Student loan debt has become a major burden for millions of Americans, with many struggling to make their monthly payments. Fortunately, there are several programs available that can help you get rid of your student loans, including forgiveness programs and repayment assistance. In this comprehensive guide, we’ll walk you through the steps on how to apply for student loan forgiveness, including eligibility requirements, application process, and forgiveness amounts.

Eligibility Requirements

The eligibility criteria for student loan forgiveness vary depending on the specific program you’re applying for. However, there are some general requirements that apply to most programs.

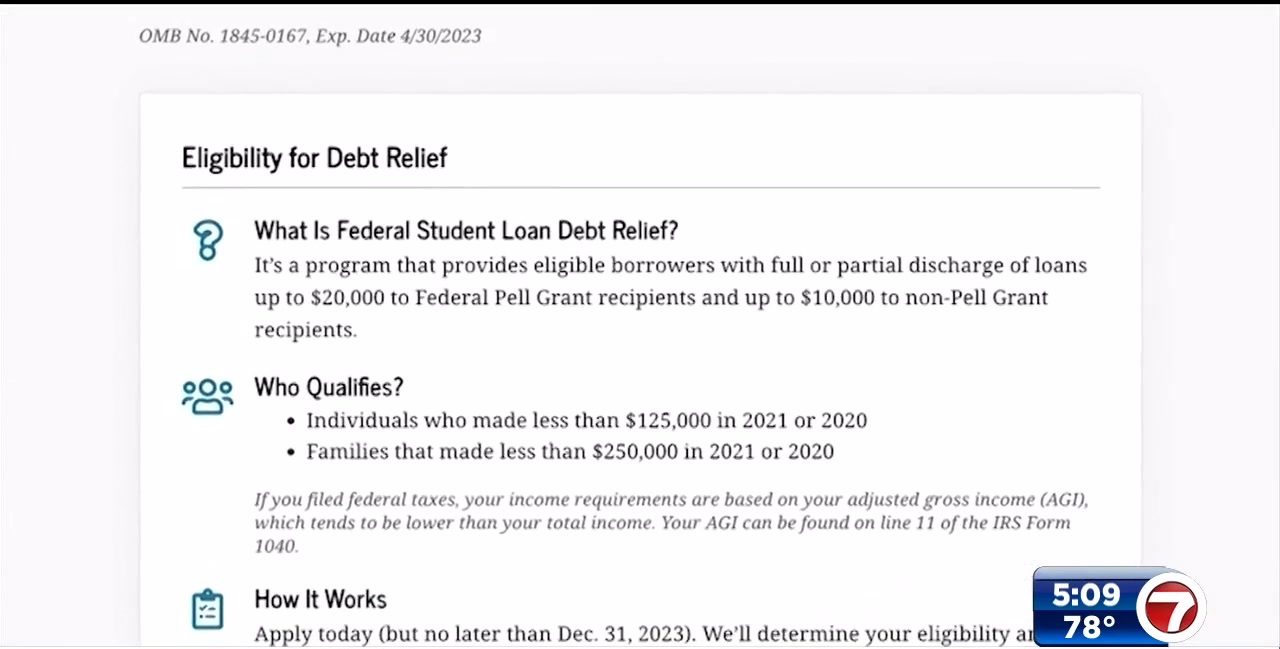

To be eligible for student loan forgiveness, you must meet the following criteria:

- Income limits: You must have an income below a certain level. The income limits vary depending on the program, but they are typically around $125,000 for individuals and $250,000 for married couples.

- Type of student loans: Not all types of student loans are eligible for forgiveness. Federal student loans are typically eligible, but private student loans are not.

- Residency requirements: Some programs require you to live in a certain state or work in a certain field in order to be eligible for forgiveness.

- Citizenship status: You must be a U.S. citizen or permanent resident to be eligible for most student loan forgiveness programs.

Examples of Individuals Who May Be Eligible for Student Loan Forgiveness

Here are some examples of individuals who may be eligible for student loan forgiveness:

- A teacher who has worked in a low-income school for at least five years.

- A nurse who has worked in a public hospital for at least 10 years.

- A social worker who has worked in a non-profit organization for at least 15 years.

Application Process

Applying for student loan forgiveness can be a daunting task, but it doesn’t have to be. Here’s a step-by-step guide to help you get started:

Before you begin, it’s important to note that not everyone is eligible for student loan forgiveness. You must meet certain eligibility requirements, which we’ll discuss in more detail later. If you’re not sure if you’re eligible, you can check with your loan servicer or visit the Federal Student Aid website.

Applying for student loan forgiveness can be a daunting task, but it’s essential to explore all available options. If you’re facing financial hardship, consider researching the Biden student loan forgiveness programs. These programs offer various forms of relief, including loan cancellation and reduced monthly payments.

To apply for forgiveness, gather your loan information and submit an application through the Federal Student Aid website. Remember, the deadline for the current forgiveness programs is approaching, so it’s crucial to act promptly.

Required Documentation

Once you’ve determined that you’re eligible, you’ll need to gather the following documentation:

- A completed application form

- Proof of income

- Proof of employment

- Proof of student loan debt

You can find the application form on the Federal Student Aid website. You can also download the form and mail it in, but it’s faster and easier to apply online.

Timeline

The application process can take several months, so it’s important to start early. Here’s a general timeline of what to expect:

- You submit your application

- Your loan servicer reviews your application

- You receive a decision on your application

- If you’re approved, your loans will be forgiven

The timeline can vary depending on the type of loan forgiveness you’re applying for and the loan servicer you have. It’s important to check with your loan servicer for specific details.

If you’re facing financial hardship, applying for student loan forgiveness may be an option. While the federal student loan payment pause is still in effect, you can use this time to gather necessary documents and prepare your application. Once the pause ends, you’ll be ready to submit your application and potentially qualify for loan forgiveness.

Click here to learn more about the student loan pause and how it may affect your loan forgiveness application.

Resources

If you need help with the application process, there are several resources available to you. You can contact your loan servicer, visit the Federal Student Aid website, or talk to a financial advisor.

Forgiveness Programs

Student loan forgiveness programs offer a glimmer of hope for borrowers struggling to repay their student loans. These programs provide various options for erasing or reducing student debt, each with its own set of eligibility requirements, forgiveness amounts, and repayment terms.

Federal Loan Forgiveness Programs

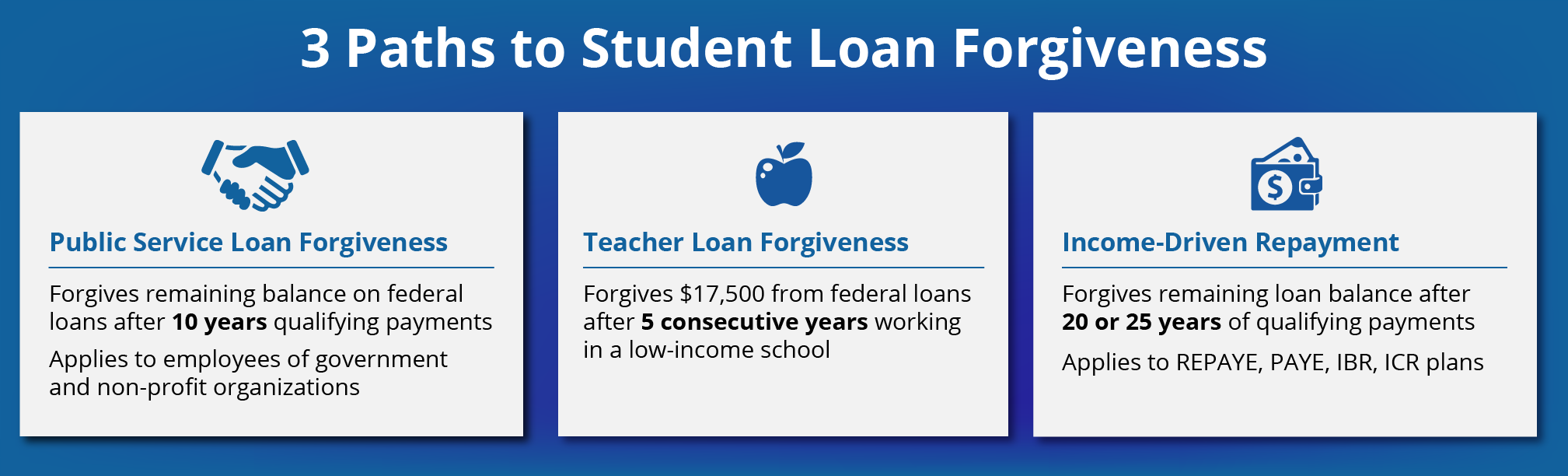

The federal government offers several loan forgiveness programs, including:

- Public Service Loan Forgiveness (PSLF): Forgives student loans for individuals who work full-time in public service for 10 years while making 120 qualifying payments.

- Teacher Loan Forgiveness: Forgives student loans for teachers who work full-time in low-income schools for five consecutive years.

- Income-Driven Repayment (IDR) Plans: Cap monthly loan payments based on income and family size, with potential for loan forgiveness after 20-25 years of repayment.

Private Loan Forgiveness Programs

Private lenders may also offer loan forgiveness programs, though these are typically more limited than federal programs. Some common private loan forgiveness programs include:

- Employer Loan Repayment Assistance: Some employers offer programs that assist employees with student loan repayment, up to a certain amount per year.

- Loan Discharge for Disability: Borrowers who become totally and permanently disabled may be eligible for loan discharge.

Comparison of Forgiveness Programs

The table below compares the different student loan forgiveness programs available:

| Program | Eligibility Requirements | Forgiveness Amount | Repayment Terms |

|—|—|—|—|

| PSLF | 10 years of full-time public service | 100% of remaining balance | 120 qualifying payments |

| Teacher Loan Forgiveness | 5 years of full-time teaching in low-income schools | 100% of remaining balance | 60 qualifying payments |

| IDR Plans | Income-based repayment | Up to 100% of remaining balance | 20-25 years of repayment |

| Employer Loan Repayment Assistance | Varies by employer | Varies by program | Varies by program |

| Loan Discharge for Disability | Total and permanent disability | 100% of remaining balance | N/A |

Pros and Cons of Forgiveness Programs

Pros:

* Eliminate or reduce student loan debt, providing financial relief

* Encourage individuals to pursue careers in public service or education

* Simplify repayment process through IDR plans

Cons:

* Strict eligibility requirements and long repayment periods

* Limited availability of private loan forgiveness programs

* Potential impact on credit score and tax liability

Repayment Options

After you receive student loans, you will need to repay them. There are several repayment options available, each with its own benefits and drawbacks.

One option is to repay your loans in full as soon as possible. This will save you money on interest, but it can be difficult to do if you have a lot of debt. Another option is to make monthly payments over a period of time. The length of time you have to repay your loans will depend on the amount of debt you have and the repayment plan you choose.

Income-Driven Repayment Plans

If you have difficulty making your monthly loan payments, you may be eligible for an income-driven repayment plan. These plans base your monthly payments on your income and family size. This can make your payments more affordable, but it will also extend the amount of time it takes to repay your loans.

- Income-Based Repayment (IBR): Your monthly payments are 10-15% of your discretionary income (your income minus 150% of the poverty level for your family size).

- Pay As You Earn Repayment (PAYE): Your monthly payments are 10% of your discretionary income (your income minus 150% of the poverty level for your family size).

- Revised Pay As You Earn Repayment (REPAYE): Your monthly payments are 10% of your discretionary income (your income minus 150% of the poverty level for your family size). You can also choose to have your monthly payments capped at 10% of your income.

Each of these plans has its own benefits and drawbacks. You should talk to your loan servicer to see which plan is right for you.

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with one monthly payment. This can simplify repayment and potentially qualify you for student loan forgiveness programs.

How to Consolidate Student Loans

To consolidate student loans, you’ll need to apply through a federal loan servicer. The process involves the following steps:

- Gather information about your existing loans, including the loan servicer and account numbers.

- Choose a federal loan servicer to consolidate your loans.

- Complete the loan consolidation application and submit it to the servicer.

- Once the application is approved, the servicer will pay off your existing loans and issue you a new consolidated loan.

Potential Risks and Benefits of Loan Consolidation

Loan consolidation can offer several benefits, including:

- Simpler repayment with a single monthly payment.

- Potential qualification for student loan forgiveness programs.

- Lower interest rates on the consolidated loan.

However, there are also some potential risks to consider:

- Loss of certain loan benefits, such as interest rate subsidies or loan forgiveness.

- Increased loan term, which could result in paying more interest over time.

- Inability to consolidate private student loans.

Forgiveness for Public Service

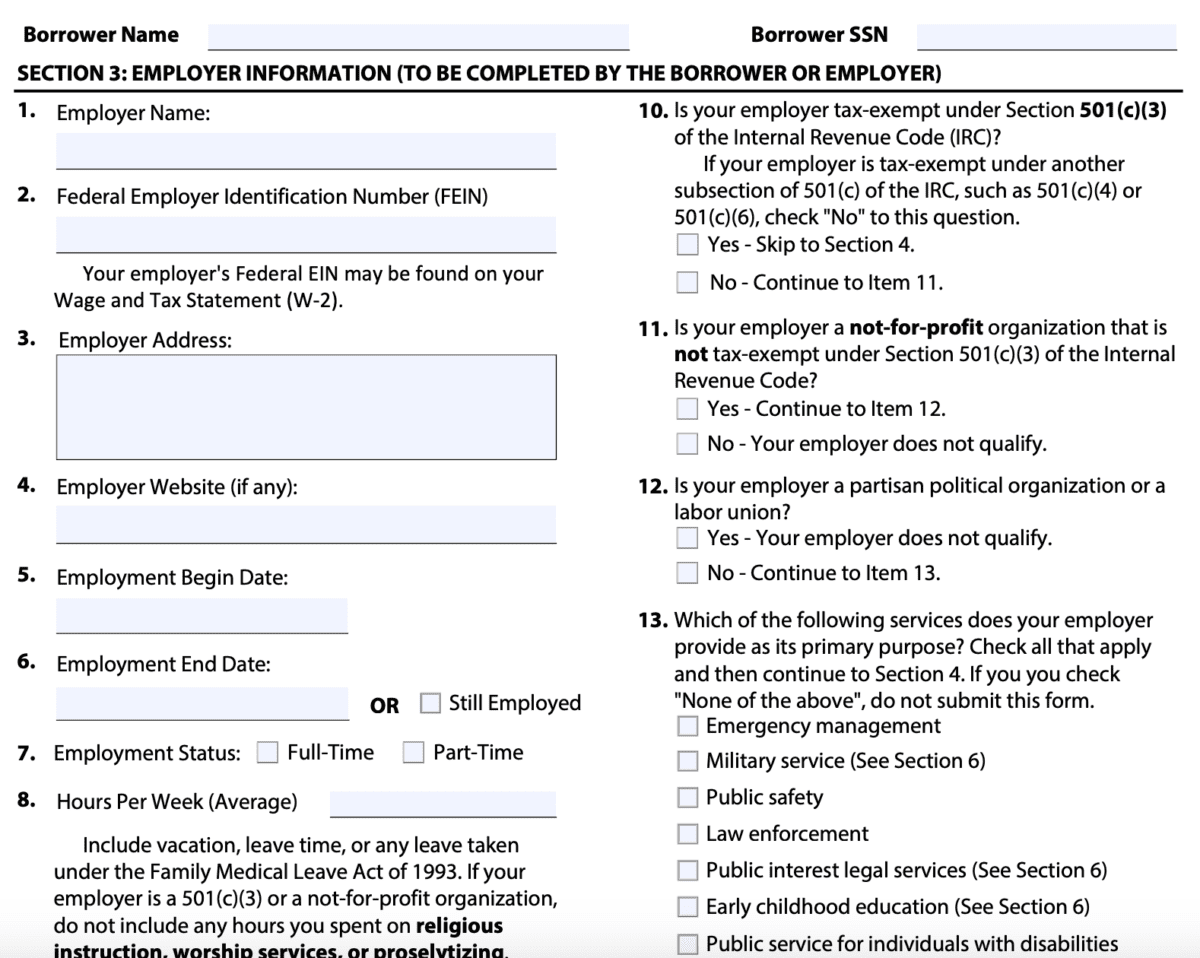

For those dedicated to serving their communities, the Public Service Loan Forgiveness (PSLF) program offers a path to debt relief. This program provides forgiveness for federal student loans after a certain number of years of qualifying public service.

To qualify for PSLF, you must meet the following requirements:

- Be employed full-time for at least 10 years in a public service job.

- Make 120 qualifying payments on your federal student loans while working in public service.

- Have federal student loans that are eligible for PSLF, such as Direct Loans, FFEL Loans, and Perkins Loans.

Eligible Occupations for PSLF

A wide range of occupations qualify for PSLF, including:

- Teachers

- Nurses

- Social workers

- Law enforcement officers

- Firefighters

- Military service members

- Nonprofit employees

- Government employees

Forgiveness for Teachers

The Teacher Loan Forgiveness program is a federal program that forgives up to $17,500 in federal student loans for teachers who work in low-income schools. The program is designed to encourage teachers to work in these schools, which often have difficulty attracting and retaining qualified teachers.

To be eligible for Teacher Loan Forgiveness, you must:

- Be a highly qualified teacher

- Teach full-time for at least five consecutive academic years in a low-income school

- Have federal student loans that are not in default

The application process for Teacher Loan Forgiveness is relatively simple. You can apply online or by mail. The application process takes about 60 days to complete.

Applying for student loan forgiveness is a crucial step towards financial freedom. While the Supreme Court deliberates on student loan debt relief , you can still initiate the application process to potentially qualify for loan forgiveness programs. Take advantage of the available resources and explore your options for student loan forgiveness today.

| Requirement | Details |

|---|---|

| Teaching Position | Highly qualified teacher in a low-income school |

| Years of Service | Five consecutive academic years |

| Loan Type | Federal student loans |

| Loan Status | Not in default |

| Application Process | Online or by mail |

| Processing Time | About 60 days |

Teacher Loan Forgiveness can be a great way to save money on your student loans. However, there are some potential drawbacks to the program. One drawback is that you must teach in a low-income school for five years, which may not be feasible for everyone.

If you are considering Teacher Loan Forgiveness, it is important to weigh the pros and cons of the program to see if it is right for you.

Resources for Teachers

There are a number of resources available for teachers who are considering Teacher Loan Forgiveness. These resources can help you learn more about the program and the application process.

- Federal Student Aid: https://studentaid.gov/manage-loans/forgiveness-cancellation/teacher-loan-forgiveness

- National Education Association: https://www.nea.org/advocating-for-change/new-from-nea/teacher-loan-forgiveness-what-you-need-know

- American Federation of Teachers: https://www.aft.org/teacher-loan-forgiveness

Sample Letter to a Lender

The following is a sample letter that you can use to request Teacher Loan Forgiveness from your lender:

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Your Phone Number]

[Your Email Address][Date]

[Lender Name]

[Lender Address]

[Lender City, State, Zip Code]RE: Request for Teacher Loan Forgiveness

Dear [Lender Name],

I am writing to request Teacher Loan Forgiveness for my federal student loans. I have been a highly qualified teacher at [School Name] for the past five years. [School Name] is a low-income school as defined by the U.S. Department of Education.

I have attached a copy of my teaching certificate and my employment history to this letter. I have also included a completed Teacher Loan Forgiveness application.

I request that you forgive the remaining balance of my federal student loans in the amount of [Amount]. I understand that I am responsible for any taxes that may be due on the forgiven amount.

Thank you for your time and consideration.

Sincerely,

[Your Signature]

[Your Typed Name]

Forgiveness for Military Service

Student loan forgiveness programs are available to military service members as a way to reward their service and help them manage their student loan debt. There are several different programs available, each with its own eligibility requirements and benefits.

Eligible Military Service

The following types of military service are eligible for student loan forgiveness:

- Active duty service

- National Guard service

- Reserves service

Requirements

To be eligible for military service student loan forgiveness, you must meet the following requirements:

- You must have served on active duty for at least 12 months

- You must have been deployed to a combat zone for at least 30 days

- You must have received an honorable discharge

- You must have a student loan that is eligible for forgiveness

How to Apply

To apply for military service student loan forgiveness, you must submit a completed application to the Department of Education. The application is available online at the Federal Student Aid website.

Benefits

Military service student loan forgiveness can provide several benefits, including:

- Forgiveness of up to $50,000 in student loan debt

- Reduced monthly payments

- Lower interest rates

Drawbacks

There are also some drawbacks to military service student loan forgiveness, including:

- You may have to pay taxes on the amount of debt that is forgiven

- You may not be eligible for other student loan forgiveness programs

Examples, How to apply for student loan forgiveness

There are several different military service student loan forgiveness programs available, including:

- The Public Service Loan Forgiveness Program

- The Teacher Loan Forgiveness Program

- The Military Service Student Loan Forgiveness Program

Alternative Options

If you do not qualify for military service student loan forgiveness, there are other options available to you, including:

- Student loan consolidation

- Student loan refinancing

- Student loan repayment assistance programs

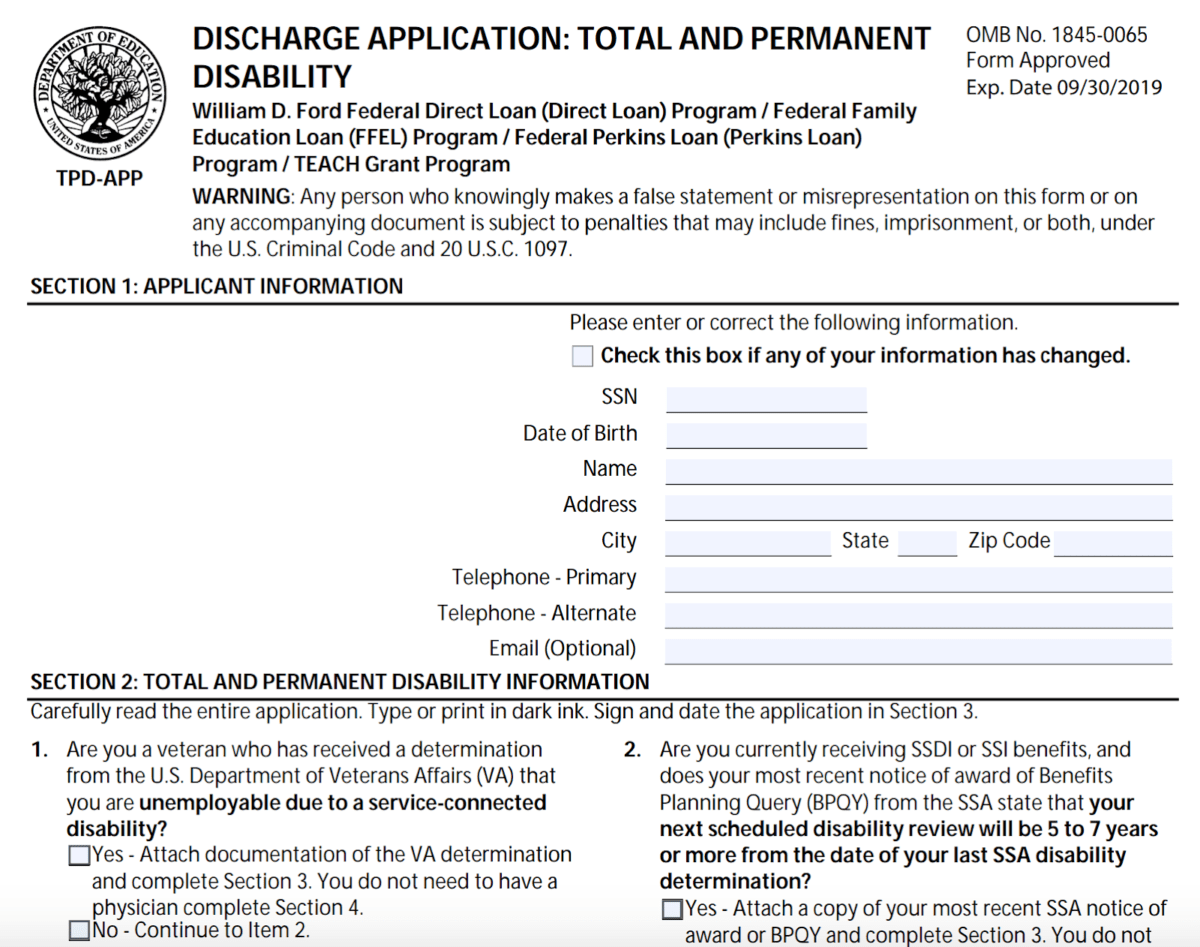

Forgiveness for Disability: How To Apply For Student Loan Forgiveness

If you are unable to work due to a disability, you may be eligible for student loan forgiveness. There are two main programs that offer forgiveness for disabled borrowers: the Total and Permanent Disability (TPD) Discharge and the Closed School Discharge.

Total and Permanent Disability (TPD) Discharge

The TPD Discharge is available to borrowers who are unable to work due to a physical or mental impairment that is expected to last for at least six months or result in death. To qualify for a TPD Discharge, you must meet the following requirements:

- You must have a physical or mental impairment that prevents you from working.

- Your impairment must be expected to last for at least six months or result in death.

- You must be unable to earn a living wage due to your impairment.

- You must have a doctor’s certification that verifies your impairment.

Closed School Discharge

The Closed School Discharge is available to borrowers who were enrolled in a school that closed before they could complete their program. To qualify for a Closed School Discharge, you must meet the following requirements:

- You must have been enrolled in a school that closed before you could complete your program.

- You must not have been able to transfer your credits to another school.

- You must not have completed your program within 120 days of the school’s closure.

If you meet the requirements for either of these programs, you can apply for student loan forgiveness by completing the appropriate application. The application process can be found on the Federal Student Aid website.

Forgiveness for Bankruptcy

Bankruptcy can have a significant impact on student loans. Depending on the type of bankruptcy filed, student loans may be discharged, or they may remain in effect. In this section, we will discuss the different types of bankruptcy and their impact on student loans, as well as the process for discharging student loans in bankruptcy.

Types of Bankruptcy

- Chapter 7 Bankruptcy: In a Chapter 7 bankruptcy, the debtor’s non-exempt assets are liquidated and the proceeds are distributed to creditors. Student loans are generally not dischargeable in Chapter 7 bankruptcy unless the debtor can prove that they are unable to repay the loans due to undue hardship.

- Chapter 13 Bankruptcy: In a Chapter 13 bankruptcy, the debtor proposes a repayment plan to their creditors. The plan must be approved by the court and must provide for the payment of all or a portion of the debtor’s debts. Student loans may be included in a Chapter 13 bankruptcy plan.

Process for Discharging Student Loans in Bankruptcy

To discharge student loans in bankruptcy, the debtor must file a motion with the bankruptcy court. The motion must be supported by evidence that the debtor is unable to repay the loans due to undue hardship. The court will then consider the debtor’s income, expenses, and other factors to determine whether to grant the discharge.

Examples of Student Loan Discharges in Bankruptcy

There have been several cases where student loans have been discharged in bankruptcy. In one case, a debtor was able to discharge his student loans after he lost his job and was unable to find new employment. In another case, a debtor was able to discharge her student loans after she became disabled and was unable to work.

Table of Bankruptcy Types and Impact on Student Loans

| Type of Bankruptcy | Impact on Student Loans |

|---|---|

| Chapter 7 | Student loans are generally not dischargeable unless the debtor can prove undue hardship. |

| Chapter 13 | Student loans may be included in a repayment plan. |

Sample Letter to Creditor Explaining Discharge of Student Loans in Bankruptcy

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Creditor Name]

[Creditor Address]

[City, State, Zip Code]

Re: Discharge of Student Loans in Bankruptcy

Dear [Creditor Name],

I am writing to inform you that my student loans have been discharged in bankruptcy. I filed for bankruptcy under Chapter [Chapter Number] on [Date]. The bankruptcy court granted my discharge on [Date].

The student loans that were discharged are as follows:

* [Loan Number 1]

* [Loan Number 2]

I am no longer obligated to repay these loans. Please update your records accordingly.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

Scams and Predatory Lenders

Applying for student loan forgiveness can be a daunting task, and it’s important to be aware of potential scams and predatory lenders who may try to take advantage of borrowers. Here’s how to avoid them:

First, never pay upfront fees for student loan forgiveness. Legitimate loan forgiveness programs do not require borrowers to pay any fees.

Second, be wary of companies that guarantee student loan forgiveness. No company can guarantee that you will qualify for forgiveness, and any company that makes such a guarantee is likely a scam.

Third, do your research before choosing a loan servicer. There are many reputable loan servicers out there, but there are also some that have been accused of predatory lending practices.

Red Flags to Watch Out For

- Companies that ask for your FSA ID or other personal information upfront

- Companies that promise to lower your monthly payments or interest rates without providing any details

- Companies that pressure you to sign up for their services right away

- Companies that charge upfront fees

- Companies that guarantee student loan forgiveness

If you think you have been scammed or taken advantage of by a predatory lender, there are resources available to help you. You can file a complaint with the Consumer Financial Protection Bureau (CFPB) or with your state’s attorney general’s office.

Resources for Borrowers

Student loan borrowers have access to a variety of resources to assist them in managing their debt. These resources include government agencies, non-profit organizations, and financial advisors.

The types of assistance available to borrowers include counseling, debt management, and legal aid.

Government Agencies

- Federal Student Aid (FSA): FSA is the U.S. Department of Education’s office that provides grants, loans, and work-study programs to students and parents. FSA also offers counseling and debt management services to borrowers.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a federal agency that protects consumers from unfair, deceptive, or abusive financial practices. The CFPB offers resources to borrowers on student loans, including information on repayment options, forgiveness programs, and scams.

Non-Profit Organizations

- National Student Loan Data System (NSLDS): NSLDS is a central database that contains information on all federal student loans. Borrowers can access their NSLDS record to view their loan history, balance, and repayment status.

- Student Loan Servicing Alliance (SLSA): SLSA is a non-profit organization that represents student loan servicers. SLSA provides resources to borrowers on student loans, including information on repayment options, forgiveness programs, and scams.

Financial Advisors

- Certified Student Loan Professionals (CSLPs): CSLPs are financial advisors who have received specialized training in student loans. CSLPs can provide borrowers with advice on repayment options, forgiveness programs, and consolidation.

- Accredited Financial Counselors (AFCs): AFCs are financial counselors who have received specialized training in credit and debt management. AFCs can provide borrowers with advice on student loans, as well as other financial matters.

Impact of Student Loan Forgiveness

Student loan forgiveness has the potential to have a significant impact on the economy. By eliminating or reducing the burden of student debt, it could free up money that borrowers can spend on other goods and services, stimulating economic growth.

Housing Market

One potential impact of student loan forgiveness is on the housing market. By reducing the amount of debt that borrowers have to repay, they may be more likely to be able to afford to buy a home. This could lead to an increase in demand for housing, which could drive up prices. However, it is also possible that student loan forgiveness could have the opposite effect on the housing market. If borrowers are no longer required to make student loan payments, they may be less likely to save for a down payment on a home. This could lead to a decrease in demand for housing, which could drive down prices.

Job Market

Student loan forgiveness could also have an impact on the job market. By reducing the amount of debt that borrowers have to repay, they may be more likely to be able to take risks in their careers. This could lead to an increase in entrepreneurship and innovation. Additionally, student loan forgiveness could make it easier for borrowers to move to new locations for work, which could lead to a more efficient allocation of labor.

Overall Economy

The overall economic impact of student loan forgiveness is likely to be positive. By freeing up money that borrowers can spend on other goods and services, it could stimulate economic growth. Additionally, student loan forgiveness could lead to an increase in entrepreneurship and innovation, which could further boost the economy.

Federal Budget

Student loan forgiveness would have a significant impact on the federal budget. The government would lose the revenue that it currently receives from student loan payments. This could lead to an increase in the federal deficit. However, it is also possible that student loan forgiveness could lead to an increase in tax revenue. If borrowers are able to spend more money on other goods and services, they will pay more taxes on those purchases.

| Impact | Potential Effect |

|---|---|

| Housing market | Increase or decrease in demand for housing |

| Job market | Increase in entrepreneurship and innovation |

| Overall economy | Positive impact on economic growth |

| Federal budget | Increase in federal deficit |

“Student loan forgiveness has the potential to be a major economic stimulus. By freeing up money that borrowers can spend on other goods and services, it could boost economic growth and create jobs.” – Mark Zandi, chief economist at Moody’s Analytics

Conclusion

The potential economic impact of student loan forgiveness is complex and uncertain. However, the evidence suggests that it is likely to have a positive impact on the economy. By freeing up money that borrowers can spend on other goods and services, it could stimulate economic growth. Additionally, student loan forgiveness could lead to an increase in entrepreneurship and innovation, which could further boost the economy.

– Discuss the different political and policy considerations surrounding student loan forgiveness

Student loan forgiveness has emerged as a contentious issue, with significant political and policy implications. The debate centers around the potential benefits and drawbacks of forgiving student debt, as well as the fairness and equity of different proposals.

Proponents of student loan forgiveness argue that it would provide much-needed relief to borrowers who are struggling to repay their loans. They also contend that it would stimulate the economy by freeing up money that borrowers could spend on other goods and services.

Opponents of student loan forgiveness argue that it would be unfair to taxpayers who have already repaid their own student loans or who did not attend college. They also contend that it would be too expensive and would set a bad precedent for future borrowers.

If you’re one of the many Americans struggling with student loan debt, you may be wondering if you qualify for student loan forgiveness. The good news is that there are a number of programs available that can help you reduce or eliminate your student loan balance.

To find out if you qualify, you’ll need to apply for forgiveness through the Federal Student Aid website. One of the most important factors that will be considered when you apply for forgiveness is your student loan interest. The amount of interest you’ve paid on your loans will affect how much forgiveness you’re eligible for.

To learn more about student loan interest, visit student loan interest . Once you’ve gathered all the necessary information, you can apply for student loan forgiveness online or by mail.

Policy Considerations

There are a number of policy considerations that must be taken into account when debating student loan forgiveness. These include:

- The cost of student loan forgiveness: The cost of student loan forgiveness would depend on the scope of the program. A program that forgave all student debt would be very expensive, while a program that only forgave a small amount of debt would be less expensive.

- The impact of student loan forgiveness on the economy: Student loan forgiveness could have a positive impact on the economy by freeing up money that borrowers could spend on other goods and services. However, it could also have a negative impact on the economy if it leads to higher taxes or inflation.

- The fairness and equity of student loan forgiveness: Student loan forgiveness could be seen as unfair to taxpayers who have already repaid their own student loans or who did not attend college. It could also be seen as unfair to borrowers who have made sacrifices to repay their loans.

Last Word

If you’re struggling with student loan debt, don’t give up hope. There are several programs available that can help you get rid of your loans. By following the steps Artikeld in this guide, you can increase your chances of getting approved for student loan forgiveness.

Detailed FAQs

Who is eligible for student loan forgiveness?

To be eligible for student loan forgiveness, you must meet certain requirements, such as having federal student loans, working in a qualifying public service job, or having a disability that prevents you from working.

What is the application process for student loan forgiveness?

The application process for student loan forgiveness varies depending on the program you’re applying for. However, in general, you’ll need to submit an application to the U.S. Department of Education.

How much student loan forgiveness can I get?

The amount of student loan forgiveness you can get depends on the program you’re applying for. Some programs offer full forgiveness, while others offer partial forgiveness.