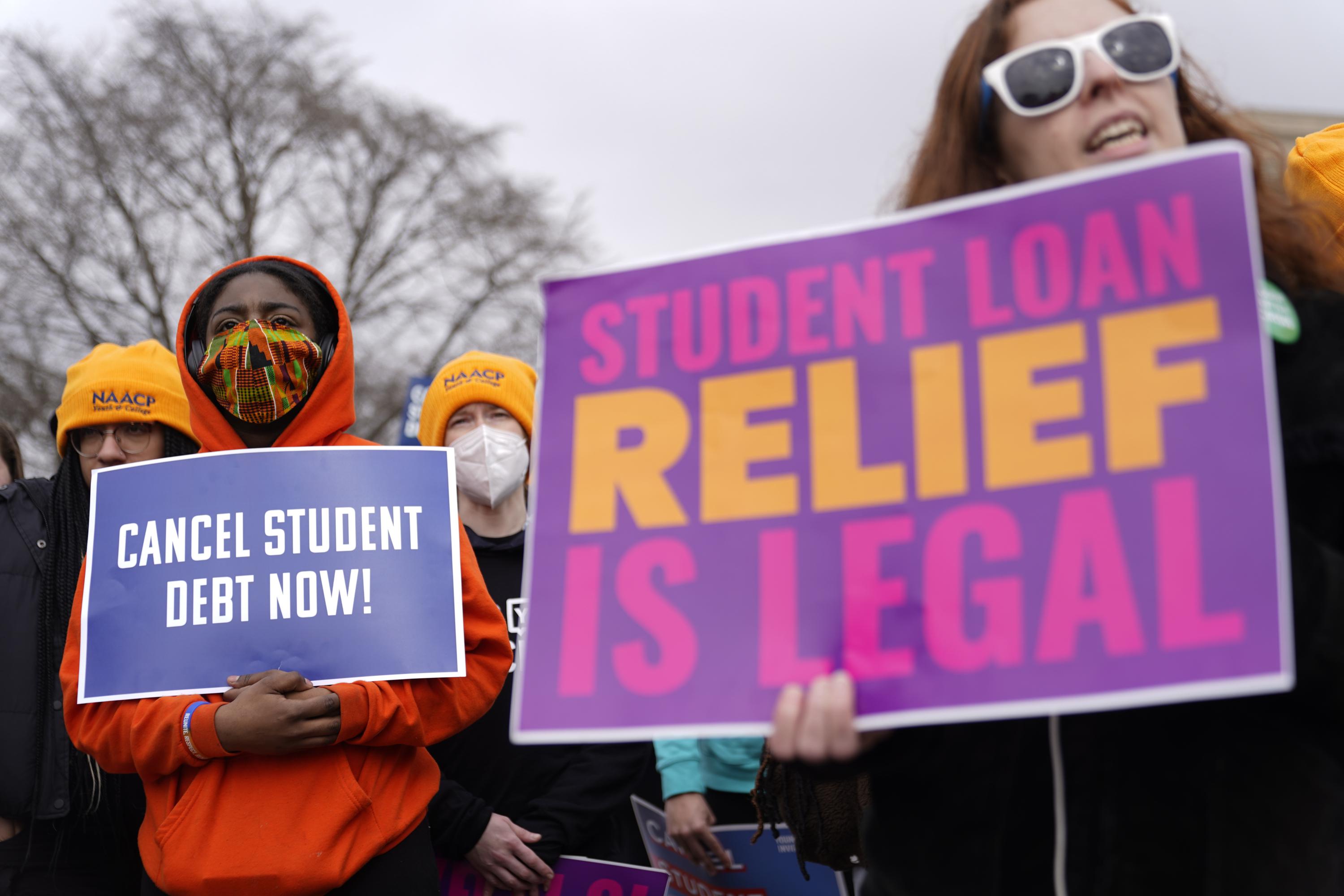

Supreme court student loan forgiveness – The Supreme Court is set to hear arguments on whether President Biden’s student loan forgiveness plan is legal. The plan, which would forgive up to $20,000 in student debt for millions of borrowers, has been challenged by several states and individuals.

The Court’s decision could have a major impact on the future of student loans in the United States. If the Court upholds the plan, it would provide much-needed relief to millions of borrowers who are struggling to repay their student debt. However, if the Court strikes down the plan, it would be a major setback for the Biden administration and could lead to further increases in student loan debt.

Legal Standing

The Supreme Court has the authority to rule on student loan forgiveness under Article III of the Constitution, which gives the Court the power to interpret laws and resolve disputes. The Court’s decision will likely hinge on whether it finds that the Biden administration has the legal authority to forgive student loans without congressional approval.

Potential Legal Challenges

Student loan forgiveness could face legal challenges on several grounds, including:

– The lack of explicit statutory authority for the executive branch to forgive student loans.

– The argument that student loan forgiveness would violate the separation of powers between the executive and legislative branches.

– The claim that student loan forgiveness would be an unconstitutional taking of property from loan servicers.

Constitutional Considerations

The Constitution imposes certain limitations on the government’s ability to forgive student loans. These limitations include the Equal Protection Clause and the Due Process Clause.

Equal Protection Clause

The Equal Protection Clause prohibits the government from denying any person within its jurisdiction the equal protection of the laws. This means that the government cannot treat different people differently based on arbitrary or irrelevant factors.

In the context of student loan forgiveness, the Equal Protection Clause could be used to challenge a program that forgave loans only to certain groups of borrowers, such as those who attended certain schools or who borrowed loans for certain purposes. Such a program could be considered discriminatory and therefore unconstitutional.

Due Process Clause

The Due Process Clause protects individuals from being deprived of life, liberty, or property without due process of law. This means that the government cannot take away a person’s property without providing them with a fair hearing.

In the context of student loan forgiveness, the Due Process Clause could be used to challenge a program that forgave loans without providing borrowers with an opportunity to contest the forgiveness. Such a program could be considered a taking of property without due process of law.

Economic Impact

Student loan forgiveness has the potential to significantly impact the economy. The scale and nature of these consequences are still being debated, but economists generally agree that it would have both positive and negative effects.

One of the most significant potential impacts is on the federal budget. The total amount of outstanding student loan debt in the United States is over $1.7 trillion. If all of this debt were forgiven, it would cost the government a substantial amount of money. This could lead to higher taxes or cuts to other government programs.

Impact on Inflation

Another potential impact of student loan forgiveness is on inflation. If a large amount of debt is suddenly forgiven, it could lead to an increase in demand for goods and services. This could put upward pressure on prices, leading to inflation.

Impact on Economic Growth

Student loan forgiveness could also have a positive impact on economic growth. If borrowers are no longer burdened by student loan debt, they may have more money to spend on other things, such as buying a home or starting a business. This could lead to increased economic activity and job creation.

Impact on Different Income Groups and Demographics

The impact of student loan forgiveness would not be felt equally by all income groups and demographics. Borrowers with higher incomes and more debt would benefit the most from forgiveness. However, borrowers with lower incomes and less debt may see little or no benefit.

Impact on the Housing Market

Student loan forgiveness could also have a significant impact on the housing market. If borrowers are no longer burdened by student loan debt, they may be more likely to buy a home. This could lead to increased demand for housing and higher home prices.

Impact on Other Consumer Spending

Student loan forgiveness could also have a positive impact on other consumer spending. If borrowers have more money to spend, they may be more likely to spend it on other goods and services, such as travel, entertainment, and dining out. This could lead to increased economic activity in a variety of sectors.

Impact on the Labor Market

Student loan forgiveness could also have a positive impact on the labor market. If borrowers are no longer burdened by student loan debt, they may be more likely to start their own businesses or pursue higher education. This could lead to job creation and wage growth.

Long-Term Economic Implications

The long-term economic implications of student loan forgiveness are still being debated. Some economists argue that it could lead to increased educational attainment and economic mobility. Others argue that it could lead to moral hazard and a decline in the value of higher education.

Social Equity

Student loan forgiveness has the potential to significantly impact social equity in the United States. By eliminating or reducing the burden of student debt, particularly for marginalized communities, it could help address racial and economic disparities in higher education and the broader economy.

Student loan debt disproportionately affects Black and Hispanic borrowers, who are more likely to take on debt to attend college and graduate with higher levels of debt. Student loan forgiveness could help reduce this racial wealth gap by freeing up financial resources for these borrowers to invest in their families, homes, and businesses.

Policies to Promote Social Equity

- Expanding access to affordable higher education, such as increasing Pell Grant funding and making public colleges and universities tuition-free.

- Providing targeted loan forgiveness programs for students from low-income backgrounds or who attend minority-serving institutions.

- Investing in programs that support student success, such as academic advising, mentoring, and financial literacy.

In addition to addressing racial disparities, student loan forgiveness could also help reduce the gender pay gap. Women are more likely to take on student debt and graduate with higher levels of debt than men. By eliminating or reducing this debt burden, women could have more financial freedom and be better able to negotiate for higher salaries.

Political Implications

The political landscape surrounding student loan forgiveness is complex and highly charged. The issue has divided both the public and policymakers, with strong opinions on both sides.

The latest on the Supreme Court’s review of the Biden administration’s student loan forgiveness program is a must-read for anyone affected by student debt. Stay up-to-date with the latest developments in the student loan forgiveness update . The Court’s decision will have a significant impact on millions of borrowers, so it’s crucial to stay informed about the Supreme Court student loan forgiveness proceedings.

For many, student loan forgiveness is seen as a necessary step to address the growing student debt crisis. They argue that the burden of student debt is holding back an entire generation of Americans from achieving their full potential. They also point to the fact that the benefits of student loan forgiveness would be felt disproportionately by low-income and minority borrowers.

Potential Impact on Upcoming Elections

The issue of student loan forgiveness is likely to have a significant impact on the upcoming elections. Democrats have made student loan forgiveness a key part of their platform, while Republicans have largely opposed the idea. The issue is likely to be a major point of debate in the 2024 presidential election.

Potential Impact on Future Political Debates

The issue of student loan forgiveness is also likely to have a long-term impact on future political debates. The issue has exposed deep divisions within both parties, and it is likely to continue to be a source of contention for years to come.

Historical Precedents

Student loan forgiveness has been a contentious issue in recent years, with proponents arguing that it would provide much-needed relief to borrowers and stimulate the economy, while opponents contend that it would be unfair to taxpayers and could lead to moral hazard. To better understand the potential implications of student loan forgiveness, it is helpful to examine historical examples of similar large-scale debt forgiveness programs.

One notable example is the cancellation of agricultural debt during the Great Depression. In the 1930s, many farmers were unable to repay their loans due to falling crop prices and other economic hardships. The government responded by implementing a series of programs that provided debt relief to farmers, including the Farm Credit Act of 1933 and the Frazier-Lemke Act of 1934. These programs helped to stabilize the agricultural sector and prevent widespread foreclosures.

Another example is the cancellation of student loans for veterans after World War II. The Servicemen’s Readjustment Act of 1944 provided for the forgiveness of student loans for veterans who had served in the military. This program helped to ease the transition of veterans back into civilian life and contributed to the post-war economic boom.

Arguments for Student Loan Forgiveness Based on Historical Precedents

Proponents of student loan forgiveness argue that historical precedents provide evidence that such programs can be effective in providing relief to borrowers and stimulating the economy. They point to the success of the agricultural debt cancellation programs during the Great Depression and the student loan forgiveness program for veterans after World War II as examples of how debt forgiveness can help to stabilize the economy and promote economic growth.

Arguments Against Student Loan Forgiveness Based on Historical Precedents

Opponents of student loan forgiveness argue that historical precedents do not necessarily support the case for such a program. They point out that the agricultural debt cancellation programs during the Great Depression were implemented in response to a specific economic crisis and that the student loan forgiveness program for veterans after World War II was part of a broader package of benefits for veterans. They also argue that student loan forgiveness could be unfair to taxpayers who have already repaid their own student loans or who have not benefited from higher education.

Lessons Learned from Historical Precedents

The historical precedents of debt forgiveness programs provide valuable lessons for considering student loan forgiveness. These lessons include:

* Debt forgiveness programs can be effective in providing relief to borrowers and stimulating the economy.

* The design of debt forgiveness programs is important to ensure that they are fair and effective.

* The potential economic, social, and political implications of debt forgiveness programs should be carefully considered before implementing such programs.

Alternative Solutions

While student loan forgiveness offers a comprehensive solution to the student loan crisis, it is not the only option. Several alternative solutions have been proposed, each with its own set of advantages and disadvantages.

The Supreme Court’s recent decision on student loan forgiveness has left many borrowers wondering about their repayment options. If you’re not sure how much you’ll owe each month, you can use a student loan repayment calculator to estimate your payments.

This can help you budget for your future and make informed decisions about your finances. Even if you’re not eligible for forgiveness, a student loan repayment calculator can help you understand your repayment options and create a plan to pay off your debt as quickly as possible.

One alternative is to increase access to affordable higher education. This could be achieved by providing more financial aid, such as grants and scholarships, to students from low-income families. Additionally, states could invest in public colleges and universities to keep tuition costs low.

The recent Supreme Court ruling on student loan forgiveness has left many borrowers wondering what their next steps should be. If you’re unsure about your repayment options, a student loan calculator can help you estimate your monthly payments and total interest charges.

This information can be crucial in determining the best course of action for your individual situation. As the Supreme Court continues to deliberate on the legality of the student loan forgiveness program, it’s important to stay informed about the latest developments and explore your repayment options.

Income-Driven Repayment Plans

Another alternative is to expand income-driven repayment plans. These plans allow borrowers to make monthly payments based on their income and family size. This can make it more affordable for borrowers to repay their loans without defaulting.

However, income-driven repayment plans can also extend the repayment period, which can lead to borrowers paying more interest over the life of the loan. Additionally, these plans may not be available to all borrowers.

Debt Refinancing

Debt refinancing is another option for borrowers who are struggling to repay their student loans. This involves taking out a new loan with a lower interest rate to pay off the old loan. This can lower the monthly payments and make the loan more affordable.

However, debt refinancing may not be available to all borrowers, and it can also lead to a longer repayment period. Additionally, if interest rates rise, the new loan may end up costing more than the original loan.

The recent Supreme Court decision on student loan forgiveness has brought relief to many borrowers. The court’s ruling opens the door to the Biden administration’s plan for student loan debt relief , which could provide much-needed financial assistance to millions of Americans.

While the full impact of the court’s decision remains to be seen, it is clear that the Supreme Court’s ruling is a significant step towards addressing the growing problem of student loan debt in the United States.

Loan Forgiveness Programs

Loan forgiveness programs are another alternative to student loan forgiveness. These programs forgive all or a portion of a borrower’s student loans after a certain number of years of service in a particular field, such as teaching or public service.

However, loan forgiveness programs are often limited in scope and may not be available to all borrowers. Additionally, these programs may require borrowers to make payments on their loans for a number of years before they are eligible for forgiveness.

Public Opinion

Public opinion on student loan forgiveness is divided, with no clear consensus. Some polls show a majority of Americans support some form of student loan forgiveness, while others show a majority opposed. There are a variety of perspectives on the issue, with some arguing that student loan forgiveness is necessary to address the growing student debt crisis, while others argue that it is unfair to taxpayers who have already paid off their loans or who did not attend college.

Arguments in Favor of Student Loan Forgiveness

- The rising cost of college has made it increasingly difficult for students to afford a higher education, and student loan debt is a major burden for many graduates.

- Student loan forgiveness would help to reduce the racial wealth gap, as Black and Latino borrowers are disproportionately affected by student loan debt.

- Student loan forgiveness would stimulate the economy by freeing up money that borrowers could spend on other goods and services.

Arguments Against Student Loan Forgiveness

- Student loan forgiveness would be unfair to taxpayers who have already paid off their loans or who did not attend college.

- Student loan forgiveness would encourage colleges and universities to raise tuition prices, knowing that the government will eventually forgive the loans.

- Student loan forgiveness would be too expensive, and the government cannot afford to forgive all student loan debt.

Legal Arguments for and Against Student Loan Forgiveness

The legality of student loan forgiveness is a complex issue with a wide range of legal arguments for and against it. Some of the key arguments are summarized in the table below:

| Legal Argument | Strength | Weakness | Likelihood of Success |

|---|---|---|---|

| Congress has the authority to forgive student loans under the Higher Education Act of 1965. | – The Higher Education Act gives the Secretary of Education broad authority to “make such regulations and perform such acts as may be necessary or appropriate to carry out the provisions” of the Act. – This authority has been interpreted to include the power to forgive student loans. |

– The Higher Education Act does not explicitly authorize the Secretary of Education to forgive student loans. – Some argue that the Secretary’s authority to forgive loans is limited to cases where the borrower is in default or has a disability. |

Moderate |

| The President has the authority to forgive student loans under Article II of the Constitution. | – Article II gives the President the power to “take care that the laws be faithfully executed.” – This power has been interpreted to include the power to forgive student loans. |

– The President’s power to forgive loans is not explicitly stated in the Constitution. – Some argue that the President’s power to forgive loans is limited to cases where the borrower is in default or has a disability. |

Low |

| Student loan forgiveness is unconstitutional because it violates the Contracts Clause. | – The Contracts Clause prohibits the government from impairing the obligation of contracts. – Student loans are contracts between the government and the borrower. – Forgiveness of student loans would impair the obligation of these contracts. |

– The Contracts Clause does not apply to the government’s own contracts. – The government has a legitimate interest in forgiving student loans in order to promote higher education. |

Low |

Create an economic model to simulate the potential impact of student loan forgiveness.

To assess the potential economic implications of student loan forgiveness, an economic model can be developed. This model would simulate the impact of various forgiveness scenarios on key economic indicators such as economic growth, inflation, and the labor market.

Time Period and Scope of the Model

The model would cover a 10-year period, allowing for the analysis of both short-term and long-term effects. The scope of the model would include the entire U.S. economy, with a focus on the impact on households, businesses, and the government.

Key Assumptions and Limitations of the Model

The model would make several key assumptions, including:

- The amount of student loan debt forgiven would be a fixed amount, such as $10,000 or $50,000 per borrower.

- The forgiveness would be applied to all federal student loans, regardless of the borrower’s income or repayment status.

- The model would not account for the potential behavioral responses of borrowers, such as changes in spending or saving patterns.

Key Variables and Parameters

The model would use a variety of variables and parameters, including:

- The total amount of student loan debt forgiven

- The distribution of student loan debt by income level

- The interest rates on student loans

- The repayment rates on student loans

- The size of the U.S. economy

- The rate of inflation

- The unemployment rate

Methodology

The model would use a combination of macroeconomic and microeconomic techniques to simulate the impact of student loan forgiveness. The macroeconomic component of the model would use a dynamic stochastic general equilibrium (DSGE) model to simulate the impact of forgiveness on economic growth, inflation, and the labor market. The microeconomic component of the model would use a microsimulation model to simulate the impact of forgiveness on individual households and businesses.

Potential Implications

The model could provide valuable insights into the potential economic implications of student loan forgiveness. The results of the model could inform policymakers as they consider the costs and benefits of different forgiveness scenarios.

Key Findings

The key findings of the model would be summarized in a report that would be made available to policymakers and the public. The report would discuss the potential impact of student loan forgiveness on economic growth, inflation, and the labor market. The report would also discuss the implications of the findings for policymakers.

Comparative Analysis: Supreme Court Student Loan Forgiveness

Globally, several countries have implemented student loan forgiveness programs to address the rising burden of student debt. These programs vary in their approaches, eligibility criteria, and outcomes. Here’s a comparative analysis of student loan forgiveness programs in different countries:

Australia, Supreme court student loan forgiveness

- The Higher Education Loan Program (HELP) allows students to defer loan repayments until their income reaches a certain threshold.

- Loans are forgiven after a period of 10-15 years, depending on the type of loan.

- The program has been successful in reducing student debt and increasing access to higher education.

Canada

- The Canada Student Loans Program offers loan forgiveness to students who have a permanent disability or who work in certain professions, such as nursing or teaching.

- The program has been effective in reducing student debt for those who qualify.

United Kingdom

- The Student Loan Forgiveness Plan forgives student loans after 25 years of repayment.

- The program has been criticized for being too generous and for not doing enough to address the underlying problem of high student debt.

United States

- The Public Service Loan Forgiveness Program forgives student loans for those who work in public service for 10 years.

- The program has been criticized for being too restrictive and for not providing enough relief to borrowers.

Comparative Analysis

These programs have varying levels of effectiveness in reducing student debt and promoting higher education access. Australia’s HELP program has been successful in reducing student debt and increasing access to higher education. Canada’s program is effective in reducing student debt for those who qualify. The United Kingdom’s program has been criticized for being too generous, while the United States’ program has been criticized for being too restrictive.

Recommendations

Based on this comparative analysis, several recommendations can be made for improving student loan forgiveness programs:

- Programs should be designed to be more generous and to provide more relief to borrowers.

- Programs should be more inclusive and should not exclude certain groups of borrowers.

- Programs should be more flexible and should allow borrowers to repay their loans in a way that works for them.

Identify the specific groups of student loan borrowers who are most affected by the crisis and provide tailored policy recommendations for each group

The student loan crisis disproportionately affects certain groups of borrowers, including low-income borrowers, borrowers of color, and first-generation college students. These borrowers are more likely to have high levels of student debt, and they are more likely to struggle to repay their loans.

Low-income borrowers

Low-income borrowers are more likely to have high levels of student debt because they are more likely to attend for-profit colleges, which are more expensive than public colleges. They are also more likely to have to take out private loans, which have higher interest rates than federal loans. As a result, low-income borrowers are more likely to default on their student loans.

Policy recommendations for low-income borrowers:

- Increase the amount of Pell Grants available to low-income students.

- Expand the Public Service Loan Forgiveness program to include more low-income borrowers.

- Create a new income-driven repayment plan that is more affordable for low-income borrowers.

Borrowers of color

Borrowers of color are more likely to have high levels of student debt because they are more likely to come from low-income families. They are also more likely to attend for-profit colleges, which are more expensive than public colleges. As a result, borrowers of color are more likely to default on their student loans.

Policy recommendations for borrowers of color:

- Increase the amount of funding available to Historically Black Colleges and Universities (HBCUs) and other minority-serving institutions.

- Expand the Minority Serving Institutions Student Loan Forgiveness Program.

- Create a new loan forgiveness program for borrowers of color who work in public service.

First-generation college students

First-generation college students are more likely to have high levels of student debt because they are less likely to have family members who can help them pay for college. They are also more likely to attend for-profit colleges, which are more expensive than public colleges. As a result, first-generation college students are more likely to default on their student loans.

Policy recommendations for first-generation college students:

- Provide more financial aid to first-generation college students.

- Create a new loan forgiveness program for first-generation college students who work in public service.

- Expand the TRIO programs, which provide support to first-generation college students.

Timeline

The issue of student loan forgiveness has been a topic of debate for many years. There have been a number of key events and developments related to this issue, including milestones, court rulings, and legislative actions.

One of the most significant milestones in the history of student loan forgiveness was the passage of the Higher Education Act of 1965. This act created the Federal Family Education Loan Program (FFELP), which provided low-interest loans to students attending college.

Key Events and Developments

- 1965: The Higher Education Act of 1965 creates the Federal Family Education Loan Program (FFELP), which provides low-interest loans to students attending college.

- 1976: The Guaranteed Student Loan (GSL) program is created, which provides low-interest loans to students attending college.

- 1993: The Direct Loan program is created, which provides low-interest loans to students attending college.

- 2007: The College Cost Reduction and Access Act of 2007 expands the Direct Loan program and eliminates the FFELP.

- 2010: The Obama administration announces the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance of student loans for borrowers who work in public service for 10 years.

- 2016: The Trump administration announces the Student Loan Forgiveness for Borrowers with Disabilities program, which forgives the remaining balance of student loans for borrowers who are permanently disabled.

- 2020: The COVID-19 pandemic leads to widespread job losses and economic hardship, and the federal government pauses student loan payments and interest.

- 2021: The Biden administration announces the American Rescue Plan Act of 2021, which includes provisions to forgive up to $10,000 in student loan debt for borrowers who earn less than $125,000 per year.

- 2022: The Supreme Court blocks the Biden administration’s student loan forgiveness plan.

Wrap-Up

The Supreme Court’s decision on student loan forgiveness is expected to be issued by the end of June. The decision will have a major impact on the lives of millions of Americans who are struggling to repay their student debt. Stay tuned for updates on this important case.

FAQ Guide

What is the Supreme Court case about student loan forgiveness?

The Supreme Court case is about whether President Biden’s student loan forgiveness plan is legal. The plan, which would forgive up to $20,000 in student debt for millions of borrowers, has been challenged by several states and individuals.

When will the Supreme Court issue a decision on student loan forgiveness?

The Supreme Court is expected to issue a decision on student loan forgiveness by the end of June.

What will happen if the Supreme Court upholds the student loan forgiveness plan?

If the Supreme Court upholds the student loan forgiveness plan, it would provide much-needed relief to millions of borrowers who are struggling to repay their student debt.

What will happen if the Supreme Court strikes down the student loan forgiveness plan?

If the Supreme Court strikes down the student loan forgiveness plan, it would be a major setback for the Biden administration and could lead to further increases in student loan debt.