With the car loan calculator taking center stage, we invite you to embark on a financial journey that empowers you to make informed decisions about your next vehicle purchase. This comprehensive tool is your trusted guide, providing clarity and control over every aspect of your car loan, ensuring you secure the best deal possible.

Our calculator is meticulously designed to cater to your unique financial situation, offering personalized calculations that factor in loan amount, term, interest rates, down payment, trade-in value, and more. Get ready to unlock a world of savings and drive away with confidence, knowing you’ve made the smartest choice for your automotive financing.

Loan Amount and Term

The loan amount and term are two of the most important factors that affect your monthly payments and the total cost of your car loan.

The loan amount is the amount of money you borrow from the lender. The loan term is the length of time you have to repay the loan. The longer the loan term, the lower your monthly payments will be. However, you will also pay more interest over the life of the loan.

Impact of Loan Amount

- A higher loan amount will result in higher monthly payments.

- A higher loan amount will also result in a higher total cost of the loan.

Impact of Loan Term

- A longer loan term will result in lower monthly payments.

- A longer loan term will also result in a higher total cost of the loan.

Example

Let’s say you are considering a car loan for $20,000. You are considering two different loan terms: a 3-year loan and a 5-year loan.

With a 3-year loan, your monthly payments would be $666.67. You would pay a total of $23,999.81 in interest over the life of the loan.

With a 5-year loan, your monthly payments would be $400.00. You would pay a total of $30,000.00 in interest over the life of the loan.

As you can see, the longer loan term results in lower monthly payments but a higher total cost of the loan.

Interest Rates

Interest rates are a crucial factor that significantly impact your monthly payments and the overall cost of your car loan. Higher interest rates lead to higher monthly payments and a higher total amount paid over the life of the loan, while lower interest rates result in lower monthly payments and a lower total cost.

It’s essential to understand how interest rates work and how they affect your loan payments. This knowledge will empower you to make informed decisions and choose the best loan option for your financial situation.

Impact on Monthly Payments

Interest rates directly affect the amount of your monthly payments. A higher interest rate means you’ll pay more in interest each month, resulting in a higher overall payment. Conversely, a lower interest rate means you’ll pay less in interest, leading to a lower monthly payment.

Impact on Total Loan Cost

Interest rates also have a significant impact on the total cost of your loan. The higher the interest rate, the more you’ll pay in interest over the life of the loan. This means that even a small difference in interest rate can result in a substantial difference in the total amount you pay.

Down Payment

Making a down payment on your car loan can have several benefits. It can reduce your monthly payments, save you money on interest charges, and build equity in your car faster.

Calculating Potential Savings

The amount of money you save on monthly payments and interest charges will depend on the size of your down payment. Generally, the larger your down payment, the lower your monthly payments and interest charges will be.

To calculate your potential savings, you can use a car loan calculator. Enter the loan amount, loan term, and interest rate, and then compare the results for different down payment amounts.

Example Table

Here is a table that compares the monthly payments and interest charges for different down payment amounts on a $20,000 car loan with a 5% interest rate and a 60-month term:

| Down Payment Amount | Monthly Payment | Interest Charges |

|—|—|—|

| 0% | $372 | $2,232 |

| 5% | $353 | $1,980 |

| 10% | $334 | $1,728 |

| 15% | $315 | $1,476 |

| 20% | $296 | $1,224 |

As you can see, making a larger down payment can significantly reduce your monthly payments and interest charges.

Summary

Making a down payment on your car loan is a smart financial move. It can save you money on monthly payments and interest charges, and it can help you build equity in your car faster. If you can afford it, making a larger down payment is always a good idea.

Trade-In Value

The trade-in value of your current vehicle can significantly impact the amount you need to finance for your new car. A higher trade-in value means a lower loan amount, which can result in lower monthly payments and a lower total cost of the loan.

Here are some examples of how different trade-in values can affect the monthly payment and total cost of a loan:

Loan Amount and Monthly Payment

- If you have a trade-in value of $5,000, your loan amount will be $20,000 (assuming you are financing $25,000). With a 5% interest rate and a 60-month loan term, your monthly payment will be $393.48 and the total cost of the loan will be $23,608.80.

- If you have a trade-in value of $10,000, your loan amount will be $15,000. With the same interest rate and loan term, your monthly payment will be $295.13 and the total cost of the loan will be $17,707.60.

- If you have no trade-in value, your loan amount will be $25,000. With the same interest rate and loan term, your monthly payment will be $491.67 and the total cost of the loan will be $29,500.20.

As you can see, a higher trade-in value can significantly reduce the amount you need to finance, which can lead to lower monthly payments and a lower total cost of the loan.

It is important to get a fair trade-in value for your current vehicle. You can do this by getting quotes from multiple dealerships or by using an online trade-in calculator.

Here are some tips for negotiating a fair trade-in value:

- Do your research and know what your car is worth.

- Be prepared to walk away from the deal if you don’t get a fair offer.

- Don’t be afraid to negotiate.

Loan Fees

Loan fees are additional costs associated with taking out a car loan. These fees can vary depending on the lender, the type of loan, and the amount of money you borrow. It’s important to be aware of these fees before you sign a loan agreement so that you can factor them into your budget.

Calculating car loans has become effortless with online calculators that simplify the process. However, for a more comprehensive understanding of loan underwriting, exploring Simplified Loan Solutions Underwriting is highly recommended. This resource provides valuable insights into loan approval criteria, enabling you to optimize your application and secure the best car loan terms.

Common Loan Fees

Some of the most common loan fees include:

- Application fee: This fee is charged to cover the cost of processing your loan application.

- Origination fee: This fee is charged to cover the cost of setting up your loan.

- Underwriting fee: This fee is charged to cover the cost of assessing your creditworthiness.

- Closing fee: This fee is charged to cover the cost of closing your loan.

- Prepayment penalty: This fee is charged if you pay off your loan early.

Impact of Loan Fees on Monthly Payments, Car loan calculator

Loan fees can have a significant impact on your monthly payments. For example, a loan with a high origination fee will have a higher monthly payment than a loan with a low origination fee. This is because the origination fee is added to the amount of money you borrow, which means you’ll be paying interest on the fee over the life of the loan.

The table below summarizes the different types of loan fees, their purpose, and how they are typically calculated.

| Fee | Purpose | Calculation |

|---|---|---|

| Application fee | To cover the cost of processing your loan application | Typically a flat fee |

| Origination fee | To cover the cost of setting up your loan | Typically a percentage of the loan amount |

| Underwriting fee | To cover the cost of assessing your creditworthiness | Typically a flat fee |

| Closing fee | To cover the cost of closing your loan | Typically a flat fee |

| Prepayment penalty | To discourage you from paying off your loan early | Typically a percentage of the remaining loan balance |

Importance of Considering Loan Fees

When you’re comparing different loan options, it’s important to consider the loan fees as well as the interest rate. A loan with a lower interest rate may not be the best option if it has high loan fees. By taking the time to understand the different types of loan fees and how they can impact your monthly payments, you can make an informed decision about which loan is right for you.

Payment Frequency

When taking out a car loan, you’ll need to decide how often you want to make payments. The two most common options are monthly and bi-weekly payments.

Monthly payments are the most common type of car loan payment. They’re made once a month, and the amount of each payment is the same. Bi-weekly payments are made every two weeks, and the amount of each payment is half of the monthly payment.

Potential Savings on Interest Charges with Bi-Weekly Payments

Bi-weekly payments can save you money on interest charges over the life of your loan. That’s because you’re making more payments each year, which means you’re paying off your loan faster. The faster you pay off your loan, the less interest you’ll pay overall.

For example, let’s say you have a $20,000 car loan with a 5% interest rate and a 60-month term. If you make monthly payments, you’ll pay $367.95 per month and $1,939.45 in interest over the life of the loan. If you make bi-weekly payments, you’ll pay $183.98 every two weeks and $1,839.45 in interest over the life of the loan. That’s a savings of $100 on interest charges!

| Payment Frequency | Total Amount Paid | Interest Saved |

|---|---|---|

| Monthly | $21,939.45 | $1,939.45 |

| Bi-weekly | $21,839.45 | $1,839.45 |

Benefits and Drawbacks of Each Payment Frequency Option

There are some benefits and drawbacks to each payment frequency option. Here’s a summary:

- Monthly payments:

- Easier to budget for

- Less likely to miss a payment

- Bi-weekly payments:

- Can save you money on interest charges

- Can help you pay off your loan faster

- Can be more difficult to budget for

- More likely to miss a payment

Ultimately, the best payment frequency option for you depends on your individual circumstances. If you’re comfortable budgeting for bi-weekly payments and you’re confident that you won’t miss any payments, then bi-weekly payments can save you money on interest charges. However, if you’re not comfortable budgeting for bi-weekly payments or you’re worried about missing payments, then monthly payments may be a better option for you.

Loan Refinancing

Refinancing a car loan involves replacing your existing loan with a new one, typically with more favorable terms. This can offer several benefits, including:

Lowering Monthly Payments

Refinancing can reduce your monthly payments by securing a lower interest rate or extending the loan term. For example, if you have a $20,000 loan with a 5% interest rate and a 60-month term, your monthly payment would be around $395. Refinancing to a loan with a 4% interest rate and a 72-month term could lower your monthly payment to $336, saving you over $60 per month.

Reducing the Total Cost of the Loan

Refinancing to a lower interest rate can also reduce the total cost of the loan. For instance, if you refinance the same $20,000 loan with a 5% interest rate to a loan with a 4% interest rate, you could save over $1,000 in interest over the life of the loan.

Extending the Loan Term

Refinancing can extend the loan term, which can lower monthly payments but increase the total cost of the loan. This option may be suitable if you need to lower your monthly payments immediately but can afford to pay the loan off over a longer period.

Changing the Loan Type

Refinancing allows you to change the loan type, such as from a variable to a fixed rate loan. A fixed rate loan provides stability in your monthly payments, while a variable rate loan may fluctuate based on market conditions.

Comparison of Lenders

When searching for a car loan, it’s essential to compare loan offers from multiple lenders to secure the best possible deal. Different lenders offer varying interest rates, loan terms, and fees, so comparing their options allows you to make an informed decision that aligns with your financial situation and car-buying needs.

To find the best loan rates and terms, consider the following tips:

Research and Get Pre-Approved

- Research different lenders, including banks, credit unions, and online lenders.

- Get pre-approved for a loan before visiting dealerships. This will give you a clear understanding of your loan eligibility and potential interest rates.

Compare Loan Terms

- Pay attention to the loan term, which is the length of time you have to repay the loan. A shorter term typically results in higher monthly payments but lower overall interest costs.

- Compare the interest rates offered by different lenders. The interest rate determines the amount of interest you will pay over the life of the loan.

Consider Loan Fees

- Inquire about any loan fees, such as origination fees, closing costs, or prepayment penalties. These fees can add to the overall cost of the loan.

- Some lenders may offer discounts or incentives for certain types of borrowers or loan terms.

Read the Fine Print

- Carefully review the loan agreement before signing to ensure you understand all the terms and conditions.

- Be aware of any potential penalties or restrictions associated with the loan.

Benefits of Pre-Approval for Car Loans

Getting pre-approved for a car loan offers numerous advantages that can enhance your car-buying experience. Pre-approval not only streamlines the loan application process but also strengthens your negotiating position and helps you save time and money.

Strengthening Negotiating Position

Pre-approval empowers you with a clear understanding of your loan terms, including the interest rate and monthly payment. Armed with this information, you can negotiate with dealerships from a position of strength. Dealerships are more likely to offer competitive rates and favorable terms to pre-approved buyers, knowing that you have already secured financing.

Saving Time and Money

Pre-approval can significantly save you time and money during the car-buying process. By completing the loan application and securing pre-approval before visiting dealerships, you eliminate the need for lengthy negotiations and multiple loan applications. This streamlined process allows you to focus on finding the right car and negotiating the best price, rather than spending hours on loan paperwork.

Impact on Credit Score

Applying for a car loan can have a temporary impact on your credit score. When you apply for a loan, the lender will perform a hard inquiry on your credit report. This can cause your score to drop a few points. However, this is typically a temporary effect, and your score will usually rebound within a few months.

There are a few things you can do to minimize the impact of applying for a car loan on your credit score:

– Shop around for the best loan rates. When you shop around, you can compare offers from multiple lenders without affecting your credit score.

– Apply for a loan only when you are serious about buying a car. Each time you apply for a loan, it will be recorded on your credit report. If you apply for too many loans in a short period of time, it can damage your score.

– Pay your bills on time. Your payment history is one of the most important factors in your credit score. Make sure to pay all of your bills on time, including your car loan payment.

– Keep your credit utilization low. Your credit utilization ratio is the amount of credit you are using compared to the amount of credit you have available. A high credit utilization ratio can damage your score.

Additional Features

Car loan calculators often include additional features that can help you make informed decisions about your car loan.

These features may include:

Payment Calculators

Payment calculators allow you to estimate your monthly car payment based on the loan amount, loan term, and interest rate. This can help you determine if you can afford the car you want.

Loan Term Calculators

Loan term calculators allow you to determine the length of your loan based on the loan amount, monthly payment, and interest rate. This can help you choose a loan term that fits your budget.

Interest Rate Calculators

Interest rate calculators allow you to estimate the interest rate you may qualify for based on your credit score and other factors. This can help you compare loan offers from different lenders and find the best deal.

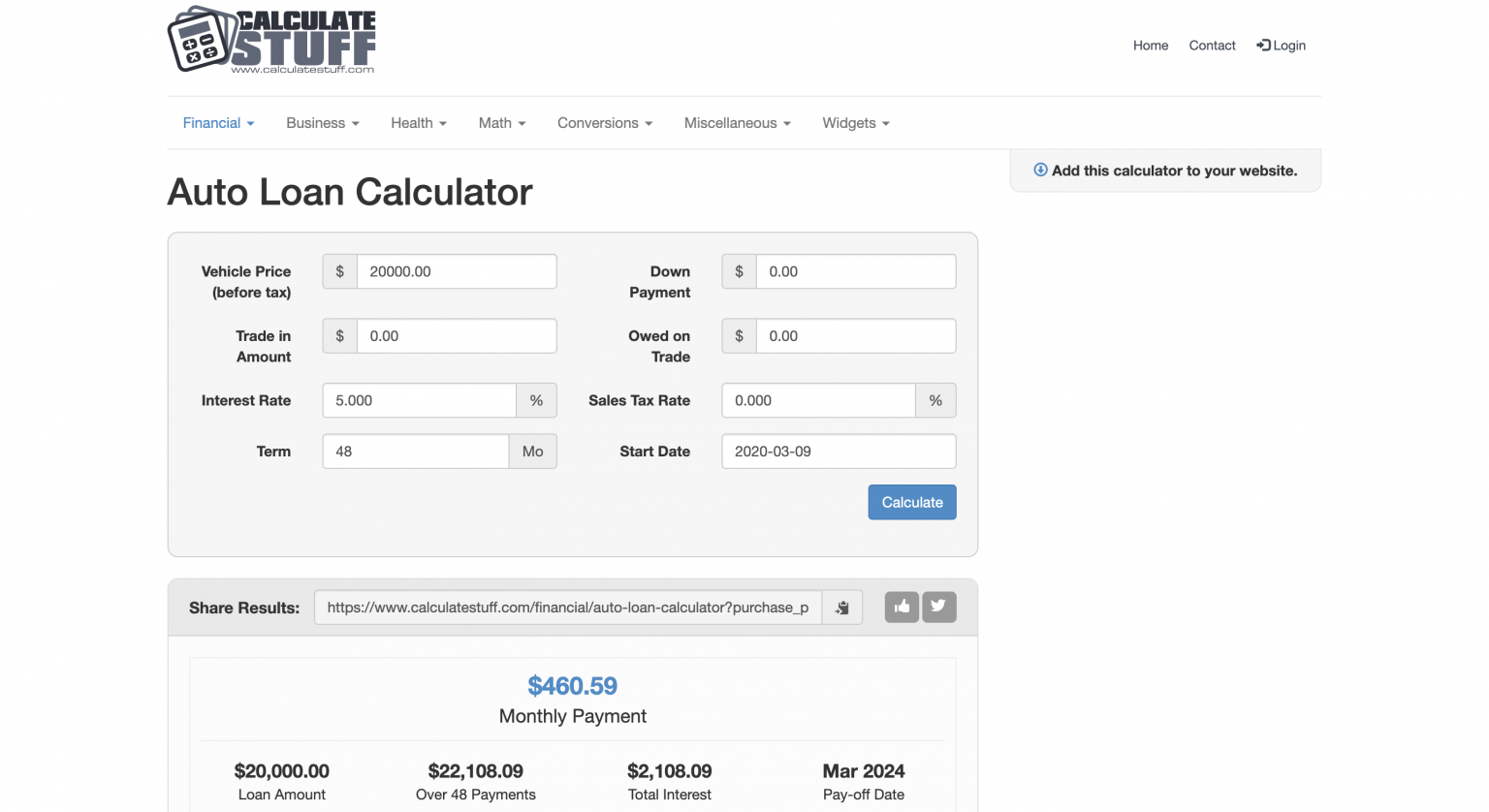

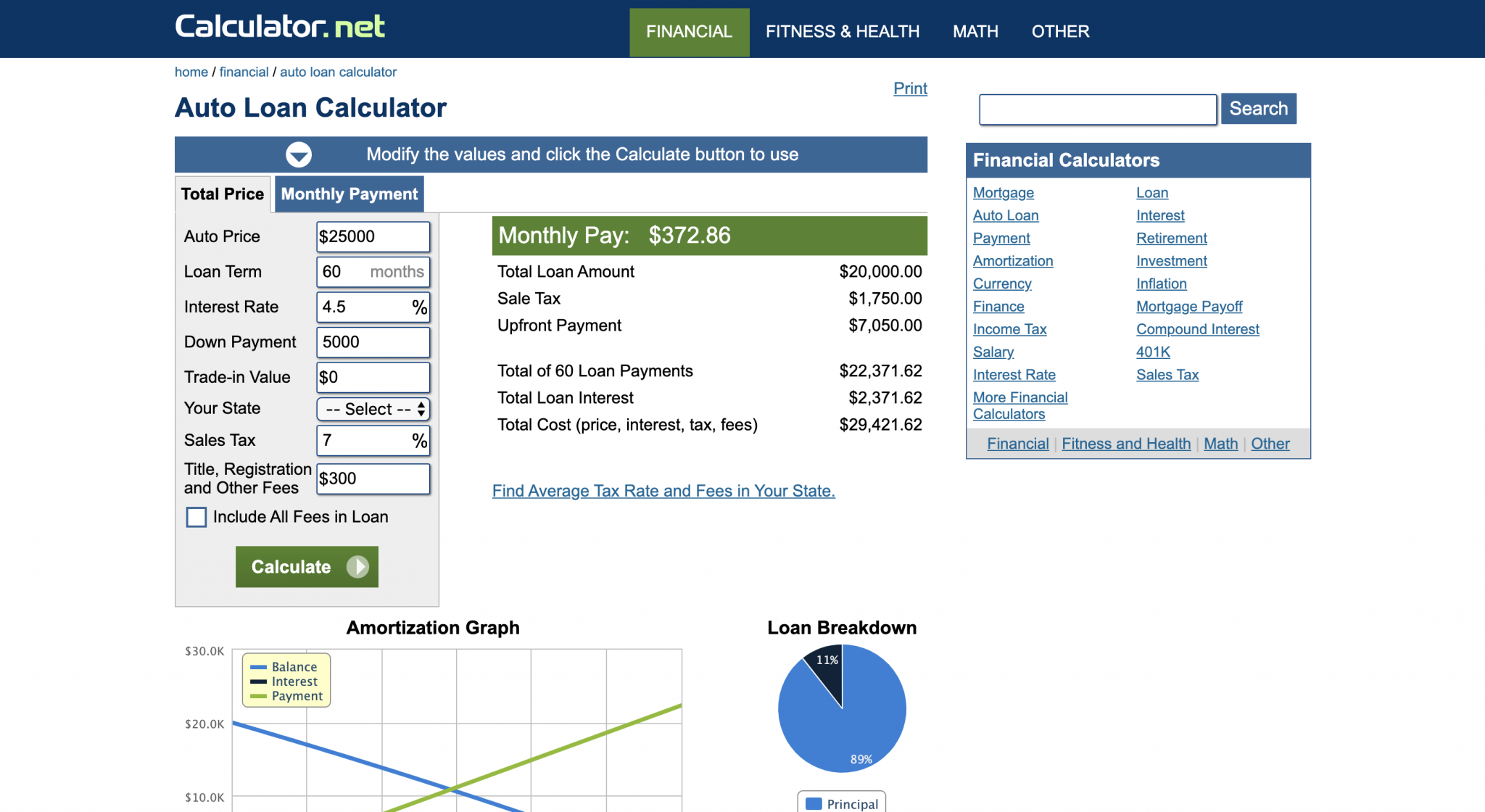

User Interface

A user-friendly interface is crucial for car loan calculators to ensure a seamless and efficient user experience. Well-designed calculators should be easy to navigate, with clear instructions and minimal jargon.

Intuitive calculators allow users to input their information quickly and accurately. They should provide real-time feedback and error checking to prevent mistakes.

Examples of Well-Designed Calculators

- Bankrate’s Car Loan Calculator: This calculator features a clean and user-friendly interface with clear instructions and easy-to-understand options.

- NerdWallet’s Auto Loan Calculator: This calculator offers a range of customization options, allowing users to compare different loan scenarios and see how changes affect their monthly payments.

Integration with Other Tools

Integrating car loan calculators with other financial tools offers numerous benefits for users seeking to manage their finances effectively.

Budgeting Apps

Syncing a car loan calculator with budgeting apps enables users to:

– Track car loan payments alongside other financial obligations

– Set realistic budgets that account for car expenses

– Monitor spending patterns and identify areas for potential savings

– Include a table that summarizes the key terms and concepts related to car loans, such as interest rates, loan terms, and down payments.

Before you head to the dealership, it’s important to understand the key terms and concepts related to car loans. This will help you make informed decisions and negotiate the best possible deal.

For those considering a car loan, using a car loan calculator can be a helpful tool in determining monthly payments and interest rates. These calculators provide an estimate of the financial obligations associated with the loan. However, it’s important to remember that a Collateral Underwriter plays a crucial role in assessing the risk associated with a loan.

Their expertise ensures that lenders make informed decisions, which ultimately impacts the loan terms and conditions offered to borrowers. Understanding the role of a Collateral Underwriter can provide valuable insights into the car loan process.

Here’s a table that summarizes some of the most important terms:

| Term | Definition |

|---|---|

| Interest rate | The percentage of the loan amount that you’ll pay in interest over the life of the loan. |

| Loan term | The length of time you have to repay the loan. |

| Down payment | The amount of money you pay upfront when you take out the loan. |

| Monthly payment | The amount of money you’ll pay each month to repay the loan. |

| Total cost of ownership | The total amount of money you’ll pay for the car over the life of the loan, including the purchase price, interest, and other fees. |

Final Review

As you navigate the complexities of car loans, remember that knowledge is power. Our calculator is your financial compass, guiding you towards the most favorable terms and helping you achieve your automotive dreams. Embrace the journey, explore your options, and let the car loan calculator be your trusted companion on the road to financial freedom.

Common Queries: Car Loan Calculator

How does the car loan calculator help me?

Our calculator provides personalized estimates based on your specific financial situation, empowering you to compare loan options, explore different scenarios, and make informed decisions about your car purchase.

What factors influence my car loan payments?

Loan amount, interest rates, loan term, down payment, and trade-in value are key factors that impact your monthly payments. Our calculator considers all these variables to give you an accurate estimate.

How can I get the best interest rates on my car loan?

Shopping around and comparing offers from multiple lenders is crucial. Our calculator helps you compare loan options and identify the most competitive interest rates.