can stretch out the repayment process for decades, making it difficult for borrowers to move on with their financial lives.

- The lack of affordable repayment options can make it impossible for borrowers to make meaningful progress towards repaying their loans.

Emotional Impact

- The stress of managing student loan debt can take a toll on borrowers’ mental health, leading to anxiety, depression, and stress.

- The financial burden of student loan debt can also lead to relationship problems and family conflict.

- The shame and stigma associated with student loan debt can make it difficult for borrowers to seek help or talk about their financial struggles.

Economic Impact

- The student loan debt crisis is having a significant impact on the economy, reducing consumer spending and increasing income inequality.

- Borrowers who are struggling to repay their loans are less likely to buy homes, start businesses, or save for retirement.

- The student loan debt crisis is also contributing to the widening wealth gap between those who have a college degree and those who do not.

Government Programs for Student Loan Forgiveness

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/L4LI4EI6CZGOFIL47BQVBCQJWA.jpg)

The federal government offers several programs that provide student loan forgiveness to eligible borrowers. These programs are designed to help borrowers who have difficulty repaying their student loans due to financial hardship or other circumstances.

The student loan debt crisis has been a major concern for millions of Americans, with many struggling to repay their loans. Recently, the Supreme Court has taken up the issue of supreme court student loan debt relief , potentially providing some much-needed relief to borrowers.

As the Court deliberates, it’s crucial to continue the conversation about student loan debt forgiveness, ensuring that all Americans have the opportunity to pursue their education without the burden of overwhelming debt.

Public Service Loan Forgiveness (PSLF)

The PSLF program forgives the remaining balance of federal student loans for borrowers who work full-time for at least 10 years in certain public service jobs. Eligible jobs include those in government, non-profit organizations, and other qualifying public service sectors.

To be eligible for PSLF, borrowers must:

- Have federal student loans (Direct Loans, FFEL Loans, or Perkins Loans)

- Be employed full-time in a qualifying public service job

- Make 120 qualifying payments on their student loans while working in a public service job

Once a borrower has met all of the eligibility requirements, they can apply for PSLF by submitting a PSLF Form to their loan servicer.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program forgives up to $17,500 in federal student loans for teachers who work full-time for at least five consecutive years in a low-income school or educational service agency.

To be eligible for Teacher Loan Forgiveness, borrowers must:

- Have federal student loans (Direct Loans, FFEL Loans, or Perkins Loans)

- Be employed full-time as a teacher in a low-income school or educational service agency

- Teach for at least five consecutive years

Borrowers can apply for Teacher Loan Forgiveness by submitting a Teacher Loan Forgiveness Application to their loan servicer.

Perkins Loan Forgiveness

The Perkins Loan Forgiveness program forgives the remaining balance of Perkins Loans for borrowers who work in certain public service jobs or who have a total and permanent disability.

To be eligible for Perkins Loan Forgiveness, borrowers must:

- Have Perkins Loans

- Be employed full-time in a qualifying public service job or have a total and permanent disability

Borrowers can apply for Perkins Loan Forgiveness by submitting a Perkins Loan Forgiveness Application to their loan servicer.

Arguments for Student Loan Debt Forgiveness

The debate over student loan debt forgiveness has sparked heated discussions, with proponents presenting compelling arguments in favor of alleviating the financial burden faced by millions of Americans.

Economic Benefits

- Student loan debt forgiveness can stimulate the economy by increasing consumer spending and investment. When borrowers are no longer burdened by high monthly payments, they have more disposable income to spend on goods and services, leading to increased economic activity.

- Reducing student loan debt can also improve job mobility and entrepreneurship. With less financial stress, borrowers are more likely to take risks and pursue new opportunities, fostering innovation and economic growth.

Social Justice Implications

- Student loan debt forgiveness can address racial and economic disparities in higher education. Borrowers from marginalized communities often face higher levels of student loan debt and have difficulty repaying it, perpetuating cycles of poverty.

- Forgiving student loan debt can also promote social mobility by making higher education more accessible to low-income students. When the cost of college is reduced, more students can pursue degrees, leading to a more educated and skilled workforce.

Fairness and Equity

- Student loan debt forgiveness is seen as a fair way to address the predatory lending practices that have led to excessive debt accumulation. Many borrowers were misled or defrauded into taking on loans they could not afford.

- Additionally, the cost of college has skyrocketed in recent decades, leaving many borrowers with unaffordable debt burdens. Forgiving student loan debt can help to correct this imbalance and ensure that all students have a fair chance at economic success.

Arguments Against Student Loan Debt Forgiveness

The debate over student loan debt forgiveness has sparked controversy, with arguments both for and against the proposal. While some advocate for the benefits of debt relief, others raise concerns about its potential consequences.

Cost to Taxpayers

One of the primary arguments against student loan debt forgiveness is the potential cost to taxpayers. The federal government holds over $1.6 trillion in student loan debt, and forgiving this debt would require a significant investment of taxpayer funds.

Critics argue that forgiving student loans would disproportionately benefit higher-income borrowers, as they are more likely to have accumulated higher levels of debt. They also express concerns that the cost of forgiveness would ultimately be passed on to taxpayers in the form of higher taxes or reduced government services.

Unfairness to Borrowers Who Have Already Repaid Their Loans

Another argument against student loan debt forgiveness is the unfairness to borrowers who have already repaid their loans. These borrowers have sacrificed financially to meet their obligations, and they may feel resentful if other borrowers are forgiven their debts.

Forgiveness could also create a moral hazard, where borrowers in the future may be less likely to repay their loans in the expectation that they will be forgiven. This could undermine the entire student loan system and make it more difficult for future students to access affordable higher education.

Potential Impact on the Credit Market

Student loan debt forgiveness could also have a negative impact on the credit market. Lenders may become more reluctant to issue student loans if they believe that the government will forgive them in the future.

This could reduce the availability of credit for future students, making it more difficult for them to finance their education. It could also lead to higher interest rates on student loans, as lenders seek to compensate for the increased risk of default.

Political Debate on Student Loan Debt Forgiveness

The political debate surrounding student loan debt forgiveness is highly contentious, with different political parties holding vastly different positions on the issue. Democrats generally support some form of student loan forgiveness, while Republicans largely oppose it.

Special interest groups and the higher education industry play a significant role in shaping the debate. For-profit colleges and student loan companies have lobbied heavily against student loan forgiveness, while progressive organizations and advocates for higher education access have pushed for it.

Recent Legislative Proposals

In recent years, several legislative proposals for student loan forgiveness have been introduced in Congress. Some notable examples include:

- The Student Loan Forgiveness Act of 2021, introduced by Senator Elizabeth Warren (D-MA), would cancel up to $50,000 in student loan debt for all federal student loan borrowers.

- The College for All Act of 2021, introduced by Senator Bernie Sanders (I-VT), would make public colleges and universities tuition-free and forgive all existing federal student loan debt.

- The Student Debt Relief Act of 2022, introduced by Representative Ayanna Pressley (D-MA), would cancel up to $20,000 in student loan debt for all federal student loan borrowers.

None of these proposals have passed into law, but they have sparked a national conversation about the issue of student loan debt.

Alternatives to Student Loan Debt Forgiveness

Student loan debt forgiveness is a hotly debated topic, but it’s not the only solution to the student loan crisis. There are a number of alternative solutions that could be explored, such as reforming the student loan repayment system, making college more affordable, and providing more financial aid to students.

Reforming the Student Loan Repayment System

One alternative to student loan debt forgiveness is to reform the student loan repayment system. This could involve making it easier for borrowers to repay their loans, such as by extending the repayment period or lowering interest rates. It could also involve creating new repayment plans that are more tailored to the needs of different borrowers.

Pros:

– Making it easier for borrowers to repay their loans could help to reduce the number of people who default on their loans.

– Reforming the student loan repayment system could also help to make college more affordable for future students.

Cons:

– Reforming the student loan repayment system would not help borrowers who have already defaulted on their loans.

– It could also be expensive to implement, as it would require the government to provide additional funding for student loans.

Making College More Affordable

Another alternative to student loan debt forgiveness is to make college more affordable. This could involve increasing funding for public colleges and universities, or providing more financial aid to students. It could also involve reforming the way that colleges are funded, such as by moving to a system of performance-based funding.

Pros:

– Making college more affordable would help to reduce the amount of student loan debt that students have to take on.

– It could also help to make college more accessible to students from all backgrounds.

Cons:

– Making college more affordable would require a significant investment of money.

– It could also be difficult to implement, as it would require changes to the way that colleges are funded.

Providing More Financial Aid to Students

A third alternative to student loan debt forgiveness is to provide more financial aid to students. This could involve increasing the amount of Pell Grants or creating new scholarships and grants. It could also involve expanding eligibility for student loans.

Pros:

– Providing more financial aid to students would help to reduce the amount of student loan debt that students have to take on.

– It could also help to make college more accessible to students from all backgrounds.

Cons:

– Providing more financial aid to students would require a significant investment of money.

– It could also be difficult to implement, as it would require changes to the way that financial aid is distributed.

Case Studies of Student Loan Debt Forgiveness Programs

Student loan debt forgiveness programs have been implemented in various countries and states in the US, offering insights into their design, implementation, and outcomes. These case studies provide valuable lessons for a potential national student loan debt forgiveness program.

Eligibility Criteria

Eligibility criteria vary across programs, targeting specific borrower groups based on factors such as income, debt-to-income ratio, occupation, or completion of public service. For instance, the UK’s Student Loan Forgiveness Plan forgives debt after 30 years of repayment for borrowers earning below a certain income threshold.

Application Process

Application processes can be straightforward or complex, involving documentation and verification of eligibility. Some programs require borrowers to submit an application, while others automatically forgive debt based on predetermined criteria. The Public Service Loan Forgiveness Program in the US, for example, requires borrowers to submit an annual certification form to track their progress towards loan forgiveness.

Amount of Debt Forgiven

The amount of debt forgiven under these programs varies significantly. Some programs forgive a portion of the debt, while others provide full forgiveness. The Australian government’s Higher Education Loan Program forgives up to 50% of the debt after 10 years of repayment for eligible borrowers.

Data and Statistics on Student Loan Debt Forgiveness

The impact of student loan debt forgiveness is a topic of ongoing debate. Proponents argue that it would provide much-needed relief to borrowers, while opponents raise concerns about the cost and fairness of such a policy.

Student loan debt forgiveness has been a hot topic for many years, with millions of Americans struggling to repay their student loans. In recent news, the Supreme Court has weighed in on the issue of supreme court student loan forgiveness , which has brought new hope to many borrowers.

While the outcome of the Supreme Court’s decision is still uncertain, it’s clear that student loan debt forgiveness remains a pressing issue for many Americans.

Number of Borrowers Who Have Received Forgiveness

As of 2022, over 1.5 million borrowers have received student loan forgiveness under various programs, including Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Perkins Loan Cancellation.

Total Amount of Debt That Has Been Forgiven

The total amount of student loan debt that has been forgiven under these programs exceeds $10 billion.

Impact of Forgiveness on Borrowers’ Financial Well-being

Studies have shown that student loan forgiveness can have a significant positive impact on borrowers’ financial well-being. For example, one study found that borrowers who received PSLF were more likely to own homes and have higher credit scores than those who did not.

- Borrowers who received PSLF were 15% more likely to own homes than those who did not.

- Borrowers who received PSLF had an average credit score that was 50 points higher than those who did not.

Limitations of the Data

It is important to note that the data on student loan debt forgiveness is limited. For example, there is no comprehensive data on the impact of forgiveness on borrowers’ long-term financial outcomes.

Implications for Policymakers

The data on student loan debt forgiveness provides some evidence that it can be an effective tool for improving borrowers’ financial well-being. However, more research is needed to fully understand the impact of forgiveness and to develop policies that are both effective and fair.

Ethical Considerations of Student Loan Debt Forgiveness

Student loan debt forgiveness has sparked a debate surrounding its ethical implications. The fairness to taxpayers, the responsibility of borrowers to repay their debts, and the potential impact on the social contract are key considerations.

Ethical Perspectives on Student Loan Debt Forgiveness

Various ethical perspectives exist on student loan debt forgiveness:

- Taxpayer Fairness: Forgiveness may be seen as unfair to taxpayers who have already repaid their loans or who may have made different financial decisions if they knew forgiveness was a possibility.

- Borrower Responsibility: Some argue that borrowers have a moral obligation to repay their debts, regardless of the circumstances that led to them taking on the loans.

- Social Contract: Forgiveness could be viewed as a breach of the social contract between individuals and the government, where citizens are expected to fulfill their financial obligations.

Ethical Dilemmas in Student Loan Debt Forgiveness

Policymakers face ethical dilemmas when considering student loan debt forgiveness:

- Balancing fairness to taxpayers with the need to address the financial burden on borrowers.

- Determining the criteria for forgiveness, such as income thresholds or loan amounts.

- Addressing the potential impact on the overall economy and the higher education system.

Potential Impact of Student Loan Debt Forgiveness

Student loan debt forgiveness could have significant implications for different stakeholders:

- Taxpayers: Forgiveness could increase the tax burden on taxpayers, potentially leading to higher taxes or reduced government services.

- Borrowers: Forgiveness could provide significant financial relief to borrowers, allowing them to invest in their future or reduce their debt burden.

- Government: Forgiveness could impact the government’s ability to provide other social programs or services due to the potential cost.

Recommendations for Addressing Ethical Considerations

Policymakers should address the ethical considerations of student loan debt forgiveness in a fair and equitable manner:

- Consider targeted forgiveness programs for borrowers with the greatest financial need.

- Establish clear criteria for forgiveness, ensuring transparency and fairness.

- Explore alternative solutions, such as income-driven repayment plans or loan refinancing options, to address the underlying issues of student loan debt.

Legal Challenges to Student Loan Debt Forgiveness

Student loan debt forgiveness is a complex issue with numerous potential legal challenges. These challenges could come from various sources, including constitutional challenges and challenges based on existing laws and regulations.

One potential legal challenge to student loan debt forgiveness is that it could be seen as a violation of the Constitution’s Equal Protection Clause. This clause prohibits the government from denying any person within its jurisdiction the equal protection of the laws. Some may argue that student loan debt forgiveness would unfairly benefit certain borrowers over others, thereby violating this clause.

Another potential legal challenge to student loan debt forgiveness is that it could be seen as a violation of the Constitution’s Due Process Clause. This clause prohibits the government from depriving any person of life, liberty, or property without due process of law. Some may argue that student loan debt forgiveness would deprive lenders of their property rights without due process of law.

Existing Laws and Regulations

In addition to constitutional challenges, student loan debt forgiveness could also face challenges based on existing laws and regulations. For example, the Higher Education Act of 1965 prohibits the government from forgiving student loans that are in default. Some may argue that this law would need to be amended or repealed before student loan debt forgiveness could be implemented.

Student loan debt forgiveness has been a topic of much debate in recent years. One type of loan that is often discussed in this context is the federal student loan . These loans are provided by the U.S. government to help students pay for college.

The terms of federal student loans can vary, but they typically have lower interest rates than private student loans. Student loan debt forgiveness can provide significant financial relief to borrowers who are struggling to repay their loans.

Another potential legal challenge to student loan debt forgiveness is that it could be seen as a violation of the Anti-Deficiency Act. This act prohibits the government from spending money that has not been appropriated by Congress. Some may argue that student loan debt forgiveness would violate this act because it would require the government to spend money that has not been appropriated for that purpose.

Legal Cases

There have been a number of legal cases brought in relation to student loan debt forgiveness. One notable case is Sweet v. Cardona, which was filed in 2022. In this case, the plaintiffs argued that the Biden administration’s student loan debt forgiveness plan was unconstitutional. The case is currently pending in court.

Another notable case is Texas v. United States, which was filed in 2023. In this case, the plaintiffs argued that the Biden administration’s student loan debt forgiveness plan was illegal because it was not authorized by Congress. The case is currently pending in court.

Impact of Student Loan Debt Forgiveness on the Higher Education System

Student loan debt forgiveness has the potential to significantly impact the higher education system. One potential impact is a change in tuition costs. If student loans are forgiven, colleges and universities may have less incentive to keep tuition costs low. This could lead to higher tuition costs for future students.

Another potential impact is a change in enrollment patterns. If student loans are forgiven, more students may be able to afford to attend college. This could lead to an increase in enrollment, particularly at public colleges and universities.

Finally, student loan debt forgiveness could also affect the availability of financial aid. If student loans are forgiven, the government may have less money available to provide financial aid to future students. This could make it more difficult for low-income students to afford college.

Long-Term Consequences for Colleges and Universities

In the long term, student loan debt forgiveness could have several consequences for colleges and universities. One potential consequence is a decrease in revenue. If student loans are forgiven, colleges and universities will lose a significant source of revenue. This could lead to cuts in faculty and staff, as well as a reduction in the number of courses and programs offered.

Another potential consequence is a change in the way that colleges and universities are funded. If student loans are forgiven, the government may be more likely to provide direct funding to colleges and universities. This could lead to a more centralized and bureaucratic system of higher education.

Impact on Student and Family Decisions

Student loan debt forgiveness could also affect the way that students and families make decisions about higher education. If student loans are forgiven, more students may be willing to take on debt to attend college. This could lead to an increase in the number of students who graduate with high levels of debt.

Student loan debt forgiveness could also affect the way that families save for college. If student loans are forgiven, families may be less likely to save for college. This could lead to a decrease in the amount of money that families have available to pay for college expenses.

Recommendations for Student Loan Debt Forgiveness Policy

To address the student loan debt crisis, policymakers should consider a range of options that balance the needs of borrowers, taxpayers, and the higher education system. Some key recommendations include:

Debt Cancellation Thresholds

- Establish income-based thresholds for student loan forgiveness, ensuring that borrowers with lower incomes receive the most relief.

- Consider a sliding scale approach, where borrowers with higher incomes pay a larger percentage of their debt.

Loan Repayment Assistance Programs

- Expand existing income-driven repayment plans to make them more accessible and affordable for borrowers.

- Create new programs that provide targeted assistance to borrowers facing financial hardship, such as those with disabilities or low-income families.

Higher Education Reforms

- Reduce the cost of college tuition and fees to make higher education more affordable for future students.

- Invest in alternative pathways to higher education, such as community colleges and vocational training programs.

Conclusion

The analysis of student loan debt forgiveness reveals a complex issue with significant implications for borrowers, taxpayers, and the higher education system. Key findings include:

- Student loan debt forgiveness can provide substantial financial relief to borrowers, potentially reducing their monthly payments, improving their credit scores, and increasing their overall financial well-being.

- The cost of student loan debt forgiveness to taxpayers is a significant concern, but it must be weighed against the potential benefits to borrowers and the broader economy.

- Student loan debt forgiveness may have unintended consequences for the higher education system, such as increasing the cost of college or reducing the availability of financial aid.

Addressing the student loan debt crisis requires a comprehensive approach that considers both debt forgiveness and broader reforms to the higher education system. Debt forgiveness can provide immediate relief to borrowers, but it is not a long-term solution to the underlying problems that have led to the current crisis.

Further research and dialogue on student loan debt forgiveness are essential to explore different forgiveness models, their eligibility criteria, and potential consequences. This research should inform policy recommendations that balance the needs of borrowers, taxpayers, and the higher education system.

Specific policy recommendations or areas for future research based on the analysis findings include:

- Exploring income-based repayment plans that cap monthly payments at a percentage of income and forgive any remaining debt after a certain number of years.

- Expanding eligibility for Public Service Loan Forgiveness to include a wider range of professions and non-profit organizations.

- Investing in programs that provide financial literacy and college counseling to help students make informed decisions about borrowing.

By engaging in thoughtful dialogue and research, we can develop comprehensive solutions that address the student loan debt crisis and ensure that higher education remains accessible and affordable for all.

Final Review

The debate over student loan debt forgiveness is far from over, with proponents and opponents clashing over its potential benefits and drawbacks. This article has provided a comprehensive overview of the arguments for and against forgiveness, highlighting the need for policymakers to carefully consider the long-term implications of any such policy. As the discussion continues, it is imperative to find solutions that address the root causes of the student loan debt crisis and ensure that higher education remains accessible and affordable for future generations.

FAQ Compilation

What are the eligibility requirements for Public Service Loan Forgiveness?

To qualify for Public Service Loan Forgiveness, borrowers must work full-time for a qualifying public service organization, such as a government agency or non-profit, and make 120 qualifying payments under an income-driven repayment plan.

What is the potential impact of student loan debt forgiveness on the economy?

Student loan debt forgiveness could stimulate the economy by freeing up borrowers’ disposable income, which could be spent on goods and services. It could also reduce income inequality by alleviating the financial burden on low- and middle-income borrowers.

What are the arguments against student loan debt forgiveness?

Opponents of student loan debt forgiveness argue that it would be unfair to taxpayers who have already repaid their loans, could increase the cost of college tuition, and potentially reduce access to higher education for future students.