Student loan news is a hot topic these days, with the total amount of student loan debt in the United States reaching astronomical levels. In this comprehensive guide, we’ll delve into the complexities of student loans, exploring the factors contributing to the crisis, the various forgiveness programs available, and the options for managing and repaying your debt.

From understanding the different types of student loans to navigating the maze of repayment plans and forgiveness options, we’ll provide you with the knowledge and tools you need to make informed decisions about your student loan debt.

Student Loan Debt Crisis

The United States is currently facing a student loan debt crisis, with over 45 million Americans owing a collective $1.75 trillion in student loans. This crisis has been caused by a number of factors, including the rising cost of college, the increasing use of student loans to finance education, and the lack of affordable repayment options. The student loan debt crisis has had a devastating impact on borrowers, both financially and emotionally. It has made it difficult for borrowers to buy homes, start families, and save for retirement. It has also led to increased stress, anxiety, and depression among borrowers.

Factors Contributing to the Student Loan Debt Crisis

There are a number of factors that have contributed to the student loan debt crisis, including:

- The rising cost of college: The cost of college has been rising steadily for decades, outpacing inflation. This has made it more difficult for students to afford college without taking on debt.

- The increasing use of student loans: Student loans have become the primary way for students to finance their education. In the 1980s, only about 25% of college students took out student loans. Today, that number is over 60%.

- The lack of affordable repayment options: The federal government offers a number of repayment options for student loans, but many of these options are not affordable for borrowers. For example, the standard repayment plan requires borrowers to pay back their loans over 10 years, regardless of their income. This can make it difficult for borrowers to make their monthly payments, and can lead to default.

Student Loan Forgiveness Programs

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/L4LI4EI6CZGOFIL47BQVBCQJWA.jpg)

The burden of student loan debt has become a major issue for millions of Americans, and the government has responded by creating a variety of programs to help borrowers manage their debt. These programs offer a range of options, from full loan forgiveness to partial forgiveness or repayment assistance. In this article, we will discuss the different student loan forgiveness programs available, their eligibility requirements, and their potential benefits and drawbacks.

Federal Student Loan Forgiveness Programs

The federal government offers several student loan forgiveness programs, including:

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance on your federal student loans after you have made 120 qualifying payments while working full-time for a public service organization.

- Teacher Loan Forgiveness: This program forgives up to $17,500 in federal student loans for teachers who work full-time for five consecutive years in a low-income school or educational service agency.

- Income-Driven Repayment (IDR) Plans: These plans cap your monthly student loan payments at a percentage of your income, and any remaining balance is forgiven after 20 or 25 years of payments.

State Student Loan Forgiveness Programs

Many states also offer student loan forgiveness programs for borrowers who work in certain fields or meet other criteria. These programs vary from state to state, so it is important to check with your state’s higher education agency to see if you are eligible.

For those eagerly awaiting the latest student loan news, the Biden administration has taken a significant step by announcing the biden student loan forgiveness program. This initiative aims to provide relief to millions of borrowers, potentially erasing a substantial portion of their outstanding debt.

Stay tuned for further updates and developments on this important student loan news.

Private Student Loan Forgiveness Programs

Some private lenders also offer student loan forgiveness programs, but these programs are typically more limited than federal or state programs. It is important to read the terms and conditions of any private student loan forgiveness program carefully before you apply.

– Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) are designed to make federal student loan payments more manageable for borrowers who are struggling financially. These plans adjust monthly payments based on the borrower’s income and family size, potentially reducing payments to as low as $0.

There are four main types of IDRs:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Each plan has its own eligibility requirements and payment calculations, but all IDRs cap monthly payments at a percentage of the borrower’s discretionary income. Discretionary income is the amount of money left over after subtracting certain living expenses from the borrower’s income.

Benefits of IDRs

- Lower monthly payments

- Potential loan forgiveness after 20 or 25 years of repayment

- Can help borrowers avoid default

Limitations of IDRs

- May not be the best option for borrowers who expect their income to increase significantly in the future

- Can extend the repayment period, resulting in more interest paid over the life of the loan

- May have a negative impact on credit scores

| Plan | Eligibility Requirements | Payment Calculation | Potential Savings |

|---|---|---|---|

| IBR | Borrowers with federal student loans who have financial hardship | 10% of discretionary income | Up to $3,000 per year |

| PAYE | Borrowers with federal student loans who have a partial financial hardship | 10% of discretionary income, capped at 10 years of repayment | Up to $2,000 per year |

| REPAYE | Borrowers with any federal student loan | 10% of discretionary income | Up to $5,000 per year |

| ICR | Borrowers with federal student loans who have a very low income | 20% of discretionary income | Up to $10,000 per year |

Borrowers who are considering an IDR should carefully weigh the benefits and limitations before enrolling. They should also consider their individual financial situation and goals.

Tips for Maximizing the Benefits of IDRs

- Apply for an IDR as soon as possible after graduating

- Re-certify your income and family size annually

- Make all of your payments on time

- Consider consolidating your loans into a single IDR

Case Study

Sarah graduated from college with $50,000 in student loan debt. She was working as a teacher and struggling to make her monthly payments. She applied for an IDR and her monthly payments were reduced to $200. After 20 years of repayment, Sarah’s remaining balance was forgiven.

Student Loan Consolidation: Student Loan News

Student loan consolidation is a process of combining multiple student loans into a single loan with one monthly payment. This can simplify your repayment process and potentially save you money on interest.

Types of Consolidation Loans

There are two main types of consolidation loans:

- Federal consolidation loans: These loans are offered by the U.S. Department of Education and have fixed interest rates.

- Private consolidation loans: These loans are offered by private lenders and may have variable interest rates.

Factors to Consider When Choosing a Loan

When choosing a consolidation loan, you should consider the following factors:

- Interest rate: The interest rate will determine how much you pay in interest over the life of the loan.

- Loan term: The loan term is the length of time you have to repay the loan. Longer loan terms will have lower monthly payments but higher total interest costs.

- Fees: Some lenders charge fees for consolidation loans. These fees can add to the total cost of the loan.

How to Apply for Student Loan Consolidation

To apply for student loan consolidation, you can follow these steps:

- Gather your loan information: You will need to provide information about all of the loans you want to consolidate.

- Choose a lender: You can compare lenders and interest rates online or by speaking to a financial advisor.

- Apply for the loan: You will need to complete an application and provide the lender with your loan information.

- Receive loan approval: Once your loan is approved, the lender will send you a loan agreement.

- Sign the loan agreement: Once you sign the loan agreement, your loans will be consolidated into a single loan.

Student Loan Refinancing

Student loan refinancing is the process of replacing your existing student loans with a new loan from a private lender. This can be a great way to lower your interest rate, shorten your loan term, or consolidate multiple loans into a single payment.

There are two main types of refinancing loans available: fixed-rate loans and variable-rate loans. Fixed-rate loans have an interest rate that will stay the same for the life of the loan, while variable-rate loans have an interest rate that can change over time. Variable-rate loans typically have lower interest rates than fixed-rate loans, but they also come with more risk.

When choosing a refinancing loan, it is important to consider the following factors:

- The interest rate

- The loan term

- The fees

- The lender’s reputation

Once you have chosen a refinancing loan, you will need to apply for it. The application process typically involves providing the lender with your financial information, such as your income, expenses, and credit score.

Applying for Student Loan Refinancing

The application process for student loan refinancing is typically straightforward. You will need to provide the lender with your personal information, financial information, and employment history. The lender will then review your application and make a decision on whether or not to approve you for a loan.

If you are approved for a loan, the lender will send you a loan agreement. This agreement will Artikel the terms of your loan, including the interest rate, loan term, and fees. You will need to sign and return the loan agreement before your loan can be funded.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions to help students pay for college costs. Unlike federal student loans, private student loans are not backed by the government and have different eligibility requirements, interest rates, repayment terms, and grace periods.

Eligibility Requirements

To qualify for a private student loan, you must meet the following requirements:

- Be a U.S. citizen or permanent resident

- Be enrolled at least half-time in an accredited college or university

- Have a good credit score and credit history

- Have a cosigner if you have a limited credit history

Interest Rates

Interest rates on private student loans vary depending on the lender, your creditworthiness, and the loan term. Interest rates can be fixed or variable. Fixed interest rates remain the same for the life of the loan, while variable interest rates can fluctuate based on market conditions.

Repayment Terms

Repayment terms for private student loans vary depending on the lender and the loan amount. Repayment periods can range from 5 to 20 years. Some lenders offer deferred repayment options, which allow you to delay repayment until after you graduate or leave school.

Grace Periods

Private student loans typically have a grace period of 6 to 12 months after you graduate or leave school. During the grace period, you are not required to make any payments on the loan.

Risks and Benefits of Private Student Loans

There are both risks and benefits to taking out private student loans. Some of the risks include:

- Higher interest rates than federal student loans

- Lack of federal loan forgiveness programs

- Potential impact on your credit score if you default on the loan

Some of the benefits of private student loans include:

- Can be used to cover any college costs, including tuition, fees, books, and living expenses

- Can be obtained without a cosigner

- Can offer flexible repayment options

Tips for Finding the Best Private Student Loan Rates and Terms

If you are considering taking out a private student loan, it is important to shop around and compare rates and terms from multiple lenders. Here are some tips for finding the best private student loan rates and terms:

- Compare interest rates from multiple lenders

- Understand loan fees

- Negotiate with lenders

How to Apply for a Private Student Loan

To apply for a private student loan, you will need to provide the following documentation:

- Completed loan application

- Proof of income

- Proof of enrollment

- Credit history

Once you have gathered the required documentation, you can submit your loan application to the lender of your choice. The lender will review your application and make a decision on whether or not to approve your loan.

Alternative Financing Options

In addition to private student loans, there are a number of other financing options available to students, including:

- Scholarships

- Grants

- Work-study programs

These options can help you reduce the amount of money you need to borrow for college.

Resources

- Federal Student Aid: Private Student Loans

- NerdWallet: Private Student Loans

- Forbes: Private Student Loans

Student Loan Scams

Student loan scams are a serious problem that can cost you thousands of dollars. Scammers often target students who are desperate for financial aid, and they use a variety of tactics to trick them into giving up their personal information or money.

Here are some of the most common student loan scams:

Warning Signs of Student Loan Scams

There are a few warning signs that can help you identify a student loan scam. These include:

- The lender asks for your personal information, such as your Social Security number or bank account number, before you have applied for a loan.

- The lender promises you a low interest rate or a loan with no fees.

- The lender asks you to pay a fee to get a loan.

- The lender is not registered with the U.S. Department of Education.

What to Do if You Think You Have Been Scammed, Student loan news

If you think you have been scammed, there are a few things you should do:

- Contact your lender and let them know that you have been scammed.

- File a complaint with the Federal Trade Commission (FTC).

- Report the scam to your state’s attorney general’s office.

Resources for Victims of Student Loan Scams

There are a number of resources available to help victims of student loan scams. These include:

- The Federal Student Aid website has a page dedicated to student loan scams.

- The FTC has a website with information on how to avoid and report student loan scams.

- Your state’s attorney general’s office may have a website with information on student loan scams.

Examples of Real-Life Student Loan Scams

Here are a few examples of real-life student loan scams:

- In 2017, a group of scammers was arrested for targeting students with fake student loans. The scammers promised students low interest rates and no fees, but they actually charged students high interest rates and fees.

- In 2018, a scammer was arrested for selling fake student loan forgiveness certificates. The scammer promised students that they could get their student loans forgiven for a fee, but the certificates were actually worthless.

Table: Warning Signs of Student Loan Scams

The following table summarizes the warning signs of student loan scams:

| Warning Sign | Explanation |

|---|---|

| The lender asks for your personal information before you have applied for a loan. | This is a red flag because legitimate lenders will not ask for your personal information until after you have applied for a loan and been approved. |

| The lender promises you a low interest rate or a loan with no fees. | This is another red flag because legitimate lenders will not offer you a loan with an interest rate that is significantly lower than the market rate. |

| The lender asks you to pay a fee to get a loan. | This is a scam because legitimate lenders will not charge you a fee to get a loan. |

| The lender is not registered with the U.S. Department of Education. | This is a red flag because legitimate lenders must be registered with the U.S. Department of Education. |

Student Loan Counseling

Student loan counseling services provide borrowers with valuable guidance and support to help them manage their student loans effectively. These services can help borrowers understand their loan options, create repayment plans, and avoid common pitfalls.

There are several different types of student loan counseling services available, including:

Free Counseling Services

– Offered by non-profit organizations, government agencies, and educational institutions.

– Provide general information about student loans, repayment options, and financial aid.

For-Profit Counseling Services

– Charge a fee for their services.

– May offer more personalized advice and support, such as credit counseling and debt management plans.

To find a reputable student loan counselor, it is important to look for someone who is certified by a reputable organization, such as the National Foundation for Credit Counseling (NFCC) or the Association for Student Financial Aid Administrators (NASFAA).

Student loan counseling can provide several benefits to borrowers, including:

– Personalized advice and support tailored to their individual needs.

– Help borrowers understand their loan options and make informed decisions about repayment.

– Assistance in creating a repayment plan that fits their budget.

– Information about student loan forgiveness programs and other repayment assistance options.

– Support and guidance to help borrowers avoid common pitfalls, such as defaulting on their loans.

Student Loan Lawsuits

The student loan debt crisis has spawned numerous lawsuits and legal challenges. These lawsuits allege various issues, including:

- Unfair or deceptive lending practices

- Breach of contract

- Violation of consumer protection laws

The legal arguments in these lawsuits center around the responsibility of lenders and servicers, the enforceability of loan agreements, and the rights of borrowers. Potential outcomes include:

- Student loan forgiveness

- Loan modifications

- Compensation for damages

Landmark Cases

Several landmark cases have shaped the legal landscape of student loans. These include:

- Navient Corp. v. Tarte (2014): The Supreme Court ruled that private student loan companies can collect on defaulted loans even if the borrower has a disability.

- Sweet v. Cardona (2022): A federal court ruled that the Department of Education’s Public Service Loan Forgiveness program was “arbitrary and capricious.”

Recent Developments

In recent years, there have been several significant developments in student loan law. These include:

- The Biden administration’s student loan forgiveness plan, which is currently facing legal challenges.

- The rise of class-action lawsuits against student loan companies.

- Increased scrutiny of student loan servicers by state and federal regulators.

Student Loan Forgiveness News

The student loan debt crisis continues to loom large in the United States, with millions of borrowers struggling to repay their loans. In recent years, there have been growing calls for student loan forgiveness, and the Biden administration has taken steps to address this issue. In this section, we will provide up-to-date news and information on student loan forgiveness initiatives and programs, explain the latest changes and developments in student loan forgiveness policies, and discuss the potential impact of student loan forgiveness on borrowers and the economy.

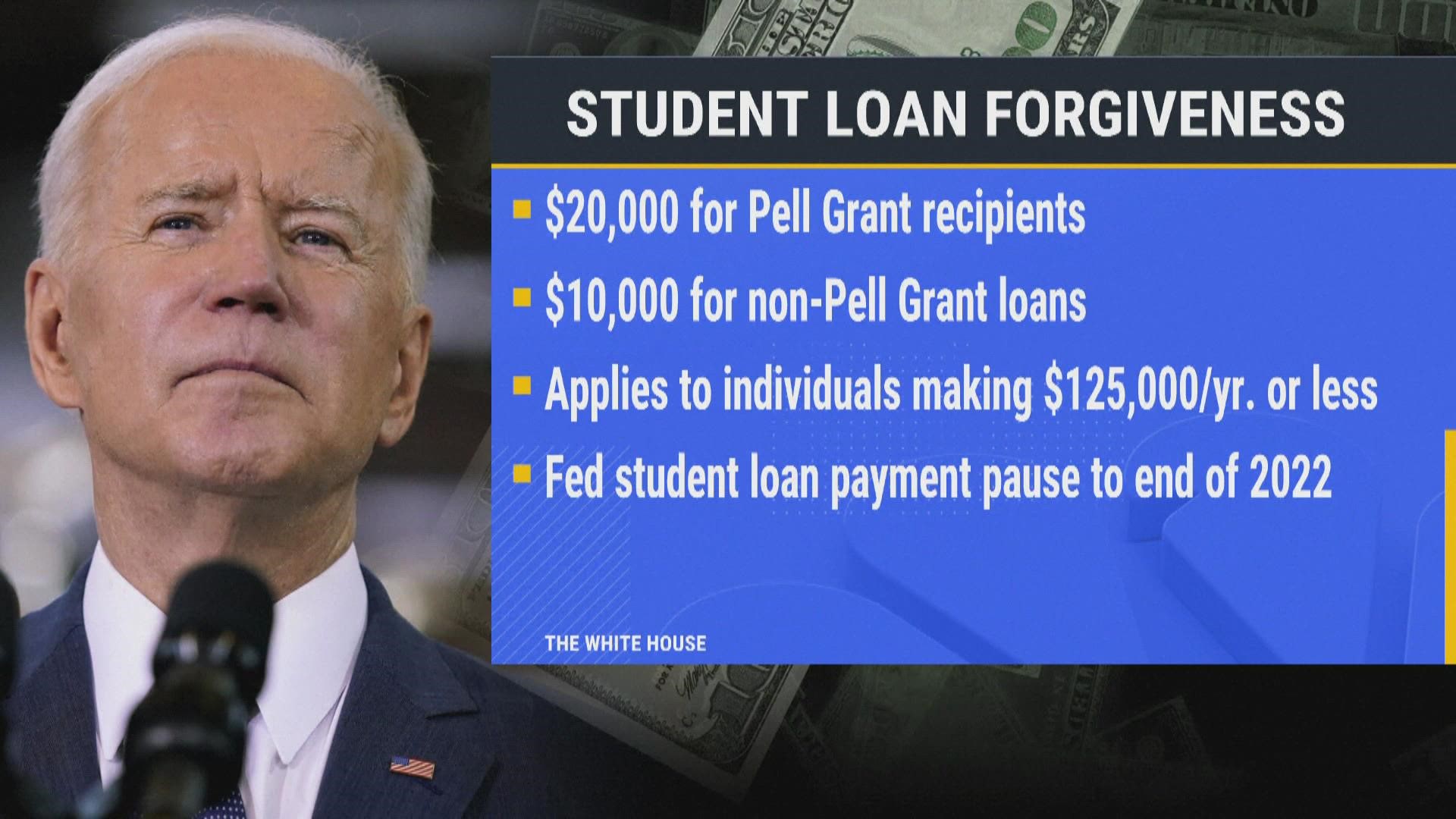

Biden’s Student Loan Forgiveness Plan

In August 2022, President Biden announced a plan to forgive up to $20,000 in student loan debt for federal student loan borrowers who earn less than $125,000 per year (or $250,000 for married couples). The plan also includes a provision to forgive up to $10,000 in student loan debt for borrowers who have received Pell Grants. The plan is expected to benefit approximately 40 million borrowers.

Legal Challenges to Student Loan Forgiveness

The Biden administration’s student loan forgiveness plan has been met with legal challenges. In October 2022, a federal judge in Texas blocked the plan, ruling that it was unconstitutional. The Biden administration has appealed the ruling, and the case is currently pending before the 5th Circuit Court of Appeals.

The Future of Student Loan Forgiveness

The future of student loan forgiveness is uncertain. The Biden administration has indicated that it is committed to student loan forgiveness, but it is unclear whether the plan will ultimately be implemented. The outcome of the legal challenges to the plan will likely play a significant role in determining the future of student loan forgiveness.

Student loan news is making headlines, with many borrowers seeking ways to manage their debt. One option that can provide financial relief is student loan consolidation. By combining multiple loans into a single, lower-interest loan, borrowers can reduce their monthly payments and save money over time.

Keep up with the latest student loan news and explore all your options to find the best solution for your financial situation.

Student Loan Repayment Assistance Programs: A Comparative Overview

Understanding the various student loan repayment assistance programs available can help you navigate the complexities of student loan repayment and potentially secure financial relief. Here’s a comprehensive table outlining the key features of these programs:

| Program Name | Eligibility Requirements | Application Process | Potential Benefits | Limitations | Potential Drawbacks |

|—|—|—|—|—|—|

| Income-Driven Repayment (IDR) Plans | Based on income and family size | Apply through your loan servicer | Lower monthly payments | Can extend the repayment period | May not be eligible for all loans |

| Student Loan Forgiveness Programs | For public service employees, teachers, and others | Varies depending on the program | Loan forgiveness after a certain number of years of service | Income limits and other restrictions | Can be competitive |

| Student Loan Consolidation | Combine multiple federal student loans into one | Apply through a loan servicer | Lower monthly payments, simplified repayment | May not qualify for income-driven repayment plans | Can increase interest charges if consolidation loan has a higher interest rate |

| Student Loan Refinancing | Replace existing student loans with a new loan from a private lender | Good credit and income required | Lower interest rates, shorter repayment terms | May not be eligible for federal loan benefits | Can increase monthly payments |

| Private Student Loans | Loans from non-federal lenders | Creditworthy borrowers required | Varies depending on the lender | May have higher interest rates and fewer repayment options | Can damage credit if not repaid on time |

| Student Loan Scams | Fraudulent schemes that target student loan borrowers | Be wary of unsolicited calls or emails | Can result in financial loss, identity theft | Report any suspicious activity to the authorities |

| Student Loan Counseling | Free assistance from non-profit organizations | Open to all student loan borrowers | Guidance on repayment options, budgeting, and financial management | May not be available in all areas | Can provide valuable information but may not resolve all financial issues |

| Student Loan Lawsuits | Legal actions against student loan servicers or lenders | For borrowers who have experienced financial harm | Can result in compensation or loan forgiveness | Can be complex and time-consuming | May not be successful in all cases |

Student Loan Default

Student loan default occurs when a borrower fails to make payments on their student loans for a period of 270 days or more. This can have serious consequences, including damage to credit scores, legal action, and wage garnishment.

There are several options available to borrowers who are at risk of defaulting on their student loans. These include:

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a single monthly payment. This can make it easier to manage student loan payments and reduce the risk of default.

Income-Driven Repayment Plans

Income-driven repayment plans base monthly student loan payments on the borrower’s income and family size. This can make student loan payments more affordable and reduce the risk of default.

Keep yourself updated on the latest student loan news. The Supreme Court recently ruled on student loan debt relief , a topic that has been widely debated. Stay informed about the implications of this ruling and other developments related to student loans to make informed decisions about your financial future.

Loan Forgiveness Programs

Loan forgiveness programs forgive student loan debt after a certain period of time or after the borrower meets certain requirements. This can be a valuable option for borrowers who are struggling to repay their student loans.

Tips for Avoiding Student Loan Default

- Make your student loan payments on time, every month.

- If you’re struggling to make your payments, contact your loan servicer to discuss options for reducing your monthly payment or putting your loans into forbearance or deferment.

- Be aware of the consequences of student loan default and take steps to avoid it.

Student Loan Statistics

Student loan debt has become a major issue in the United States, with millions of Americans struggling to repay their loans. The total amount of student loan debt in the U.S. has surpassed $1.7 trillion, making it the second largest type of consumer debt after mortgages.

Student loan borrowers come from all walks of life, but there are some demographic groups that are more likely to have student loan debt than others. For example, younger Americans are more likely to have student loan debt than older Americans, and women are more likely to have student loan debt than men. Borrowers with lower income levels are also more likely to have student loan debt.

The amount of student loan debt has been increasing steadily over time. In 2007, the average student loan debt was $23,200. By 2019, the average student loan debt had increased to $32,731.

In the realm of student loan news, the recent announcement of Biden’s student loan debt relief has sent ripples through the higher education landscape. This groundbreaking initiative has ignited hope and sparked conversations about the future of student debt management.

As the discourse unfolds, we delve into the implications of this transformative policy, exploring its potential impact on borrowers and the overall financial landscape.

Student Loan Debt by Race

Student loan debt is not distributed equally across all racial groups. Black and Hispanic borrowers are more likely to have student loan debt than white borrowers, and they also have higher average student loan debt balances. For example, in 2019, the average student loan debt for Black borrowers was $38,800, compared to $28,500 for white borrowers.

Student Loan Debt by Income Level

Student loan debt is also not distributed equally across all income levels. Borrowers with lower income levels are more likely to have student loan debt than borrowers with higher income levels. For example, in 2019, 45% of borrowers with income levels below $25,000 had student loan debt, compared to 27% of borrowers with income levels above $100,000.

– Student Loan Forgiveness Calculator

Navigating the complexities of student loan forgiveness can be daunting. To simplify the process, we’ve created an interactive calculator that empowers you to estimate potential savings under various forgiveness programs.

Features

- Input loan information (balance, interest rate, repayment term)

- Select from forgiveness programs (e.g., Public Service Loan Forgiveness, Teacher Loan Forgiveness)

- Estimate loan forgiveness amount and savings over the loan’s life

Assumptions and Limitations

- Based on current laws and regulations

- Does not account for future changes in laws or regulations

- Estimates may not be accurate in all cases

How to Use

Visit [website address] and input your loan information and desired forgiveness program. The calculator will estimate your potential forgiveness amount and savings.

Student Loan Resources

Student loan debt can be a daunting burden, but there are many resources available to help you manage your loans and achieve financial success.

The following list of resources includes government websites, non-profit organizations, and financial advisors who can provide you with information and assistance on a variety of student loan topics, including loan forgiveness, repayment assistance, and default prevention.

Government Websites

- Federal Student Aid: The U.S. Department of Education’s website provides information on all federal student loans, including eligibility, repayment options, and loan forgiveness programs. https://studentaid.gov

- Consumer Financial Protection Bureau (CFPB): The CFPB provides information on student loans, including how to avoid scams and how to file a complaint if you have a problem with your lender. https://www.consumerfinance.gov/student-loans

- Internal Revenue Service (IRS): The IRS provides information on student loan tax deductions and credits. https://www.irs.gov/credits-deductions/student-loan-interest-deduction

Non-Profit Organizations

- National Student Loan Program (NSLP): The NSLP is a non-profit organization that provides free counseling and assistance to student loan borrowers. https://www.nslp.org

- Student Loan Borrower Assistance Project (SLBAP): The SLBAP is a non-profit organization that provides free legal assistance to student loan borrowers. https://www.studentloanborrowerassistance.org

- American Student Assistance: American Student Assistance is a non-profit organization that provides free counseling and resources to student loan borrowers. https://www.asa.org

Financial Advisors

- Student Loan Planner: Student Loan Planner is a financial planning firm that specializes in helping student loan borrowers. https://studentloanplanner.com

- SoFi: SoFi is a financial services company that offers student loan refinancing and other financial products. https://www.sofi.com

- LendKey: LendKey is a financial services company that offers student loan refinancing and other financial products. https://www.lendkey.com

Ending Remarks

Whether you’re a current student, a recent graduate, or someone who has been struggling with student loan debt for years, this guide will empower you with the information and resources you need to take control of your financial future.

Remember, you’re not alone in this journey. With the right strategies and support, you can overcome the challenges of student loan debt and achieve your financial goals.

General Inquiries

What are the different types of student loans?

There are two main types of student loans: federal student loans and private student loans. Federal student loans are backed by the U.S. government and offer a variety of benefits, such as lower interest rates and more flexible repayment options. Private student loans are offered by banks and other private lenders and typically have higher interest rates and fewer benefits.

What are the different student loan forgiveness programs available?

There are a number of student loan forgiveness programs available, including Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Perkins Loan Forgiveness. Each program has its own eligibility requirements and application process.

What are the different student loan repayment plans available?

There are a number of different student loan repayment plans available, including the Standard Repayment Plan, the Graduated Repayment Plan, and the Extended Repayment Plan. Each plan has its own unique features and benefits.