Joe biden student loan forgiveness – President Joe Biden’s student loan forgiveness plan has sparked widespread debate and anticipation. This comprehensive overview delves into the intricacies of the plan, exploring its goals, eligibility criteria, application process, potential impact, and broader implications for higher education and the economy.

With the rising cost of college education becoming an increasingly heavy burden for students and families, Biden’s plan aims to provide much-needed relief to millions of borrowers. However, the plan has also raised questions about its feasibility, fairness, and potential consequences.

Policy Overview

President Biden’s student loan forgiveness plan aims to provide much-needed relief to millions of Americans burdened by student debt. The plan offers targeted loan forgiveness for borrowers meeting specific eligibility criteria.

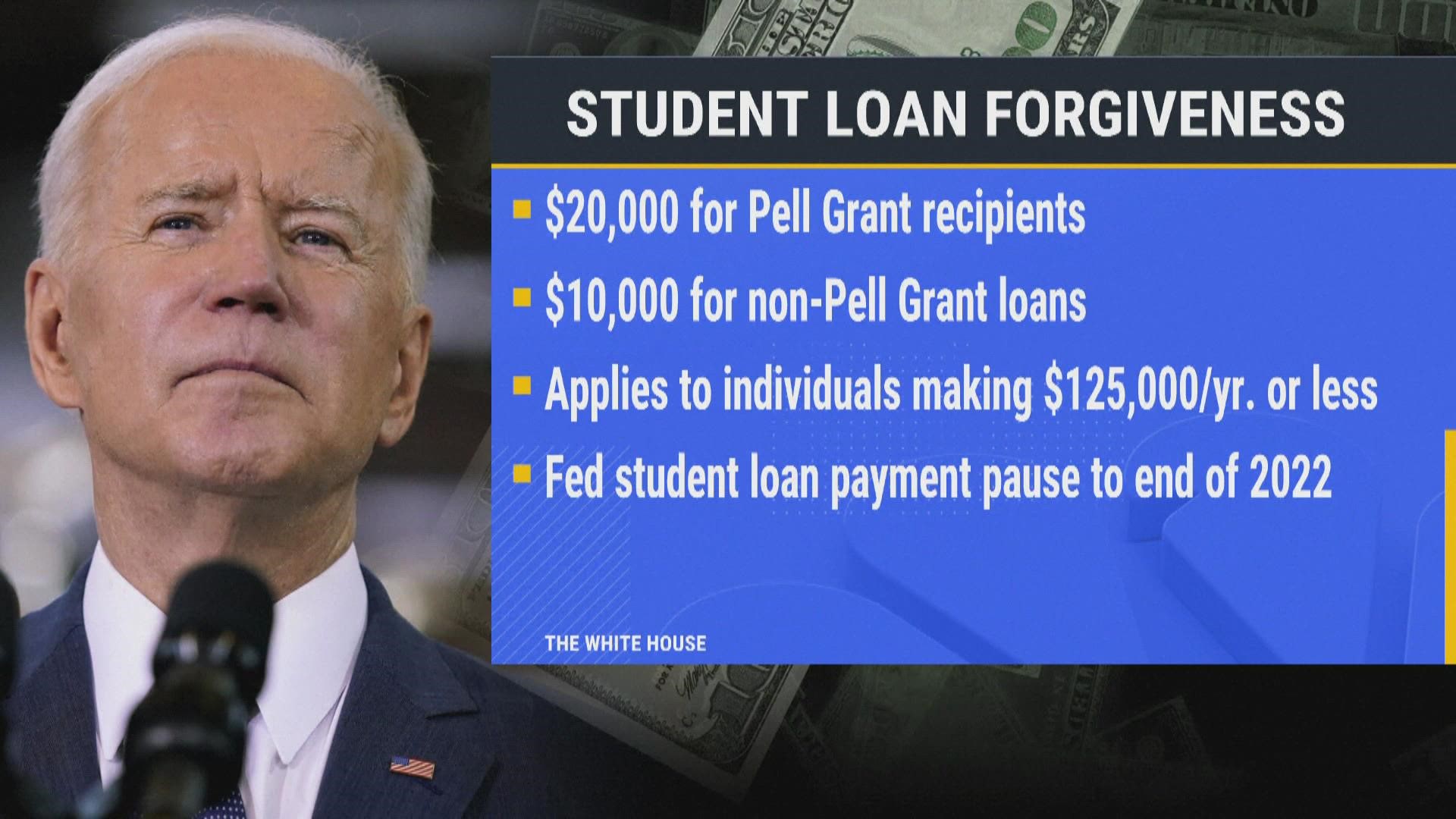

Key provisions include:

- Up to $10,000 in loan forgiveness for individual borrowers earning less than $125,000 annually or couples earning less than $250,000 annually.

- Up to $20,000 in loan forgiveness for Pell Grant recipients meeting the same income criteria.

- Eligibility for borrowers with federal student loans, including undergraduate and graduate loans.

- No restrictions based on borrowers’ credit history or default status.

Eligibility Criteria

To qualify for loan forgiveness, borrowers must meet the following eligibility criteria:

- Earn less than $125,000 annually (or $250,000 for couples) based on their 2020 or 2021 tax returns.

- Have federal student loans, including undergraduate and graduate loans.

- Not have defaulted on their student loans.

Application Process, Joe biden student loan forgiveness

The application process for loan forgiveness is expected to open in early October 2023. Borrowers can apply online through the Federal Student Aid website. The application will require borrowers to provide their personal information, income documentation, and loan details.

The application review and approval process will take several weeks. Borrowers will receive notification of their loan forgiveness status by email or mail.

Loan Forgiveness Amounts

The amount of loan forgiveness borrowers receive depends on their income and whether they received a Pell Grant.

President Joe Biden’s long-awaited student loan forgiveness plan is finally here. The plan, which was announced in August 2022, will provide up to $20,000 in debt relief to federal student loan borrowers. To learn more about the plan and see if you qualify, visit the official Biden student loan debt relief website.

The plan is expected to benefit millions of Americans and will help to reduce the overall burden of student loan debt in the United States.

- Individual borrowers earning less than $125,000 annually will receive up to $10,000 in loan forgiveness.

- Individual borrowers who received Pell Grants and earn less than $125,000 annually will receive up to $20,000 in loan forgiveness.

- Couples earning less than $250,000 annually will receive up to $10,000 in loan forgiveness per borrower.

- Couples who received Pell Grants and earn less than $250,000 annually will receive up to $20,000 in loan forgiveness per borrower.

Impact and Implications

Biden’s student loan forgiveness plan is expected to have a significant impact on borrowers’ financial well-being. It will provide much-needed relief to millions of Americans struggling with student debt.

The plan may also have implications for the overall student loan system and higher education affordability. It could reduce the number of borrowers who default on their student loans and make it easier for borrowers to repay their debt.

The plan’s economic effects are still being debated. Some economists argue that it will stimulate the economy by increasing consumer spending. Others argue that it will increase inflation and the federal deficit.

Economic Impact

Student loan forgiveness has the potential to have a significant impact on the economy. In the short term, it could boost consumer spending and economic growth. In the long term, it could reduce income inequality and promote economic mobility.

The impact of student loan forgiveness on borrowers would be significant. It would free up billions of dollars in disposable income, which could be used to pay down other debts, save for retirement, or invest in businesses.

Joe Biden’s announcement on student loan forgiveness has sparked a national conversation about the issue of student loan . With millions of Americans struggling under the weight of student debt, this move is seen as a significant step towards addressing the financial burden faced by many.

While the specifics of the forgiveness plan are still being finalized, it is clear that Biden’s announcement has reignited the debate on student loan reform and its potential impact on the economy.

Taxpayers

The cost of student loan forgiveness would be borne by taxpayers. The total cost would depend on the size of the program, but it could range from hundreds of billions to trillions of dollars.

Financial Institutions

Student loan forgiveness could have a negative impact on financial institutions. Banks and other lenders could lose billions of dollars in revenue. This could lead to higher interest rates on other types of loans.

Credit Markets and Interest Rates

Student loan forgiveness could have a modest impact on credit markets and interest rates. The increased supply of loanable funds could lead to lower interest rates on other types of loans.

Economic Growth

Student loan forgiveness could have a positive impact on economic growth. The increased disposable income for borrowers could lead to increased consumer spending and investment.

Inequality

Student loan forgiveness could help to reduce income inequality. Borrowers with lower incomes would benefit disproportionately from the program.

Federal Budget

Student loan forgiveness would have a negative impact on the federal budget. The cost of the program would increase the federal deficit.

| Potential Economic Effects of Student Loan Forgiveness | Estimate |

|—|—|

| GDP | $100 billion to $200 billion |

| Unemployment | 0.5% to 1% |

| Inflation | 0.1% to 0.2% |

Arguments for and Against Student Loan Forgiveness

There are a number of arguments for and against student loan forgiveness.

Arguments for student loan forgiveness:

- It would help to reduce income inequality.

- It would promote economic mobility.

- It would boost consumer spending and economic growth.

Arguments against student loan forgiveness:

- It would be unfair to taxpayers who have already paid off their student loans.

- It would be too expensive.

- It would encourage colleges and universities to raise tuition prices.

Political Implications

Biden’s student loan forgiveness plan has ignited a firestorm of political debate, with both supporters and detractors weighing in on its merits. The plan has been praised by Democrats and student loan advocates, who argue that it will provide much-needed relief to millions of Americans struggling with debt. Republicans and some economists, however, have criticized the plan, arguing that it is too expensive and will ultimately benefit high-income earners more than those who truly need help.

Reactions from Different Political Parties

The plan has been met with strong support from Democrats, who see it as a major victory for their party’s agenda. Many Democrats believe that the plan will help to boost the economy by freeing up money that borrowers can spend on other goods and services. They also argue that the plan will help to reduce the racial wealth gap, as Black and Hispanic borrowers are disproportionately affected by student loan debt.

Republicans, on the other hand, have been highly critical of the plan. They argue that it is too expensive and will ultimately benefit high-income earners more than those who truly need help. Republicans also worry that the plan will lead to inflation by increasing the money supply.

President Joe Biden’s student loan forgiveness plan has been making headlines, and for good reason. Millions of Americans are struggling with student loan debt, and the prospect of having that debt forgiven is a huge relief. For the latest on the student loan forgiveness update, be sure to check out this comprehensive article: student loan forgiveness update . This article will provide you with all the information you need to know about the plan, including eligibility requirements and how to apply.

So if you’re one of the millions of Americans who are struggling with student loan debt, be sure to check out this article for the latest on the student loan forgiveness update.

Potential Impact on the Upcoming Midterm Elections

The student loan forgiveness plan is likely to have a significant impact on the upcoming midterm elections. Democrats are hoping that the plan will help them to energize their base and win back voters who are struggling with student loan debt. Republicans, on the other hand, are hoping to use the plan to paint Democrats as fiscally irresponsible and out of touch with the concerns of ordinary Americans.

The ultimate impact of the plan on the midterm elections remains to be seen. However, it is clear that the plan has become a major political issue and is likely to be a key talking point in the months leading up to the election.

Social Equity

The student loan forgiveness plan has the potential to address racial and economic disparities in student debt. Historically marginalized communities, such as Black and Hispanic borrowers, have disproportionately high levels of student debt and are more likely to default on their loans.

The plan’s provisions, such as the cancellation of up to $20,000 in debt for Pell Grant recipients, could help to reduce these disparities. Additionally, the plan could help to increase social mobility and educational opportunities for these communities by making college more affordable and accessible.

Impact on Historically Marginalized Communities

- The plan could help to reduce the racial wealth gap by canceling debt for Black and Hispanic borrowers, who have disproportionately high levels of student debt.

- The plan could help to increase homeownership rates for Black and Hispanic families, as they would have more money available to save for a down payment.

- The plan could help to increase college enrollment and graduation rates for Black and Hispanic students, as they would have less debt to worry about.

Higher Education Reform

Student loan forgiveness has the potential to significantly impact higher education institutions. One of the primary concerns is the potential reduction in tuition revenue. With students no longer burdened by student loan debt, they may be less willing to pay high tuition fees. This could lead to a decrease in university endowments and financial aid policies.

Tuition Costs

If student loan forgiveness becomes a reality, universities may need to re-evaluate their tuition costs. With less revenue coming from student loans, they may need to find alternative sources of funding. This could lead to higher tuition costs for students who do not qualify for loan forgiveness.

Financial Aid Policies

Student loan forgiveness could also impact financial aid policies. Currently, many universities offer financial aid packages that include a combination of grants, scholarships, and loans. If student loans are forgiven, universities may need to re-evaluate their financial aid policies to ensure that students still have access to affordable higher education.

University Endowments

Student loan forgiveness could also impact university endowments. Many universities rely on endowment funds to support their operations and provide financial aid to students. If student loan forgiveness reduces the amount of money that universities receive from student loans, it could lead to a decrease in endowment funds. This could have a negative impact on the quality of education and the availability of financial aid.

Summary of Key Arguments for and Against Alternative Approaches to Student Loan Forgiveness

Various alternative approaches to student loan forgiveness have been proposed, each with its own set of arguments and potential implications. Understanding these arguments is crucial for policymakers to make informed decisions about the best course of action.

Debt Cancellation

- Arguments for: Addresses the burden of student debt, promotes economic growth, and reduces racial and economic disparities.

- Arguments against: Costly, unfair to taxpayers who have already repaid their loans, and could lead to inflation.

- Evidence: Studies have shown that debt cancellation can boost consumer spending and stimulate economic growth.

- Potential unintended consequences: Could increase demand for higher education, leading to higher tuition costs.

Income-Driven Repayment

- Arguments for: Makes loan repayment more affordable for low-income borrowers, reduces defaults, and promotes economic mobility.

- Arguments against: Can be complex to administer, may not provide sufficient relief for high-debt borrowers, and could lead to increased costs for taxpayers.

- Evidence: Research indicates that income-driven repayment plans have reduced defaults and improved repayment rates.

- Potential unintended consequences: Could encourage borrowers to take on more debt, as they know they will have more flexible repayment options.

Loan Refinancing

- Arguments for: Can reduce monthly payments and interest rates, making loans more affordable.

- Arguments against: May not be accessible to all borrowers, especially those with poor credit, and could lead to increased debt in the long run.

- Evidence: Refinancing can save borrowers thousands of dollars over the life of their loans.

- Potential unintended consequences: Could lead to borrowers consolidating multiple loans into one large loan, making it more difficult to repay.

Public Service Loan Forgiveness

- Arguments for: Encourages individuals to pursue public service careers, addresses the shortage of qualified workers in critical fields.

- Arguments against: Can be difficult to qualify for, may not provide sufficient incentive for some borrowers, and could be costly for taxpayers.

- Evidence: Public service loan forgiveness programs have increased the number of professionals working in public service fields.

- Potential unintended consequences: Could lead to increased competition for public service jobs and may not be effective in attracting individuals from diverse backgrounds.

Legal Challenges

The legality of Biden’s student loan forgiveness plan has been a subject of intense debate. Critics argue that the plan exceeds the authority granted to the executive branch by the Constitution and Congress. They contend that the Higher Education Relief Opportunities for Students Act of 2003 (HEROES Act), which the administration cites as the legal basis for the plan, does not provide the necessary authority for such broad-scale debt cancellation.

Constitutional Challenges

One potential legal challenge is based on the Constitution’s separation of powers doctrine. Critics argue that the plan represents an overreach of executive authority and infringes on the powers of Congress to appropriate funds and make laws. They contend that the administration cannot unilaterally cancel student debt without explicit authorization from Congress.

Statutory Challenges

Another potential legal challenge is based on the HEROES Act itself. Critics argue that the act was intended to provide temporary relief to student loan borrowers during national emergencies, such as the COVID-19 pandemic. They contend that the administration’s interpretation of the act to authorize broad-scale debt cancellation is an unlawful expansion of its authority.

Administrative Law Challenges

In addition to constitutional and statutory challenges, the plan may also face legal challenges based on administrative law grounds. Critics argue that the administration failed to follow proper procedures in implementing the plan, such as providing adequate notice and opportunity for public comment. They contend that these procedural flaws could invalidate the plan.

Potential Impact of Legal Challenges

Legal challenges could have a significant impact on the implementation of Biden’s student loan forgiveness plan. If the plan is struck down by the courts, it could result in the cancellation of millions of dollars in student debt being reversed. This could have a devastating impact on borrowers who were counting on the relief provided by the plan.

Strategies to Mitigate Legal Risks

The Biden administration could employ several strategies to mitigate legal risks and ensure the plan’s legality. One strategy is to provide a more robust legal justification for the plan, including a detailed explanation of how the HEROES Act authorizes the administration to cancel student debt. Another strategy is to engage in a more thorough public comment process to address concerns raised by critics.

International Perspectives

Student loan forgiveness policies vary widely across countries, reflecting diverse approaches to higher education financing and social equity. By examining policies in other nations, we can gain valuable insights into the potential benefits and challenges of Biden’s plan.

Eligibility Criteria

Biden’s plan targets borrowers with federal student loans who earn less than $125,000 per year ($250,000 for married couples). In contrast, some countries, such as Canada, offer forgiveness to all borrowers regardless of income. Others, like Australia, have income-contingent repayment plans that adjust monthly payments based on earnings.

Forgiveness Amounts

Biden’s plan proposes forgiving up to $10,000 in federal student loans per borrower, while some countries offer more generous amounts. For example, Norway provides debt forgiveness of up to $35,000 after a certain number of years of repayment.

Repayment Terms

Biden’s plan does not alter repayment terms for federal student loans. However, some countries, such as the United Kingdom, offer extended repayment periods or lower interest rates for borrowers who struggle to repay their loans.

Rationale and Effectiveness

The rationale behind student loan forgiveness policies varies across countries. Some countries, like Canada, view forgiveness as a way to reduce the financial burden on graduates and promote economic growth. Others, like Australia, prioritize making higher education more accessible to low-income students.

The effectiveness of these policies in reducing student debt and improving access to higher education has been mixed. In some countries, forgiveness programs have successfully reduced student debt levels and increased college enrollment rates. However, in others, the impact has been more limited due to factors such as high tuition costs and limited availability of financial aid.

Lessons Learned

International experiences provide valuable lessons for the design and implementation of Biden’s plan. Best practices include:

– Targeting forgiveness to borrowers with the greatest need

– Considering income-contingent repayment plans to ensure affordability

– Evaluating the long-term impact of forgiveness on student debt levels and access to higher education

Potential pitfalls include:

– The cost of forgiveness programs and their impact on the federal budget

– The potential for forgiveness to encourage excessive borrowing

– The need to address the underlying factors contributing to high student debt levels

By carefully considering these lessons, Biden’s plan can strive to achieve its goals of reducing student debt and improving access to higher education while minimizing potential drawbacks.

Public Opinion

President Biden’s student loan forgiveness plan has garnered significant public attention and sparked widespread debate. Various polls and surveys have sought to gauge public sentiment towards the initiative, providing insights into the level of support and opposition among different demographic groups and perspectives.

According to a recent poll conducted by the Pew Research Center, 64% of Americans support some form of student loan forgiveness, with 35% favoring complete cancellation and 29% supporting partial forgiveness. The poll also found that support for forgiveness is particularly strong among younger Americans, with 77% of those aged 18-29 expressing support.

Key Demographics and Perspectives

Support for student loan forgiveness varies across different demographic groups. Younger Americans, those with higher levels of student debt, and individuals identifying as Democrats are more likely to support the plan. Conversely, older Americans, those with lower levels of student debt, and Republicans are more likely to oppose it.

Proponents of student loan forgiveness argue that it would provide much-needed financial relief to millions of Americans, particularly those who are struggling to repay their loans. They also contend that it would boost the economy by freeing up disposable income that could be spent on other goods and services.

Opponents of the plan argue that it would be unfair to those who have already repaid their student loans or who chose not to attend college. They also contend that it would be too expensive and would ultimately lead to higher taxes.

Potential Impact on Policy Implementation and Future Reforms

Public opinion can play a significant role in shaping policy implementation and future reforms. If there is strong public support for student loan forgiveness, it could increase the likelihood that the plan will be implemented and expanded in the future. Conversely, if there is strong public opposition, it could make it more difficult to implement the plan or could lead to its repeal or modification.

Historical Context

Student loan forgiveness and debt relief programs have a long history in the United States. The first such program was established in 1965 as part of the Higher Education Act. This program provided loan forgiveness to teachers who worked in low-income schools. In the years since, several other student loan forgiveness and debt relief programs have been created, including:

- The Public Service Loan Forgiveness (PSLF) Program, which forgives student loans for public service workers after 10 years of service.

- The Teacher Loan Forgiveness Program, which forgives student loans for teachers who work in low-income schools for five years.

- The Perkins Loan Forgiveness Program, which forgives student loans for borrowers who work in certain public service professions.

These programs have helped millions of borrowers repay their student loans. However, they have also been criticized for being too narrow in scope and for not providing enough relief to borrowers who are struggling with student debt.

Previous Attempts at Addressing Student Debt

There have been several previous attempts to address student debt in the United States. In 2010, the Obama administration created the Pay As You Earn (PAYE) program, which allows borrowers to cap their monthly student loan payments at 10% of their discretionary income. In 2014, the administration expanded the PSLF program to include more public service workers.

These efforts have helped to reduce the burden of student debt for some borrowers. However, they have not been enough to address the growing student debt crisis.

Lessons Learned from Past Experiences

The history of student loan forgiveness and debt relief programs in the United States provides several lessons that can be applied to future efforts. First, it is important to create programs that are broad in scope and that provide meaningful relief to borrowers who are struggling with student debt. Second, it is important to ensure that programs are easy to understand and administer. Third, it is important to evaluate programs regularly to ensure that they are meeting their goals.

– Extract and clean data from various sources, including government agencies, private lenders, and non-profit organizations.

The first step in analyzing student loan data is to extract and clean it from various sources. This includes government agencies such as the Department of Education, private lenders such as banks and credit unions, and non-profit organizations such as the National Center for Education Statistics.

President Joe Biden’s recent announcement of student loan forgiveness has been met with mixed reactions. Some have hailed it as a step in the right direction, while others have criticized it as being too little, too late. However, there is no doubt that the issue of student loan debt relief is a complex one, with no easy solutions.

Biden’s plan is just one of many proposals that have been put forward in recent years, and it remains to be seen whether it will be enough to address the growing crisis of student loan debt.

Once the data has been extracted, it needs to be cleaned. This involves removing duplicate data, correcting errors, and standardizing the data so that it can be compared and analyzed.

Data Sources

- Department of Education

- Private lenders

- Non-profit organizations

Data Cleaning Process

- Remove duplicate data

- Correct errors

- Standardize the data

Expert Perspectives

President Biden’s plan to forgive student loan debt has sparked a range of reactions from experts in higher education, economics, and public policy. Some experts believe that the plan will have a positive impact on the economy and will help to reduce the burden of student debt on borrowers. Others are concerned about the cost of the plan and its potential impact on taxpayers. In this section, we will summarize the views of experts on Biden’s plan and analyze its potential impact.

Economic Impact

Economists have expressed mixed views on the potential economic impact of Biden’s plan. Some economists believe that the plan will have a positive impact on the economy by increasing consumer spending and boosting economic growth. Others are concerned that the plan will lead to higher inflation and increase the federal deficit. According to a study by the Penn Wharton Budget Model, the plan would cost $1.5 trillion and would increase the federal deficit by $1.2 trillion. The study also found that the plan would have a small positive impact on GDP, but would also lead to higher inflation.

Higher Education Reform

Experts in higher education have also expressed mixed views on the potential impact of Biden’s plan on higher education. Some experts believe that the plan will help to make college more affordable and accessible for students. Others are concerned that the plan will lead to lower standards at colleges and universities. According to a study by the American Council on Education, the plan would reduce the cost of college for students by an average of $1,000 per year. The study also found that the plan would lead to a small increase in college enrollment.

Case Studies: Joe Biden Student Loan Forgiveness

Biden’s student loan forgiveness plan has had a significant impact on individuals and institutions. Case studies provide valuable insights into the real-world effects of the policy, showcasing both its successes and challenges.

Individual Experiences

Personal stories illustrate the transformative impact of student loan forgiveness on individuals. Many borrowers have reported feeling a sense of relief and financial freedom after their debt was forgiven. For example, one borrower was able to purchase a home for the first time after years of struggling to save due to student loan payments.

Institutional Impact

Institutions, particularly colleges and universities, have also been affected by the student loan forgiveness plan. Some institutions have reported an increase in enrollment as students are drawn to the prospect of reduced student loan debt. Additionally, some institutions have implemented programs to assist students with navigating the loan forgiveness process.

Timeline and Updates

President Biden announced his student loan forgiveness plan on August 24, 2022. The plan aims to provide relief to federal student loan borrowers and has faced legal challenges and political debates.

Here’s a timeline of key events and developments related to the plan:

Initial Announcement

- August 24, 2022: President Biden announces the student loan forgiveness plan.

- The plan includes forgiving up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year, or $250,000 for married couples filing jointly.

- Borrowers who received Pell Grants are eligible for an additional $10,000 in forgiveness.

Legal Challenges

- September 29, 2022: Six Republican-led states file a lawsuit challenging the legality of the student loan forgiveness plan.

- October 21, 2022: A federal judge in Texas blocks the implementation of the plan, ruling that it is unconstitutional.

- November 10, 2022: The Biden administration appeals the ruling.

Recent Developments

- February 23, 2023: The Supreme Court agrees to hear oral arguments in the case on April 28, 2023.

- The Biden administration continues to defend the plan, arguing that it is a necessary step to provide relief to struggling borrowers.

- The outcome of the Supreme Court case will determine the fate of the student loan forgiveness plan.

We will continue to provide updates on the latest news and developments related to Biden’s student loan forgiveness plan.

Last Word

The implementation of Biden’s student loan forgiveness plan will undoubtedly have a significant impact on the lives of millions of Americans. While the plan has the potential to alleviate financial burdens and promote economic mobility, it is crucial to carefully consider its long-term effects on the student loan system, higher education institutions, and the broader economy. As the plan moves forward, ongoing monitoring and evaluation will be essential to ensure that it meets its intended goals and addresses the complex challenges surrounding student debt.

General Inquiries

Who is eligible for student loan forgiveness under Biden’s plan?

Borrowers who meet certain income requirements and have federal student loans, including undergraduate and graduate loans, are eligible for forgiveness.

How much student loan debt will be forgiven?

Up to $10,000 in federal student loan debt will be forgiven for eligible borrowers. Pell Grant recipients may be eligible for up to $20,000 in forgiveness.

When will the student loan forgiveness plan be implemented?

The Biden administration aims to implement the plan by the end of 2022. However, the exact timeline may be subject to legal challenges and other factors.