Federal student loan forgiveness has emerged as a contentious topic, with far-reaching implications for borrowers, taxpayers, and the economy as a whole. This comprehensive guide delves into the intricacies of student loan forgiveness, examining its history, current landscape, and potential social, economic, and political consequences.

From its inception to the various types and eligibility criteria, we explore the nuances of federal student loans. We analyze the repayment process and the different loan forgiveness and repayment assistance programs available, providing a clear understanding of the options for borrowers.

Executive Summary

The federal student loan forgiveness program has been a significant development in the United States, with the potential to impact millions of borrowers.

The program aims to provide relief to borrowers who have been struggling with student loan debt, and it has the potential to have a major impact on the economy.

Significance

The significance of the federal student loan forgiveness program lies in its potential to provide financial relief to millions of Americans who are struggling with student loan debt.

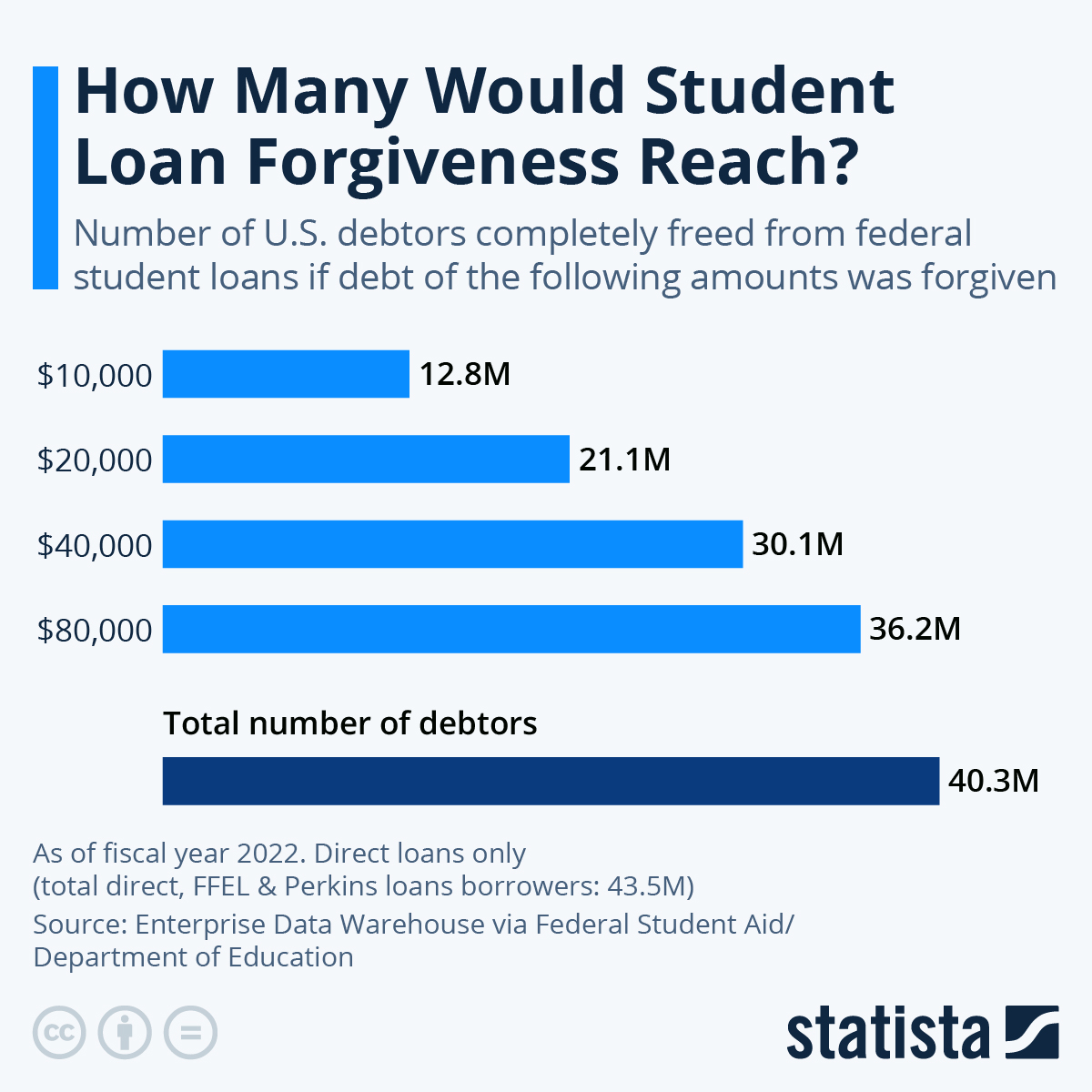

According to a recent study by the Brookings Institution, the program could eliminate or reduce student loan debt for up to 43 million borrowers.

Impact

The impact of the federal student loan forgiveness program is likely to be significant, both for individual borrowers and for the economy as a whole.

For individual borrowers, the program could provide much-needed financial relief, allowing them to save money, invest in their future, and contribute more to the economy.

Amidst the discussions surrounding federal student loan forgiveness, it’s important to consider the impact on Nelnet borrowers. As a leading student loan servicer, Nelnet manages millions of accounts, and its policies will significantly affect those seeking debt relief. By visiting nelnet student loan , borrowers can stay informed about the latest updates and explore repayment options that may be available to them in light of potential forgiveness measures.

Background

Federal student loans have played a pivotal role in shaping higher education in the United States. Since their inception, these loans have enabled millions of students to pursue their academic dreams and attain higher levels of education.

The federal government offers various types of student loans to cater to the diverse needs of borrowers. These loans can be broadly categorized into two types: subsidized and unsubsidized loans. Subsidized loans are awarded to students with financial need, and the government pays the interest on these loans while the student is enrolled in school. Unsubsidized loans, on the other hand, are not based on financial need, and the borrower is responsible for paying the interest on these loans from the start.

To be eligible for federal student loans, students must meet certain requirements. These requirements include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, and being enrolled at least half-time in a degree-granting program at an eligible school.

The application process for federal student loans is relatively straightforward. Students can apply for these loans through the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about the student’s financial situation and academic progress and uses this information to determine the student’s eligibility for federal student aid.

Once a student has been approved for a federal student loan, they will need to complete a promissory note. This promissory note is a legal document that Artikels the terms of the loan, including the interest rate, repayment period, and other important details.

Repayment of federal student loans typically begins six months after the student graduates or drops below half-time enrollment. Borrowers have a variety of repayment options to choose from, including the Standard Repayment Plan, the Graduated Repayment Plan, and the Extended Repayment Plan. Borrowers may also be eligible for loan forgiveness or repayment assistance programs, such as Public Service Loan Forgiveness and Income-Driven Repayment.

Loan Forgiveness and Repayment Assistance Programs

The federal government offers several loan forgiveness and repayment assistance programs to help borrowers manage their student loan debt. These programs include:

- Public Service Loan Forgiveness (PSLF): PSLF forgives the remaining balance of a borrower’s federal student loans after they have made 120 qualifying payments while working full-time for a public service organization.

- Teacher Loan Forgiveness: Teacher Loan Forgiveness forgives up to $17,500 of a borrower’s federal student loans after they have taught full-time for five consecutive years in a low-income school.

- Income-Driven Repayment (IDR): IDR caps a borrower’s monthly student loan payments at a percentage of their discretionary income. IDR also provides loan forgiveness after 20 or 25 years of repayment, depending on the repayment plan.

Current Landscape

The current federal student loan forgiveness landscape is complex and ever-evolving. There are a number of different programs available, each with its own eligibility requirements and benefits. Some of the most well-known programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Perkins Loan Forgiveness.

In recent years, there has been a growing movement to expand student loan forgiveness programs. This movement has been driven by the rising cost of college tuition and the increasing burden of student debt. As a result of this movement, several new student loan forgiveness programs have been created, and the eligibility requirements for existing programs have been expanded.

Public Service Loan Forgiveness (PSLF)

PSLF is a federal program that forgives the remaining balance of your federal student loans after you have made 120 qualifying payments while working full-time for a public service employer. Qualifying employers include government agencies, non-profit organizations, and certain other types of organizations that provide public services.

– Analyze the potential economic effects of federal student loan forgiveness on

The forgiveness of federal student loans could have a significant impact on the economy. The following are some of the potential economic effects that have been identified:

The forgiveness of federal student loans could have a significant impact on the economy. The following are some of the potential economic effects that have been identified:

The federal budget

The forgiveness of federal student loans would reduce the amount of money that the government collects in revenue. This could lead to a decrease in the federal budget deficit. However, the forgiveness of student loans could also lead to an increase in economic growth, which could offset the loss of revenue.

Inflation

The forgiveness of federal student loans could lead to an increase in inflation. This is because the government would have to borrow more money to finance the forgiveness of student loans, which could lead to an increase in interest rates. Higher interest rates could lead to an increase in the cost of goods and services.

Interest rates

The forgiveness of federal student loans could lead to a decrease in interest rates. This is because the government would have to borrow less money to finance the forgiveness of student loans, which could lead to a decrease in demand for loans. Lower demand for loans could lead to a decrease in interest rates.

Economic growth

The forgiveness of federal student loans could lead to an increase in economic growth. This is because the forgiveness of student loans would free up money that borrowers could spend on other goods and services. This could lead to an increase in consumer spending, which could lead to an increase in economic growth.

Social Impacts

Federal student loan forgiveness has the potential to significantly impact society. It could reduce income inequality, improve access to higher education, and boost the financial well-being of borrowers and their families. However, it could also have negative consequences, such as increasing the federal budget deficit and raising tuition costs.

Income Inequality

Student loan debt disproportionately affects low-income and minority borrowers. Forgiveness could help to reduce income inequality by eliminating this burden and freeing up more money for these borrowers to spend on other essential needs, such as housing, food, and healthcare.

Access to Higher Education

Forgiveness could make it easier for students from low-income families to attend college. By reducing the financial burden of student loans, forgiveness could make higher education more affordable and accessible for these students.

Financial Well-being

Forgiveness could significantly improve the financial well-being of borrowers and their families. By eliminating student loan debt, forgiveness could free up more money for borrowers to save, invest, and spend on other important expenses. This could lead to increased economic security and stability for these borrowers and their families.

Higher Education Institutions, Federal student loan forgiveness

Forgiveness could have a negative impact on higher education institutions. By reducing the amount of student loan debt outstanding, forgiveness could lead to lower tuition costs. This could make it more difficult for colleges and universities to fund their operations and could lead to cuts in programs and services.

Federal Budget

Forgiveness would have a significant impact on the federal budget. The total cost of forgiveness would depend on the specific terms of the program, but it could range from hundreds of billions to trillions of dollars. This could lead to increased federal borrowing and higher interest rates.

Political Considerations

The debate over federal student loan forgiveness is heavily influenced by political factors. These factors include the political ideologies of different parties and elected officials, the role of special interest groups, and the public’s perception of the issue.

Federal student loan forgiveness has been a hot topic of discussion lately, with many borrowers wondering if they will be eligible for relief. The Biden administration has proposed a plan that would forgive up to $10,000 in student loan debt for borrowers who meet certain income requirements.

This plan has been met with mixed reactions, with some borrowers expressing relief and others expressing disappointment that the forgiveness amount is not higher. However, the Biden administration’s plan is a significant step towards addressing the growing student loan debt crisis.

More information about biden student loan debt relief can be found online.

Proponents of student loan forgiveness argue that it would provide much-needed relief to millions of Americans who are struggling to repay their student loans. They also argue that it would boost the economy by freeing up money that borrowers could spend on other goods and services.

Opponents of student loan forgiveness argue that it would be unfair to taxpayers who have already repaid their own student loans or who have chosen not to attend college. They also argue that it would be too expensive and would add to the federal deficit.

The political debate over student loan forgiveness is likely to continue for some time. The outcome of the debate will depend on a number of factors, including the results of the 2024 presidential election and the makeup of the next Congress.

Political Ideologies

The political ideologies of different parties and elected officials play a significant role in the debate over student loan forgiveness. Democrats are generally more supportive of student loan forgiveness than Republicans. This is because Democrats tend to believe that the government has a responsibility to help people who are struggling financially. Republicans, on the other hand, tend to believe that individuals are responsible for their own financial well-being.

Special Interest Groups

Special interest groups also play a role in the debate over student loan forgiveness. Groups that represent student loan borrowers, such as the National Association of Student Financial Aid Administrators, support student loan forgiveness. Groups that represent taxpayers, such as the National Taxpayers Union, oppose student loan forgiveness.

Public Perception

The public’s perception of the issue of student loan forgiveness is also important. Polls show that a majority of Americans support student loan forgiveness. However, there is a significant minority of Americans who oppose student loan forgiveness. The public’s perception of the issue is likely to influence the decisions of elected officials.

Legal Framework

Federal student loan forgiveness has a complex legal framework, with both statutory and regulatory provisions governing its implementation. The Higher Education Act of 1965, as amended, provides the primary statutory authority for federal student loans, including the authority to forgive such loans under certain circumstances. The U.S. Department of Education (ED) has also issued regulations implementing the loan forgiveness provisions of the Higher Education Act.

Statutory Authority

The Higher Education Act authorizes ED to forgive federal student loans in several specific circumstances, including:

- When the borrower dies or becomes totally and permanently disabled.

- When the borrower’s school closes or the borrower is unable to complete the program due to circumstances beyond their control.

- When the borrower has worked in certain public service jobs for a specified period of time.

Regulatory Framework

ED’s regulations provide additional guidance on the implementation of the loan forgiveness provisions of the Higher Education Act. These regulations address issues such as the eligibility criteria for loan forgiveness, the application process, and the procedures for reviewing and approving loan forgiveness requests.

Potential Legal Challenges

Federal student loan forgiveness could face legal challenges on several grounds. One potential challenge is that it may be considered an unconstitutional exercise of Congress’s spending power. Another potential challenge is that it may violate the Equal Protection Clause of the U.S. Constitution by discriminating against borrowers who do not qualify for forgiveness.

Despite these potential legal challenges, ED has implemented several loan forgiveness programs in recent years. These programs have provided billions of dollars in loan forgiveness to borrowers who meet the eligibility criteria.

Comparative Analysis

Federal student loan forgiveness programs in the United States have been compared to similar programs in other countries, such as Australia, Canada, and the United Kingdom. These programs vary in terms of eligibility criteria, loan amounts forgiven, and repayment options.

In Australia, the Higher Education Loan Program (HELP) allows students to defer loan repayments until they reach a certain income threshold. The loan is forgiven after 10 years of repayment or if the borrower reaches retirement age. In Canada, the Canada Student Loans Program offers loan forgiveness to borrowers who have made 10 years of regular payments and meet certain income requirements. In the United Kingdom, the Student Loans Company offers loan forgiveness to borrowers who have made 25 years of repayments or who reach retirement age.

Eligibility Criteria

The eligibility criteria for federal student loan forgiveness programs vary by country. In the United States, borrowers who have worked in public service for at least 10 years may be eligible for loan forgiveness. In Australia, borrowers who have reached a certain income threshold are eligible for loan deferment and forgiveness. In Canada, borrowers who have made 10 years of regular payments and meet certain income requirements are eligible for loan forgiveness. In the United Kingdom, borrowers who have made 25 years of repayments or who reach retirement age are eligible for loan forgiveness.

Loan Amounts Forgiven

The amount of student loan debt forgiven under these programs also varies. In the United States, borrowers who have worked in public service for at least 10 years may be eligible for forgiveness of up to $17,500 in federal student loans. In Australia, borrowers who have reached a certain income threshold are eligible for deferment and forgiveness of up to $104,452 in HELP loans. In Canada, borrowers who have made 10 years of regular payments and meet certain income requirements are eligible for loan forgiveness of up to $40,000. In the United Kingdom, borrowers who have made 25 years of repayments or who reach retirement age are eligible for loan forgiveness of up to £30,000.

Repayment Options

The repayment options for federal student loan forgiveness programs also vary by country. In the United States, borrowers who are eligible for loan forgiveness may choose to repay their loans through a standard repayment plan, an extended repayment plan, or an income-driven repayment plan. In Australia, borrowers who have reached a certain income threshold may choose to defer their HELP loan repayments or make reduced repayments. In Canada, borrowers who have made 10 years of regular payments and meet certain income requirements may choose to repay their loans through a standard repayment plan, an extended repayment plan, or an income-contingent repayment plan. In the United Kingdom, borrowers who have made 25 years of repayments or who reach retirement age may choose to repay their loans through a standard repayment plan, an extended repayment plan, or a graduate repayment plan.

Data and Statistics

Federal student loan debt in the United States has reached unprecedented levels, with over 45 million borrowers collectively owing more than $1.7 trillion. The distribution of this debt is uneven, with certain demographics and types of loans being disproportionately affected.

By income, the burden of student loan debt falls heavily on those with lower incomes. Borrowers in the bottom 20% of income earners hold nearly 40% of the total federal student loan debt. Racial disparities are also evident, with Black and Hispanic borrowers more likely to have student loan debt and to owe larger amounts compared to their White counterparts.

Undergraduate vs. Graduate Debt

Undergraduate loans account for the majority of federal student loan debt, with over 60% of borrowers having only undergraduate debt. Graduate loans, while representing a smaller share of borrowers, typically involve larger loan amounts. On average, graduate borrowers owe over twice as much as undergraduate borrowers.

Potential Impact of Forgiveness Programs

The potential impact of federal student loan forgiveness programs on the economy is a subject of ongoing debate. Some economists argue that forgiveness would stimulate economic growth by freeing up disposable income for borrowers to spend or invest. Others contend that it could lead to inflation or increase the federal deficit.

Summary Table

The following table summarizes key data and statistics on federal student loan debt and the potential impact of forgiveness programs:

| Metric | Value |

|---|---|

| Total federal student loan debt | $1.7 trillion |

| Number of federal student loan borrowers | 45 million |

| Average student loan debt per borrower | $37,000 |

| Percentage of federal student loan debt held by borrowers in the bottom 20% of income earners | 40% |

| Percentage of federal student loan borrowers who are Black or Hispanic | 37% |

| Average student loan debt for undergraduate borrowers | $25,000 |

| Average student loan debt for graduate borrowers | $55,000 |

| Potential economic impact of student loan forgiveness (estimated) | $100 billion to $200 billion in increased GDP |

Case Studies

Federal student loan forgiveness programs have had a significant impact on the lives of many individuals and groups. Here are a few case studies that illustrate the benefits and challenges associated with these programs:

A recent study by the Brookings Institution found that federal student loan forgiveness programs have had a positive impact on the financial well-being of borrowers. The study found that borrowers who received loan forgiveness were more likely to own homes, have higher credit scores, and save for retirement.

Another study by the National Association of Student Financial Aid Administrators found that federal student loan forgiveness programs have helped to reduce the racial wealth gap. The study found that black borrowers who received loan forgiveness were more likely to have higher incomes and lower levels of debt than black borrowers who did not receive loan forgiveness.

However, there are also some challenges associated with federal student loan forgiveness programs. One challenge is that these programs can be expensive. The Congressional Budget Office has estimated that the cost of forgiving all federal student loans would be over $1 trillion.

Another challenge is that federal student loan forgiveness programs can be unfair to those who have already repaid their loans. Some argue that it is unfair to forgive the loans of those who have not made an effort to repay them.

Impact on Individuals

* Sarah, a recent college graduate, was able to purchase her first home after receiving federal student loan forgiveness.

* John, a single father of two, was able to pay off his credit card debt and save for his children’s education after receiving federal student loan forgiveness.

* Mary, a nurse, was able to quit her second job and focus on her family after receiving federal student loan forgiveness.

Impact on Groups

* The National Association of Black Accountants (NABA) found that black borrowers who received federal student loan forgiveness were more likely to have higher incomes and lower levels of debt than black borrowers who did not receive loan forgiveness.

* The Hispanic Association of Colleges and Universities (HACU) found that Hispanic borrowers who received federal student loan forgiveness were more likely to own homes and have higher credit scores than Hispanic borrowers who did not receive loan forgiveness.

* The American Association of University Women (AAUW) found that women who received federal student loan forgiveness were more likely to save for retirement and have higher levels of financial literacy than women who did not receive loan forgiveness.

Policy Recommendations

To improve federal student loan forgiveness programs, policymakers should consider implementing the following recommendations:

Expand Eligibility for PSLF

Expand eligibility for the Public Service Loan Forgiveness (PSLF) program to include more public service workers, such as teachers, nurses, and social workers. This would help to ensure that more borrowers can access loan forgiveness after working in public service for a certain number of years.

Increase the Forgiveness Amount

Increase the amount of loan forgiveness available through PSLF and other forgiveness programs. This would help to make a greater impact on borrowers’ financial burdens and encourage more people to pursue public service careers.

Simplify the Forgiveness Process

Simplify the process for applying for and receiving loan forgiveness. This would help to reduce the burden on borrowers and ensure that more people are able to access the benefits of forgiveness programs.

Provide More Information and Counseling

Provide more information and counseling to borrowers about federal student loan forgiveness programs. This would help borrowers to make informed decisions about their repayment options and ensure that they are aware of the benefits of forgiveness programs.

As the debate over federal student loan forgiveness rages on, the Supreme Court is set to hear arguments on the legality of President Biden’s plan to cancel billions of dollars in debt. The court’s decision will have a major impact on the millions of Americans who are struggling to repay their student loans.

For more information on the Supreme Court’s upcoming hearing on student loan forgiveness, click here . The outcome of this case could have a significant impact on the future of federal student loan forgiveness.

Evaluate the Effectiveness of Forgiveness Programs

Evaluate the effectiveness of federal student loan forgiveness programs on a regular basis. This would help to ensure that the programs are meeting their goals and that they are being implemented in the most effective way possible.

Ethical Considerations

The ethics of federal student loan forgiveness are complex and multifaceted. There are a number of potential ethical implications to consider, including issues of fairness and equity, the impact on taxpayers and the overall economy, and the potential for unintended consequences.

One of the primary ethical concerns is the issue of fairness. Some argue that it is unfair to forgive student loans for some borrowers while others who have already repaid their loans or who chose not to attend college will not receive any benefit. Others argue that student loan forgiveness is a necessary step to address the growing student debt crisis and to promote economic mobility.

Another ethical concern is the potential impact on taxpayers. Student loan forgiveness would likely be a costly endeavor, and some argue that it would be unfair to burden taxpayers with the cost of forgiving student loans. Others argue that the benefits of student loan forgiveness, such as increased economic growth and reduced income inequality, would outweigh the costs.

There is also the potential for unintended consequences to consider. For example, some argue that student loan forgiveness could lead to increased tuition costs, as colleges and universities would no longer have the incentive to keep tuition costs down. Others argue that student loan forgiveness could lead to reduced access to higher education, as colleges and universities would be less likely to admit students who are unable to pay for their education.

Ultimately, the ethical implications of federal student loan forgiveness are complex and there is no easy answer. It is important to weigh all of the potential ethical considerations carefully before making a decision about whether or not to forgive student loans.

Distributive Justice

One of the key ethical considerations in student loan forgiveness is the issue of distributive justice. Distributive justice is concerned with the fair distribution of benefits and burdens in society. Some argue that student loan forgiveness would be an unjust distribution of benefits, as it would primarily benefit those who have attended college, while those who have not attended college would not receive any benefit. Others argue that student loan forgiveness is necessary to address the growing student debt crisis and to promote economic mobility.

Intergenerational Equity

Another ethical consideration is the issue of intergenerational equity. Intergenerational equity is concerned with the fair distribution of benefits and burdens between generations. Some argue that student loan forgiveness would be an unfair burden on future generations, as they would be responsible for paying for the cost of forgiving student loans. Others argue that student loan forgiveness is necessary to address the growing student debt crisis and to promote economic mobility, which would benefit future generations.

Federal student loan forgiveness has been a topic of much discussion in recent months. For the latest updates on this issue, be sure to check out our student loan forgiveness update . We’ll keep you informed on all the latest developments, so you can stay up-to-date on the latest news about federal student loan forgiveness.

Unintended Consequences

There is also the potential for unintended consequences to consider. For example, some argue that student loan forgiveness could lead to increased tuition costs, as colleges and universities would no longer have the incentive to keep tuition costs down. Others argue that student loan forgiveness could lead to reduced access to higher education, as colleges and universities would be less likely to admit students who are unable to pay for their education.

Future Outlook

The future of federal student loan forgiveness is uncertain. Several factors could influence future policy decisions, including the political landscape, economic conditions, and the actions of key stakeholders.

Likelihood of Different Scenarios

Several scenarios are possible for the future of federal student loan forgiveness:

- Broad forgiveness: All or a significant portion of federal student loans could be forgiven.

- Targeted forgiveness: Forgiveness could be limited to borrowers who meet certain criteria, such as income or occupation.

- No forgiveness: Federal student loans could continue to be repaid as they are currently.

The likelihood of each scenario depends on a variety of factors, including the political will to enact forgiveness, the economic impact of forgiveness, and the legal feasibility of forgiveness.

Potential Impact of Future Developments

Future developments related to federal student loan forgiveness could have a significant impact on borrowers, higher education institutions, and the overall economy.

- Borrowers: Broad forgiveness could provide significant financial relief to borrowers, potentially freeing up funds for other expenses such as housing, childcare, or retirement savings.

- Higher education institutions: Forgiveness could reduce the amount of revenue that colleges and universities receive from student loans, which could lead to tuition increases or cuts to programs.

- Overall economy: Forgiveness could stimulate the economy by increasing consumer spending and reducing household debt.

Key Stakeholders

Several key stakeholders will play a role in shaping the future of federal student loan forgiveness, including:

- Borrowers: Borrowers are the primary stakeholders in federal student loan forgiveness. They will be directly affected by any changes to the forgiveness program.

- Higher education institutions: Colleges and universities are also key stakeholders in federal student loan forgiveness. They will be affected by any changes to the program that reduce the amount of revenue they receive from student loans.

- Government: The government is responsible for administering the federal student loan program. The government will need to make a decision about whether or not to forgive student loans and, if so, how to do so.

The actions of these key stakeholders will help to determine the future of federal student loan forgiveness.

Last Point

The debate surrounding federal student loan forgiveness is multifaceted, involving ethical considerations, legal frameworks, and comparative analyses with similar programs in other countries. By presenting a balanced and nuanced perspective, this guide empowers readers to form informed opinions on this critical issue.

As we look to the future, we examine potential developments and trends related to student loan forgiveness, considering the likelihood of different scenarios and their impact on borrowers, higher education institutions, and the overall economy. We identify key stakeholders and their potential roles in shaping future outcomes, providing a comprehensive understanding of the evolving landscape of federal student loan forgiveness.

FAQ Resource

What are the eligibility requirements for federal student loan forgiveness?

Eligibility for federal student loan forgiveness programs varies depending on the specific program. Some common eligibility criteria include working in certain public service professions, meeting income requirements, or having a disability.

How much student loan debt would be forgiven under different forgiveness scenarios?

The amount of student loan debt forgiven under different forgiveness scenarios depends on the specific program and the borrower’s individual circumstances. Some programs offer full forgiveness, while others may forgive a portion of the debt.

What are the potential economic effects of federal student loan forgiveness?

The potential economic effects of federal student loan forgiveness are complex and subject to debate. Some argue that it could stimulate the economy by increasing consumer spending, while others contend that it could lead to inflation or higher interest rates.