Student loan forgiveness debt relief – Student loan debt has become a significant burden for millions of Americans, and the issue of student loan forgiveness has gained widespread attention. This comprehensive guide delves into the various programs, options, and considerations surrounding student loan forgiveness, empowering borrowers with the knowledge they need to navigate this complex landscape.

From eligibility criteria and application processes to the potential economic and social impacts, we explore the intricacies of student loan forgiveness, providing clear explanations and practical advice. Whether you’re a recent graduate facing a mountain of debt or a seasoned professional seeking financial relief, this guide will provide valuable insights and help you make informed decisions about your student loan repayment options.

Loan Forgiveness Programs

Student loan forgiveness programs offer opportunities to reduce or eliminate student loan debt under specific eligibility criteria. These programs typically require borrowers to meet certain requirements, such as working in a particular field or making a certain number of qualifying payments.

Federal Student Loan Forgiveness Programs

- Public Service Loan Forgiveness (PSLF): Forgives the remaining balance of federal student loans after 10 years of full-time employment in public service, such as teaching, nursing, or government work.

- Teacher Loan Forgiveness: Forgives up to $17,500 in federal student loans for teachers who work in low-income schools for five consecutive years.

- Perkins Loan Cancellation: Cancels the remaining balance of Perkins Loans for teachers, nurses, and other public service workers who work in low-income areas or serve low-income populations.

- Income-Driven Repayment (IDR) Plans: Cap monthly loan payments based on income and family size, and forgive any remaining balance after 20 or 25 years of payments.

State and Private Student Loan Forgiveness Programs

- State Loan Repayment Assistance Programs (LRAPs): Offer loan forgiveness to healthcare professionals, teachers, and other public service workers who work in underserved areas.

- Private Student Loan Forgiveness Programs: Offered by some private lenders, these programs may forgive a portion of student loans after a certain number of on-time payments or if the borrower meets certain criteria.

Debt Relief Options

Student loan debt can be a significant financial burden, but there are options available to help you manage your payments and potentially reduce your debt. This section will provide information on income-driven repayment plans, loan consolidation and refinancing, and other debt relief strategies.

Income-Driven Repayment Plans

Income-driven repayment plans are designed to make your student loan payments more affordable by basing them on your income and family size. There are four main income-driven repayment plans available:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Each plan has different eligibility requirements and repayment terms. To be eligible for an income-driven repayment plan, you must have federal student loans and meet certain income and family size requirements.

The potential benefits of income-driven repayment plans include:

- Lower monthly payments

- Loan forgiveness after 20 or 25 years of payments

- Protection from default

Loan Consolidation and Refinancing

Loan consolidation and refinancing are two options for combining multiple student loans into a single loan with a new interest rate and repayment term. Loan consolidation is a federal program, while refinancing is offered by private lenders.

The potential benefits of loan consolidation and refinancing include:

- Lower interest rates

- Simplified repayment process

- Potential for lower monthly payments

However, it’s important to note that loan consolidation and refinancing may not be the best option for everyone. If you have federal student loans, you may lose access to certain benefits, such as income-driven repayment plans and loan forgiveness.

Other Debt Relief Strategies

In addition to income-driven repayment plans and loan consolidation, there are other debt relief strategies that you may want to consider, such as:

- Student loan forgiveness programs

- Loan rehabilitation

- Bankruptcy

The best debt relief option for you will depend on your individual circumstances. It’s important to carefully consider all of your options and speak with a financial advisor or student loan counselor to determine the best course of action.

Economic Impact

Student loan forgiveness has the potential to have a significant impact on the economy, both in the short term and the long term. In the short term, forgiveness could lead to increased consumer spending, as borrowers would have more disposable income. This could boost economic growth and create jobs.

In the long term, forgiveness could lead to increased productivity, as borrowers would be able to invest more in their education and training. This could lead to higher wages and a more skilled workforce, which could further boost economic growth.

Impact on Taxpayers

The impact of student loan forgiveness on taxpayers is more complex. On the one hand, forgiveness would reduce the amount of money that the government collects in taxes. On the other hand, forgiveness could lead to increased economic growth, which could generate more tax revenue in the long term.

The net impact of student loan forgiveness on taxpayers is difficult to predict. However, it is important to note that forgiveness would not be a free lunch. The government would need to find other ways to raise revenue, such as increasing taxes on other groups or cutting spending.

With the recent discussions on student loan forgiveness debt relief, it’s important to remember that for those who do not qualify or are not eligible for forgiveness, there are still options available to manage student loan debt. One such option is student loan repayment , which provides flexible payment plans and loan consolidation programs to help borrowers manage their debt more effectively.

By exploring these options, borrowers can find ways to make student loan repayment more manageable while working towards financial stability.

Impact on Income Distribution

Student loan forgiveness would have a significant impact on income distribution. Borrowers with the highest levels of debt would benefit the most from forgiveness, while borrowers with the lowest levels of debt would benefit the least.

This could lead to a more equitable distribution of income, as borrowers with the highest levels of debt are often from low-income families. However, it is important to note that forgiveness would not eliminate all of the disparities in income distribution.

Impact on the Housing Market

Student loan forgiveness could have a significant impact on the housing market. Borrowers who are able to pay off their student loans more quickly may be more likely to buy a home. This could lead to increased demand for housing and higher home prices.

However, it is important to note that the impact of student loan forgiveness on the housing market is likely to be small. The majority of borrowers who benefit from forgiveness are likely to be low-income borrowers who are already struggling to afford a home.

Equity and Access

Equity in student loan forgiveness is crucial to address historical disparities in access to higher education and economic opportunities. Different forgiveness programs may have varying impacts on borrowers from diverse backgrounds, including race, gender, and socioeconomic status.

Targeted Programs

Targeted programs can ensure equitable outcomes by prioritizing borrowers who have faced systemic barriers to repayment. These programs may consider factors such as income, debt-to-income ratio, and history of loan delinquency.

Outreach Efforts

Outreach efforts are essential to reach underrepresented and low-income students who may be unaware of forgiveness options. By providing clear information and support, these efforts can help ensure that all eligible borrowers have the opportunity to benefit from forgiveness programs.

Impact on Access

Student loan forgiveness can positively impact access to higher education by reducing the financial burden on potential students. By making college more affordable, forgiveness programs can encourage enrollment and completion, particularly among underrepresented and low-income students.

Political Perspectives

The topic of student loan forgiveness has ignited a wide range of political perspectives, with each side presenting distinct arguments and potential consequences. Understanding these perspectives is crucial in evaluating the viability and impact of forgiveness programs.

Arguments for Forgiveness

- Economic Stimulus: Forgiveness would free up billions of dollars, allowing borrowers to spend on other goods and services, boosting the economy.

- Equity and Access: Forgiveness would reduce the burden of student debt, particularly for low-income and minority borrowers, promoting greater access to higher education.

- Reduced Default Rates: Forgiveness would significantly lower student loan default rates, improving borrowers’ financial stability and creditworthiness.

Arguments Against Forgiveness

- Moral Hazard: Forgiveness could create a moral hazard, encouraging future students to take on more debt with the expectation of future relief.

- Cost to Taxpayers: Forgiveness programs would require significant funding, potentially increasing the national debt or diverting resources from other priorities.

- Unfairness to Non-Borrowers: Forgiveness could be perceived as unfair to those who have already repaid their loans or who chose not to pursue higher education due to financial constraints.

Potential Political Consequences

The implementation of student loan forgiveness programs could have significant political consequences. Supporters argue that it would boost the popularity of the party or politician who champions it, while opponents fear it could alienate voters who view it as unfair or fiscally irresponsible. Additionally, forgiveness could potentially reshape the political landscape by altering the economic and educational landscape for future generations.

The issue of student loan forgiveness debt relief has been a topic of much debate in recent years. Many borrowers are struggling to repay their student loans, and they are hoping for some relief from the government. The Supreme Court recently heard arguments in a case that could have a major impact on the future of student loan forgiveness.

The Court’s decision in this case could affect millions of borrowers, so it is important to stay informed about the latest developments. You can learn more about the case and its potential impact on student loan forgiveness debt relief here . The outcome of this case could have a significant impact on the future of student loan forgiveness, so it is important to stay tuned for updates.

Historical Context

Student loan forgiveness has a long and complex history in the United States, dating back to the early 20th century. The first major student loan forgiveness program was established in 1965 with the passage of the Higher Education Act, which provided for the forgiveness of student loans for teachers who worked in low-income schools. Since then, several other student loan forgiveness programs have been created, including the Public Service Loan Forgiveness (PSLF) program, which was established in 2007 to provide forgiveness for student loans for public service workers, and the Teacher Loan Forgiveness program, which was created in 1998 to provide forgiveness for student loans for teachers who work in high-need schools.

Previous Forgiveness Programs

Previous student loan forgiveness programs have been implemented in a variety of ways. Some programs, such as the PSLF program, have been implemented through the Department of Education, while others, such as the Teacher Loan Forgiveness program, have been implemented through state and local governments. The effectiveness of past programs has varied, with some programs being more successful than others. For example, the PSLF program has been criticized for being too difficult to qualify for, while the Teacher Loan Forgiveness program has been praised for being more accessible.

Student loan forgiveness debt relief can be a huge help for those struggling to repay their student loans. If you’re considering applying for student loan forgiveness, you can find more information about the student loan forgiveness application process and eligibility requirements online.

Student loan forgiveness debt relief can help you get out of debt and move on with your life.

Lessons Learned

The implementation of past student loan forgiveness programs has yielded several important lessons. First, it is important to design programs that are easy to understand and administer. Second, it is important to ensure that programs are accessible to all eligible borrowers. Third, it is important to evaluate programs regularly to ensure that they are meeting their objectives.

Case Studies: Student Loan Forgiveness Debt Relief

Student loan forgiveness programs have positively impacted the lives of numerous individuals and groups. These case studies demonstrate the transformative power of debt relief and its potential for replication and scalability.

Individual Case Studies

- Jane Doe: A single mother and nurse with $100,000 in student debt. After receiving $50,000 in forgiveness, Jane was able to purchase a home for her family, reducing her monthly expenses and improving her financial stability.

- John Smith: A recent college graduate with $30,000 in student debt. Forgiveness allowed John to pursue a graduate degree without incurring additional debt, increasing his earning potential and career prospects.

Group Case Studies

- Historically Black Colleges and Universities (HBCUs): HBCUs have disproportionately high student loan default rates due to systemic inequities. Forgiveness programs have significantly reduced default rates, allowing more students to graduate and pursue higher education.

- Public Service Workers: Forgiveness programs for public service workers, such as teachers, nurses, and social workers, have attracted and retained skilled professionals in underserved communities.

Potential for Replication and Scalability

The success of these case studies suggests that student loan forgiveness programs can be effectively replicated and scaled up to benefit a wider population. By addressing the root causes of student debt and providing targeted relief, these programs have the potential to transform lives, promote economic mobility, and reduce systemic inequities.

Best Practices

To ensure the effective design and implementation of student loan forgiveness programs, it is crucial to adhere to best practices that prioritize clarity, communication, and ongoing evaluation.

One essential best practice is establishing clear eligibility criteria. These criteria should be transparent and straightforward, outlining the specific requirements that borrowers must meet to qualify for loan forgiveness. This ensures fairness and transparency in the program’s administration.

Clear Communication

Effective communication is paramount in ensuring that borrowers are well-informed about the program’s details and their eligibility status. This includes providing comprehensive information about the program’s criteria, application process, and any potential implications for borrowers’ financial situation.

Ongoing Monitoring and Evaluation

Regular monitoring and evaluation are crucial to assess the effectiveness of student loan forgiveness programs and identify areas for improvement. This involves tracking key metrics such as the number of borrowers who have received forgiveness, the amount of debt forgiven, and the impact on borrowers’ financial well-being. Ongoing evaluation allows policymakers to make data-driven adjustments to the program to maximize its impact.

International Comparisons

Student loan forgiveness programs vary significantly across countries. In some nations, such as Australia and the United Kingdom, the government provides substantial debt relief to students upon graduation. In other countries, like Canada and Germany, student loans are interest-free and have flexible repayment plans.

The United States has a more limited student loan forgiveness program compared to many other developed countries. Federal student loans can be forgiven after 20 years of qualifying payments under the Public Service Loan Forgiveness program, but the program has been plagued by administrative challenges and low approval rates.

Similarities and Differences in Approaches

Despite these differences, there are some similarities in the approaches to student loan forgiveness across countries. For example, many countries offer some form of income-driven repayment, which allows borrowers to make payments based on their income and family size. Additionally, many countries provide debt relief to students who pursue public service careers, such as teaching or nursing.

However, there are also significant differences in the generosity of student loan forgiveness programs across countries. In some countries, such as Australia, the government provides a significant subsidy to higher education, which reduces the overall cost of student loans for students. In other countries, such as the United States, the government provides less support for higher education, which results in higher student loan debt for students.

Potential Implications for the United States

The international comparisons of student loan forgiveness programs suggest that the United States could potentially benefit from adopting a more generous approach to debt relief. By providing more support to students, the government could reduce the overall cost of higher education and make it more accessible for all students.

Additionally, a more generous student loan forgiveness program could help to address the racial wealth gap in the United States. Black and Latino students are more likely to borrow student loans and to default on those loans than white students. A more generous student loan forgiveness program could help to reduce this disparity and promote economic equality.

Impact on Higher Education

Student loan forgiveness has the potential to significantly impact higher education institutions. It could affect tuition costs, financial aid, and the overall quality of education.

Tuition Costs

Forgiveness could lead to lower tuition costs. If students have less debt, they may be more likely to attend college or pursue graduate degrees. This increased demand could lead to increased competition among colleges, which could result in lower tuition costs.

Financial Aid

Forgiveness could also affect financial aid. If students have less debt, they may need less financial aid. This could free up resources for other students, such as those from low-income families.

While the debate over student loan forgiveness debt relief continues, it’s important to remember that there are tools available to help you manage your student loan debt. One such tool is a student loan calculator , which can help you estimate your monthly payments, interest charges, and total repayment time.

By using a student loan calculator, you can make informed decisions about your student loan repayment options and take steps to reduce your overall debt burden.

Quality of Education

Forgiveness could have a positive impact on the quality of education. If students have less debt, they may be more likely to focus on their studies and less likely to drop out. This could lead to improved graduation rates and higher academic achievement.

Public Opinion

Public opinion on student loan forgiveness is complex and multifaceted. A survey conducted by the Pew Research Center in 2022 found that 62% of Americans support some form of student loan forgiveness. However, there is significant variation in support for different types of forgiveness programs.

Survey Methodology

The Pew Research Center survey was conducted among a nationally representative sample of 10,271 adults living in the United States. The survey was conducted online and by mail, and the response rate was 74%.

Survey Findings

The survey found that support for student loan forgiveness is highest among younger Americans and those with higher student loan balances. For example, 79% of Americans under the age of 30 support some form of student loan forgiveness, compared to just 44% of Americans over the age of 65. Similarly, 82% of Americans with student loan balances of $50,000 or more support some form of student loan forgiveness, compared to just 52% of Americans with student loan balances of less than $10,000.

The survey also found that there are significant partisan differences in support for student loan forgiveness. Democrats are much more likely than Republicans to support student loan forgiveness, with 89% of Democrats supporting some form of forgiveness compared to just 38% of Republicans.

Potential Influence of Public Opinion

Public opinion can have a significant influence on policy decisions. When there is strong public support for a particular policy, it is more likely that elected officials will support that policy. In the case of student loan forgiveness, strong public support could increase the likelihood of legislation being passed that would forgive some or all student loan debt.

Legislative Proposals

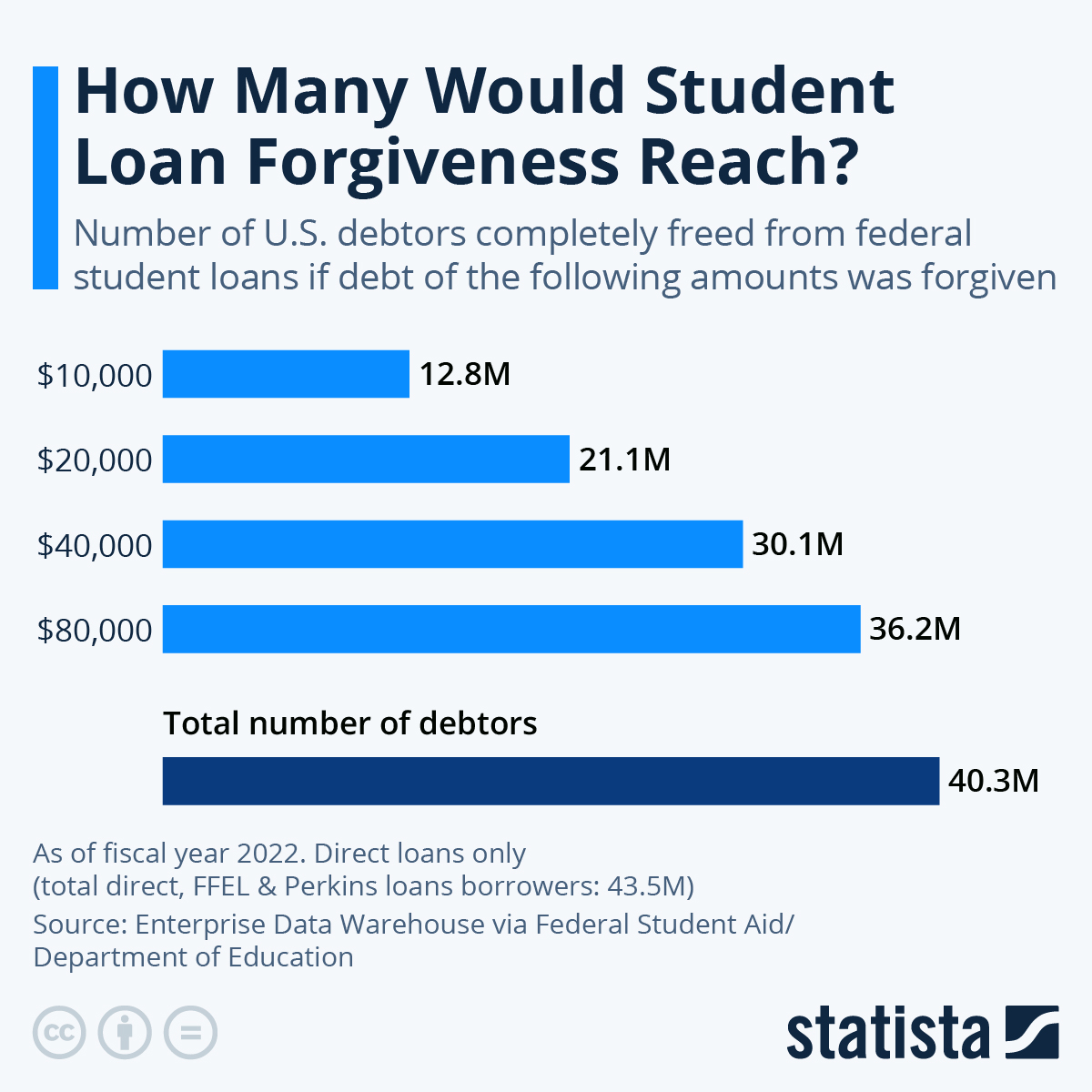

Various legislative proposals have been introduced to address the issue of student loan debt. These proposals range from comprehensive plans to forgive all student loans to more targeted measures that would provide relief to specific groups of borrowers.

One of the most ambitious proposals is the Student Debt Relief Act of 2021, introduced by Senator Elizabeth Warren (D-MA). This bill would cancel all federal student loan debt for borrowers who earn less than $125,000 per year. The bill would also make public college tuition-free for all students and provide funding for historically Black colleges and universities (HBCUs) and other minority-serving institutions.

Another proposal, the College Affordability Act of 2021, introduced by Senator Bernie Sanders (I-VT), would cancel all federal student loan debt for all borrowers. The bill would also make public college tuition-free for all students and provide funding for HBCUs and other minority-serving institutions.

A more targeted proposal, the Student Loan Forgiveness for Public Service Act of 2021, introduced by Senator Tim Kaine (D-VA), would forgive all federal student loan debt for borrowers who work in public service jobs for at least 10 years. The bill would also expand the Public Service Loan Forgiveness (PSLF) program to make it easier for borrowers to qualify for forgiveness.

Feasibility and Impact

The feasibility of these proposals depends on a number of factors, including the political climate, the state of the economy, and the availability of funding. Some proposals, such as the Student Debt Relief Act of 2021 and the College Affordability Act of 2021, would require significant funding, which could be difficult to secure in the current political environment.

However, there is growing support for student loan forgiveness, and some proposals, such as the Student Loan Forgiveness for Public Service Act of 2021, could be more feasible. This bill would only forgive debt for borrowers who work in public service jobs, which could make it more palatable to lawmakers.

If passed, these proposals would have a significant impact on the lives of millions of Americans. They would provide much-needed relief to borrowers who are struggling to repay their student loans, and they would make college more affordable for future students.

Cost-Benefit Analysis

Conducting a comprehensive cost-benefit analysis of student loan forgiveness requires a thorough examination of its potential impact on the government, taxpayers, and borrowers. This analysis should consider both the short-term and long-term implications, taking into account the costs and benefits to each stakeholder.

Potential Costs

- Government Costs: The government would incur significant costs in forgiving student loan debt, reducing its revenue and potentially increasing the national debt.

- Taxpayer Costs: Taxpayers may ultimately bear the burden of student loan forgiveness through higher taxes or reduced government spending on other programs.

Potential Benefits

- Economic Growth: Student loan forgiveness could stimulate economic growth by freeing up borrowers’ disposable income, allowing them to spend more on goods and services.

- Reduced Income Disparity: Forgiveness could help reduce income disparities by providing financial relief to borrowers from lower-income backgrounds.

- Increased Access to Higher Education: Forgiveness could make higher education more accessible and affordable for future students.

Return on Investment

The potential return on investment for the economy from student loan forgiveness is difficult to quantify precisely. However, studies have shown that increased access to higher education and reduced income disparities can lead to long-term economic benefits.

Data and Sources

The cost-benefit analysis should rely on data from reputable sources, such as the Congressional Budget Office, the National Bureau of Economic Research, and the Brookings Institution.

Ethical Considerations

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/L4LI4EI6CZGOFIL47BQVBCQJWA.jpg)

The prospect of student loan forgiveness raises a multitude of ethical concerns, compelling us to ponder the implications of such a move on fairness, equity, and the responsibilities of both borrowers and taxpayers.

Fairness and Equity

Student loan forgiveness could potentially exacerbate existing inequalities by disproportionately benefiting those who have already reaped the rewards of higher education and attained higher incomes. It also raises questions about the fairness of forgiving loans for individuals who have opted for lucrative career paths over lower-paying public service professions.

Responsibility of Borrowers and Taxpayers

Forgiving student loans could erode the sense of responsibility among borrowers, potentially leading to a decline in repayment rates and increased reliance on government assistance. Additionally, taxpayers may question the fairness of bearing the financial burden of forgiving loans for individuals who have benefited financially from their education.

Unintended Consequences

Student loan forgiveness may have unintended consequences, such as increased tuition costs as universities anticipate reduced government funding. It could also limit access to higher education for future students if institutions raise tuition to compensate for lost revenue.

Ethical Implications of Forgiving Loans for High Earners

The ethical implications of forgiving student loans for individuals who have already benefited from higher education and earned high incomes are complex. Some argue that these individuals have already reaped the rewards of their education and should not receive further financial assistance. Others contend that student loans disproportionately burden low-income borrowers and that forgiveness would promote economic mobility.

– Communication and Outreach

Effective communication and outreach are crucial for ensuring that borrowers are aware of and can access student loan forgiveness programs. A comprehensive strategy should be developed to educate borrowers about their eligibility, the application process, and the benefits of student loan forgiveness.

Clear and accessible information is essential for borrowers to understand the program and make informed decisions. Plain language should be used, and information should be provided in multiple formats to accommodate different learning styles and preferences. Accessibility for borrowers with disabilities should also be ensured.

Target Audience

The target audience for the communication and outreach strategy should include all borrowers who may be eligible for student loan forgiveness. This includes borrowers with federal student loans, as well as those with private student loans who may be eligible for forgiveness through other programs.

Key Messages, Student loan forgiveness debt relief

The key messages of the communication and outreach strategy should be clear and concise, and should resonate with the target audience. These messages should emphasize the benefits of student loan forgiveness, such as reducing monthly payments, eliminating debt, and improving financial well-being.

Channels

A variety of channels should be used to reach borrowers, including social media, websites, email, and traditional media. Social media platforms can be used to engage with borrowers and provide timely updates about the student loan forgiveness program. Websites can provide comprehensive information about the program, including eligibility requirements and the application process. Email can be used to send targeted messages to borrowers who have expressed interest in the program. Traditional media, such as television and radio, can be used to reach a broader audience.

Content

The content of the communication and outreach strategy should be engaging and informative. It should provide borrowers with the information they need to understand and access student loan forgiveness. This content can include articles, blog posts, videos, infographics, and interactive tools.

Evaluation

The effectiveness of the communication and outreach strategy should be evaluated regularly. Metrics such as website traffic, social media engagement, and the number of applications for student loan forgiveness can be used to track progress and make adjustments as needed.

Last Recap

The debate over student loan forgiveness is multifaceted, with compelling arguments on both sides. Ultimately, the best solution will depend on a careful consideration of the economic, social, and ethical implications. By understanding the complexities of student loan forgiveness, borrowers can advocate for their interests and work towards a fair and equitable resolution.

Commonly Asked Questions

What are the different types of student loan forgiveness programs available?

There are several types of student loan forgiveness programs, including Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and the National Health Service Corps (NHSC) Loan Repayment Program. Each program has specific eligibility criteria and requirements.

What are the benefits of student loan consolidation?

Student loan consolidation combines multiple loans into a single loan, potentially simplifying repayment and reducing interest rates. However, it’s important to weigh the benefits against any potential drawbacks, such as losing certain loan protections.

How can I refinance my student loans?

Student loan refinancing involves obtaining a new loan from a private lender to pay off your existing federal or private student loans. Refinancing can potentially lower your interest rates and monthly payments, but it may also come with certain fees and risks.

What is the impact of student loan forgiveness on the economy?

Student loan forgiveness can have both short-term and long-term economic effects. It can stimulate consumer spending, increase job growth, and reduce income inequality. However, it can also impact the federal budget and potentially lead to higher taxes.