When will student loan forgiveness be applied – With the weight of student loan debt looming over millions of Americans, the question of when student loan forgiveness will be applied is on everyone’s mind. This comprehensive guide will delve into the intricacies of student loan forgiveness, exploring its timeline, eligibility requirements, and potential impact, providing a roadmap to navigate this complex financial landscape.

As we embark on this journey, we will unravel the different types of federal student loan forgiveness programs, their specific eligibility criteria, and the application process involved. We will also examine the factors that could influence the timeline for forgiveness and discuss alternative options for managing student loan debt.

Federal Student Loan Forgiveness Overview

The federal government offers several programs that can help borrowers repay their student loans. These programs include loan forgiveness, loan cancellation, and loan discharge. Loan forgiveness is the complete elimination of a student loan debt. Loan cancellation is the elimination of a student loan debt after a certain period of time, such as 10 years of service in a public service job. Loan discharge is the elimination of a student loan debt due to a disability or other hardship.

There are several different types of federal student loan forgiveness programs available. Some of the most common programs include:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Income-Driven Repayment (IDR) plans

- Disability Discharge

- Death Discharge

Each program has its own eligibility requirements and application process. To learn more about these programs, visit the Federal Student Aid website.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after you have made 120 qualifying payments while working full-time for a qualifying public service employer.

To qualify for PSLF, you must meet the following requirements:

- Be employed by a qualifying public service employer

- Have made 120 qualifying payments on your federal student loans

- Be in good standing on your loans

To apply for PSLF, you must submit a PSLF Form to your loan servicer. The PSLF Form is available on the Federal Student Aid website.

Timeline for Student Loan Forgiveness

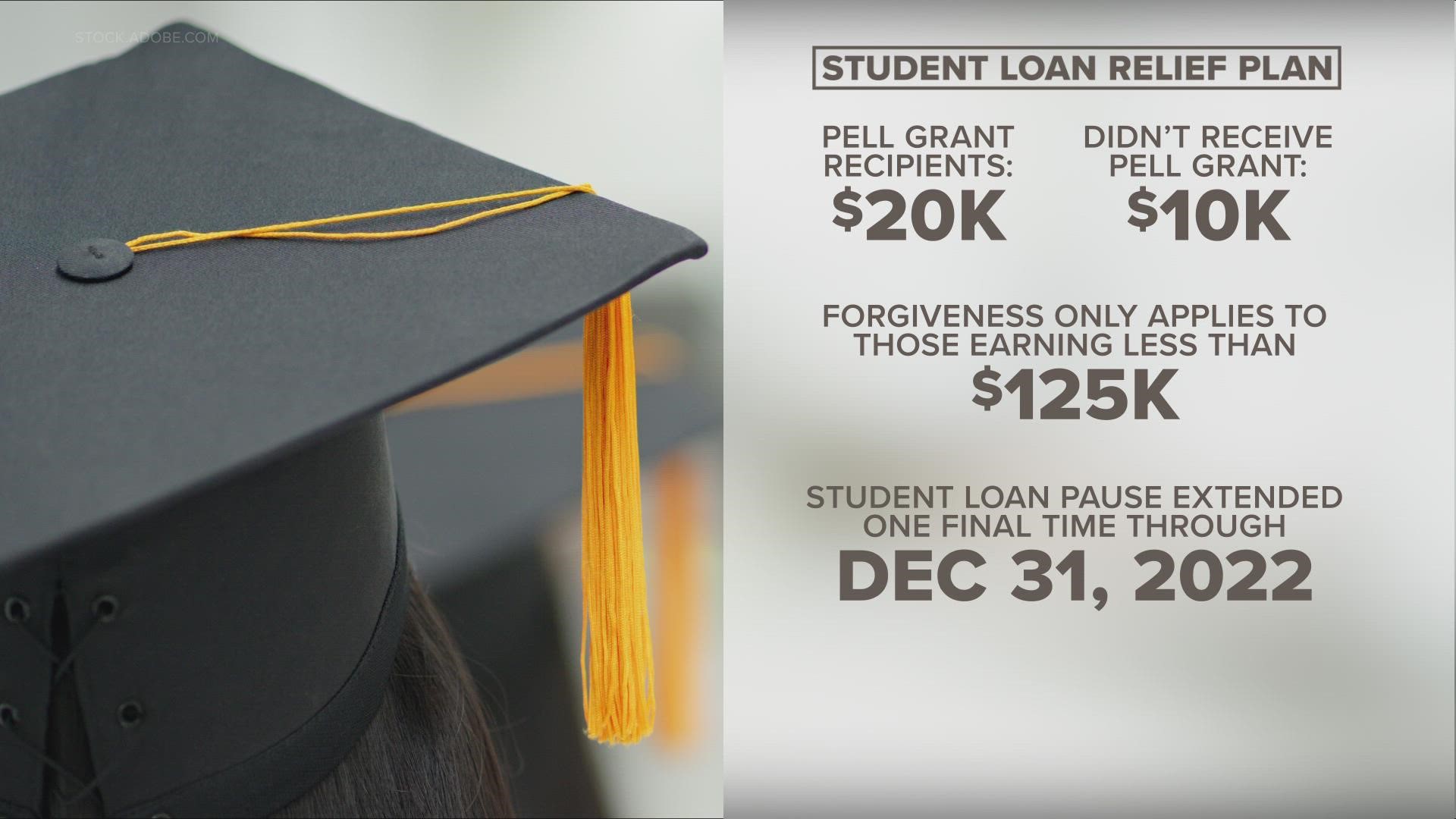

The Biden administration has announced a plan to forgive up to $20,000 in federal student loan debt for Pell Grant recipients and up to $10,000 for other federal student loan borrowers. The forgiveness will be applied automatically to eligible borrowers once the Department of Education receives their income information. Borrowers can also apply for forgiveness through a simple online application.

The timeline for student loan forgiveness is as follows:

* August 24, 2022: The Biden administration announced the student loan forgiveness plan.

* Early October 2022: The Department of Education will begin accepting applications for forgiveness.

* Mid-November 2022: The Department of Education will begin forgiving student loans automatically.

There are a few potential delays or changes to the timeline. For example, if the Department of Education receives a large number of applications for forgiveness, it may take longer to process them all. Additionally, if there are any legal challenges to the forgiveness plan, it could be delayed or even overturned.

Several factors could affect the timeline for student loan forgiveness. These include:

* The number of applications for forgiveness received by the Department of Education

* The speed at which the Department of Education processes applications

* Any legal challenges to the forgiveness plan

Eligibility Requirements for Student Loan Forgiveness

Determining your eligibility for student loan forgiveness programs is crucial. Each program has specific requirements, and meeting them is essential to secure debt relief.

To assess your eligibility, gather relevant documentation, such as income tax returns, proof of employment, and loan statements. These documents will provide the necessary information to determine your eligibility.

The fate of student loan forgiveness hangs in the balance as the Supreme Court prepares to hear arguments on the Biden administration’s plan. The court’s decision will have a profound impact on millions of borrowers, and it’s unclear when student loan forgiveness will be applied if the plan is upheld.

However, the Supreme Court’s ruling could provide some clarity on the timeline for forgiveness, and it’s worth staying tuned for updates as the case progresses.

Income-Driven Repayment Plans

- Meet income requirements based on the Federal Poverty Level (FPL).

- Make qualifying payments on time for the required number of years (20-25 years).

Public Service Loan Forgiveness, When will student loan forgiveness be applied

- Work full-time for a qualifying public service employer (e.g., government, non-profit).

- Make 120 qualifying payments on federal student loans while employed in public service.

Teacher Loan Forgiveness

- Teach full-time for five consecutive years in a low-income school or educational service agency.

- Meet other eligibility criteria, such as certification and student loan type.

Other Forgiveness Programs

- Total and Permanent Disability (TPD) Discharge: Available to borrowers who become totally and permanently disabled.

- Closed School Discharge: Applicable to borrowers whose schools closed while they were enrolled or within 120 days after they withdrew.

Impact of Student Loan Forgiveness

Student loan forgiveness has the potential to significantly impact individuals and the economy. It could provide financial relief to millions of borrowers, boost economic growth, and reduce income inequality.

One of the most significant benefits of student loan forgiveness is that it would provide financial relief to millions of borrowers. Many borrowers are struggling to repay their student loans, and forgiveness would free up their monthly cash flow. This could allow them to save for a down payment on a home, start a family, or pursue other financial goals.

Student loan forgiveness could also boost economic growth. When borrowers have more money to spend, they are more likely to do so, which can help to create jobs and stimulate the economy. A study by the Levy Economics Institute found that student loan forgiveness could add $108 billion to the economy over the next decade.

Finally, student loan forgiveness could help to reduce income inequality. Borrowers from low-income families are more likely to default on their student loans than borrowers from high-income families. Forgiveness would help to level the playing field and give all borrowers a fair chance at economic success.

Drawbacks of Student Loan Forgiveness

There are also some potential drawbacks to student loan forgiveness. One concern is that it could be expensive. The cost of forgiving all federal student loans would be in the trillions of dollars. This could lead to higher taxes or cuts to other government programs.

While we eagerly await the announcement of student loan forgiveness, it’s crucial to plan ahead. Our student loan repayment calculator can help you estimate your monthly payments and plan for your financial future. With this tool, you can determine the best repayment strategy for your specific situation, ensuring you’re well-prepared when student loan forgiveness becomes a reality.

Another concern is that student loan forgiveness could be unfair to those who have already repaid their loans. They may feel that they are being penalized for making responsible financial decisions.

While the timing of student loan forgiveness remains uncertain, there are resources available to help manage student loan debt. One option to consider is a save student loan plan , which can provide personalized guidance and support in navigating the complexities of student loan repayment.

As we await further updates on the implementation of student loan forgiveness, it’s prudent to explore these options to mitigate the financial burden of student loans.

Finally, student loan forgiveness could lead to inflation. If the government forgives a large amount of debt, it could increase the money supply and lead to higher prices.

Conclusion

The potential impact of student loan forgiveness is complex. There are both benefits and drawbacks to consider. Ultimately, the decision of whether or not to forgive student loans is a political one.

Alternatives to Student Loan Forgiveness

Student loan forgiveness has been a hot topic of debate in recent years, but it’s important to remember that it’s not the only option for managing student loan debt. There are a number of other alternatives that may be a better fit for your individual circumstances.

Refinancing

Refinancing your student loans can be a great way to lower your interest rate and monthly payments. However, it’s important to compare offers from multiple lenders before refinancing to make sure you’re getting the best deal possible.

Income-driven repayment plans

Income-driven repayment plans are designed to make your student loan payments more affordable by basing them on your income and family size. There are a number of different income-driven repayment plans available, so you can choose the one that works best for you.

Consolidation

Consolidating your student loans can simplify your repayment process by combining multiple loans into a single loan with a single interest rate and monthly payment. This can make it easier to track your progress and stay on top of your payments.

Loan forgiveness programs (other than broad forgiveness)

There are a number of loan forgiveness programs available that can help you pay off your student loans faster. These programs are typically based on your profession or your service to your community.

Debt settlement

Debt settlement is a last resort option for managing student loan debt. It involves negotiating with your creditors to pay off your loans for less than the full amount you owe. However, debt settlement can have a negative impact on your credit score.

Legal Challenges to Student Loan Forgiveness

Student loan forgiveness programs have faced several legal challenges, raising concerns about their legality and potential impact on taxpayers. These challenges have been based on various legal arguments, including:

Constitutionality

Some lawsuits have argued that student loan forgiveness programs violate the Constitution’s Spending Clause, which requires Congress to appropriate funds for all government spending. Critics contend that these programs amount to unauthorized spending and that Congress has not properly appropriated funds for them.

Equal Protection

Other challenges have alleged that student loan forgiveness programs violate the Equal Protection Clause of the Constitution, which prohibits the government from denying any person equal protection under the law. These lawsuits argue that the programs unfairly benefit certain groups of borrowers, such as those with higher incomes or those who attended certain types of schools, while excluding others.

Administrative Procedure Act

Additionally, some challenges have been brought under the Administrative Procedure Act (APA), which governs the procedures that federal agencies must follow when creating and implementing regulations. These lawsuits argue that the Department of Education has not followed proper APA procedures in implementing student loan forgiveness programs.

Arguments for the Challenges

Supporters of these legal challenges argue that student loan forgiveness programs are unconstitutional, unfair, and procedurally flawed. They contend that these programs exceed Congress’s spending authority, discriminate against certain borrowers, and violate the APA’s requirements for notice and comment.

Arguments Against the Challenges

Opponents of the challenges argue that student loan forgiveness programs are constitutional, equitable, and necessary to address the student loan debt crisis. They contend that Congress has the authority to appropriate funds for these programs, that the programs are designed to benefit borrowers who are struggling financially, and that the Department of Education has followed proper APA procedures.

Potential Impact on Timeline

The legal challenges to student loan forgiveness programs have the potential to delay or even derail the implementation of these programs. If the courts rule against the programs, they could be blocked or significantly altered. This could have a major impact on the timeline for student loan forgiveness, potentially pushing it back or making it less generous.

Political Implications of Student Loan Forgiveness

Student loan forgiveness has emerged as a contentious political issue, with significant implications for the political landscape. Different political parties hold contrasting perspectives on this topic, shaping the implementation and potential outcomes of student loan forgiveness programs.

The highly anticipated student loan forgiveness is still under debate, with no concrete date set for its implementation. However, you can stay updated on the latest developments by visiting student loan forgiveness biden . This comprehensive website provides valuable insights and up-to-date information on the status of student loan forgiveness, ensuring that you’re well-informed about this crucial matter.

Political Parties’ Perspectives

- Democrats generally support student loan forgiveness, viewing it as a necessary measure to address the growing student debt crisis and promote economic equity.

- Republicans are more divided on this issue, with some opposing forgiveness due to concerns about its impact on the federal budget and potential unfairness to those who have already repaid their loans.

Impact on Political Landscape

The political implications of student loan forgiveness are complex and multifaceted. It could potentially:

- Mobilize voters: Forgiveness programs could energize young voters, particularly those burdened by student debt, potentially benefiting candidates who support such measures.

- Shift political alliances: Forgiveness could realign political alliances, as borrowers who benefit from the program may become more supportive of the party responsible for its implementation.

- Alter campaign strategies: Candidates may tailor their campaigns to appeal to voters affected by student debt, highlighting their stance on forgiveness and offering specific plans to address the issue.

Challenges and Considerations

Despite its potential benefits, student loan forgiveness faces several challenges and considerations, including:

- Fiscal impact: The cost of forgiveness programs could strain the federal budget, potentially leading to debates about funding priorities and potential cuts to other programs.

- Equity concerns: Critics argue that forgiveness may disproportionately benefit those with higher incomes and education levels, while providing less relief to those with lower incomes and less valuable degrees.

- Moral hazard: Some opponents contend that forgiveness could create a moral hazard, encouraging future students to take on excessive debt in anticipation of future forgiveness.

Ultimately, the political implications of student loan forgiveness will depend on the specific details of the programs implemented, the political climate at the time, and the broader economic and social context.

Historical Context of Student Loan Forgiveness

The concept of student loan forgiveness has been considered for decades, driven by concerns about the rising cost of higher education and the burden of student debt on borrowers. Historically, student loan forgiveness programs have been implemented in response to specific economic or social circumstances.

Previous Student Loan Forgiveness Programs

- Higher Education Act of 1965: Provided loan forgiveness for teachers who worked in low-income schools.

- Public Service Loan Forgiveness (PSLF): Established in 2007, PSLF forgives loans for public service workers after 10 years of service.

- Teacher Loan Forgiveness: Created in 1998, this program forgives loans for teachers who work in high-need schools.

These programs have varied in their eligibility criteria, scope, and outcomes. For example, PSLF has been criticized for its complex requirements and low approval rates, while Teacher Loan Forgiveness has been praised for its effectiveness in attracting and retaining teachers in underserved communities.

Lessons Learned from Previous Programs

Previous student loan forgiveness programs have provided valuable lessons, including:

- Eligibility criteria should be clear and accessible.

- Programs should be adequately funded and administered.

- The impact on borrowers and institutions should be carefully considered.

These lessons can inform the design and implementation of future student loan forgiveness programs, ensuring that they are effective, equitable, and sustainable.

| Program | Eligibility Criteria | Scope | Outcomes |

|---|---|---|---|

| Higher Education Act of 1965 | Teachers working in low-income schools | Loan forgiveness after 5 years of service | Reduced teacher shortages in low-income areas |

| Public Service Loan Forgiveness (PSLF) | Public service workers with 10 years of service | Loan forgiveness up to $10,000 per year | Increased participation in public service professions |

| Teacher Loan Forgiveness | Teachers working in high-need schools | Loan forgiveness after 5 years of service | Improved teacher retention in underserved communities |

Potential Benefits and Drawbacks of Student Loan Forgiveness

Student loan forgiveness has the potential to provide significant benefits to borrowers, including:

- Reduced financial burden

- Increased economic mobility

- Stimulation of the economy

However, there are also potential drawbacks to consider:

- Cost to taxpayers

- Potential for increased tuition costs

- Moral hazard (encouraging future borrowers to take on more debt)

The potential benefits and drawbacks of student loan forgiveness must be carefully weighed when considering the design and implementation of future programs.

State-Level Student Loan Forgiveness Programs

Various states across the United States offer student loan forgiveness programs designed to assist borrowers in managing their student debt. These programs vary in eligibility criteria, application processes, and benefits provided.

To determine if you qualify for a state-level student loan forgiveness program, it’s crucial to research the specific requirements and guidelines set by each state. Eligibility often depends on factors such as residency, profession, and financial need.

Eligibility Requirements

Eligibility requirements for state-level student loan forgiveness programs can vary significantly. Common criteria include:

- Residency: Most programs require applicants to be residents of the state for a specified period.

- Income: Some programs have income limits to ensure that assistance is directed to those with the greatest financial need.

- Profession: Certain programs are designed for specific professions, such as teachers, nurses, or social workers.

- Loan type: Some programs may only cover certain types of student loans, such as federal or state-issued loans.

Application Process

The application process for state-level student loan forgiveness programs typically involves submitting an application form and providing supporting documentation. The application form usually requests personal information, financial details, and proof of eligibility. It’s important to carefully review the application requirements and submit all necessary documentation to avoid delays or rejection.

Program Summary Table

The following table provides a summary of key details for various state-level student loan forgiveness programs:

| State | Program Name | Eligibility Criteria | Application Deadline | Contact Information |

|---|---|---|---|---|

| California | Teacher Loan Forgiveness Program | Teachers in public schools serving low-income communities | March 31st | (800) 549-5589 |

| New York | Higher Education Loan Forgiveness Program | NYS residents with high financial need and working in public service | December 31st | (888) 997-4372 |

| Pennsylvania | Student Loan Relief for Nurses Program | Nurses working in underserved areas | June 30th | (717) 787-7394 |

Common Pitfalls to Avoid

When applying for state-level student loan forgiveness programs, it’s essential to avoid common pitfalls that can lead to delays or rejection:

- Missing deadlines: Submit your application before the deadline to ensure it’s considered for review.

- Incomplete applications: Provide all required documentation and information to avoid delays in processing.

- Ineligibility: Carefully review the eligibility criteria to ensure you meet the requirements before applying.

- Incorrect information: Ensure that all information provided on your application is accurate and up-to-date.

Potential Impact

State-level student loan forgiveness programs can have a significant impact on student loan debt in the United States. By providing financial assistance to eligible borrowers, these programs can help reduce the burden of student debt and promote economic mobility. Moreover, these programs can encourage individuals to pursue higher education and enter professions that serve their communities.

Resources for Student Loan Forgiveness

If you’re struggling with student loan debt, there are several resources available to help you learn more about student loan forgiveness. These resources can provide information on eligibility requirements, application procedures, and timelines.

The following table provides a list of resources that can help you learn more about student loan forgiveness:

Resource Name

| Resource Name | Link | Description |

|---|---|---|

| Federal Student Aid | https://studentaid.gov/manage-loans/forgiveness-cancellation | The official website of the U.S. Department of Education’s Federal Student Aid program provides comprehensive information on student loan forgiveness, including eligibility requirements and application procedures. |

| National Student Legal Defense Network | https://www.nsldnetwork.org/student-loan-forgiveness | A non-profit organization that provides free legal assistance to student loan borrowers, including help with student loan forgiveness applications. |

| American Bar Association | https://www.americanbar.org/groups/young_lawyers/publications/tyl-journal/tyl-journal-home/2019-spring/student-loan-forgiveness-a-primer-for-young-lawyers | An article that provides an overview of student loan forgiveness, including eligibility requirements and application procedures. |

To access these resources, simply click on the link provided. Some resources may require you to create an account or provide additional information.

In addition to the resources listed above, you can also contact your loan servicer for more information about student loan forgiveness. Your loan servicer is the company that manages your student loans and can provide you with information on your eligibility for forgiveness and the application process.

Frequently Asked Questions about Student Loan Forgiveness

Student loan forgiveness is a hot topic, and there are a lot of questions surrounding it. Here are some of the most frequently asked questions about student loan forgiveness, along with clear and concise answers.

Eligibility Criteria and How to Apply

Who is eligible for student loan forgiveness?

- Public service workers with at least 10 years of qualifying employment and payments

- Borrowers with disabilities who are unable to work

- Borrowers whose schools closed while they were enrolled or within 120 days of withdrawing

How do I apply for student loan forgiveness?

- For Public Service Loan Forgiveness (PSLF), submit an Employment Certification Form annually and a Forgiveness Application once you have 120 qualifying payments.

- For other forgiveness programs, check with your loan servicer for specific application instructions.

Loan Forgiveness Process

How long does it take to get student loans forgiven?

- PSLF: 10 years of qualifying payments

- Disability Discharge: Varies depending on the individual’s circumstances

- Closed School Discharge: Usually within 120 days of the school’s closure

What happens to my student loans if I qualify for forgiveness?

- The remaining balance on your eligible loans will be discharged.

- You will no longer be responsible for making payments on those loans.

Tax Implications

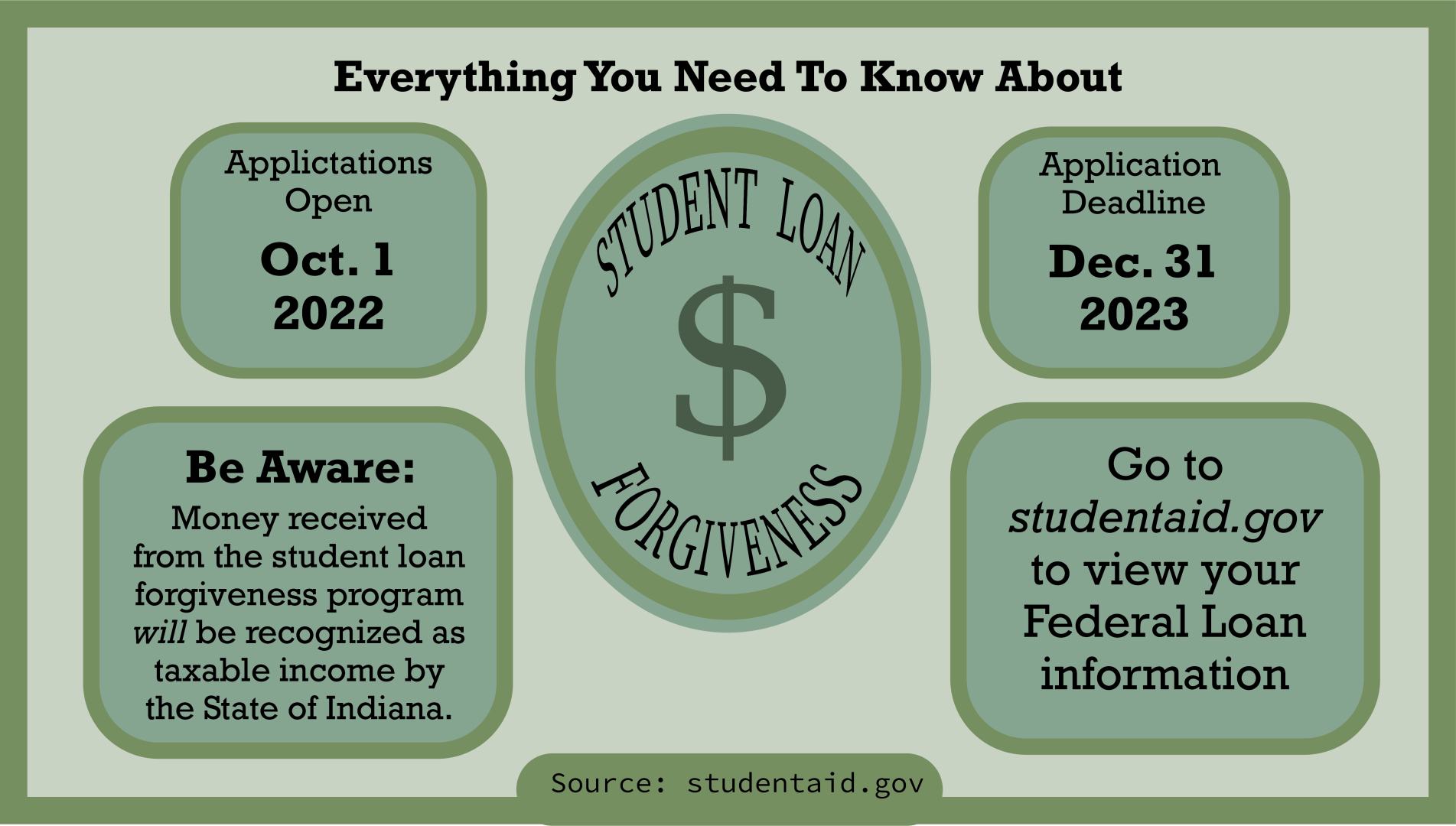

Is student loan forgiveness taxable?

- Federal student loan forgiveness is generally not taxable.

- However, state income tax laws may vary.

Will I get a refund for payments I’ve already made?

- For most forgiveness programs, you will not receive a refund for payments you’ve already made.

- However, if you qualify for Closed School Discharge, you may be eligible for a refund of payments made after the school closed.

Other Questions

What if I have private student loans?

- Federal student loan forgiveness programs do not apply to private student loans.

- You may want to contact your private lender to inquire about potential forgiveness options.

Can I consolidate my student loans before applying for forgiveness?

- Yes, you can consolidate your student loans before applying for forgiveness.

- However, it’s important to note that consolidating your loans may affect your eligibility for certain forgiveness programs.

What are some alternatives to student loan forgiveness?

- Income-driven repayment plans

- Loan deferment or forbearance

- Student loan refinancing

Case Studies of Student Loan Forgiveness

Student loan forgiveness programs have provided relief to many individuals struggling with student debt. Here are a few case studies of people who have successfully received student loan forgiveness:

A Nurse’s Journey to Forgiveness

Sarah, a registered nurse, graduated with over $100,000 in student loan debt. She worked in a low-income community for several years, qualifying for the Public Service Loan Forgiveness (PSLF) program. After 10 years of service, Sarah’s remaining student loan balance was forgiven, allowing her to focus on her career and provide for her family.

Teacher’s Dream Fulfilled

John, a high school teacher, dedicated his career to teaching in low-income schools. He participated in the Teacher Loan Forgiveness Program and, after five years of service, had $17,500 in student loans forgiven. This forgiveness enabled John to continue his passion for teaching without the burden of overwhelming debt.

Relief for a Disabled Veteran

Mark, a disabled veteran, struggled to repay his student loans due to his injuries. He applied for the Total and Permanent Disability Discharge program and had his entire student loan balance discharged. This forgiveness provided Mark with financial stability and peace of mind during a challenging time in his life.

Data and Statistics on Student Loan Forgiveness

Student loan forgiveness has become a hot topic in recent years, as the cost of college continues to rise. In this section, we will provide data and statistics on student loan forgiveness, including the number of people who have received forgiveness, the amount of debt that has been forgiven, and the average amount of forgiveness per person. We will also discuss the trends and patterns in the data.

Number of People Who Have Received Forgiveness

According to the Department of Education, over 1.3 million people have received student loan forgiveness since 2007. This includes over 900,000 people who have received forgiveness under the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance on federal student loans after 10 years of service in a public service job.

Amount of Debt That Has Been Forgiven

The total amount of student loan debt that has been forgiven since 2007 is over $100 billion. This includes over $60 billion in debt that has been forgiven under the PSLF program.

Average Amount of Forgiveness Per Person

The average amount of student loan forgiveness per person is over $30,000. This includes over $60,000 in forgiveness per person under the PSLF program.

Trends and Patterns in the Data

The data on student loan forgiveness shows that the number of people who are receiving forgiveness is increasing each year. This is likely due to the rising cost of college and the increasing number of people who are struggling to repay their student loans. The data also shows that the average amount of forgiveness per person is also increasing each year.

– Analyze the ethical considerations of student loan forgiveness.

Student loan forgiveness is a complex issue with a range of ethical considerations. On the one hand, some argue that it is unfair to forgive student loans, as it would reward those who made poor financial decisions and punish those who have already paid off their debts. On the other hand, others argue that student loan forgiveness is necessary to address the growing student debt crisis and to promote economic equity.

There are a number of different ethical arguments for and against student loan forgiveness. Some of the key arguments in favor of student loan forgiveness include:

* Fairness: Student loan forgiveness would help to level the playing field for those who have been burdened by student debt. Many people who have student loans have been unable to achieve their full economic potential because of the high cost of their education. Student loan forgiveness would help to free up these individuals to pursue their goals and contribute more fully to society.

* Equity: Student loan forgiveness would help to address the racial wealth gap. Black and Hispanic borrowers are more likely to have student loans than white borrowers, and they also have higher levels of student debt. Student loan forgiveness would help to reduce this disparity and promote economic equity.

* Responsibility: Some argue that student loan forgiveness would reward those who made poor financial decisions. However, it is important to remember that many people who have student loans were not able to make informed decisions about the cost of their education. They may have been misled by predatory lenders or they may not have had access to affordable alternatives.

There are also a number of ethical arguments against student loan forgiveness. Some of the key arguments against student loan forgiveness include:

* Unfairness: Student loan forgiveness would be unfair to those who have already paid off their debts. These individuals may feel that they are being punished for making responsible financial decisions.

* Moral hazard: Student loan forgiveness could create a moral hazard, whereby students are more likely to take on debt in the future if they believe that it will be forgiven. This could lead to a further increase in the cost of higher education.

* Economic impact: Student loan forgiveness could have a negative impact on the economy. It could reduce the amount of money available for other government programs, such as Social Security and Medicare.

The ethical considerations of student loan forgiveness are complex and there is no easy answer. It is important to weigh the different arguments carefully before making a decision about whether or not to support student loan forgiveness.

How these ethical considerations could influence the implementation of student loan forgiveness programs.

The ethical considerations discussed above could influence the implementation of student loan forgiveness programs in a number of ways. For example, the government could decide to forgive student loans only for those who meet certain criteria, such as those who have low incomes or who have been unable to find employment. The government could also decide to forgive only a portion of student debt, or to forgive student debt over a period of time.

The ethical considerations could also influence the design of student loan forgiveness programs. For example, the government could decide to create a program that is easy to apply for and that does not require borrowers to prove financial hardship. The government could also decide to create a program that is transparent and that allows borrowers to track the progress of their applications.

The ethical considerations discussed above are just a few of the factors that could influence the implementation of student loan forgiveness programs. It is important to weigh these factors carefully in order to create a program that is fair, equitable, and responsible.

– Speculate on the future of student loan forgiveness, including potential changes to existing programs or the implementation of new programs.

The future of student loan forgiveness is uncertain, but there are a number of potential changes that could be made to existing programs or new programs that could be implemented.

One possibility is that the government could expand the eligibility criteria for existing student loan forgiveness programs. For example, the government could lower the income threshold for borrowers who are eligible for Public Service Loan Forgiveness or extend the repayment period for borrowers who are eligible for income-driven repayment plans.

Another possibility is that the government could create new student loan forgiveness programs. For example, the government could create a program that forgives all student loan debt for borrowers who work in certain high-need professions, such as teaching or nursing.

The future of student loan forgiveness will likely be determined by a number of factors, including the economic conditions, political shifts, and demographic changes. If the economy continues to improve, the government may be more likely to expand existing student loan forgiveness programs or create new programs. However, if the economy worsens, the government may be less likely to provide student loan forgiveness.

The future of student loan forgiveness will also be affected by political shifts. If the Democrats gain control of the government, they are likely to be more supportive of student loan forgiveness than the Republicans. However, if the Republicans gain control of the government, they are likely to be less supportive of student loan forgiveness.

Finally, the future of student loan forgiveness will also be affected by demographic changes. As the number of student loan borrowers continues to grow, the government may be more likely to provide student loan forgiveness in order to help borrowers manage their debt.

Conclusive Thoughts: When Will Student Loan Forgiveness Be Applied

Navigating the complexities of student loan forgiveness can be daunting, but with the right information and guidance, you can determine your eligibility, explore your options, and potentially secure the financial relief you need. Remember, understanding when student loan forgiveness will be applied is the first step towards breaking free from the burden of student debt.

User Queries

What is the current timeline for student loan forgiveness?

The timeline for student loan forgiveness is still being determined and may vary depending on the specific program you qualify for. However, some programs, such as Public Service Loan Forgiveness, have a 10-year repayment period before forgiveness is granted.

Who is eligible for student loan forgiveness?

Eligibility for student loan forgiveness programs varies depending on the program. Generally, you must have federal student loans, meet income requirements, and have made a certain number of qualifying payments.

What is the application process for student loan forgiveness?

The application process for student loan forgiveness also varies depending on the program. However, you will typically need to submit an application and provide documentation to verify your eligibility.