The student loan forgiveness program has been a topic of much debate in recent years. This comprehensive guide will provide you with all the information you need to know about the program, including eligibility requirements, application process, benefits, and more.

With student loan debt reaching new heights, the pressure is mounting on the government to provide relief to borrowers. The student loan forgiveness program is one potential solution that could help millions of Americans escape the burden of student debt.

Introduction

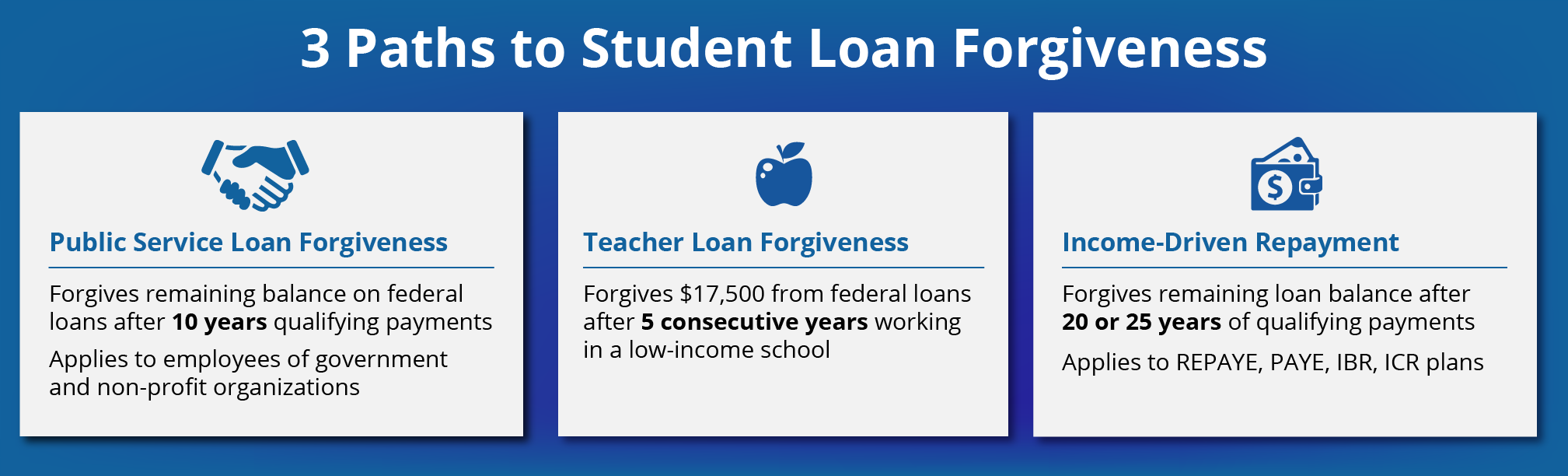

The student loan forgiveness program is a government initiative designed to provide financial relief to borrowers who are struggling to repay their student loans. The program was first introduced in 2007 and has since been expanded several times. The current version of the program, known as the Public Service Loan Forgiveness (PSLF) program, allows borrowers who work in public service jobs to have their student loans forgiven after 10 years of service.

The PSLF program was created in response to the growing problem of student loan debt in the United States. In 2007, the total amount of student loan debt in the U.S. was $600 billion. By 2019, that number had grown to $1.6 trillion. The PSLF program is designed to help borrowers who are struggling to repay their student loans by providing them with a way to have their loans forgiven after 10 years of service.

Eligibility

To be eligible for the PSLF program, borrowers must meet the following requirements:

- Be employed by a government agency or a non-profit organization

- Have made 120 qualifying payments on their student loans

- Have not defaulted on their student loans

Eligibility Requirements

To qualify for the student loan forgiveness program, borrowers must meet certain eligibility criteria. These criteria include income limits, loan types, and repayment status.

The following types of federal student loans are eligible for forgiveness under the program:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Federal Family Education Loans (FFEL)

- Perkins Loans

Borrowers who have made 120 qualifying payments on their student loans may be eligible for forgiveness under the program. Qualifying payments are those that are made on time and in full. Borrowers who have made less than 120 qualifying payments may still be eligible for partial forgiveness.

To determine if you are eligible for the student loan forgiveness program, you can complete the Public Service Loan Forgiveness (PSLF) Help Tool.

| Criteria | Requirement |

|---|---|

| Income | Borrowers must meet certain income limits to be eligible for forgiveness. The income limits are based on the borrower’s Adjusted Gross Income (AGI). |

| Loan Type | Only certain types of federal student loans are eligible for forgiveness. The eligible loan types are listed above. |

| Repayment Status | Borrowers must have made 120 qualifying payments on their student loans to be eligible for forgiveness. |

The following flowchart illustrates the eligibility determination process for the student loan forgiveness program:

Frequently Asked Questions about Eligibility

Q: What is the income limit for the student loan forgiveness program?

A: The income limit for the student loan forgiveness program is based on the borrower’s Adjusted Gross Income (AGI). The income limit is $125,000 for single borrowers and $250,000 for married couples who file jointly.

Q: What types of loans are eligible for forgiveness?

A: The following types of federal student loans are eligible for forgiveness under the program: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Federal Family Education Loans (FFEL), and Perkins Loans.

Q: How do I know if I have made 120 qualifying payments?

A: You can check your qualifying payment history by logging into your Federal Student Aid account at StudentAid.gov. You can also contact your loan servicer for more information.

Application Process

Applying for the student loan forgiveness program is a straightforward process that can be completed online. Here’s a step-by-step guide to help you through the application:

Application Timeline

The application process typically takes 60 to 90 days to complete. However, the timeline may vary depending on the volume of applications received.

Required Documents

- Proof of income

- Proof of employment

- Loan statements

- Tax returns

Application Website

You can apply for the student loan forgiveness program online at the following website: https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service

Key Steps in the Application Process

| Step | Description |

|---|---|

| 1 | Create an account on the Federal Student Aid website |

| 2 | Gather the required documents |

| 3 | Complete the online application |

| 4 | Submit the application and supporting documents |

| 5 | Wait for the application to be processed |

| 6 | Receive a decision on your application |

Forgiveness Amounts

The amount of student loan forgiveness you receive depends on the type of loan you have, your income, and the specific forgiveness program you qualify for.

Federal student loans are eligible for the most generous forgiveness programs, including Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. These programs forgive the entire remaining balance of your federal student loans after you have made a certain number of qualifying payments while working in a public service job or teaching in a low-income school.

Private student loans are not eligible for federal forgiveness programs. However, some private lenders offer their own forgiveness programs. These programs typically have more restrictive eligibility requirements than federal programs, and they may only forgive a portion of your loan balance.

The amount of forgiveness you receive can have a significant impact on your financial future. If you have a large amount of student loan debt, forgiveness can help you reduce your monthly payments, save money on interest, and reach your financial goals sooner.

The impact of student loan forgiveness on borrowers of different income levels and debt burdens is complex. Some borrowers may benefit more from forgiveness than others, depending on their individual circumstances.

For example, borrowers with high incomes and low debt burdens may not benefit as much from forgiveness as borrowers with low incomes and high debt burdens. This is because borrowers with high incomes are more likely to be able to repay their loans on their own, even without forgiveness.

However, forgiveness can still be beneficial for borrowers with high incomes if they have a large amount of debt. For example, a borrower with a high income and $100,000 in student loan debt may still benefit from forgiveness if it reduces their monthly payments and saves them money on interest.

The potential economic effects of student loan forgiveness are also complex. Some economists argue that forgiveness would stimulate the economy by freeing up money that borrowers would otherwise have to spend on loan repayments. Others argue that forgiveness would be too expensive and would lead to higher taxes.

The key arguments for student loan forgiveness include:

* Forgiveness would help to reduce the burden of student loan debt on borrowers.

* Forgiveness would stimulate the economy by freeing up money that borrowers would otherwise have to spend on loan repayments.

* Forgiveness would help to reduce the racial wealth gap, as Black and Hispanic borrowers are more likely to have student loan debt than white borrowers.

The key arguments against student loan forgiveness include:

* Forgiveness would be too expensive and would lead to higher taxes.

* Forgiveness would be unfair to borrowers who have already repaid their loans.

* Forgiveness would encourage colleges and universities to raise tuition prices, knowing that the government will forgive the loans anyway.

Ultimately, the decision of whether or not to forgive student loans is a complex one that involves a number of factors. There are strong arguments both for and against forgiveness, and the potential impact of forgiveness on borrowers and the economy is uncertain.

Benefits of Student Loan Forgiveness

Student loan forgiveness can have a significant impact on borrowers’ financial and overall well-being. By eliminating or reducing the burden of student loan debt, forgiveness can provide borrowers with financial relief, increase their disposable income, and improve their credit scores.

For example, borrowers who qualify for full forgiveness may be able to save thousands of dollars in interest payments over the life of their loans. This can free up a significant amount of money that can be used to pay for other expenses, such as housing, food, or healthcare.

Financial Benefits

- Reduced monthly payments or elimination of debt

- Increased disposable income

- Improved credit scores

- Access to lower interest rates on other loans

Overall Well-being Benefits

- Reduced stress and anxiety

- Improved mental and physical health

- Increased job satisfaction

- Greater financial security

– Discuss the challenges of student loan forgiveness, including the potential costs of the program and how forgiveness could impact the economy.: Student Loan Forgiveness Program

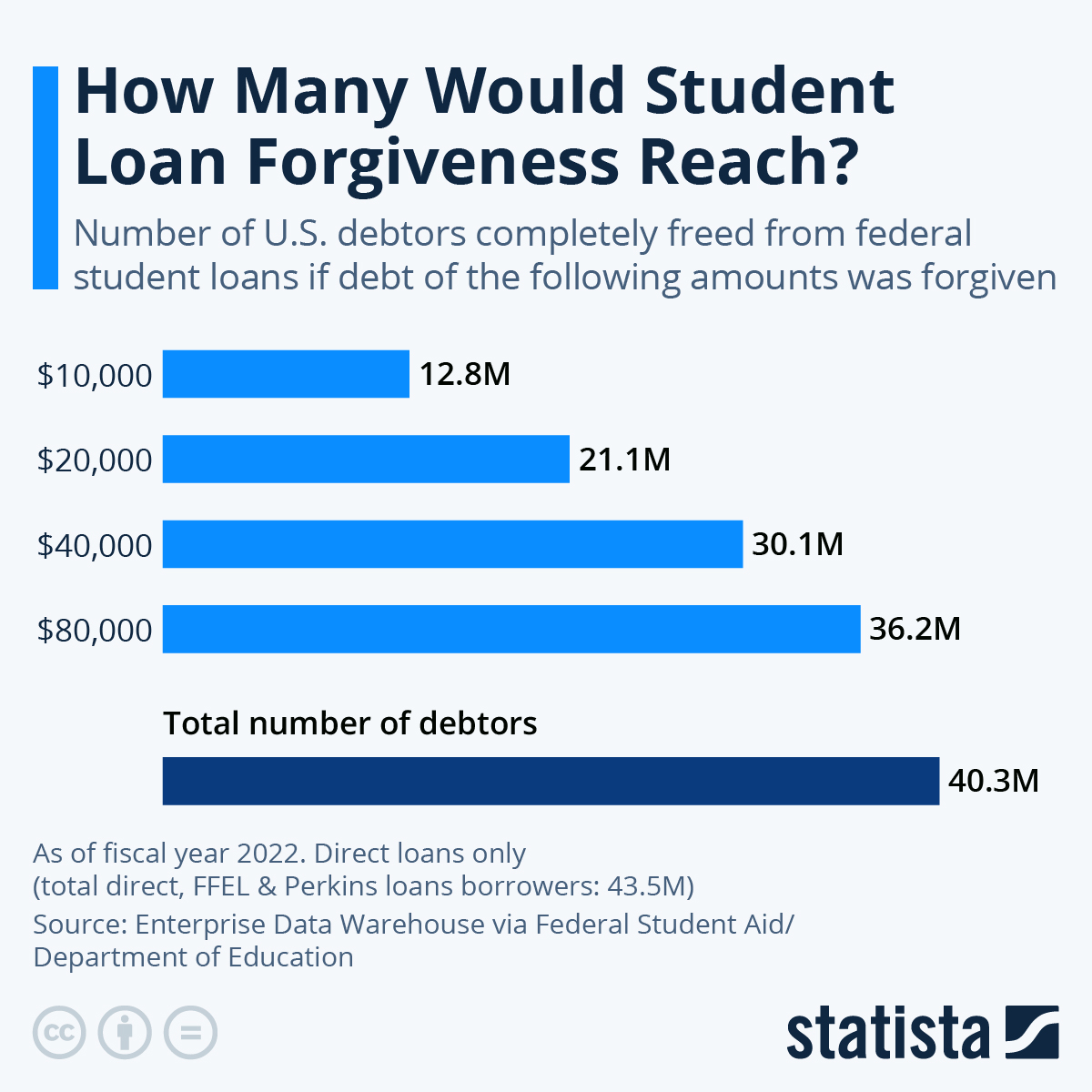

Student loan forgiveness is a complex issue with a number of potential challenges. One of the biggest challenges is the cost of the program. The total amount of student loan debt in the United States is over $1.7 trillion, and forgiving all of this debt would be a significant expense for the government.

Another challenge is the potential impact of forgiveness on the economy. Some economists argue that forgiving student loan debt would stimulate the economy by freeing up money that borrowers could spend on other goods and services. Others argue that it would lead to inflation by increasing the demand for goods and services.

Potential costs of student loan forgiveness

- The total cost of forgiving all student loan debt in the United States would be over $1.7 trillion.

- The government would have to find a way to pay for this, either by raising taxes or cutting spending.

- Forgiving student loan debt could lead to inflation by increasing the demand for goods and services.

Potential impact of student loan forgiveness on the economy

- Forgiving student loan debt could stimulate the economy by freeing up money that borrowers could spend on other goods and services.

- It could also lead to inflation by increasing the demand for goods and services.

- The impact of student loan forgiveness on the economy is difficult to predict and would depend on a number of factors, such as the size of the program and the way it is implemented.

Alternative Solutions to Student Loan Debt

In addition to student loan forgiveness, there are several alternative solutions that can help borrowers manage their student loan debt. These solutions aim to make student loan payments more manageable and provide borrowers with options to reduce their overall debt burden.

The student loan forgiveness program provides financial relief to eligible borrowers. If you’re wondering how to take advantage of this program, learn how to apply for student loan forgiveness through our comprehensive guide. Understanding the application process is crucial for maximizing your chances of qualifying for loan forgiveness under this valuable program.

One common alternative solution is income-driven repayment plans. These plans adjust a borrower’s monthly payments based on their income and family size. This can significantly reduce the amount of money a borrower has to pay each month, making it easier to stay current on their payments and avoid default.

Income-Driven Repayment Plans

- Income-Based Repayment (IBR): This plan caps monthly payments at 10% of a borrower’s discretionary income. Discretionary income is the amount of income a borrower has left after paying for basic living expenses, such as food, housing, and transportation.

- Pay As You Earn Repayment (PAYE): This plan caps monthly payments at 10% of a borrower’s discretionary income, but it also forgives any remaining balance after 20 years of payments.

- Revised Pay As You Earn Repayment (REPAYE): This plan caps monthly payments at 10% of a borrower’s discretionary income, but it allows borrowers to repay their loans over a longer period of time, up to 25 years.

Income-driven repayment plans can be a good option for borrowers who have high student loan debt relative to their income. However, it’s important to note that these plans can extend the repayment period, which means borrowers will pay more interest over the life of their loans.

While the student loan forgiveness program offers a glimmer of hope, it’s crucial to stay informed about your repayment options. Utilize a student loan payment calculator to estimate your monthly payments, interest rates, and loan term. This tool empowers you to plan effectively and navigate the complexities of student loan repayment, ensuring a smoother transition as you work towards financial freedom.

Political Implications of Student Loan Forgiveness

The prospect of student loan forgiveness has ignited a fierce political debate in the United States. The program has been the subject of heated discussions in Congress, with both sides presenting compelling arguments and counterarguments.

Biden Administration’s Perspective

President Biden has been a vocal advocate for student loan forgiveness, proposing a plan to cancel up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year. The administration argues that this measure would provide much-needed relief to millions of Americans struggling with student debt, boost the economy, and promote racial equity.

Democratic Lawmakers’ Views

Democratic lawmakers have largely supported the Biden administration’s proposal, arguing that it would help address the growing student debt crisis and reduce economic disparities. They maintain that forgiving student loans would free up funds for borrowers to spend on other necessities, stimulate consumer spending, and create jobs.

Republican Lawmakers’ Opposition

Republican lawmakers have overwhelmingly opposed student loan forgiveness, arguing that it would be unfair to taxpayers who have already paid off their student loans or chosen not to attend college. They also contend that it would increase inflation and exacerbate the federal deficit.

Advocacy Groups’ Perspectives

Advocacy groups representing students and borrowers have welcomed the prospect of student loan forgiveness, arguing that it would provide much-needed relief and promote access to higher education. However, some groups have expressed concerns that the Biden administration’s proposal may not go far enough and that more comprehensive measures are needed to address the systemic issues underlying the student debt crisis.

Midterm and Presidential Elections

Student loan forgiveness is expected to be a major issue in the upcoming midterm elections and the 2024 presidential election. Democrats hope that the prospect of debt relief will motivate young voters and other borrowers to turn out in support of their candidates. Republicans, on the other hand, are likely to use the issue to attack Democrats as fiscally irresponsible and out of touch with the concerns of average Americans.

Long-Term Political Consequences

Student loan forgiveness could have significant long-term political consequences. It could reshape the relationship between the government and higher education, potentially leading to increased government involvement in the financing and regulation of colleges and universities. It could also affect the political landscape by galvanizing young voters and other borrowers into a more politically active constituency.

Historical Examples

Student loan forgiveness has been used as a political tool in the past. In 2007, President George W. Bush signed into law a student loan forgiveness program for teachers who worked in low-income schools. This program was designed to encourage more people to enter the teaching profession and address the shortage of qualified teachers in underserved communities.

Impact on Higher Education

Student loan forgiveness has the potential to significantly impact higher education. In the short term, forgiveness could lead to decreased tuition costs, increased enrollment rates, and improved quality of higher education. In the long term, forgiveness could increase the diversity of students in higher education and improve the financial stability of higher education institutions.

College Costs

Student loan forgiveness could decrease tuition costs by reducing the amount of money that students need to borrow to pay for college. This could make college more affordable for students, especially those from low-income backgrounds.

Enrollment Rates

Student loan forgiveness could increase enrollment rates by making college more affordable for students. This could lead to a more educated workforce and a stronger economy.

Quality of Higher Education

Student loan forgiveness could improve the quality of higher education by providing institutions with more resources to invest in faculty salaries, research funding, and student services. This could lead to improved teaching, research, and student outcomes.

Diversity of Students

Student loan forgiveness could increase the diversity of students in higher education by making college more affordable for students from low-income backgrounds. This could lead to a more diverse workforce and a more inclusive society.

Financial Stability of Higher Education Institutions

Student loan forgiveness could improve the financial stability of higher education institutions by providing them with more revenue from tuition payments. This could lead to increased investment in faculty, research, and student services.

Overall Economy

Student loan forgiveness could boost the overall economy by increasing the number of college graduates in the workforce. This could lead to increased productivity and innovation.

Comparison to Other Countries

The United States is not the only country grappling with the issue of student loan debt. Many other countries have implemented their own student loan forgiveness programs, with varying degrees of success.

One of the most comprehensive student loan forgiveness programs in the world is the one offered by the United Kingdom. The program, which was introduced in 2006, allows borrowers to have their student loans forgiven after 25 years of making payments. The program is available to all borrowers, regardless of their income or debt level.

The student loan forgiveness program is a crucial initiative that has been a topic of much discussion lately. To learn more about the specifics of this program and its impact, check out our comprehensive guide on Biden student loan . The program’s goal is to provide relief to borrowers who are struggling with student loan debt, and it offers a range of options to help them manage their payments and achieve financial stability.

Another country with a generous student loan forgiveness program is Canada. The Canadian government offers a number of different student loan forgiveness programs, including the Repayment Assistance Plan (RAP) and the Loan Forgiveness Program (LFP). The RAP provides financial assistance to borrowers who are having difficulty making their student loan payments, while the LFP forgives the student loans of borrowers who work in certain public service professions.

The United States student loan forgiveness program is more limited than the programs offered by the United Kingdom and Canada. The US program only forgives the student loans of borrowers who work in certain public service professions, and the amount of forgiveness is capped at $17,500.

Despite its limitations, the US student loan forgiveness program has been a success. Since the program was introduced in 2007, over 1 million borrowers have had their student loans forgiven.

Similarities and Differences

The student loan forgiveness programs in the United States, the United Kingdom, and Canada share a number of similarities. All three programs are designed to help borrowers who are struggling to repay their student loans. All three programs also forgive the student loans of borrowers who work in certain public service professions.

However, there are also some key differences between the three programs. The US program is more limited than the programs offered by the United Kingdom and Canada. The US program only forgives the student loans of borrowers who work in certain public service professions, and the amount of forgiveness is capped at $17,500. The UK and Canadian programs, on the other hand, are available to all borrowers, regardless of their income or debt level.

Examples of Implementation

The student loan forgiveness programs in the United States, the United Kingdom, and Canada have been implemented in a variety of ways.

In the United States, the student loan forgiveness program is administered by the US Department of Education. Borrowers who want to apply for forgiveness must submit an application to the Department of Education. The Department of Education will then review the application and determine whether the borrower is eligible for forgiveness.

In the United Kingdom, the student loan forgiveness program is administered by the Student Loans Company. Borrowers who want to apply for forgiveness must submit an application to the Student Loans Company. The Student Loans Company will then review the application and determine whether the borrower is eligible for forgiveness.

In Canada, the student loan forgiveness programs are administered by the Canada Revenue Agency. Borrowers who want to apply for forgiveness must submit an application to the Canada Revenue Agency. The Canada Revenue Agency will then review the application and determine whether the borrower is eligible for forgiveness.

Future of Student Loan Forgiveness

The future of student loan forgiveness in the United States is uncertain. The program has been the subject of much debate, with proponents arguing that it is necessary to help borrowers who are struggling to repay their loans and opponents arguing that it is too expensive and unfair to taxpayers who have already repaid their loans.

Several potential changes could be made to the program. One possibility is that the government could make the program more generous, by increasing the amount of debt that is forgiven or by expanding the eligibility requirements. Another possibility is that the government could make the program more restrictive, by reducing the amount of debt that is forgiven or by narrowing the eligibility requirements.

The future of student loan forgiveness will likely be determined by a number of factors, including the political climate, the economy, and the financial situation of borrowers. If the economy continues to improve and borrowers are able to repay their loans, the government may be less likely to make the program more generous. However, if the economy worsens and borrowers are unable to repay their loans, the government may be more likely to make the program more generous.

Potential Impact of Changes on Students and the Economy

Changes to the student loan forgiveness program could have a significant impact on students and the economy. If the program is made more generous, it could help to reduce the amount of debt that students have to repay, which could free up money for other expenses, such as buying a home or starting a business. This could have a positive impact on the economy, as it would increase consumer spending and investment.

However, if the program is made more restrictive, it could make it more difficult for students to repay their loans, which could lead to defaults and bankruptcies. This could have a negative impact on the economy, as it would reduce consumer spending and investment.

Ethical Implications and Impact on Higher Education

Student loan forgiveness also raises a number of ethical implications. Some people argue that it is unfair to forgive the debts of borrowers who have already repaid their loans, while others argue that it is necessary to help borrowers who are struggling to repay their loans.

Student loan forgiveness could also have a significant impact on the higher education system. If the program is made more generous, it could lead to an increase in the cost of college, as colleges and universities would be able to charge more for tuition, knowing that the government will forgive some of the debt.

Political and Social Factors

The future of student loan forgiveness will also be influenced by a number of political and social factors. The program is likely to be a major issue in the 2020 presidential election, with candidates from both parties taking different positions on the issue.

The program is also likely to be affected by the growing movement for social justice. Advocates for social justice argue that student loan forgiveness is necessary to address the racial and economic disparities in the higher education system.

As the nation eagerly awaits news on the student loan forgiveness program, the current student loan pause provides a much-needed reprieve for borrowers. This temporary suspension of payments has allowed individuals to allocate funds towards other financial obligations, pursue higher education, or simply gain financial stability during uncertain times.

As the student loan forgiveness program continues to undergo legal challenges, the student loan pause serves as a lifeline, offering a glimmer of hope for borrowers struggling under the weight of student debt.

Case Studies

Student loan forgiveness programs have the potential to make a significant impact on the lives of borrowers. Here are a few case studies of individuals who have benefited from these programs:

One such individual is Sarah, a recent college graduate who was struggling to make ends meet while repaying her student loans. She was able to qualify for the Public Service Loan Forgiveness program, which forgives the remaining balance of federal student loans after 10 years of service in a public service job. This program has allowed Sarah to pursue her passion for teaching without the burden of overwhelming student loan debt.

Another Success Story

Another success story is that of John, a single father who was struggling to support his family while paying off his student loans. He was able to qualify for the Income-Driven Repayment program, which caps monthly student loan payments at a percentage of his income. This program has allowed John to keep up with his student loan payments without sacrificing the well-being of his family.

Testimonials

Here are some testimonials from borrowers who have received forgiveness:

“Student loan forgiveness has changed my life. I was able to finally buy a home and start a family, things that I never thought I would be able to do with the burden of student loan debt.” – Sarah

“I am so grateful for the Income-Driven Repayment program. It has allowed me to focus on my career and my family without the constant worry of how I was going to make my student loan payments.” – John

Data Analysis

Analyzing data on the student loan forgiveness program provides valuable insights into its impact and effectiveness. Statistics reveal the number of borrowers who have successfully received forgiveness, shedding light on the program’s reach.

Furthermore, examining the demographics of these borrowers offers a comprehensive understanding of the individuals benefitting from the program, highlighting factors such as age, income level, and educational background.

Borrower Demographics

Data analysis indicates that the majority of borrowers who have received forgiveness are individuals with lower incomes and higher levels of student loan debt. This suggests that the program is effectively targeting those most burdened by student loan obligations.

Additionally, the data shows that a significant proportion of borrowers who have received forgiveness are first-generation college graduates, indicating that the program is helping to break down barriers to higher education for underrepresented groups.

Timeline of Student Loan Forgiveness

The history of student loan forgiveness in the United States is a complex one, with multiple programs and initiatives being introduced over the years. Here is a timeline of some of the key events and milestones in the development of the program:

1965: Higher Education Act

The Higher Education Act of 1965 created the first federal student loan program. The act also included a provision for loan forgiveness for teachers who worked in low-income schools.

1976: Guaranteed Student Loan Program

The Guaranteed Student Loan Program (GSL) was created in 1976. The GSL program provided low-interest loans to students from private lenders. The program also included a provision for loan forgiveness for public service workers.

1998: Public Service Loan Forgiveness Program, Student loan forgiveness program

The Public Service Loan Forgiveness Program (PSLF) was created in 1998. The PSLF program provides loan forgiveness for public service workers who make 120 qualifying payments on their student loans.

2007: College Cost Reduction and Access Act

The College Cost Reduction and Access Act of 2007 expanded the PSLF program to include more public service workers. The act also created the Income-Based Repayment (IBR) program, which allows borrowers to cap their monthly loan payments at a percentage of their income.

2010: Student Aid and Fiscal Responsibility Act

The Student Aid and Fiscal Responsibility Act of 2010 made changes to the IBR program and created the Pay As You Earn (PAYE) program. The PAYE program allows borrowers to cap their monthly loan payments at a lower percentage of their income than the IBR program.

2014: Student Loan Forgiveness for Borrowers with Disabilities

In 2014, the Department of Education announced that it would forgive the student loans of borrowers who are totally and permanently disabled.

2020: CARES Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed in response to the COVID-19 pandemic, included a provision for a temporary suspension of student loan payments and interest accrual.

2021: Biden Administration Student Loan Forgiveness Plan

In August 2021, the Biden administration announced a plan to forgive up to $10,000 in student loan debt for borrowers who earn less than $125,000 per year. The plan also included a provision to forgive up to $20,000 in student loan debt for borrowers who received Pell Grants.

– Define key terms related to the student loan forgiveness program.

Before delving into the intricacies of the student loan forgiveness program, it is essential to establish a clear understanding of the key terms associated with it. A comprehensive glossary will serve as an invaluable reference point, providing precise definitions and elucidating the nuances of each concept.

The glossary will be meticulously organized, either alphabetically or by category, to facilitate effortless navigation. Each term will be accompanied by lucid explanations and illustrative examples, ensuring a thorough grasp of its meaning and application.

To enhance the user experience, the glossary will be visually appealing, employing a combination of text formatting, color-coding, and bullet points to make it both informative and engaging.

By providing a comprehensive and accessible glossary, we aim to empower individuals with the knowledge necessary to navigate the complexities of the student loan forgiveness program and make informed decisions about their financial future.

Glossary of Terms

- Default: Failure to make scheduled loan payments, leading to serious consequences such as damage to credit score and legal action.

- Forbearance: A temporary pause or reduction in loan payments, granted under specific circumstances such as financial hardship.

- Income-Driven Repayment (IDR) Plan: A repayment plan that adjusts monthly payments based on income and family size, potentially reducing the burden of student loan debt.

- Loan Forgiveness: The cancellation of all or a portion of outstanding student loan debt, typically after a specified period of time or under specific conditions.

- Public Service Loan Forgiveness (PSLF): A program that forgives student loan debt for individuals who work in public service jobs, such as teaching, nursing, or government.

- Student Loan: A type of loan specifically designed to finance higher education expenses, such as tuition, fees, and living costs.

- Subsidized Loan: A loan for which the government pays the interest while the borrower is in school or during periods of deferment or forbearance.

- Unsubsidized Loan: A loan for which the borrower is responsible for paying the interest from the time the loan is disbursed.

Summary

The student loan forgiveness program is a complex and ever-evolving issue. As the program continues to be debated, it is important to stay informed about the latest developments. This guide will provide you with the information you need to make informed decisions about your student loans.

Essential FAQs

What is the student loan forgiveness program?

The student loan forgiveness program is a government program that provides relief to borrowers who meet certain eligibility requirements. The program forgives a portion of the borrower’s student loan debt, and in some cases, the entire debt.

Who is eligible for the student loan forgiveness program?

To be eligible for the student loan forgiveness program, borrowers must meet certain criteria, such as having a certain amount of student loan debt, working in a certain profession, or having served in the military.

How do I apply for the student loan forgiveness program?

To apply for the student loan forgiveness program, borrowers must submit an application to the U.S. Department of Education. The application process is relatively simple, and borrowers can apply online or by mail.

What are the benefits of the student loan forgiveness program?

The student loan forgiveness program can provide significant benefits to borrowers, such as reducing their monthly payments, eliminating their student loan debt, and improving their credit score.

What are the challenges of the student loan forgiveness program?

The student loan forgiveness program has some challenges, such as the potential cost to taxpayers and the potential impact on the economy. However, the program also has the potential to provide significant benefits to borrowers and the economy as a whole.