Student loan payment calculators are indispensable tools that empower you to take control of your student loan debt. With their intuitive interfaces and comprehensive features, these calculators provide you with a clear understanding of your repayment options, helping you make informed decisions that can save you money and reduce stress.

Whether you’re just starting to repay your loans or looking to optimize your repayment strategy, student loan payment calculators offer a wealth of benefits. They help you understand the impact of different repayment plans, estimate your monthly payments, and even explore potential savings through loan consolidation or refinancing.

Overview

A student loan payment calculator is a tool that helps students estimate their monthly student loan payments and understand their repayment options. It can help students make informed decisions about their student loans and save money on interest.

There are many different types of student loan payment calculators available, each with its own features and benefits. Some calculators are simple and easy to use, while others are more complex and offer more detailed information.

Types of Student Loan Payment Calculators

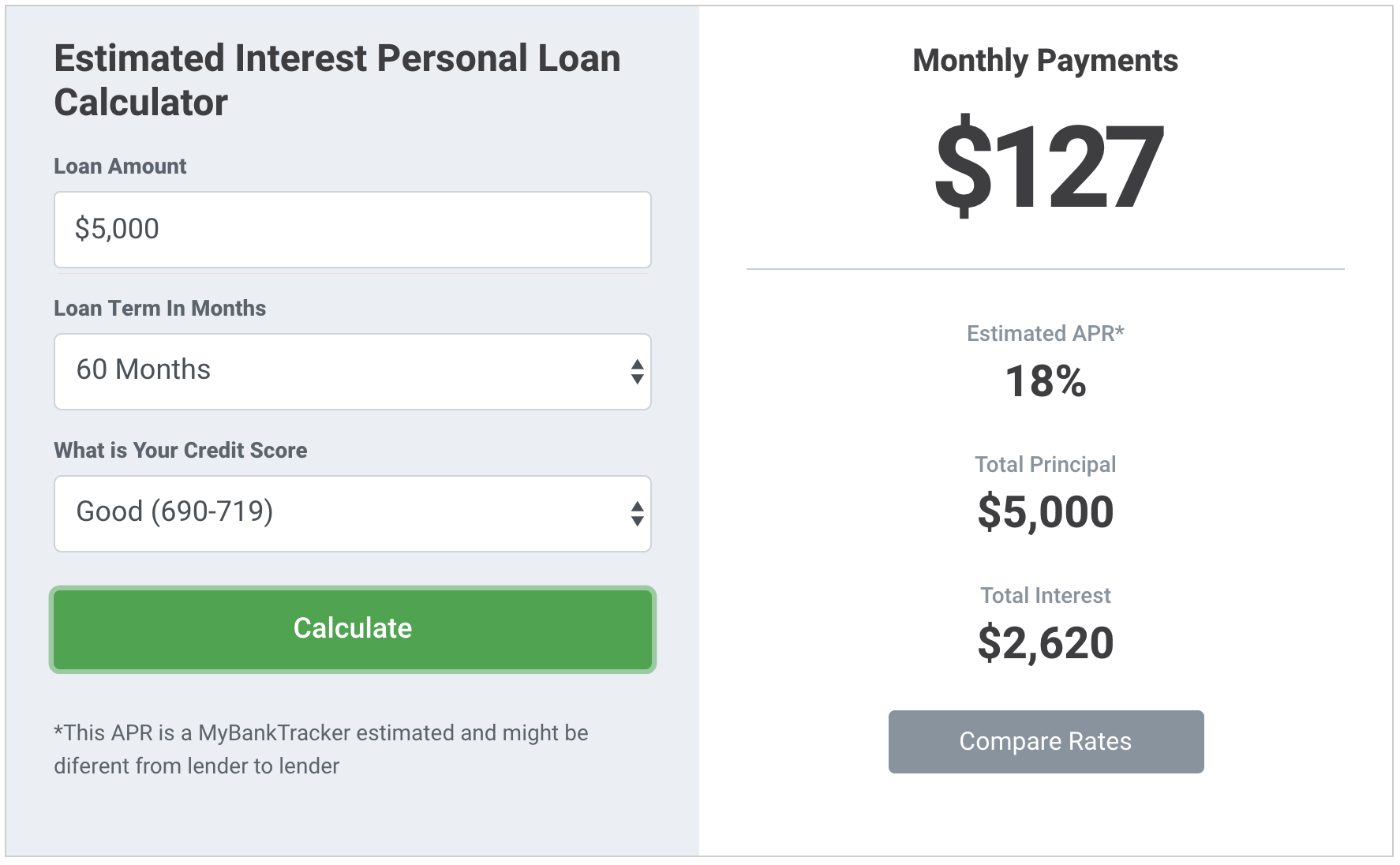

- Simple calculators: These calculators require only a few basic inputs, such as the loan amount, interest rate, and loan term. They provide a quick and easy way to estimate monthly payments.

- Detailed calculators: These calculators require more detailed inputs, such as the loan type, repayment plan, and additional fees. They provide more accurate estimates of monthly payments and can also help students compare different repayment options.

- Personalized calculators: These calculators allow students to input their own financial information, such as their income and expenses. They provide personalized estimates of monthly payments and can help students create a budget that works for them.

Examples of Student Loan Payment Calculators

- NerdWallet Student Loan Calculator

- Bankrate Student Loan Calculator

- Wells Fargo Student Loan Calculator

Functionality

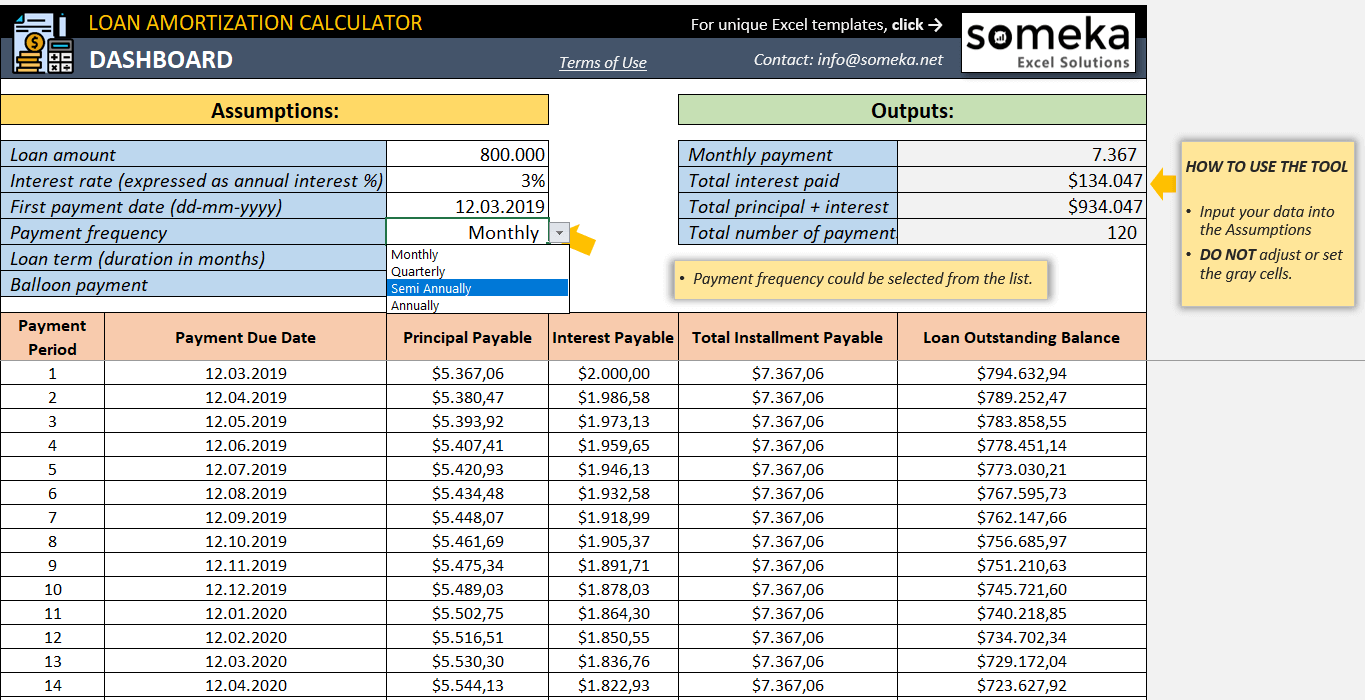

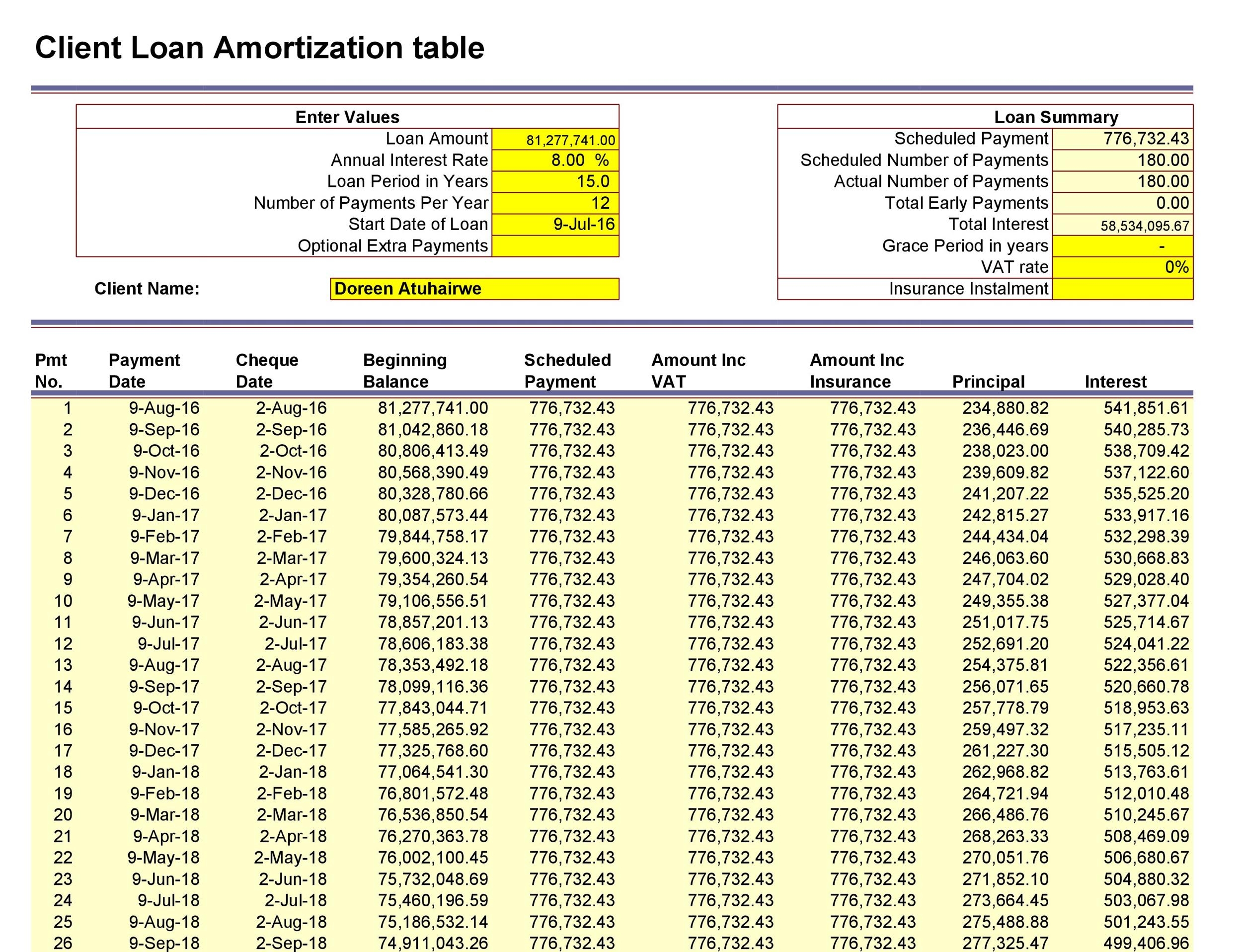

The student loan payment calculator is an online tool that helps borrowers estimate their monthly loan payments and total interest charges. It requires several input parameters, including the loan amount, interest rate, loan term, and repayment method.

The calculation process involves using a formula that considers the loan amount, interest rate, and loan term to determine the monthly payment amount. The formula also calculates the total interest charges over the life of the loan.

Input Parameters

- Loan amount: The amount of money borrowed.

- Interest rate: The annual percentage rate charged on the loan.

- Loan term: The length of time over which the loan will be repaid.

- Repayment method: The method used to repay the loan, such as fixed or variable rate.

Output Results

- Monthly payment amount: The amount of money that will be paid each month to repay the loan.

- Total interest charges: The total amount of interest that will be paid over the life of the loan.

- Loan payoff date: The date on which the loan will be paid off in full.

Examples of Use

- Borrowers can use the calculator to compare different loan options and choose the one that best meets their needs.

- Borrowers can also use the calculator to estimate their monthly payments and total interest charges before applying for a loan.

- Financial advisors can use the calculator to help their clients make informed decisions about student loans.

Limitations

- The calculator does not take into account other factors that may affect the monthly payment amount, such as fees and insurance.

- The calculator assumes that the interest rate will remain constant over the life of the loan. However, interest rates can change, which could affect the monthly payment amount.

- The calculator does not provide advice on whether or not to take out a student loan.

Improvements

- The calculator could be improved by adding a feature that allows borrowers to input additional factors, such as fees and insurance.

- The calculator could also be improved by providing more information about student loans, such as the different types of loans available and the repayment options.

- The calculator could also be improved by providing advice on whether or not to take out a student loan.

Types of Calculators

The world of calculators is vast and diverse, with different types designed to meet specific needs. From basic arithmetic to advanced scientific calculations, there’s a calculator for every task. Let’s dive into the various types of calculators, exploring their unique features, benefits, and drawbacks.

Scientific Calculators

Scientific calculators are designed for complex mathematical operations, making them indispensable tools for students, scientists, and engineers. They feature a wide range of advanced functions, including trigonometric, logarithmic, and statistical calculations. Their large displays and intuitive interfaces make them easy to use, even for intricate computations.

Graphing Calculators

Graphing calculators combine the capabilities of scientific calculators with the ability to plot graphs and visualize data. They’re ideal for students and professionals in fields like mathematics, physics, and engineering. By graphing equations and functions, users can gain a deeper understanding of mathematical concepts and solve problems graphically.

Financial Calculators

Financial calculators are tailored to handle financial calculations, making them essential for investors, accountants, and financial professionals. They offer specialized functions for calculating interest rates, loan payments, bonds, and other financial instruments. Their user-friendly interfaces and built-in formulas simplify complex financial computations.

Programmable Calculators

Programmable calculators allow users to create and store their own programs, automating complex calculations and repetitive tasks. They’re ideal for engineers, scientists, and programmers who need to perform customized calculations. However, programming these calculators requires technical knowledge and can be time-consuming.

Desktop Calculators

Desktop calculators are designed for basic arithmetic operations and are commonly used in offices and homes. They offer large, easy-to-read displays and basic functions like addition, subtraction, multiplication, and division. Their simplicity and affordability make them suitable for everyday calculations.

Factors Affecting Calculations

When using a student loan payment calculator, several factors can influence the accuracy of the results. Understanding these factors and their effects can help you make informed decisions about your student loans.

The following are the key factors that affect student loan payment calculations:

Loan Amount

- The total amount you borrowed for your education directly impacts your monthly payments.

- A higher loan amount generally results in higher monthly payments.

- For example, if you borrow $50,000, your monthly payments will be higher than if you borrow $25,000.

Loan Term

- The length of time you have to repay your loan affects your monthly payments.

- A longer loan term typically leads to lower monthly payments but higher total interest paid over the life of the loan.

- For instance, if you have a 10-year loan term, your monthly payments will be lower than if you have a 20-year loan term.

Interest Rate

- The interest rate on your student loan is a crucial factor in determining your monthly payments.

- A higher interest rate means you will pay more interest over the life of the loan, resulting in higher monthly payments.

- For example, if you have an interest rate of 5%, your monthly payments will be lower than if you have an interest rate of 8%.

Repayment Plan

- The repayment plan you choose affects the amount of your monthly payments.

- Different repayment plans have different terms and conditions, such as the length of the repayment period and the amount of interest charged.

- For instance, an income-driven repayment plan may lower your monthly payments but extend the repayment period.

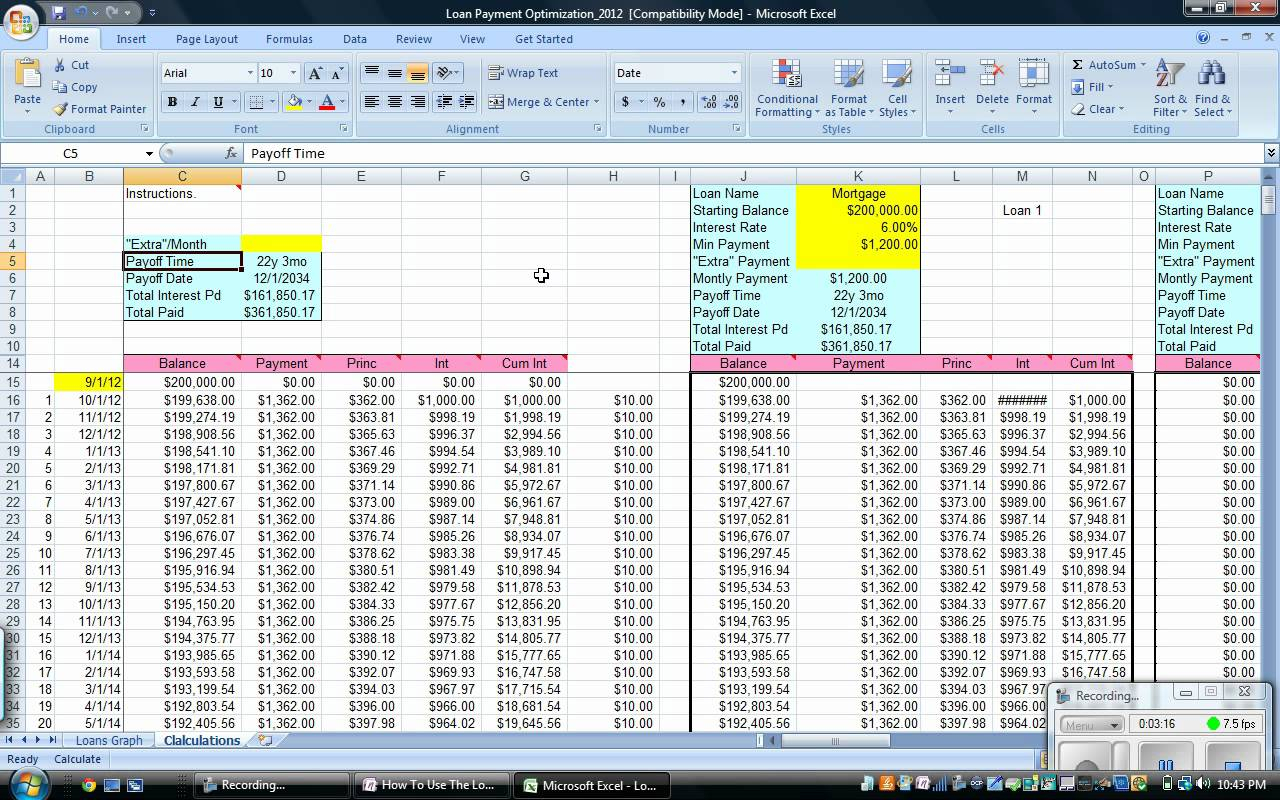

Additional Payments

- Making additional payments towards your student loan can significantly reduce the total amount of interest you pay and shorten the repayment period.

- Even small additional payments can make a substantial difference over time.

- For example, if you make an extra payment of $50 each month, you can save hundreds of dollars in interest.

Repayment Options

Student loan repayment options vary depending on the type of loan, the lender, and the borrower’s financial situation. Loan calculators can help borrowers evaluate different repayment options by providing estimates of monthly payments, total interest paid, and loan payoff dates.

Common repayment options include:

Standard Repayment Plan

- Fixed monthly payments over a 10-year period (for federal loans) or a 5- to 25-year period (for private loans).

- Payments are applied first to interest, then to principal.

- Shorter repayment periods result in higher monthly payments but lower total interest paid.

Graduated Repayment Plan

- Monthly payments start low and gradually increase over the repayment period.

- Payments are applied first to interest, then to principal.

- Can be beneficial for borrowers who expect their income to increase over time.

Extended Repayment Plan

- Monthly payments are lower than with the Standard Repayment Plan.

- Repayment period is extended to 20 or 25 years (for federal loans) or up to 30 years (for private loans).

- Total interest paid is higher than with the Standard Repayment Plan.

Income-Driven Repayment (IDR) Plan

- Monthly payments are based on the borrower’s income and family size.

- Payments are capped at a certain percentage of the borrower’s discretionary income.

- After a certain number of years, any remaining loan balance is forgiven.

Additional Features

In addition to basic loan payment calculations, many calculators offer a range of additional features to enhance usability and provide more comprehensive information.

These features can help borrowers make informed decisions about their repayment options and manage their student loans effectively.

Customizable Inputs

Some calculators allow users to customize inputs such as the loan amount, interest rate, and repayment period.

This enables borrowers to tailor the calculations to their specific loan terms and explore different repayment scenarios.

To help manage your student loan debt , consider using a student loan payment calculator. These tools provide personalized estimates based on your loan details and can help you create a repayment plan that fits your budget. By understanding your repayment options and exploring strategies to reduce your student loan debt, you can take control of your financial future.

Repayment Projections, Student loan payment calculator

Many calculators provide projections of how much borrowers will pay in interest and principal over the life of their loan.

This information can help borrowers understand the total cost of their loan and make plans for repaying it.

To effectively manage your student loans, a student loan payment calculator is an essential tool. It provides a clear understanding of your repayment plan and helps you stay on track. However, if you’re struggling with overwhelming student debt, exploring federal student loan forgiveness programs may be a viable option.

These programs can potentially reduce or even eliminate your loan balance, allowing you to regain financial stability. Once you’ve navigated the complexities of federal student loan forgiveness, you can return to the student loan payment calculator to adjust your repayment strategy accordingly, ensuring that you’re on the path to financial freedom.

Payment Scheduling

Some calculators offer payment scheduling features that allow borrowers to set up automatic payments and track their progress.

This can help borrowers stay organized and avoid missed payments, which can damage their credit score.

Eligibility Checks

Certain calculators can check borrowers’ eligibility for loan forgiveness programs or other financial assistance.

This information can help borrowers determine if they qualify for programs that can reduce their monthly payments or forgive their loan balance.

Accuracy and Reliability

In assessing the effectiveness of a student loan payment calculator, accuracy and reliability are paramount. Accurate calculations provide users with a realistic representation of their repayment plan, enabling informed decision-making. Reliable calculations ensure consistent and dependable results, minimizing the risk of errors or misleading information.

Factors Affecting Accuracy

Several factors can influence the accuracy of a student loan payment calculator:

- Loan Details: Incorrect or incomplete information about loan amount, interest rate, and repayment term can lead to inaccurate calculations.

- Calculator Functionality: Calculators with limited functionality or errors in their programming can produce unreliable results.

- User Input: Errors or omissions in entering loan details or repayment preferences can compromise accuracy.

- Data Sources: Calculators that rely on external data sources (e.g., interest rates) may be affected by the accuracy and timeliness of these sources.

- Assumptions: Calculators often make assumptions about future events, such as interest rate changes or changes in repayment status. These assumptions can impact accuracy.

Importance of Accuracy and Reliability

Accurate and reliable calculations are crucial for students to:

- Plan Repayments Effectively: Precise calculations help students estimate their monthly payments, total interest paid, and repayment timeline.

- Compare Loan Options: Accurate calculations allow students to compare different loan options and make informed decisions about the best loan for their financial situation.

- Avoid Overpayment: Reliable calculations prevent students from overpaying on their loans by ensuring they make payments that align with their repayment plan.

- Manage Finances Responsibly: Accurate and reliable calculations help students manage their finances effectively by providing a clear understanding of their loan obligations.

The table below summarizes the factors that can affect the accuracy and reliability of a student loan payment calculator:

| Factor | Impact on Accuracy |

|---|---|

| Loan Details | Incorrect loan information can lead to inaccurate calculations. |

| Calculator Functionality | Errors in programming or limited functionality can compromise accuracy. |

| User Input | Errors or omissions in user input can result in inaccurate results. |

| Data Sources | Inaccurate or outdated data sources can affect the accuracy of calculations. |

| Assumptions | Assumptions about future events can impact accuracy, especially if these assumptions are not realized. |

Using the Calculator

Using the student loan payment calculator is a straightforward process. Here’s a step-by-step guide to help you get started:

Step 1: Gather Your Information

Before you start using the calculator, gather the following information:

- Loan amount

- Loan term (in months)

- Interest rate

Step 2: Enter Your Information

Once you have your information, enter it into the calculator’s fields.

Step 3: Calculate Your Payment

Once you have entered your information, click the “Calculate” button. The calculator will display your monthly payment amount.

Step 4: Review Your Results

Once you have your payment amount, review it carefully to make sure it is accurate. You can also use the calculator to see how your payments will change if you make extra payments or change your loan term.

Example

Let’s say you have a student loan of $10,000 with a 10-year term and an interest rate of 6%. To calculate your monthly payment, you would enter the following information into the calculator:

- Loan amount: $10,000

- Loan term: 120 months

- Interest rate: 6%

The calculator would then display your monthly payment amount of $112.67.

Case Studies

The student loan payment calculator has proven to be a valuable tool for borrowers, helping them make informed decisions about their student loan repayment. Here are a few case studies that demonstrate its benefits:

One borrower, Sarah, had multiple student loans with varying interest rates and repayment terms. She used the calculator to compare different repayment options and found that she could save thousands of dollars in interest by refinancing her loans to a lower interest rate. Another borrower, John, was struggling to make his monthly student loan payments. He used the calculator to create a realistic repayment plan that allowed him to reduce his monthly payments and avoid default.

Student loan payment calculators provide a convenient way to estimate monthly payments, interest charges, and repayment timelines. For those seeking additional financial relief, exploring save student loan plan options can be a valuable step. By consolidating loans, refinancing at a lower interest rate, or pursuing loan forgiveness programs, borrowers can potentially reduce their overall repayment burden.

Student loan payment calculators remain a helpful tool throughout the loan repayment journey, allowing borrowers to track progress and adjust their strategies as needed.

Impact of Calculator on Informed Decision-Making

The student loan payment calculator empowers borrowers with the information they need to make informed decisions about their student loans. By providing personalized calculations and comparing different repayment options, the calculator helps borrowers understand the full cost of their loans and make choices that align with their financial goals.

Limitations

Student loan payment calculators, while valuable tools, have certain limitations. It’s essential to understand these limitations to ensure accurate results and make informed decisions.

Scenarios Where Calculators May Not Be Applicable

Calculators may not provide accurate results in situations where:

– Variable interest rates: Most calculators assume fixed interest rates, which may not reflect actual loan terms with variable rates that fluctuate over time.

– Inconsistent income: Calculators typically assume a constant income, but real-life situations may involve income changes that can affect repayment plans.

– Additional expenses: Calculators may not consider additional expenses such as living costs, healthcare, or unexpected events that can impact loan repayment.

Summary Table of Limitations

| Limitation | Implication |

|—|—|

| Does not account for variable interest rates | May underestimate or overestimate monthly payments |

| Assumes constant income | May not reflect changes in income over time |

| Does not consider additional expenses | May underestimate the total cost of repayment |

Design Considerations

When designing a student loan payment calculator, there are several design elements to consider that can affect the user experience. These include the size, shape, color, and button layout of the calculator.

Size and Shape

The size and shape of the calculator should be appropriate for the intended use. A calculator that is too small may be difficult to read and use, while a calculator that is too large may be bulky and difficult to carry around. The shape of the calculator should also be considered, as some shapes may be more comfortable to hold and use than others.

Color

The color of the calculator can also affect the user experience. Bright colors may be more visually appealing, but they can also be more distracting. Neutral colors may be more calming and easier to read, but they may also be less visually appealing.

Button Layout

The button layout of the calculator should be logical and easy to use. The most commonly used buttons should be placed in the most accessible locations. The buttons should also be large enough to be easily pressed, and they should be spaced far enough apart to avoid accidental presses.

Student loan payment calculators are an essential tool for anyone navigating the complexities of student loan payments. They provide a personalized estimate of monthly payments, interest rates, and repayment timelines, empowering borrowers with the knowledge they need to make informed financial decisions.

Whether you’re exploring different repayment options or simply seeking a clear understanding of your current student loan payments, student loan payments calculators offer valuable insights that can help you manage your debt effectively.

User Feedback

It is important to consider user feedback when designing a student loan payment calculator. User feedback can help to identify areas where the calculator can be improved. For example, users may provide feedback on the size, shape, color, or button layout of the calculator. This feedback can then be used to make improvements to the calculator.

Emerging Design Trends

There are several emerging design trends in calculators that have the potential to improve the user experience. These trends include the use of touchscreens and voice control.

Touchscreens allow users to interact with the calculator more directly. This can make the calculator easier to use, as users do not have to press physical buttons. Voice control allows users to control the calculator using their voice. This can be helpful for users who have difficulty using their hands.

Data Security

Protecting borrower information is crucial in student loan payment calculators. These platforms handle sensitive data like Social Security numbers, income, and loan details, making them targets for cybercriminals.

To safeguard borrower information, calculators employ robust security measures, including:

Encryption

- Calculators encrypt data using industry-standard algorithms, ensuring it remains confidential even if intercepted.

Authentication

- Strong authentication mechanisms prevent unauthorized access to borrower accounts.

- Two-factor authentication or multi-factor authentication may be used to verify a user’s identity.

Data Storage

- Borrower information is stored on secure servers with restricted access.

- Data is regularly backed up to prevent loss in case of hardware failure or cyberattacks.

Compliance

- Calculators comply with industry regulations and privacy laws, such as the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA).

- This ensures that borrower information is handled responsibly and in accordance with best practices.

User Interface

The user interface of a typical student loan payment calculator is designed to be intuitive and user-friendly. It typically consists of a layout of buttons, a display, and other controls that are arranged in a logical manner. The buttons are clearly labeled and easy to find, and the display is large and easy to read. The calculator also provides feedback to the user, such as error messages and confirmation messages, to help them use the calculator effectively.

Enhancing Usability

The user interface of a student loan payment calculator is designed to enhance usability by making it easy to find and use the desired functions. The buttons are organized into logical groups, and the display is clear and concise. This makes it easy for users to find the information they need and to enter their data accurately.

Improving Accessibility

The user interface of a student loan payment calculator is also designed to improve accessibility by providing features such as large buttons, high-contrast colors, and tactile feedback. This makes it easier for users with disabilities to use the calculator.

Key Features of the User Interface

The following table summarizes the key features of the user interface of a typical student loan payment calculator and their impact on usability and accessibility:

| Feature | Impact on Usability | Impact on Accessibility |

|---|---|---|

| Large buttons | Makes it easier to find and use the desired functions | Makes it easier for users with disabilities to use the calculator |

| High-contrast colors | Makes it easier to read the display | Makes it easier for users with visual impairments to use the calculator |

| Tactile feedback | Provides feedback to the user when they press a button | Makes it easier for users with hearing impairments to use the calculator |

User Flow

The following flowchart illustrates the user flow through the calculator’s interface, highlighting key decision points and interactions:

[Image of a flowchart illustrating the user flow through the calculator’s interface]

User Guide

To use the student loan payment calculator, follow these steps:

- Enter your loan amount.

- Enter your interest rate.

- Enter your loan term.

- Click the “Calculate” button.

The calculator will display your monthly payment and your total interest paid.

Integration with Other Tools

Student loan payment calculators can integrate with various financial tools to provide a comprehensive experience. These integrations enable seamless data transfer, personalized recommendations, and enhanced financial management.

By connecting to budgeting apps, calculators can automatically import transaction data, categorizing loan payments and tracking progress towards financial goals. Integration with credit monitoring services allows users to monitor their credit scores and identify areas for improvement, helping them make informed decisions about loan refinancing or consolidation.

Integration with Tax Software

Integration with tax software enables users to calculate the tax implications of their student loan payments and plan accordingly. The calculator can automatically populate tax forms with relevant information, reducing the risk of errors and maximizing deductions and credits.

Future Developments: Student Loan Payment Calculator

Student loan payment calculators are continuously evolving to meet the changing needs of borrowers. Future developments in these calculators are expected to enhance their functionality, accuracy, and user experience.

One significant development will be the integration of artificial intelligence (AI) and machine learning (ML) into calculators. AI-powered calculators will be able to provide personalized recommendations based on a borrower’s individual circumstances, such as their income, debt-to-income ratio, and credit score. This will help borrowers make more informed decisions about their repayment options.

Data Security Enhancements

As student loan calculators become more sophisticated, data security will become increasingly important. Future developments will focus on implementing robust security measures to protect borrowers’ sensitive financial information.

Last Recap

In the ever-evolving landscape of student loan repayment, student loan payment calculators remain invaluable resources. They provide you with the knowledge and confidence to navigate your repayment journey successfully, empowering you to make informed decisions that can lead to financial freedom.

User Queries

What is a student loan payment calculator?

A student loan payment calculator is a tool that helps you estimate your monthly student loan payments based on factors such as your loan amount, interest rate, and repayment term.

How can a student loan payment calculator help me?

A student loan payment calculator can help you understand your repayment options, estimate your monthly payments, and explore potential savings through loan consolidation or refinancing.

What information do I need to use a student loan payment calculator?

To use a student loan payment calculator, you will typically need to provide information such as your loan amount, interest rate, and repayment term.

Are student loan payment calculators accurate?

Student loan payment calculators are generally accurate, but they may not take into account all factors that could affect your monthly payments, such as changes in interest rates or your income.

Where can I find a student loan payment calculator?

You can find student loan payment calculators on a variety of websites, including the websites of lenders, government agencies, and non-profit organizations.