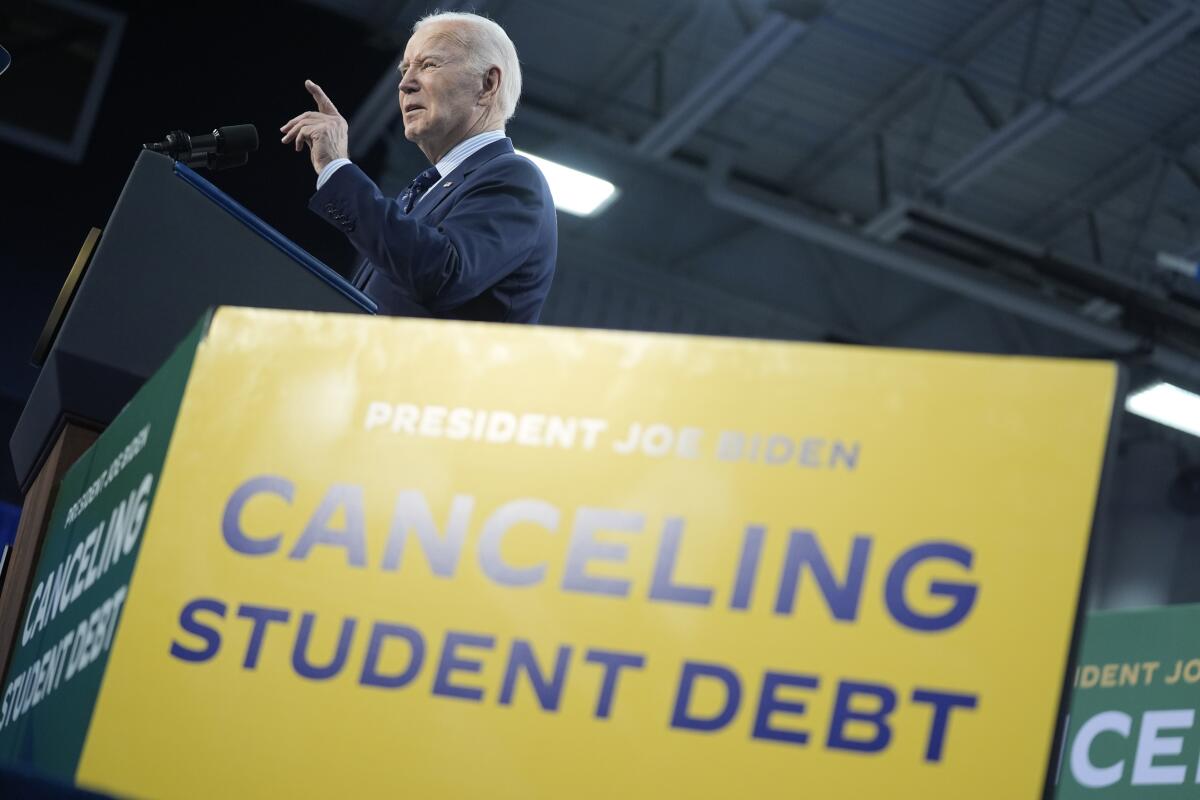

Student loan cancellation is a hot topic in the United States today. With over $1.7 trillion in outstanding student loan debt, many people are struggling to repay their loans and are calling for the government to cancel their debt.

There are many arguments for and against student loan cancellation. Proponents argue that it would provide much-needed relief to borrowers, stimulate the economy, and reduce wealth inequality. Opponents argue that it would be unfair to taxpayers who have already paid off their loans, and that it would encourage colleges and universities to raise tuition prices.

Impact on Student Debt

Student loan debt has become a significant financial burden for millions of Americans, with the total outstanding balance surpassing $1.7 trillion. The current state of student loan debt is characterized by high interest rates, complex repayment options, and a lack of affordable alternatives for borrowers who struggle to make payments.

Student loan cancellation would have a profound impact on borrowers, providing them with immediate financial relief and potentially freeing up funds for other expenses such as housing, healthcare, or starting a business. It could also reduce the racial wealth gap, as Black and Hispanic borrowers disproportionately hold student debt.

Economic Consequences

The economic consequences of student loan cancellation are complex and multifaceted. Some economists argue that it would stimulate the economy by increasing consumer spending and investment. Others contend that it could lead to inflation or higher interest rates. The long-term economic impact of student loan cancellation will depend on a variety of factors, including the size of the cancellation, the design of the program, and the overall state of the economy.

The recent news about student loan cancellation has been met with mixed reactions. Some believe that it is a necessary step to help alleviate the financial burden that many students face after graduating, while others argue that it is unfair to those who have already paid off their loans.

Whatever your stance on the issue, there is no doubt that student loans have become a major part of the American higher education system. In fact, according to a recent study, the average student loan debt for the class of 2020 was over $30,000. This is a significant increase from just a few decades ago, when the average student loan debt was less than $10,000. If you are considering taking out a student loan, it is important to do your research and understand all of your options.

There are a variety of different student loans available, and each one has its own unique terms and conditions. It is important to compare the different loans and choose the one that is right for you. You can find more information about student loans at bayupras.com

.

Arguments for Cancellation

Student loan cancellation has become a topic of significant debate in recent years. Proponents of cancellation argue that it is a moral and ethical imperative to alleviate the burden of student debt, which has become a major source of financial stress for millions of Americans.

Benefits to Society

Student loan cancellation could also provide significant benefits to society as a whole. By freeing up billions of dollars in consumer spending, it could stimulate the economy and create jobs. It could also reduce income inequality and promote social mobility, as it would disproportionately benefit low-income and minority borrowers.

Arguments against Cancellation

While student loan cancellation has its proponents, there are also arguments against the policy. Some individuals believe that student loan cancellation is unfair to those who have already repaid their loans or who chose not to attend college due to the cost.

The uncertainty surrounding student loan cancellation has left many borrowers in limbo. While the Biden administration has extended the student loan pause until August 31, 2023, the future of student loan forgiveness remains unclear. With the current pause in place, borrowers can temporarily halt their student loan payments and interest accrual, providing some much-needed financial relief.

However, the long-term fate of student loan cancellation remains to be determined, leaving many borrowers anxiously awaiting news of any potential forgiveness.

Additionally, there are concerns that student loan cancellation could be costly and could lead to inflation. Some economists argue that student loan cancellation would increase the national debt and could lead to higher taxes for all Americans.

Impact on Taxpayers

One of the biggest concerns about student loan cancellation is its potential impact on taxpayers. The cost of student loan cancellation would likely be borne by taxpayers, either through higher taxes or reduced government spending on other programs.

The exact cost of student loan cancellation is difficult to estimate, but it could be as high as $1.6 trillion. This would be a significant addition to the national debt, which is already over $28 trillion.

Higher taxes or reduced government spending could have a negative impact on the economy. Higher taxes could reduce economic growth, while reduced government spending could lead to job losses.

Political Considerations

The political feasibility of student loan cancellation is a complex issue with far-reaching implications. The debate over student loan cancellation has become increasingly polarized in recent years, with strong opinions on both sides. Political parties and interest groups have played a significant role in shaping the debate, and the potential impact of student loan cancellation on future elections is a major consideration for policymakers.

Political Parties and Interest Groups

The Democratic Party has generally been more supportive of student loan cancellation than the Republican Party. Democrats have argued that student loan debt is a major burden for many Americans and that cancellation would help to stimulate the economy. Republicans, on the other hand, have generally opposed student loan cancellation, arguing that it would be unfair to taxpayers who have already paid off their own student loans.

A number of interest groups have also weighed in on the debate over student loan cancellation. The National Education Association, the largest teachers’ union in the United States, has strongly supported student loan cancellation. The American Bankers Association, on the other hand, has opposed student loan cancellation, arguing that it would hurt the economy.

Potential Impact on Future Elections

The potential impact of student loan cancellation on future elections is difficult to predict. However, it is clear that the issue is a major concern for both political parties. Democrats believe that student loan cancellation could help them to win votes in future elections, while Republicans believe that it could hurt them. The outcome of the 2020 election will likely have a significant impact on the future of student loan cancellation.

Historical Context: Student Loan Cancellation

Student loan cancellation has a long and complex history in the United States. The first federal student loan cancellation program was established in 1965 as part of the Higher Education Act. This program provided for the cancellation of student loans for teachers who worked in low-income schools. Since then, several other student loan cancellation programs have been created, each with its own eligibility criteria and requirements.

One of the most significant student loan cancellation programs was the Public Service Loan Forgiveness (PSLF) program, which was created in 2007. This program provides for the cancellation of student loans for public service workers, such as teachers, nurses, and firefighters, after they have made 120 qualifying payments on their loans. However, the PSLF program has been plagued by problems, and many borrowers have been denied forgiveness even after meeting the program’s requirements.

Previous Attempts to Cancel Student Loans

- In 1983, Congress passed the Bankruptcy Amendments and Federal Judgeship Act, which made it more difficult for student loan borrowers to discharge their debts in bankruptcy.

- In 1990, Congress passed the Student Loan Default Prevention Act, which created the PSLF program.

- In 2010, Congress passed the Student Aid and Fiscal Responsibility Act, which expanded the PSLF program and created the Teacher Loan Forgiveness program.

- In 2015, the Obama administration announced a new initiative to forgive student loans for borrowers who were defrauded by their colleges.

Outcomes of Previous Attempts to Cancel Student Loans

- The Bankruptcy Amendments and Federal Judgeship Act made it more difficult for student loan borrowers to discharge their debts in bankruptcy, but it did not eliminate the possibility of bankruptcy discharge.

- The PSLF program has been plagued by problems, and many borrowers have been denied forgiveness even after meeting the program’s requirements.

- The Teacher Loan Forgiveness program has been more successful than the PSLF program, but it is still limited in scope.

- The Obama administration’s initiative to forgive student loans for borrowers who were defrauded by their colleges has been successful in providing relief to some borrowers, but it is also limited in scope.

Lessons Learned from Past Student Loan Cancellation Efforts

- Student loan cancellation programs can be effective in providing relief to borrowers, but they must be carefully designed and implemented.

- It is important to set clear eligibility criteria and requirements for student loan cancellation programs.

- It is important to provide adequate funding for student loan cancellation programs.

- It is important to monitor student loan cancellation programs to ensure that they are meeting their objectives.

Key Factors that Contributed to the Success or Failure of Past Student Loan Cancellation Programs

- The clarity of the eligibility criteria and requirements

- The availability of funding

- The effectiveness of the program’s implementation

- The level of public support for the program

Comparison of Different Student Loan Cancellation Programs Implemented in Other Countries

- In the United Kingdom, the government offers a student loan forgiveness program for borrowers who work in public service jobs.

- In Canada, the government offers a student loan forgiveness program for borrowers who have a permanent disability.

- In Australia, the government offers a student loan forgiveness program for borrowers who have a low income.

Potential Impact of Student Loan Cancellation on the Economy and Higher Education System

- Student loan cancellation could have a positive impact on the economy by freeing up money that borrowers could spend on other goods and services.

- Student loan cancellation could also have a positive impact on the higher education system by making college more affordable for students.

- However, student loan cancellation could also have some negative consequences, such as increasing the federal deficit.

Alternative Solutions

Addressing the student loan debt crisis requires exploring alternative solutions beyond cancellation. These include income-driven repayment plans and loan forgiveness programs, which aim to provide relief and make repayment more manageable for borrowers.

Income-Driven Repayment Plans

Income-driven repayment plans adjust monthly payments based on a borrower’s income and family size. This allows borrowers to pay a lower amount while they are struggling financially and increase payments when their income rises. These plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

Pros:

- Reduces monthly payments for low-income borrowers

- Provides flexibility and affordability

- Can lead to loan forgiveness after 20 or 25 years of payments

Cons:

- Can extend the repayment period

- May not be suitable for all borrowers

- Can result in higher total interest paid

Loan Forgiveness Programs

Loan forgiveness programs provide complete or partial cancellation of student debt after a certain period of time or under specific conditions. These programs include:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Nurse Corps Loan Repayment Program

Pros:

- Provides significant relief for eligible borrowers

- Encourages graduates to pursue public service careers

- Can help reduce the overall burden of student debt

Cons:

- Has strict eligibility requirements

- Can be difficult to navigate and apply for

- May not be available to all borrowers

Economic Impact

Student loan cancellation would have a significant impact on the U.S. economy. The exact impact is difficult to predict, but economists generally agree that it would have a positive effect. Student loan cancellation would free up money that borrowers could spend on other goods and services, which would boost economic growth. It would also reduce the amount of debt that borrowers owe, which would improve their financial well-being and make it easier for them to buy homes, start businesses, and save for retirement.

Impact on Inflation

One concern about student loan cancellation is that it could lead to inflation. If borrowers suddenly have more money to spend, they may bid up prices for goods and services, which could lead to inflation. However, economists generally believe that the impact on inflation would be small. The amount of debt that would be canceled is relatively small compared to the size of the U.S. economy, and the money that borrowers would save would likely be spent on a variety of goods and services, which would help to keep inflation in check.

Student loan cancellation has been a hot topic in recent years, with many advocating for the forgiveness of all or part of student debt. For the latest updates and news on student loan cancellation, check out our comprehensive student loan news section.

We cover everything from new developments in the Biden administration’s student loan forgiveness plan to tips on managing your student loans and exploring alternative repayment options.

Impact on Employment

Student loan cancellation could also have a positive impact on employment. If borrowers have more money to spend, they may be more likely to start businesses or invest in their own education, which could lead to job creation. Additionally, student loan cancellation would reduce the amount of debt that borrowers owe, which would make it easier for them to repay other debts, such as mortgages and car loans. This could free up even more money that borrowers could spend on goods and services, which would further boost economic growth.

Long-Term Economic Consequences

The long-term economic consequences of student loan cancellation are likely to be positive. By freeing up money that borrowers can spend on other goods and services, student loan cancellation would boost economic growth and improve the financial well-being of borrowers. This would lead to a more prosperous economy in the long run.

Social Justice Implications

Student loan cancellation has significant social justice implications, particularly for marginalized communities. By eliminating the burden of student debt, it can reduce wealth inequality, increase economic mobility, and improve access to higher education.

Reduced Wealth Inequality

Student loan debt disproportionately affects low-income and minority borrowers. By canceling student debt, we can narrow the wealth gap between those with and without college degrees. According to the Brookings Institution, student loan cancellation would increase the wealth of Black households by 40%.

Increased Economic Mobility

Student loan debt can hinder financial mobility by making it difficult for borrowers to save for a home, start a business, or pursue other financial goals. Student loan cancellation would free up financial resources for borrowers, allowing them to invest in their future and contribute to the economy.

Improved Access to Higher Education

Student loan debt can deter students from pursuing higher education, especially those from low-income backgrounds. Student loan cancellation would make college more affordable and accessible, allowing more students to achieve their educational goals.

Intersectionality of Race, Gender, and Socioeconomic Status

The burden of student loan debt intersects with race, gender, and socioeconomic status. Black and Hispanic borrowers are more likely to have student loan debt than white borrowers. Women are more likely to have student loan debt than men. And low-income borrowers are more likely to have student loan debt than high-income borrowers.

By addressing the social justice implications of student loan debt, we can create a more equitable and just society.

Financial Planning Considerations

Student loan cancellation has the potential to significantly impact borrowers’ financial planning. Here are some key considerations:

Impact on Credit Scores

Student loan cancellation may have a negative impact on credit scores, as it reduces the amount of debt being reported on credit reports. However, this impact is typically temporary, and credit scores will usually recover within a few months.

Impact on Savings Goals

Student loan cancellation can free up a significant amount of money that can be used to achieve other financial goals, such as saving for a down payment on a house or retirement. This can have a positive impact on borrowers’ long-term financial security.

Preparing for the Possibility of Student Loan Cancellation

Borrowers can prepare for the possibility of student loan cancellation by making extra payments on their loans, building up their savings, and exploring other financial aid options. This will help them to reduce their overall debt burden and improve their financial flexibility.

Communication Strategies

Student loan cancellation is a complex issue with significant implications for borrowers, higher education institutions, and the economy as a whole. To ensure that borrowers are well-informed about the potential impacts of student loan cancellation, a comprehensive communication strategy is essential.

Student loan cancellation has been a hot topic lately, but for those who aren’t eligible or don’t qualify, there are still options to manage their debt. One such option is student loan repayment, which allows borrowers to make smaller monthly payments over a longer period of time.

While student loan repayment may not be as ideal as cancellation, it can provide some relief to those struggling to repay their loans. And, with careful planning, borrowers may even be able to pay off their loans faster than they would have with a traditional repayment plan.

For more information on student loan repayment, visit student loan repayment .

The communication strategy should include the following key elements:

Target Audience Segmentation, Student loan cancellation

The target audience for the communication strategy should be segmented into specific groups based on their unique needs and interests. These groups may include:

- Current student loan borrowers

- Former student loan borrowers

- Potential student loan borrowers

- Parents of student loan borrowers

- Educators and policymakers

Message Development

The messages developed for each target audience should be clear, concise, and informative. They should provide borrowers with a basic understanding of the potential impacts of student loan cancellation, including:

- The eligibility criteria for student loan cancellation

- The application process for student loan cancellation

- The potential financial implications of student loan cancellation

- The potential impact of student loan cancellation on higher education affordability

- The potential economic effects of student loan cancellation

Distribution Channels

The communication strategy should utilize a variety of distribution channels to reach the target audience. These channels may include:

- Social media

- Website

- Print advertising

- Television advertising

Q&A Section

The communication strategy should include a Q&A section to address common borrower concerns. These concerns may include:

- What are the eligibility criteria for student loan cancellation?

- How do I apply for student loan cancellation?

- What are the potential financial implications of student loan cancellation?

- What is the potential impact of student loan cancellation on higher education affordability?

- What are the potential economic effects of student loan cancellation?

Timeline for Communication Rollout

The communication strategy should include a timeline for the rollout of communication materials. This timeline should be developed in collaboration with key stakeholders, including the Department of Education, the Consumer Financial Protection Bureau, and student loan servicers.

Monitoring and Evaluation

The communication strategy should include a plan for monitoring and evaluating the effectiveness of the communication materials. This plan should include metrics for measuring the reach, engagement, and impact of the communication materials.

Policy Recommendations

The implementation of student loan cancellation necessitates thoughtful policy recommendations to guarantee a successful and equitable program. To design an effective program, several key elements should be considered:

- Eligibility criteria: Determine the criteria for loan forgiveness, such as income thresholds, loan type, or years of service in certain professions.

- Loan amount: Specify the maximum loan amount eligible for cancellation, ensuring it is sufficient to provide meaningful relief to borrowers.

- Repayment plan: Establish a clear repayment plan for any remaining loan balance after cancellation, considering factors like income-based repayment options.

- Implementation timeline: Set a realistic timeline for the implementation of the program, including the process for borrowers to apply and receive loan forgiveness.

Impact on Higher Education System

Student loan cancellation could potentially have a significant impact on the higher education system:

- Reduced student debt burden: Freeing students from the burden of student loans could encourage more individuals to pursue higher education.

- Increased access to education: Making higher education more affordable could increase access for students from disadvantaged backgrounds.

- Potential for increased tuition costs: Some argue that loan cancellation could lead to increased tuition costs, as colleges may seek to recoup lost revenue.

Impact on Higher Education

Student loan cancellation has the potential to significantly impact higher education institutions. One of the most significant effects would be a reduction in tuition costs. Currently, many colleges and universities rely on tuition revenue to fund their operations. If student loan debt is canceled, it could lead to a decrease in the amount of money that students are willing to pay for college. As a result, colleges and universities may be forced to lower their tuition costs in order to remain competitive.

Another potential impact of student loan cancellation is a change in financial aid programs. Currently, many colleges and universities offer financial aid programs to help students pay for the cost of college. If student loan debt is canceled, it could reduce the need for these programs. As a result, colleges and universities may be forced to reduce or eliminate their financial aid programs.

Finally, student loan cancellation could also affect enrollment trends. If student loan debt is canceled, it could make college more affordable for many students. As a result, it could lead to an increase in the number of students who enroll in college. This could have a positive impact on the overall quality of higher education in the United States.

Impact on the Future of Higher Education

Student loan cancellation could also have a significant impact on the future of higher education. If student loan debt is canceled, it could make college more accessible to a wider range of students. This could lead to a more diverse and inclusive student body, which could benefit the overall quality of higher education.

In addition, student loan cancellation could also help to reduce the cost of college for future generations. If colleges and universities are forced to lower their tuition costs in order to remain competitive, it could make college more affordable for everyone. This could have a positive impact on the long-term economic prospects of the United States.

Case Studies

Student loan cancellation programs have been implemented in several countries worldwide, each with its unique design and outcomes. These case studies provide valuable insights into the political, economic, and social factors that shape the implementation and effectiveness of such programs.

United States

In the United States, the Public Service Loan Forgiveness (PSLF) program offers loan forgiveness to individuals who work full-time in public service jobs for 10 years while making on-time loan payments. The program aims to encourage individuals to pursue careers in public service fields, such as education, healthcare, and law enforcement. However, the PSLF program has faced criticism due to its complex eligibility requirements and lengthy repayment period, resulting in a low forgiveness rate.

Canada

Canada’s student loan cancellation program, the Repayment Assistance Plan (RAP), provides loan forgiveness to low-income earners who have difficulty repaying their student loans. The program aims to reduce student debt and improve financial stability for individuals with lower incomes. RAP participants must make regular loan payments for a period of time, and their remaining loan balance is forgiven after a certain number of years.

United Kingdom

The United Kingdom’s student loan cancellation program, known as the “Plan 2” repayment system, offers graduated loan repayments based on income. Borrowers with higher incomes make larger monthly payments, while those with lower incomes make smaller payments. After 25 years, any remaining loan balance is forgiven. The program aims to make student loan repayments more manageable and reduce the financial burden on individuals with lower incomes.

Conclusive Thoughts

The debate over student loan cancellation is likely to continue for some time. There are strong arguments on both sides of the issue, and it is ultimately up to policymakers to decide whether or not to cancel student loan debt.

FAQ Summary

What is student loan cancellation?

Student loan cancellation is the forgiveness of student loan debt by the government or other lender.

Who would benefit from student loan cancellation?

Student loan cancellation would benefit millions of Americans who are struggling to repay their student loans. This includes recent graduates, low-income borrowers, and borrowers who have been in repayment for many years.

How much would student loan cancellation cost?

The cost of student loan cancellation would depend on the specific terms of the program. However, some estimates suggest that it could cost up to $1.7 trillion.