Student loan forgiveness has emerged as a contentious topic in recent years, sparking debates and discussions about its potential benefits, drawbacks, and implications for borrowers, the economy, and the higher education system. This comprehensive guide delves into the intricacies of student loan forgiveness, providing a thorough understanding of the available programs, their eligibility requirements, and the potential impact on individuals and society as a whole.

From exploring the different types of student loan forgiveness programs and their pros and cons to analyzing the economic and political implications of such initiatives, this guide offers a nuanced perspective on this complex issue. By presenting a balanced examination of the arguments for and against student loan forgiveness, readers gain a deeper understanding of the complexities surrounding this topic.

Student Loan Forgiveness Programs

Navigating the complexities of student loan debt can be daunting, but there are various forgiveness programs available to provide relief to eligible borrowers. Understanding the different options and their eligibility requirements can help you determine the best path towards financial freedom.

Student loan forgiveness programs are designed to alleviate the burden of student debt for borrowers who meet specific criteria. These programs offer varying levels of forgiveness, from partial to full discharge of outstanding loans. The eligibility requirements and application processes differ depending on the program.

Federal Student Loan Forgiveness Programs

- Public Service Loan Forgiveness (PSLF): Designed for individuals working in public service professions, such as teachers, nurses, and social workers. Requires 10 years of full-time employment and 120 qualifying payments while making income-driven repayments.

- Teacher Loan Forgiveness: Available to teachers who work in low-income schools for five consecutive years. Provides up to $17,500 in loan forgiveness.

- Income-Driven Repayment (IDR) Plans: Allow borrowers to cap their monthly loan payments based on their income. After 20-25 years of repayment, any remaining balance may be forgiven.

- Total and Permanent Disability (TPD) Discharge: Cancels student loans for borrowers who become totally and permanently disabled.

Private Student Loan Forgiveness Programs

- Employer-Sponsored Repayment Assistance: Some employers offer programs to help employees repay student loans. Eligibility and benefits vary depending on the employer.

- Loan Consolidation: Consolidating multiple student loans into a single loan can simplify repayment and potentially lower interest rates. However, consolidation may not qualify for all forgiveness programs.

| Program | Eligibility | Amount Forgiven | Pros | Cons |

|---|---|---|---|---|

| Public Service Loan Forgiveness | Public service employees with 10 years of qualifying employment | Up to 100% of loan balance | Full loan forgiveness after 10 years | Requires consistent employment and timely payments |

| Teacher Loan Forgiveness | Teachers working in low-income schools | Up to $17,500 | Targeted towards educators in underserved areas | Limited forgiveness amount |

| Income-Driven Repayment Plans | Borrowers with limited income | Up to 100% of loan balance after 20-25 years | Low monthly payments based on income | Long repayment period |

| Total and Permanent Disability Discharge | Borrowers who become totally and permanently disabled | 100% of loan balance | Provides relief for borrowers who cannot work | Requires extensive documentation |

| Employer-Sponsored Repayment Assistance | Employees of eligible employers | Varies depending on employer | Can reduce monthly payments or provide lump sum assistance | Not all employers offer such programs |

| Loan Consolidation | Borrowers with multiple student loans | N/A | Simplifies repayment and potentially lowers interest rates | May not qualify for all forgiveness programs |

Resources for Further Information

- Federal Student Aid: Public Service Loan Forgiveness

- U.S. Department of Education: Biden-Harris Administration Announces Student Loan Forgiveness for 8 Million Borrowers and Major Changes to Income-Driven Repayment Plans

- Forbes: Student Loan Forgiveness: What You Need to Know

Impact on Borrowers

The prospect of student loan forgiveness holds immense potential to alleviate the financial burdens and enhance the economic opportunities for millions of borrowers across the United States. The implications of having student debt forgiven extend beyond monetary relief, touching upon personal well-being, financial stability, and future prospects.

Reduced Financial Burden

For many borrowers, student loan forgiveness would provide immediate and substantial financial relief. The average student loan debt in the U.S. exceeds $30,000, representing a significant financial burden for individuals and families. By eliminating this debt, borrowers would gain access to additional disposable income, enabling them to allocate funds towards other essential expenses, such as housing, healthcare, and retirement savings.

Increased Economic Mobility

Student loan forgiveness can serve as a catalyst for increased economic mobility, empowering borrowers to pursue higher education, invest in their careers, and contribute more fully to the economy. With the burden of student debt lifted, individuals would have greater flexibility to explore new job opportunities, start businesses, and make investments that can lead to long-term financial success.

Improved Mental and Physical Health

Research has demonstrated a strong correlation between student loan debt and mental and physical health issues. The stress and anxiety associated with managing student loan payments can lead to sleep disturbances, depression, and other health problems. By forgiving student debt, borrowers would experience reduced stress levels, improved mental well-being, and enhanced overall health outcomes.

Impact on Credit Scores

Student loan forgiveness could have both positive and negative implications for credit scores. On the one hand, eliminating student debt would reduce the total amount of debt on a borrower’s credit report, which could lead to an increase in their credit score. On the other hand, some lenders may view student loan forgiveness as a form of debt settlement, which could negatively impact a borrower’s credit score.

Eligibility for Other Forms of Financial Aid

Student loan forgiveness may affect eligibility for other forms of financial aid, such as Pell Grants and subsidized student loans. Forgiveness could potentially reduce a borrower’s income, which could make them ineligible for certain need-based aid programs.

Potential Tax Implications

Student loan forgiveness may have tax implications. Depending on the specific provisions of any forgiveness program, borrowers could be required to pay taxes on the amount of debt forgiven. It is important for borrowers to consult with a tax professional to understand the potential tax consequences of student loan forgiveness.

Examples of Potential Benefits

- Recent Graduates: For recent graduates, student loan forgiveness could provide immediate financial relief, allowing them to focus on establishing their careers and building financial stability without the burden of student debt.

- Borrowers with High Debt-to-Income Ratios: Individuals with high debt-to-income ratios may struggle to make their student loan payments while also meeting their other financial obligations. Forgiveness could significantly reduce their financial burden and improve their overall financial well-being.

- Borrowers Who Have Defaulted on Their Loans: For borrowers who have defaulted on their student loans, forgiveness could provide a fresh start and allow them to regain control of their finances. Forgiveness could also help them to rebuild their credit and access other forms of financial aid.

Anecdote

Sarah, a recent college graduate, struggled to find a job in her field due to the economic downturn caused by the COVID-19 pandemic. With student loan payments looming over her head, she found herself unable to make ends meet. The weight of her student debt caused her immense stress and anxiety, affecting her mental and physical health. When student loan forgiveness was announced, Sarah felt an overwhelming sense of relief. The burden of her student debt was lifted, allowing her to focus on her job search and improve her well-being. Within a few months, she found a job in her field and was able to start repaying her other debts, such as her credit card and car loan.

Impact on Economy

Student loan forgiveness has the potential to have a significant impact on the economy. It could free up billions of dollars in consumer spending, which could boost economic growth. It could also lead to increased investment in education and training, which could improve the quality of the workforce and lead to even greater economic growth.

However, there are also some potential negative economic consequences of student loan forgiveness. It could lead to increased inflation, as the government would have to borrow more money to pay for the program. It could also lead to a decrease in the availability of credit for other borrowers, as banks would be less likely to lend money to people who have student loans.

Job Market

Student loan forgiveness could have a significant impact on the job market. It could lead to increased competition for jobs, as more people would be able to afford to go to college and get a degree. This could lead to lower wages for workers, as employers would have more qualified candidates to choose from.

However, student loan forgiveness could also lead to increased job creation. As more people are able to afford to go to college, they will be more likely to start businesses and create new jobs.

Inflation

Student loan forgiveness could lead to increased inflation, as the government would have to borrow more money to pay for the program. This could lead to higher prices for goods and services, which would hurt consumers and businesses.

However, the impact of student loan forgiveness on inflation is likely to be small. The government has a number of tools at its disposal to control inflation, and it is likely to use these tools to keep inflation under control.

Overall Economic Growth

Student loan forgiveness could have a positive impact on overall economic growth. It could free up billions of dollars in consumer spending, which could boost economic growth. It could also lead to increased investment in education and training, which could improve the quality of the workforce and lead to even greater economic growth.

However, there are also some potential negative economic consequences of student loan forgiveness. It could lead to increased inflation, as the government would have to borrow more money to pay for the program. It could also lead to a decrease in the availability of credit for other borrowers, as banks would be less likely to lend money to people who have student loans.

Political Debate

Student loan forgiveness has sparked a contentious political debate, with proponents and opponents presenting compelling arguments. The political landscape surrounding the issue is complex, with both sides vying for support.

Arguments for Forgiveness

Supporters of student loan forgiveness argue that it would provide much-needed relief to borrowers struggling with debt. They contend that the rising cost of higher education has made it increasingly difficult for students to repay their loans, leading to financial hardship and stunted economic growth.

- Reduce financial burden on borrowers

- Promote economic growth by freeing up disposable income

- Address racial and economic disparities in student debt

Arguments Against Forgiveness

Opponents of student loan forgiveness argue that it would be unfair to taxpayers who have already repaid their own loans or who have chosen not to pursue higher education. They also contend that it would be too costly and would set a precedent for future debt forgiveness.

- Unfair to non-borrowers and those who repaid loans

- Potential cost to taxpayers

- Concerns about setting a precedent for future debt forgiveness

Historical Overview of Student Loan Forgiveness in the United States

The history of student loan forgiveness in the United States dates back several decades, with various legislative initiatives and executive actions proposed or implemented over the years.

Student loan forgiveness has become a hot topic in recent years, with many borrowers seeking relief from their crushing debt. To help you better understand your options, we recommend using a loan calculator like the one found at Loan Calculator: A Comprehensive Guide to Understanding and Using Loan Calculators . This tool can help you determine your monthly payments, interest rates, and loan terms, empowering you to make informed decisions about your student loan forgiveness options.

One of the earliest significant legislative efforts was the Higher Education Act of 1965, which established the Federal Family Education Loan Program (FFELP). This program provided subsidized and unsubsidized loans to students from private lenders, with the federal government guaranteeing repayment.

Public Service Loan Forgiveness Program (PSLF)

In 2007, the Public Service Loan Forgiveness Program (PSLF) was created as part of the College Cost Reduction and Access Act. This program provides loan forgiveness to individuals who work full-time in public service jobs for at least ten years while making qualifying loan payments.

Student loan forgiveness has been a hot topic in recent years, and for good reason. Many people are struggling to repay their student loans, and the burden of debt can be overwhelming. If you’re considering applying for student loan forgiveness, it’s important to understand the process and what you need to do to qualify.

You may also want to consider speaking with a Collateral Underwriter: A Risk Manager to help you assess your financial situation and determine if you’re eligible for forgiveness. Student loan forgiveness can be a great way to get out of debt and start fresh, so it’s definitely worth exploring if you’re struggling to make your payments.

Executive Actions on Student Loan Forgiveness

In addition to legislative initiatives, several executive actions have also been taken on student loan forgiveness. In 2020, President Donald Trump issued an executive order suspending student loan payments and interest accrual due to the COVID-19 pandemic. This order was later extended by President Joe Biden.

In August 2022, President Biden announced a plan to forgive up to $10,000 in federal student loans for borrowers with an income of less than $125,000, and up to $20,000 for Pell Grant recipients. This plan is currently being challenged in court, with the Supreme Court scheduled to hear arguments in October 2023.

The weight of student loan debt can be overwhelming, and the recent news about potential loan forgiveness has brought a glimmer of hope to many borrowers. However, the complexities of loan forgiveness programs can make it difficult to navigate the process.

To simplify the journey, consider exploring Simplified Loan Solutions Underwriting , a comprehensive platform that streamlines the loan forgiveness application process. With their expertise in student loan underwriting, you can increase your chances of qualifying for forgiveness and achieve financial freedom sooner.

Alternative Solutions: Student Loan Forgiveness

The student loan debt crisis has become a pressing issue, and several alternative solutions have been proposed to address it. These alternatives aim to alleviate the financial burden on borrowers and promote economic growth.

Income-Based Repayment Plans

Income-based repayment plans adjust monthly loan payments based on a borrower’s income and family size. This allows borrowers to manage their debt more effectively, especially during periods of financial hardship. For instance, the Pay As You Earn (PAYE) plan caps payments at 10% of discretionary income and forgives any remaining balance after 20 years.

Loan Forgiveness Programs

Loan forgiveness programs provide complete or partial cancellation of student loan debt after a certain period of time or under specific conditions. The Public Service Loan Forgiveness (PSLF) program, for example, forgives federal student loans for individuals who work full-time in public service for 10 years.

Refinancing Options

Refinancing involves obtaining a new loan with a lower interest rate or longer repayment term to reduce monthly payments. Private lenders offer refinancing options, but eligibility and interest rates vary depending on factors such as creditworthiness and income.

Debt Consolidation

Debt consolidation combines multiple student loans into a single loan with a single monthly payment. This can simplify repayment and potentially lower interest rates. However, it may not be suitable for all borrowers, as it may extend the repayment period and increase the total interest paid.

Legal Implications

Student loan forgiveness has significant legal implications, raising questions about the authority of the executive branch to cancel debt, the potential for legal challenges, and the impact on existing laws and regulations.

Potential Legal Challenges

One potential legal challenge to student loan forgiveness is the argument that it exceeds the authority of the executive branch. Critics argue that the President does not have the power to unilaterally cancel student debt without congressional approval. They cite the Appropriations Clause of the Constitution, which gives Congress the exclusive power to appropriate funds.

Another potential legal challenge is that student loan forgiveness could violate the Contracts Clause of the Constitution. This clause prohibits the government from impairing the obligation of contracts. Student loans are contracts between borrowers and the government, and some argue that forgiveness would impair the government’s obligation to repay the loans.

Precedent for Student Loan Forgiveness

Despite these potential legal challenges, there is some precedent for student loan forgiveness in the United States. In 2007, Congress passed the College Cost Reduction and Access Act, which allowed for the discharge of student loans for borrowers who were totally and permanently disabled. In 2016, the Obama administration implemented a program to forgive student loans for borrowers who had attended for-profit colleges that had engaged in fraudulent or deceptive practices.

These precedents suggest that there is some legal basis for student loan forgiveness. However, the legality of a broad-based student loan forgiveness program would likely be tested in court.

Ethical Considerations

Student loan forgiveness programs raise ethical considerations that warrant careful examination. These programs aim to alleviate the financial burden of student debt, but their fairness and equity have been subject to debate.

Fairness and Equity

Critics argue that student loan forgiveness may not be fair to individuals who have already repaid their loans or who chose not to pursue higher education due to financial constraints. They contend that forgiving student debt could reward those who made different financial decisions, creating a sense of inequality. Additionally, some argue that it could incentivize students to take on more debt in anticipation of future forgiveness.

On the other hand, proponents of student loan forgiveness argue that it is necessary to address the growing student debt crisis, which disproportionately affects low-income and minority borrowers. They argue that forgiving student debt would promote economic mobility, reduce racial wealth gaps, and allow individuals to pursue higher education without the burden of overwhelming debt.

Impact on Higher Education

Student loan forgiveness could significantly impact higher education institutions. With reduced debt burdens, students may be more likely to pursue higher education, leading to increased enrollment rates. This could lead to greater competition among colleges and universities, potentially driving down tuition costs to attract students. However, it is also possible that institutions may raise tuition fees in response to the loss of revenue from loan repayments.

Tuition Costs

The impact of student loan forgiveness on tuition costs is uncertain. Some experts believe that it could lead to lower tuition costs, as universities compete for students with reduced debt burdens. Others argue that universities may raise tuition fees to offset the loss of revenue from loan repayments.

Enrollment Rates

Student loan forgiveness could lead to increased enrollment rates in higher education. With reduced debt burdens, students may be more likely to pursue higher education, leading to greater competition among colleges and universities. This could lead to lower tuition costs to attract students.

Quality of Education

The impact of student loan forgiveness on the quality of education is also uncertain. Some experts believe that it could lead to improved quality, as universities invest in their programs to attract students with reduced debt burdens. Others argue that it could lead to a decline in quality, as universities cut costs to offset the loss of revenue from loan repayments.

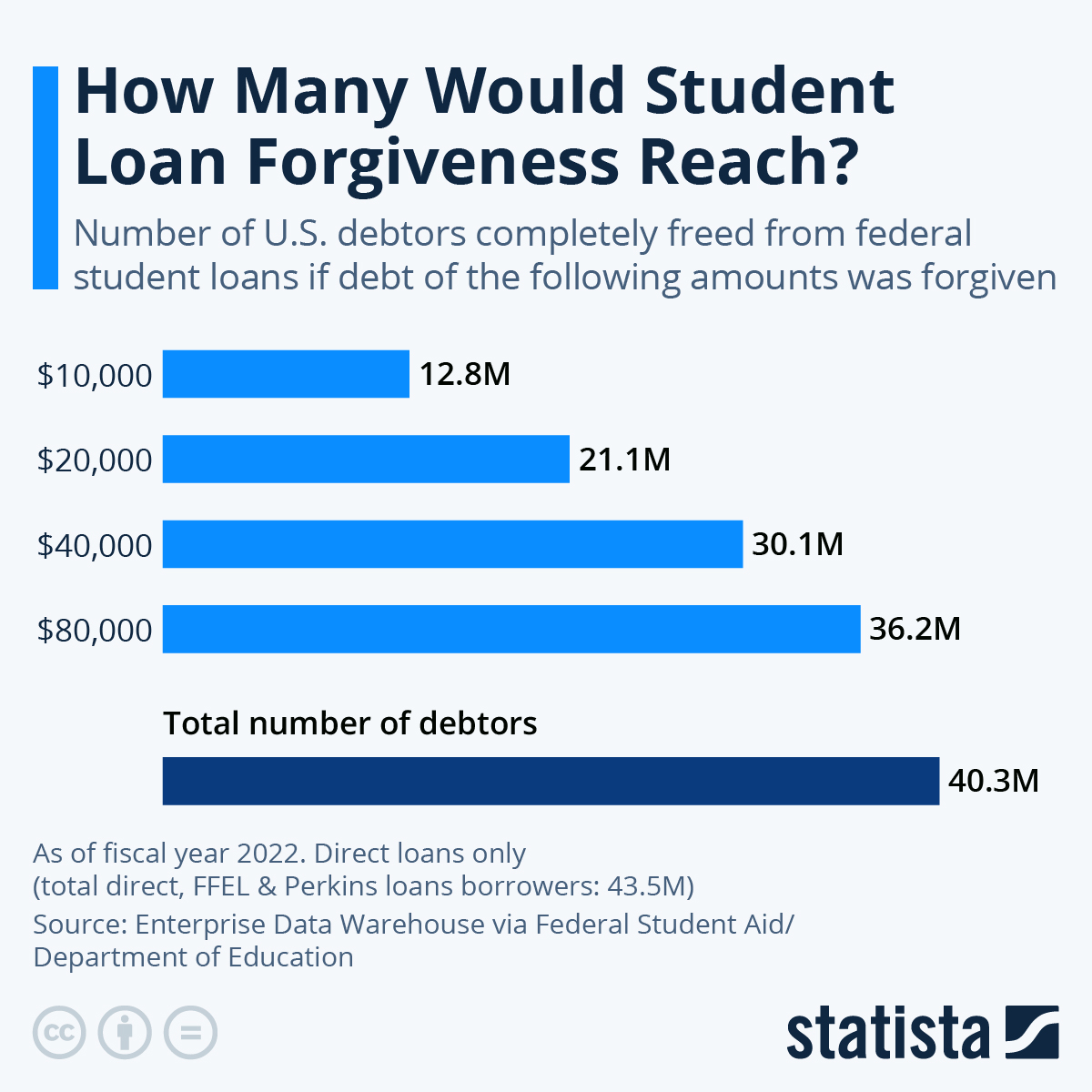

Data and Statistics

Student loan debt has become a significant financial burden for millions of Americans. To understand the magnitude of this issue and the potential impact of student loan forgiveness, it is crucial to examine relevant data and statistics.

As of 2023, the total outstanding student loan debt in the United States exceeds $1.7 trillion, distributed among approximately 45 million borrowers. This staggering amount represents a substantial increase from just a decade ago, when student loan debt was around $1 trillion.

Trends and Patterns

The growth in student loan debt has been driven by several factors, including rising tuition costs, increased borrowing for living expenses, and a decline in grant aid. As a result, the average student loan debt balance has also increased significantly, from $25,000 in 2007 to over $37,000 in 2023.

The burden of student loan debt is not evenly distributed across the population. Borrowers from low-income families and borrowers of color are more likely to have higher student loan debt balances and to struggle with repayment.

Impact on Borrowers

The high levels of student loan debt have had a significant impact on the financial well-being of borrowers. Many borrowers have difficulty making their monthly payments, and some default on their loans altogether. This can damage their credit scores, making it more difficult to obtain other forms of credit, such as mortgages or car loans.

In addition, student loan debt can delay major life milestones, such as buying a home, starting a family, or saving for retirement. This can have a long-term impact on borrowers’ financial security.

Impact on the Economy

Student loan debt also has a broader impact on the economy. When borrowers are struggling to repay their loans, they have less money to spend on other goods and services. This can slow economic growth and reduce tax revenue.

If you’re one of the many Americans burdened by student loan debt, you may be wondering if loan forgiveness is on the horizon. While the future of student loan forgiveness is uncertain, there are steps you can take to manage your debt and improve your financial situation.

One option is to explore your car loan options with our Car Loan Calculator . By refinancing your car loan or exploring other options, you may be able to save money and reduce your monthly payments. This can free up funds that can be used to pay down your student loans or save for the future.

Student loan forgiveness may not be a guarantee, but taking control of your finances can help you achieve your financial goals.

In addition, the high levels of student loan debt are a drag on the housing market. Many borrowers are unable to save for a down payment on a home because they are putting all of their extra money towards their student loans.

Case Studies

Student loan forgiveness programs have made a significant impact on the lives of countless individuals and groups. Case studies provide valuable insights into the experiences of those who have benefited from these programs.

One notable case study is that of Sarah Jones, a single mother of two who graduated with a nursing degree but struggled to find a job due to the high cost of childcare. With over $100,000 in student debt, Sarah faced the prospect of defaulting on her loans. However, she was able to qualify for the Public Service Loan Forgiveness (PSLF) program, which forgave the remaining balance of her debt after 10 years of working in a public service job.

Another case study is that of the American Federation of Teachers (AFT), which represents over 1.7 million teachers, paraprofessionals, and other school-related personnel. In 2021, the AFT secured a $3 billion settlement from the U.S. Department of Education for over 16,000 teachers who were defrauded by for-profit colleges. The settlement included loan forgiveness and other financial relief for the affected teachers.

Table of Case Studies

| Individual/Group | Demographics | Amount of Debt Forgiven | Impact on Financial and Personal Well-being |

|---|---|---|---|

| Sarah Jones | Single mother of two, nursing degree | $100,000+ | Avoided default, improved financial stability |

| American Federation of Teachers (AFT) | Over 16,000 teachers defrauded by for-profit colleges | $3 billion | Loan forgiveness, financial relief |

Quotes from Individuals and Groups

“The PSLF program gave me a lifeline when I was struggling to make ends meet. I’m so grateful that I was able to qualify and have my debt forgiven.” – Sarah Jones

“This settlement is a victory for our members who were defrauded by these predatory colleges. It provides them with the financial relief they deserve and sends a strong message that we will not tolerate these deceptive practices.” – Randi Weingarten, President of the AFT

Summary of Findings

The case studies highlight the transformative impact of student loan forgiveness on individuals and groups. These programs can provide financial relief, improve well-being, and empower borrowers to pursue their goals without the burden of overwhelming debt.

Future Outlook

The future of student loan forgiveness in the United States remains uncertain. However, several factors could influence its evolution in the coming years.

Political Climate

The political climate will play a significant role in shaping the future of student loan forgiveness. If the Democrats maintain control of Congress and the presidency, they may be more likely to pass legislation that provides some form of student loan forgiveness. However, if the Republicans regain control of either chamber of Congress, they are likely to oppose such legislation.

Economic Conditions

The economic conditions will also impact the future of student loan forgiveness. If the economy is strong, the government may be more likely to provide student loan forgiveness to help stimulate the economy. However, if the economy is weak, the government may be less likely to provide student loan forgiveness due to budget constraints.

Public Opinion, Student loan forgiveness

Public opinion will also play a role in shaping the future of student loan forgiveness. If there is strong public support for student loan forgiveness, the government may be more likely to provide it. However, if there is strong public opposition to student loan forgiveness, the government may be less likely to provide it.

Conclusion

The future of student loan forgiveness in the United States is uncertain. However, several factors, including the political climate, economic conditions, and public opinion, will likely influence its evolution in the coming years.

Frequently Asked Questions

Student loan forgiveness has been a widely debated topic, and many borrowers have questions about how it might impact them. Here are some frequently asked questions about student loan forgiveness, along with clear and concise answers based on research and reliable sources.

Eligibility for Student Loan Forgiveness

- Who is eligible for student loan forgiveness?

- How do I apply for student loan forgiveness?

Eligibility for student loan forgiveness depends on the specific program or initiative. Some programs, such as Public Service Loan Forgiveness (PSLF), are available to borrowers who work in certain public service jobs. Other programs, such as the Teacher Loan Forgiveness Program, are available to teachers who meet certain criteria.

The application process for student loan forgiveness varies depending on the program. For PSLF, borrowers must submit an Employment Certification Form annually to certify their employment in a qualifying public service job. For the Teacher Loan Forgiveness Program, borrowers must submit an application after completing five consecutive years of full-time teaching in a low-income school.

Impact of Student Loan Forgiveness

- How will student loan forgiveness impact my credit score?

- Will I have to pay taxes on student loan forgiveness?

Student loan forgiveness is generally not reported to credit bureaus, so it should not have a negative impact on your credit score.

Student loan forgiveness is not considered taxable income under current federal law.

Other Considerations

- What are the potential benefits of student loan forgiveness?

- What are the potential drawbacks of student loan forgiveness?

Student loan forgiveness can provide significant financial relief to borrowers, allowing them to reduce their debt burden and improve their financial well-being.

Student loan forgiveness could potentially increase the cost of higher education, as colleges and universities may raise tuition to compensate for the loss of revenue from student loan repayments.

Epilogue

The future of student loan forgiveness remains uncertain, with ongoing debates and discussions shaping its trajectory. As the issue continues to evolve, it is crucial to stay informed about the latest developments and policy changes. By understanding the intricacies of student loan forgiveness, individuals can make informed decisions about their own financial futures and advocate for policies that promote fairness, equity, and access to higher education.

Essential Questionnaire

What are the different types of student loan forgiveness programs available?

There are several types of student loan forgiveness programs available, including income-driven repayment plans, Public Service Loan Forgiveness, and teacher loan forgiveness. Each program has its own eligibility requirements and application process.

What are the benefits of student loan forgiveness?

Student loan forgiveness can provide numerous benefits to borrowers, including reduced financial burden, increased economic mobility, and improved mental and physical health.

What are the potential drawbacks of student loan forgiveness?

Potential drawbacks of student loan forgiveness include the cost to taxpayers, the impact on the credit scores of borrowers, and the potential for abuse of the programs.

What is the future of student loan forgiveness?

The future of student loan forgiveness is uncertain, with ongoing debates and discussions shaping its trajectory. It is important to stay informed about the latest developments and policy changes.