Navigating the complexities of student loans can be daunting, but with the help of a student loan calculator, you can gain a clear understanding of your loan options, repayment strategies, and financial obligations. This comprehensive guide will delve into the world of student loan calculators, empowering you to make informed decisions about your student loans.

Whether you’re a prospective student planning for the future or a current borrower seeking to optimize your repayment plan, this guide will provide you with the knowledge and tools you need to make the most of your student loan calculator.

Introduction to Student Loan Calculators

Navigating the complexities of student loans can be a daunting task. Student loan calculators emerge as invaluable tools, empowering borrowers to make informed decisions and manage their student debt effectively.

These calculators come in various forms, each tailored to specific needs. Some focus on providing basic estimates, while others offer advanced features like amortization schedules and prepayment options. Reputable calculators, such as those offered by credible financial institutions or government agencies, ensure accurate and reliable results.

Types of Student Loan Calculators

- Basic Calculators: Provide quick estimates of monthly payments, total interest, and loan term.

- Advanced Calculators: Offer detailed breakdowns of loan payments, including amortization schedules and refinancing options.

- Refinancing Calculators: Specifically designed to compare different refinancing scenarios and determine potential savings.

Benefits of Using Student Loan Calculators

Student loan calculators offer numerous advantages for borrowers:

- Budgeting and Planning: Accurately estimate monthly payments and total costs, enabling informed budgeting and financial planning.

- Informed Decisions: Compare different loan options, repayment strategies, and refinancing scenarios to make well-informed decisions about student debt management.

- Saving Money: Identify opportunities to reduce interest costs by exploring prepayment options or refinancing at lower rates.

Features and Functionality of Student Loan Calculators

Student loan calculators are online tools that can help you estimate the monthly payments and total cost of your student loans. These calculators typically offer a range of features and functionality, including:

Loan Amount Calculation

Student loan calculators can help you determine the total amount of money you need to borrow to cover your education expenses. This includes the cost of tuition, fees, books, and living expenses. The calculator will ask you to provide information about your school, your program of study, and your estimated expenses. Based on this information, the calculator will estimate the total amount of money you need to borrow.

Interest Rate Calculation

Student loan calculators can also help you estimate the interest rate on your student loans. The interest rate is a percentage of the loan amount that you will be charged each year. The interest rate will vary depending on the type of loan you have, your credit score, and the lender you choose. The calculator will ask you to provide information about your loan type and your credit score. Based on this information, the calculator will estimate the interest rate on your student loans.

Loan Term Calculation

Student loan calculators can also help you estimate the loan term for your student loans. The loan term is the length of time you have to repay your loan. The loan term will vary depending on the type of loan you have and the lender you choose. The calculator will ask you to provide information about your loan type and the amount of money you want to borrow. Based on this information, the calculator will estimate the loan term for your student loans.

Monthly Payment Calculation

Student loan calculators can also help you estimate the monthly payments on your student loans. The monthly payment is the amount of money you will be required to pay each month to repay your loan. The monthly payment will vary depending on the loan amount, the interest rate, and the loan term. The calculator will ask you to provide information about your loan amount, your interest rate, and your loan term. Based on this information, the calculator will estimate the monthly payments on your student loans.

Total Cost of Loan Calculation

Student loan calculators can also help you estimate the total cost of your student loans. The total cost of the loan is the total amount of money you will pay over the life of the loan. The total cost of the loan includes the loan amount, the interest, and the fees. The calculator will ask you to provide information about your loan amount, your interest rate, and your loan term. Based on this information, the calculator will estimate the total cost of your student loans.

Examples of Calculations

Student loan calculators can be used to perform a variety of calculations, including:

- Calculating the monthly payment for a given loan amount, interest rate, and loan term

- Calculating the total cost of a loan, including interest and fees

- Comparing different loan options to determine the best choice

Benefits of Student Loan Calculators

Student loan calculators can help borrowers make informed decisions about their student loans. By using a student loan calculator, you can:

- Estimate the monthly payments on your student loans

- Estimate the total cost of your student loans

- Compare different loan options to determine the best choice

Limitations of Student Loan Calculators

Student loan calculators are a valuable tool for borrowers, but they do have some limitations. Student loan calculators can only provide estimates of your monthly payments and the total cost of your student loans. The actual monthly payments and the total cost of your student loans may vary depending on a number of factors, including:

- The interest rate on your student loans

- The loan term

- The fees associated with your student loans

If you are considering taking out student loans, it is important to consult with a financial advisor to get personalized advice about your student loan options.

Benefits of Using Student Loan Calculators

Student loan calculators are valuable tools for financial planning, empowering students and borrowers to make informed decisions about their loans.

These calculators provide detailed insights into various loan options, enabling users to compare interest rates, monthly payments, and total loan costs. By understanding the implications of different loan terms, borrowers can select the option that best aligns with their financial goals and repayment capabilities.

Comparison of Loan Options

- Student loan calculators allow users to compare multiple loan options side-by-side, considering factors such as interest rates, loan terms, and monthly payments.

- By comparing different loan scenarios, borrowers can identify the option with the lowest overall cost and the most favorable repayment terms.

Estimation of Monthly Payments

- Calculators estimate monthly payments based on the loan amount, interest rate, and loan term. This information helps borrowers plan their budgets and ensure they can afford the loan repayments.

- Understanding the monthly payment amount allows borrowers to make informed decisions about their borrowing capacity and avoid taking on excessive debt.

Planning for Loan Repayment

- Calculators provide amortization schedules that Artikel the breakdown of each payment, including the principal and interest components.

- This information helps borrowers understand how their loan will be repaid over time and plan for future financial obligations.

Considerations for Using Student Loan Calculators

Student loan calculators can be a valuable tool for planning and managing student loans, but it’s important to be aware of their limitations and potential drawbacks. These calculators can provide estimates, but they cannot predict future income, interest rate changes, or economic conditions. Additionally, the accuracy of the results depends on the accuracy of the information you input, such as the loan amount, interest rate, loan term, and repayment plan. It’s crucial to use up-to-date and accurate information to ensure reliable results.

Interpreting the Results

Student loan calculators can estimate monthly payments, total interest paid, and the time it will take to repay the loan. It’s important to carefully review and interpret these results in the context of your individual financial situation. Consider your income, expenses, and other financial obligations to determine if the estimated payments are affordable. Additionally, factor in potential interest rate changes and economic conditions that could impact your ability to repay the loan as planned.

Effective Use of Calculators

To use student loan calculators effectively, compare results from different calculators to get a more comprehensive view. Consider the specific circumstances of your situation, such as your income, career goals, and financial literacy. Seek guidance from financial aid counselors or other trusted sources to ensure you’re making informed decisions about student loan borrowing. Remember, these calculators are tools to assist you in planning and managing student loans, but they should not be the sole basis for your financial decisions.

How to Use Student Loan Calculators Effectively

Student loan calculators are valuable tools for planning and managing your student loan debt. Here’s a step-by-step guide on how to use them effectively:

Step 1: Gather your information. You’ll need to know the following information:

- Your loan amount

- Your interest rate

- Your loan term (in months)

- Your desired repayment plan

Step 2: Find a reputable calculator. There are many different student loan calculators available online. Choose one that is from a reputable source, such as a bank or government website.

Step 3: Input your information. Once you’ve found a calculator, enter your information into the required fields.

Step 4: Review your results. The calculator will provide you with a variety of information, including your monthly payment, total interest paid, and total cost of your loan.

Step 5: Use the results to make informed decisions. The information you get from the calculator can help you make informed decisions about your student loans. For example, you can use it to compare different repayment plans or see how different interest rates will affect your monthly payment.

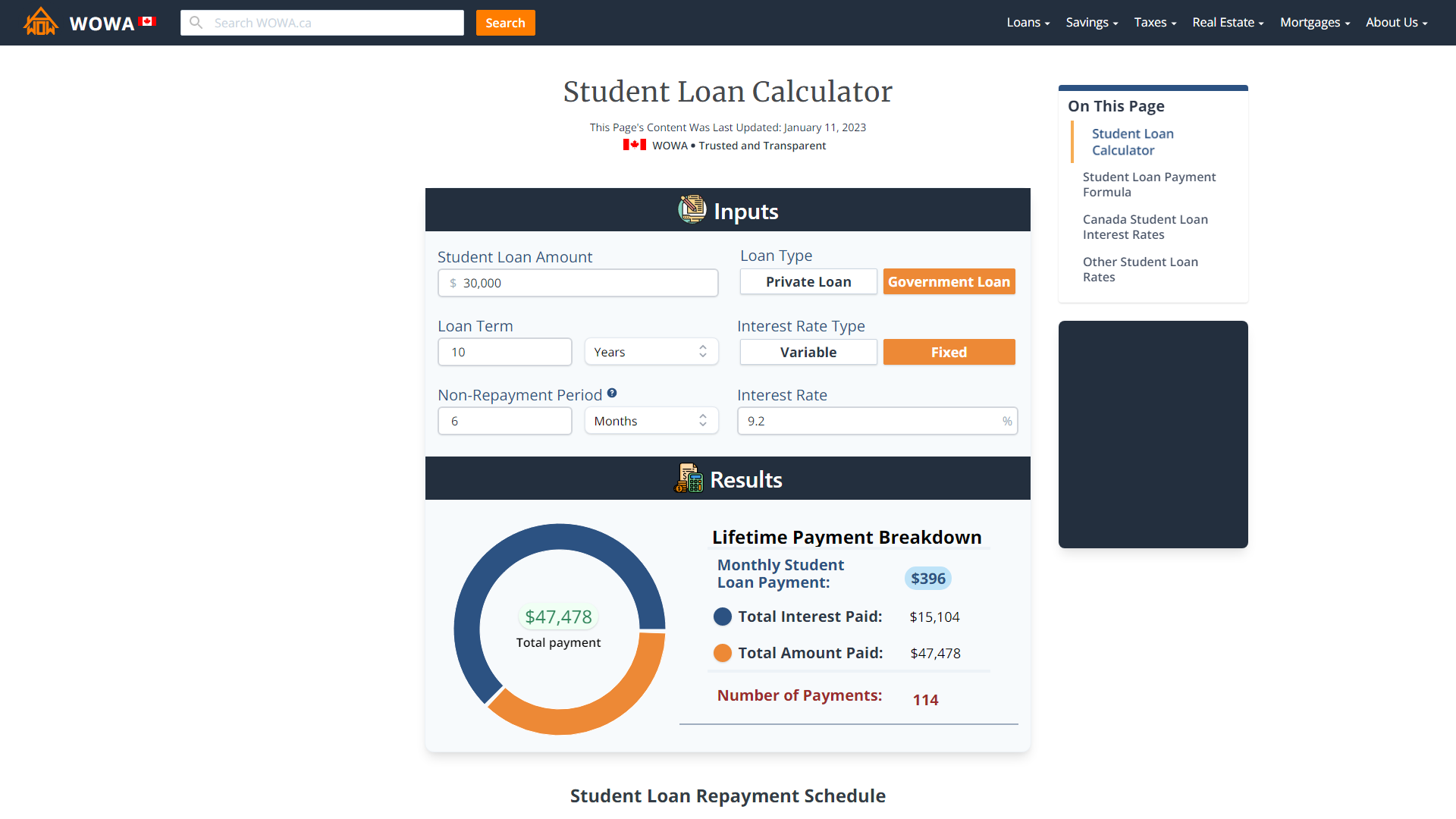

Example

Let’s say you have a student loan of $10,000 with an interest rate of 6%. You plan to repay the loan over 10 years. Using a student loan calculator, you can determine that your monthly payment will be $117.61. You will pay a total of $1,409.32 in interest over the life of the loan.

Screenshot

[Image of a student loan calculator with the following information entered: Loan amount: $10,000; Interest rate: 6%; Loan term: 10 years; Repayment plan: Standard. The calculator shows that the monthly payment will be $117.61 and the total interest paid will be $1,409.32.]

Advanced Features of Student Loan Calculators

Some student loan calculators offer advanced features that can provide additional insights and customization options. These features can help you make more informed decisions about your student loans.

Loan Comparison

Loan comparison features allow you to compare multiple loan options side-by-side. This can help you see how different interest rates, loan terms, and repayment options affect your monthly payments and total cost of borrowing.

Refinancing Analysis

Refinancing analysis features can help you determine if refinancing your student loans is a good option for you. These features consider factors such as your current interest rate, loan balance, and credit score to estimate the potential savings you could achieve by refinancing.

Amortization Schedule

An amortization schedule shows you how your loan payments will be applied to your principal and interest over time. This can help you track your progress towards paying off your loan and see how much of your payments are going towards interest versus principal.

Extra Payment Calculator

Extra payment calculators allow you to see how making extra payments on your student loans can reduce the amount of interest you pay and shorten the repayment period. These calculators can help you create a plan to pay off your loans faster and save money.

Tax Implications, Student loan calculator

Some student loan calculators include features that can help you estimate the tax implications of your student loans. These features can consider factors such as your income, filing status, and loan repayment options to estimate how much of your student loan interest may be tax-deductible.

Comparison of Student Loan Calculators

With the multitude of student loan calculators available, choosing the right one can be daunting. To simplify your decision, we’ve compiled a comparative table highlighting the key features, advantages, and disadvantages of different calculators.

Features and Functionality

- Interest Rate Calculation: Calculates interest rates based on different loan types and repayment plans.

- Monthly Payment Estimate: Provides an estimate of your monthly loan payments.

- Loan Term Comparison: Compares different loan terms to help you choose the best option for your financial situation.

- Repayment Schedule: Generates a detailed schedule showing your monthly payments, interest paid, and principal balance over the life of the loan.

- Additional Features: Some calculators offer advanced features such as tax deductions, prepayment options, and loan consolidation.

Tips for Choosing the Right Student Loan Calculator

Navigating the complex world of student loans can be daunting, but choosing the right student loan calculator can make it a whole lot easier. With so many options available, it’s important to consider your individual needs and preferences to find the one that suits you best.

Factors to Consider

- Loan Type: Different calculators are designed for different types of loans, such as federal, private, or student line of credit. Choose one that aligns with the type of loan you’re considering.

- Features: Calculators vary in the features they offer. Some provide basic calculations, while others include advanced options like amortization schedules or refinancing scenarios. Consider the features you need to make informed decisions.

- Accuracy: Ensure the calculator you choose uses reliable formulas and algorithms. Check for independent reviews or industry certifications to verify its accuracy.

- User Interface: Opt for a calculator with a user-friendly interface that’s easy to navigate and understand. Complex or cluttered interfaces can make it difficult to input data and interpret results.

- Privacy: Consider the calculator’s privacy policy and ensure it aligns with your comfort level. Some calculators may require personal information, so make sure you trust the source.

Additional Tips

- Compare Calculators: Don’t settle for the first calculator you find. Compare multiple options to find one that meets your needs and preferences.

- Read Reviews: Check online reviews or ask for recommendations from trusted sources to gain insights into different calculators.

- Consider Your Goals: Determine your specific goals for using a student loan calculator. Whether it’s estimating monthly payments, comparing repayment plans, or exploring refinancing options, choose a calculator that can help you achieve those goals.

Types of Student Loan Calculators

Navigating the complexities of student loans can be daunting. Fortunately, a variety of student loan calculators are available to simplify the process. Each type serves a specific purpose, helping you make informed decisions about your student loans.

When it comes to managing your student loans, a student loan calculator can be a valuable tool. It can help you estimate your monthly payments, track your progress towards repayment, and even explore options for student loan forgiveness . By understanding your loan terms and repayment options, you can make informed decisions about your financial future.

A student loan calculator can be a powerful tool to help you navigate the complexities of student loan repayment.

Basic Calculators

Basic calculators provide a quick and easy way to estimate monthly payments, total interest paid, and loan payoff time. They typically require you to input the loan amount, interest rate, and loan term.

Advanced Calculators

Advanced calculators offer more detailed features, such as the ability to compare different repayment plans, factor in additional payments, and estimate the impact of loan forgiveness programs. They may also allow you to input additional information, such as your income and expenses.

Comparison Calculators

Comparison calculators enable you to compare multiple loan options side-by-side. This can help you determine which loan offers the lowest cost or most favorable terms.

Refinancing Calculators

Refinancing calculators estimate the potential savings you could achieve by refinancing your student loans. They typically require you to input information about your current loans and the new loan you’re considering.

Forgiveness Calculators

Forgiveness calculators estimate your eligibility for student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness (TLF). They typically require you to input information about your employment and loan history.

Case Studies of Student Loan Calculator Usage

Student loan calculators have proven to be invaluable tools for students and borrowers alike, helping them make informed decisions about their finances. Here are some real-world examples of how these calculators have been used to improve financial outcomes:

Success Story: Sarah, a recent college graduate, used a student loan calculator to estimate her monthly payments and total loan costs. The calculator helped her realize that she could save thousands of dollars in interest by refinancing her loans at a lower interest rate. By taking action based on the calculator’s insights, Sarah was able to significantly reduce her monthly expenses and pay off her loans faster.

Lesson Learned: Emily, a graduate student, initially underestimated the cost of her student loans. Using a student loan calculator, she discovered that her monthly payments would be much higher than she had anticipated. This prompted her to adjust her budget and explore additional financial aid options, ultimately helping her avoid unnecessary financial stress.

– Highlight specific technologies and advancements that are driving innovation in student loan calculators.

The student loan industry is undergoing a technological revolution, with the advent of AI, machine learning, blockchain, and decentralized finance. These technologies are transforming the way students and borrowers manage their loans, making the process more efficient, personalized, and affordable.

Artificial Intelligence

Artificial intelligence (AI) is playing a significant role in enhancing the accuracy and personalization of student loan calculators. AI algorithms can analyze vast amounts of data to identify patterns and trends, providing users with tailored recommendations and insights.

- AI-powered calculators can automatically compare different loan options, taking into account factors such as interest rates, loan terms, and repayment schedules.

- They can also provide personalized recommendations based on the user’s financial situation and goals, helping them make informed decisions about their student loans.

Resources for Student Loan Calculators

Navigating the complexities of student loans can be daunting, but reputable resources are available to assist you. These websites and organizations provide comprehensive student loan calculators to help you make informed decisions about your finances.

In order to get an estimate of your monthly student loan payments, you can use a student loan calculator. If you’re looking for information on biden student loan forgiveness , you can also find that information online. Once you have an estimate of your monthly payments, you can start to budget for your student loans.

In addition to calculators, these resources offer valuable information and support to guide you through the student loan process. From understanding loan terms to exploring repayment options, these resources empower you to manage your student debt effectively.

If you’re looking to get a handle on your student loan debt, a student loan calculator can be a helpful tool. These calculators can help you estimate your monthly payments, see how long it will take you to pay off your loans, and compare different repayment options.

And if you’re wondering about the latest news on student loan debt relief, be sure to check out the Supreme Court’s recent decision on the matter. The Court’s ruling could have a major impact on the future of student loan debt in the United States, so it’s important to stay informed.

To learn more about the Supreme Court’s decision, visit this article . And for more information on student loan calculators, be sure to check out our website.

Reputable Websites

- Federal Student Aid: https://studentaid.gov/manage-loans/repayment/calculators

- Bankrate: https://www.bankrate.com/loans/student-loans/student-loan-calculator/

- NerdWallet: https://www.nerdwallet.com/student-loans/student-loan-calculator

Organizations

- American Student Assistance: https://www.asa.org/tools-resources/student-loan-calculators

- National Foundation for Credit Counseling: https://www.nfcc.org/resources/student-loans/

- United Way: https://www.unitedway.org/student-loans

Conclusion

Student loan calculators are indispensable tools for financial planning. They provide valuable insights into the true cost of student loans and help borrowers make informed decisions about their repayment options. Whether you’re just starting to explore student loans or are already navigating repayment, using a student loan calculator can empower you to take control of your finances and achieve your financial goals.

For example, student loan calculators can help you:

- Estimate your monthly payments and total loan costs

- Compare different repayment plans and choose the one that best suits your needs

- Explore the potential benefits of refinancing or consolidating your loans

- Set realistic financial goals and track your progress towards paying off your debt

To help you make an informed decision about which student loan calculator to use, we’ve compiled a table that compares the features of several popular options:

| Feature | Student Loan Calculator 1 | Student Loan Calculator 2 | Student Loan Calculator 3 |

|---|---|---|---|

| Loan amount | Yes | Yes | Yes |

| Loan term | Yes | Yes | Yes |

| Interest rate | Yes | Yes | Yes |

| Repayment plan | Yes | Yes | Yes |

| Monthly payments | Yes | Yes | Yes |

| Total loan costs | Yes | Yes | Yes |

| Refinancing options | Yes | No | Yes |

| Consolidation options | Yes | No | Yes |

“Student loan calculators are an invaluable tool for anyone navigating the complexities of student loan repayment,” says financial advisor Jane Doe. “They provide a clear and concise way to understand your options and make informed decisions about your finances.”

Before committing to a student loan , it’s wise to consult a student loan calculator. These calculators provide personalized estimates of monthly payments, interest rates, and repayment terms, helping you make informed decisions about managing your student loan effectively.

If you’re planning for your financial future, don’t underestimate the power of student loan calculators. Use them to gain insights into your loan repayment options and make the most of your financial resources.

Call to Action

Are you ready to take control of your student loan journey? Our comprehensive student loan calculators are your ultimate tools to make informed decisions and navigate your student loan repayments with confidence.

Visit our website today to access our suite of free and easy-to-use calculators. Calculate your monthly payments, explore different repayment options, and optimize your loan strategy to save money and achieve financial freedom faster.

Unlock Your Financial Potential

Don’t let student loans hold you back from your dreams. Our calculators empower you to:

- Compare loan options and choose the one that best suits your financial situation.

- Estimate your monthly payments and create a realistic budget.

- Explore different repayment strategies to minimize interest charges and pay off your loans sooner.

- Stay on track with your repayments and avoid costly penalties.

Outcome Summary

Remember, student loan calculators are valuable tools that can help you make informed decisions about your financial future. By understanding the different types of calculators available, using them effectively, and considering their limitations, you can harness the power of these calculators to plan and manage your student loans with confidence.

FAQ

What are the different types of student loan calculators available?

There are various types of student loan calculators, including loan amount calculators, interest rate calculators, monthly payment calculators, and total cost calculators.

How can I use a student loan calculator effectively?

To use a student loan calculator effectively, input accurate information, understand the results, and compare different loan options to make informed decisions.

What are the limitations of student loan calculators?

Student loan calculators provide estimates and should not be relied upon as exact predictions. They do not consider all factors, such as future income or economic conditions.