In the realm of higher education, federal student loans play a pivotal role in financing the dreams of countless students. Join us as we delve into the intricacies of this complex financial instrument, exploring its purpose, eligibility criteria, types, interest rates, repayment plans, forgiveness programs, and more. Our comprehensive guide, infused with the captivating tone of fimela.com, promises an immersive and enlightening journey through the labyrinth of federal student loans.

Federal Student Loan Overview

Federal student loans are financial aid provided by the U.S. government to assist students in covering the costs of higher education. These loans are designed to help students pay for tuition, fees, books, and living expenses.

If you have federal student loans, you may be able to consolidate them into a single loan with a lower interest rate through a loan servicer like Aidvantage Student Loan . This can make it easier to manage your student loan payments and save money on interest in the long run.

Be sure to compare loan servicers and interest rates before consolidating your loans to find the best option for you.

To be eligible for federal student loans, students must meet certain criteria. These criteria include being a U.S. citizen or eligible non-citizen, being enrolled in an eligible degree program, and maintaining satisfactory academic progress.

Types of Federal Student Loans

The federal government offers various types of student loans to help students finance their higher education. Each type of loan has its own set of interest rates, repayment terms, and benefits and drawbacks. Understanding the different types of federal student loans can help you make an informed decision about which loan is right for you.

The main types of federal student loans include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Perkins Loans

Direct Subsidized Loans

Direct Subsidized Loans are available to undergraduate students who demonstrate financial need. The government pays the interest on these loans while the student is in school, during the grace period, and during periods of deferment.

Interest Rate: The interest rate for Direct Subsidized Loans is fixed at 4.99% for the 2023-2024 academic year.

Repayment Terms: Direct Subsidized Loans must be repaid within 10 years of entering repayment.

Benefits: The main benefit of Direct Subsidized Loans is that the government pays the interest while the student is in school and during periods of deferment. This can save students a significant amount of money over the life of the loan.

Drawbacks: The main drawback of Direct Subsidized Loans is that they are only available to students who demonstrate financial need.

Federal Student Loan Interest Rates

Interest rates on federal student loans are determined by a formula set by the U.S. Department of Education. The formula takes into account the 10-year Treasury note rate plus a fixed percentage, known as the spread.

There are two types of interest rates for federal student loans: fixed and variable.

Fixed Interest Rates

Fixed interest rates remain the same throughout the life of the loan. This means that the borrower will always know how much interest they will be paying each month.

Variable Interest Rates

Variable interest rates can change over time, based on the 10-year Treasury note rate. This means that the borrower’s monthly payments could increase or decrease over time.

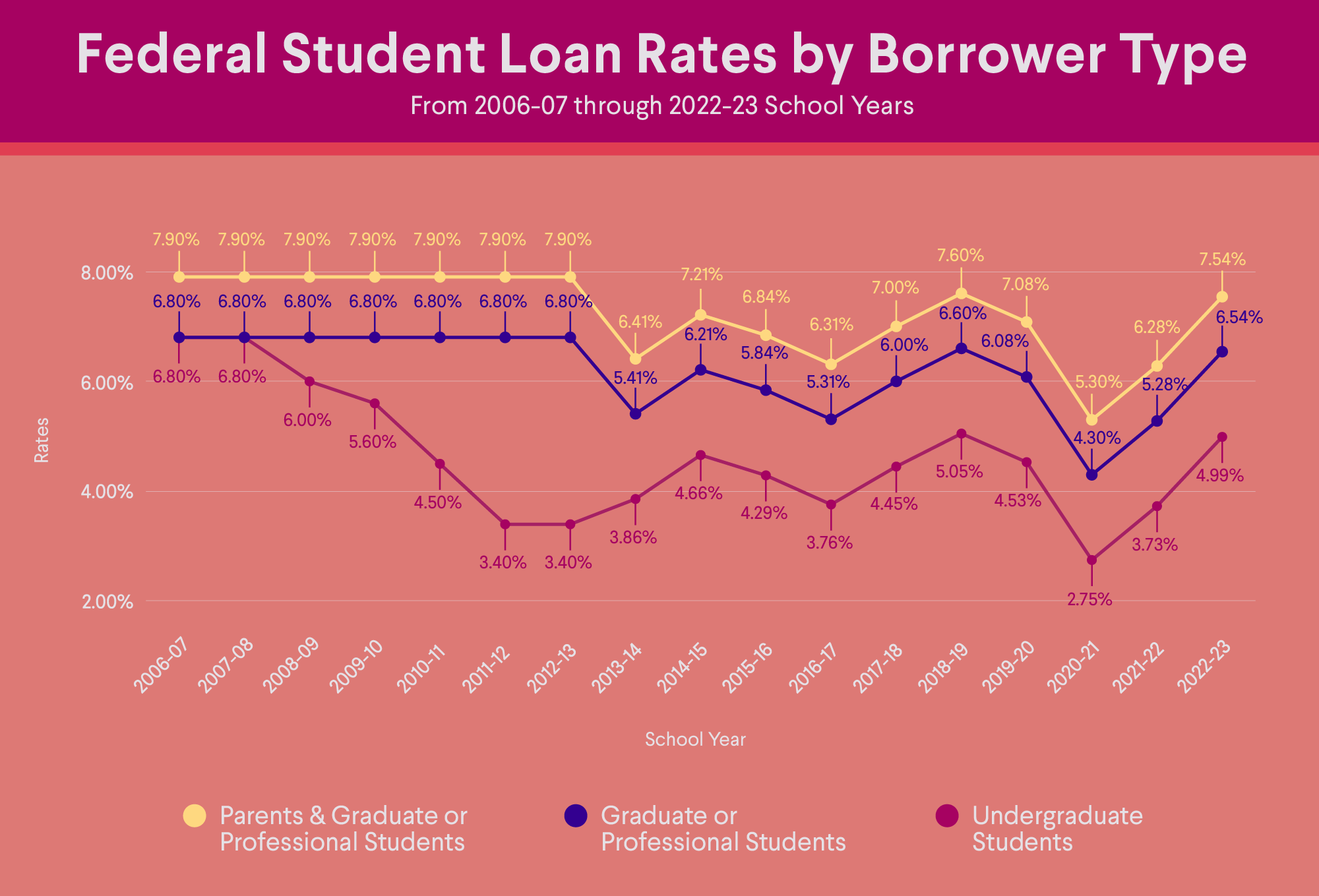

Historical Data on Interest Rate Trends

Interest rates on federal student loans have fluctuated over time. In recent years, interest rates have been relatively low. However, they are expected to increase in the future.

Federal Student Loan Repayment Plans

When it comes to repaying your federal student loans, you have a variety of repayment plans to choose from. Each plan has its own set of pros and cons, so it’s important to compare them carefully before making a decision. Here’s a breakdown of the different repayment plans available:

Standard Repayment Plan

The Standard Repayment Plan is the most common repayment plan. Under this plan, you’ll make fixed monthly payments for a period of 10 years. The pros of this plan are that it’s simple and easy to understand, and it helps you pay off your loan faster than other plans.

Graduated Repayment Plan

The Graduated Repayment Plan is similar to the Standard Repayment Plan, but your monthly payments will start out lower and gradually increase over time. This plan can be a good option if you have a low income when you first start repaying your loans, but expect your income to increase in the future.

Extended Repayment Plan

The Extended Repayment Plan allows you to extend the repayment period for your loans to up to 25 years. This plan can be a good option if you have a high amount of debt or if you’re struggling to make your monthly payments.

Income-Driven Repayment Plans

Income-Driven Repayment Plans (IDRs) are designed to make your monthly payments more affordable based on your income and family size. There are four different IDRs available: the Income-Based Repayment Plan (IBR), the Income-Contingent Repayment Plan (ICR), the Pay As You Earn Repayment Plan (PAYE), and the Revised Pay As You Earn Repayment Plan (REPAYE). Each plan has its own set of eligibility requirements and repayment terms.

The burden of federal student loan debt has been a growing concern for many Americans. With the rising cost of education, more and more students are taking on substantial loans to finance their degrees. In response to this crisis, the government has implemented several programs to provide relief, including federal student loan forgiveness . These programs can help borrowers reduce or even eliminate their debt, making it easier for them to achieve financial stability and pursue their career goals.

Federal student loans remain a crucial resource for students, and these forgiveness programs provide a lifeline for those struggling with repayment.

| Repayment Plan | Monthly Payments | Repayment Period | Eligibility Requirements |

|---|---|---|---|

| Standard Repayment Plan | Fixed | 10 years | None |

| Graduated Repayment Plan | Start low, increase over time | 10 years | None |

| Extended Repayment Plan | Fixed | Up to 25 years | Must have high debt-to-income ratio |

| Income-Based Repayment Plan (IBR) | Based on income and family size | Up to 25 years | Must have low income and high debt-to-income ratio |

| Income-Contingent Repayment Plan (ICR) | Based on income and family size | Up to 25 years | Must have high debt-to-income ratio |

| Pay As You Earn Repayment Plan (PAYE) | Based on income and family size | Up to 20 years | Must have low income and high debt-to-income ratio |

| Revised Pay As You Earn Repayment Plan (REPAYE) | Based on income and family size | Up to 25 years | None |

Federal Student Loan Forgiveness Programs

Navigating the complexities of federal student loan repayment can be overwhelming. Fortunately, there are several forgiveness programs available to assist borrowers in managing their debt. These programs offer varying eligibility criteria and application processes. Understanding the nuances of each program is crucial for maximizing the chances of loan forgiveness.

If you’re considering taking out federal student loans to finance your education, it’s important to be aware of the student loan interest rates . These rates can vary depending on the type of loan you take out, as well as your creditworthiness.

It’s important to compare rates from different lenders before you decide on a loan, so you can get the best possible deal on your federal student loan.

Public Service Loan Forgiveness (PSLF)

The PSLF program provides loan forgiveness to individuals who work full-time for a qualifying public service organization, such as government agencies, non-profit organizations, or certain healthcare facilities. To qualify, borrowers must make 120 qualifying payments under an income-driven repayment plan. The remaining balance of the loan is forgiven after the 120th payment.

Teacher Loan Forgiveness (TLF)

The TLF program offers loan forgiveness to teachers who work full-time in a low-income school or educational service agency. To qualify, borrowers must teach for five consecutive years and meet certain income requirements. The maximum amount of loan forgiveness is $17,500 for highly qualified teachers and $5,000 for teachers who are not highly qualified.

Perkins Loan Cancellation

The Perkins Loan Cancellation program provides loan forgiveness to individuals who work in certain public service fields, such as teaching, nursing, or law enforcement. To qualify, borrowers must work full-time for a qualifying organization for five years. The amount of loan forgiveness is based on the length of service and the type of organization.

Income-Driven Repayment (IDR) Plans

IDR plans are designed to make student loan payments more manageable for borrowers with low incomes. These plans cap monthly payments at a percentage of the borrower’s discretionary income. After 20 or 25 years of qualifying payments, the remaining balance of the loan is forgiven.

Federal Student Loan Consolidation

Consolidating federal student loans is a process that combines multiple federal student loans into a single loan. This can be beneficial for borrowers who have multiple loans with different interest rates and repayment terms. Consolidation can simplify the repayment process and potentially lower the monthly payment.

Benefits of Consolidation

- Simplified repayment: With consolidation, you’ll have only one monthly payment to make, instead of multiple payments to different lenders.

- Lower interest rate: Consolidation can qualify you for a lower interest rate, which can save you money on interest over the life of the loan.

- Extended repayment term: Consolidation can extend the repayment term of your loan, which can lower your monthly payment.

Drawbacks of Consolidation

- Loss of certain benefits: If you consolidate federal student loans that are eligible for loan forgiveness programs, such as Public Service Loan Forgiveness or Teacher Loan Forgiveness, you may lose eligibility for those programs.

- Higher total interest paid: Extending the repayment term can result in paying more interest over the life of the loan.

- Application fee: There is a $43 application fee to consolidate federal student loans.

Whether or not consolidation is right for you depends on your individual circumstances. If you’re considering consolidation, it’s important to weigh the benefits and drawbacks carefully before making a decision.

Define federal student loan default

Federal student loan default occurs when a borrower fails to make payments on their federal student loans for 270 days or more. This can have serious consequences, including damage to your credit score, wage garnishment, and even loss of professional licenses.

Consequences of defaulting on federal student loans

The consequences of defaulting on federal student loans can be severe. These consequences include:

- Damage to your credit score

- Wage garnishment

- Loss of professional licenses

- Inability to receive federal student aid in the future

Provide resources for avoiding or getting out of default

If you are at risk of defaulting on your federal student loans, there are resources available to help you. These resources include:

- The Department of Education’s website

- Federal Student Aid’s website

- Nonprofit credit counseling agencies

Provide a list of common reasons why borrowers default on their federal student loans

There are many reasons why borrowers default on their federal student loans. Some of the most common reasons include:

- Loss of income

- High levels of debt

- Unaffordable monthly payments

- Lack of understanding of repayment options

Explain the impact of default on credit score

Defaulting on your federal student loans can have a significant impact on your credit score. A default will stay on your credit report for seven years, and it can make it difficult to qualify for loans, credit cards, and other forms of credit.

Federal student loans can be a burden for many borrowers, leading them to seek relief through programs like student loan forgiveness debt relief . These programs aim to reduce or eliminate outstanding balances, providing financial relief to those struggling with student loan payments.

However, it’s important to note that federal student loans offer certain benefits and protections that may not be available through private lenders, so it’s crucial to weigh all options carefully before making any decisions about loan forgiveness.

Provide tips for managing federal student loan debt

If you are struggling to manage your federal student loan debt, there are a number of things you can do to get help. These tips include:

- Contact your loan servicer to discuss your options

- Apply for a lower monthly payment

- Consider consolidating your loans

- Explore loan forgiveness programs

Explain the process of loan rehabilitation and consolidation

If you have defaulted on your federal student loans, you may be able to rehabilitate your loans or consolidate them. Loan rehabilitation is a process that allows you to bring your defaulted loans out of default by making nine on-time monthly payments within 10 months. Consolidation is a process that allows you to combine multiple federal student loans into a single loan with a single monthly payment.

Provide a table summarizing the key differences between default and delinquency

| Default | Delinquency |

|---|---|

| Failure to make payments for 270 days or more | Failure to make payments for 30-89 days |

| Can result in serious consequences, including damage to credit score, wage garnishment, and loss of professional licenses | Can result in late fees and damage to credit score |

| Can be rehabilitated or consolidated | Can be brought current by making up missed payments |

Provide a list of organizations that offer free or low-cost credit counseling

If you need help managing your federal student loan debt, there are a number of organizations that offer free or low-cost credit counseling. These organizations include:

- National Foundation for Credit Counseling

- American Consumer Credit Counseling

- Money Management International

Explain the role of the Department of Education in assisting borrowers in default

The Department of Education has a number of programs and resources to help borrowers in default. These programs and resources include:

- The Default Prevention and Resolution Program

- The Loan Rehabilitation Program

- The Consolidation Program

Provide a sample letter that borrowers can use to request a loan rehabilitation

If you have defaulted on your federal student loans, you can request a loan rehabilitation by writing a letter to your loan servicer. The letter should include the following information:

- Your name and address

- Your Social Security number

- The loan number(s) of the defaulted loans

- A statement that you are requesting loan rehabilitation

- A statement that you understand the terms and conditions of loan rehabilitation

- Your signature

Federal Student Loan Statistics

The staggering burden of federal student loan debt in the United States has become a pressing national concern. As of June 2023, the total outstanding balance of federal student loans has surpassed a whopping $1.78 trillion, distributed among approximately 45 million borrowers. This colossal sum represents a significant financial burden for individuals and families across the country, impacting their ability to pursue higher education, purchase homes, and save for retirement.

Demographics of Federal Student Loan Borrowers

The demographics of federal student loan borrowers paint a diverse picture. Women account for a slightly higher proportion of borrowers than men, with 56% of all outstanding federal student loan debt held by female borrowers. The racial and ethnic makeup of borrowers is also diverse, with 39% identifying as White, 30% as Black or African American, 18% as Hispanic or Latino, and 13% as Asian or Pacific Islander.

Trends in Federal Student Loan Borrowing

The trend in federal student loan borrowing has been steadily increasing over the past several decades. The average federal student loan debt per borrower has more than doubled since 2005, from $17,900 to $37,667. This increase is primarily driven by rising tuition costs at colleges and universities, as well as the increasing number of students pursuing higher education.

Federal Student Loan Policy

The federal government has a long history of providing student loans to help students pay for college. The current federal student loan policy landscape is complex, with a variety of loan programs and repayment options available. In recent years, there have been a number of changes to federal student loan policy, including the creation of new income-driven repayment plans and the expansion of loan forgiveness programs.

Recent Changes to Federal Student Loan Policy

- The creation of new income-driven repayment plans, such as the Revised Pay As You Earn (REPAYE) plan and the Pay As You Earn (PAYE) plan, which allow borrowers to cap their monthly payments at a percentage of their income.

- The expansion of loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and the Teacher Loan Forgiveness program, which allow borrowers to have their loans forgiven after a certain number of years of service in certain professions.

- The simplification of the federal student loan application process, which has made it easier for students to apply for and receive federal student loans.

Potential Future Policy Changes

There are a number of potential future changes to federal student loan policy that have been proposed, including:

- Making college tuition-free for all students

- Eliminating the interest rates on federal student loans

- Expanding the eligibility for loan forgiveness programs

It is unclear whether any of these proposals will be enacted into law, but they reflect the growing debate about the future of federal student loan policy.

Federal Student Loan Scams

Student loan scams are a growing problem, and it’s important to be aware of the signs so you can avoid falling victim. These scams often target students who are struggling to repay their loans, and they can cost you thousands of dollars.

Here are some of the most common student loan scams:

- Phishing scams: These scams involve sending you an email or text message that looks like it’s from your loan servicer. The message will often contain a link to a fake website that looks like the real thing. If you click on the link and enter your personal information, the scammers will be able to steal your identity and access your student loan account.

- Loan consolidation scams: These scams involve offering to consolidate your student loans into a single, lower-interest loan. The scammers will often charge you a fee for this service, but they won’t actually consolidate your loans. Instead, they’ll just keep your money and leave you with your original loans.

- Loan forgiveness scams: These scams involve offering to help you get your student loans forgiven. The scammers will often charge you a fee for this service, but they won’t actually be able to get your loans forgiven. Instead, they’ll just keep your money and leave you with your original loans.

If you’re ever contacted by someone who’s offering to help you with your student loans, be sure to do your research before you give them any personal information. You can check with your loan servicer to see if the offer is legitimate, or you can contact the Federal Trade Commission (FTC) to report the scam.

How to Avoid Falling Victim to Student Loan Scams

- Be wary of any unsolicited emails or text messages about your student loans.

- Never click on links in emails or text messages that you don’t recognize.

- Don’t give out your personal information to anyone who calls or emails you about your student loans.

- Only work with loan servicers that are approved by the U.S. Department of Education.

- If you’re ever unsure about whether or not an offer is legitimate, contact your loan servicer or the FTC.

Resources for Reporting Student Loan Scams

- Federal Trade Commission (FTC): https://www.ftc.gov/studentloans

- U.S. Department of Education: https://studentaid.gov/manage-loans/repayment/scams

A Short Article That Summarizes the Most Common Student Loan Scams and How to Avoid Them

Student loan scams are a growing problem, and it’s important to be aware of the signs so you can avoid falling victim. These scams often target students who are struggling to repay their loans, and they can cost you thousands of dollars.

Here are some of the most common student loan scams:

| Type of Scam | Red Flags | Steps to Take |

|---|---|---|

| Phishing scams | Emails or text messages that look like they’re from your loan servicer, but contain links to fake websites | Don’t click on the links. Contact your loan servicer to verify the offer. |

| Loan consolidation scams | Offers to consolidate your student loans into a single, lower-interest loan, but charge a fee for the service | Don’t pay any fees for loan consolidation. You can consolidate your loans for free through your loan servicer. |

| Loan forgiveness scams | Offers to help you get your student loans forgiven, but charge a fee for the service | Don’t pay any fees for loan forgiveness. You can apply for loan forgiveness programs through the U.S. Department of Education. |

If you’re ever contacted by someone who’s offering to help you with your student loans, be sure to do your research before you give them any personal information. You can check with your loan servicer to see if the offer is legitimate, or you can contact the Federal Trade Commission (FTC) to report the scam.

Tips for Avoiding Student Loan Scams

- Be wary of any unsolicited emails or text messages about your student loans.

- Never click on links in emails or text messages that you don’t recognize.

- Don’t give out your personal information to anyone who calls or emails you about your student loans.

- Only work with loan servicers that are approved by the U.S. Department of Education.

- If you’re ever unsure about whether or not an offer is legitimate, contact your loan servicer or the FTC.

How to Report Student Loan Scams

- Federal Trade Commission (FTC): https://www.ftc.gov/studentloans

- U.S. Department of Education: https://studentaid.gov/manage-loans/repayment/scams

Call to Action, Federal student loan

Be vigilant about student loan scams, and report any suspected scams to the appropriate authorities. By working together, we can help protect students from these predatory scams.

Federal Student Loan Resources

Federal student loan borrowers have access to a range of resources to help them manage their loans and repay them effectively. These resources include loan servicers, government agencies, and non-profit organizations. Each type of resource offers unique services and support, tailored to meet the specific needs of borrowers.

Loan servicers are companies that manage federal student loans on behalf of the U.S. Department of Education. They handle tasks such as processing payments, providing account information, and assisting with loan repayment options. Government agencies, such as the Federal Student Aid office, provide general information about federal student loans, offer financial aid counseling, and administer loan forgiveness programs. Non-profit organizations offer free or low-cost counseling and assistance to borrowers who are struggling to repay their loans or who need help understanding their repayment options.

To choose the right resources for your needs, consider the following factors:

- Your specific loan situation

- The type of assistance you need

- The availability of resources in your area

The following table provides a list of helpful resources for federal student loan borrowers:

| Name of resource | Type of resource | Contact information | Description of services offered |

|---|---|---|---|

| Federal Student Aid | Government agency | Website: https://studentaid.gov/ Phone number: 1-800-433-3243 |

Provides general information about federal student loans, offers financial aid counseling, and administers loan forgiveness programs. |

| National Student Loan Data System (NSLDS) | Government agency | Website: https://nslds.ed.gov/ | Provides a central database of all federal student loans and grants. |

| Federal Student Loan Ombudsman | Government agency | Website: https://studentaid.gov/feedback-ombudsman/ Phone number: 1-877-557-2599 |

Assists borrowers who have problems with their loan servicers or who are experiencing financial hardship. |

| American Student Assistance | Non-profit organization | Website: https://www.asa.org/ Phone number: 1-888-233-3005 |

Provides free counseling and assistance to borrowers who are struggling to repay their loans or who need help understanding their repayment options. |

| National Foundation for Credit Counseling | Non-profit organization | Website: https://www.nfcc.org/ Phone number: 1-800-388-2227 |

Provides free and low-cost credit counseling and debt management services to borrowers who are struggling with their finances. |

Federal Student Loan Glossary

Knowing the terms related to federal student loans is essential for understanding your options and making informed decisions about your student loans. Here’s a glossary of some key terms to help you navigate the world of federal student loans:

Federal Direct Loan

A loan made directly to a student by the U.S. Department of Education.

Federal Perkins Loan

A loan made to undergraduate and graduate students with exceptional financial need.

Federal PLUS Loan

A loan made to parents of undergraduate students to help pay for their education.

Subsidized Loan

A loan for which the government pays the interest while the student is in school and during certain deferment and forbearance periods.

Unsubsidized Loan

A loan for which the student is responsible for paying the interest from the time the loan is disbursed.

Interest Rate

The annual percentage rate charged on a loan.

Loan Term

The length of time you have to repay your loan.

Repayment Plan

A plan that determines how you will repay your loan, including the amount and frequency of your payments.

Deferment

A period of time when you can temporarily stop making payments on your loan.

Forbearance

A period of time when you can temporarily reduce or stop making payments on your loan.

Default

When you fail to make your loan payments on time.

Federal Student Loan Timeline

Federal student loans have been around for decades, and the program has undergone several changes over the years. Here is a timeline of some of the key events in the history of federal student loans:

| Date | Event | Description |

|---|---|---|

| 1958 | National Defense Education Act (NDEA) | The NDEA was the first federal law to provide student loans. The loans were available to students who were pursuing degrees in science, mathematics, engineering, or foreign languages. |

| 1965 | Higher Education Act (HEA) | The HEA expanded the federal student loan program to include all students, regardless of their major. The HEA also created the Federal Family Education Loan Program (FFELP), which allowed private lenders to make student loans backed by the federal government. |

| 1976 | Middle Income Student Assistance Act (MISAA) | The MISAA created the Parent Loans for Undergraduate Students (PLUS) program, which allows parents to borrow money to help their children pay for college. |

| 1993 | Student Loan Reform Act (SLRA) | The SLRA made several changes to the federal student loan program, including increasing the loan limits and expanding the repayment options. |

| 2007 | College Cost Reduction and Access Act (CCRAA) | The CCRAA made several changes to the federal student loan program, including simplifying the repayment process and creating new loan forgiveness programs. |

| 2010 | Health Care and Education Reconciliation Act (HCERA) | The HCERA made several changes to the federal student loan program, including eliminating the FFELP and creating a new federal direct loan program. |

| 2015 | Every Student Succeeds Act (ESSA) | The ESSA made several changes to the federal student loan program, including expanding the income-driven repayment options and creating a new Public Service Loan Forgiveness program. |

The federal student loan program has undergone many changes over the years, but the goal has always been to help students finance their education. The program has helped millions of students attend college and achieve their dreams.

Federal Student Loan Infographics

Visualizing key data points about federal student loans can help us understand the scope and impact of this issue. Infographics, with their combination of statistics, charts, and graphs, provide a powerful tool for presenting complex information in a clear and concise way.

Here’s a sample infographic that highlights some of the key statistics related to federal student loans:

Federal Student Loan Statistics

- As of 2022, the total amount of federal student loan debt in the United States exceeded $1.7 trillion.

- There are over 45 million Americans with federal student loan debt.

- The average federal student loan balance is over $37,000.

- Student loan debt is the second-largest type of consumer debt in the United States, after mortgage debt.

- Student loan debt has a significant impact on the financial well-being of borrowers, making it difficult for them to save for retirement, buy homes, or start families.

Closure

As we reach the culmination of our exploration, it is evident that federal student loans present a multifaceted landscape of opportunities and challenges. Understanding the nuances of this financial tool empowers borrowers to make informed decisions, optimize their repayment strategies, and ultimately achieve their academic and financial goals. May this comprehensive guide serve as a beacon of knowledge, illuminating the path towards financial literacy and empowering you to navigate the complexities of federal student loans with confidence.

FAQ Guide: Federal Student Loan

What are the different types of federal student loans?

Federal student loans are categorized into various types, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Federal Perkins Loans. Each type offers unique features, interest rates, and eligibility criteria.

How do I determine my eligibility for federal student loans?

To be eligible for federal student loans, you must meet certain criteria, such as being a U.S. citizen or eligible non-citizen, enrolled in an eligible degree program, and demonstrating financial need (for subsidized loans).

What is the difference between subsidized and unsubsidized loans?

Subsidized loans are awarded to students with financial need, and the government pays the interest on these loans while the student is in school. Unsubsidized loans are not based on financial need, and the student is responsible for paying the interest from the start.