Are you grappling with the complexities of student loan repayment? Look no further than our comprehensive student loan repayment calculator, a financial lifeline that empowers you to navigate the intricacies of your loan with confidence. This tool is your key to understanding the ins and outs of your loan, empowering you to make informed decisions that can save you time, money, and stress.

Our calculator is not just a number cruncher; it’s a personalized guide that tailors its calculations to your unique financial situation. With just a few clicks, you’ll gain valuable insights into your loan’s repayment journey, including monthly payments, interest charges, and the total cost of your loan. Armed with this knowledge, you’ll be able to craft a repayment strategy that aligns with your financial goals and sets you on the path to financial freedom.

Student Loan Repayment Calculator Overview

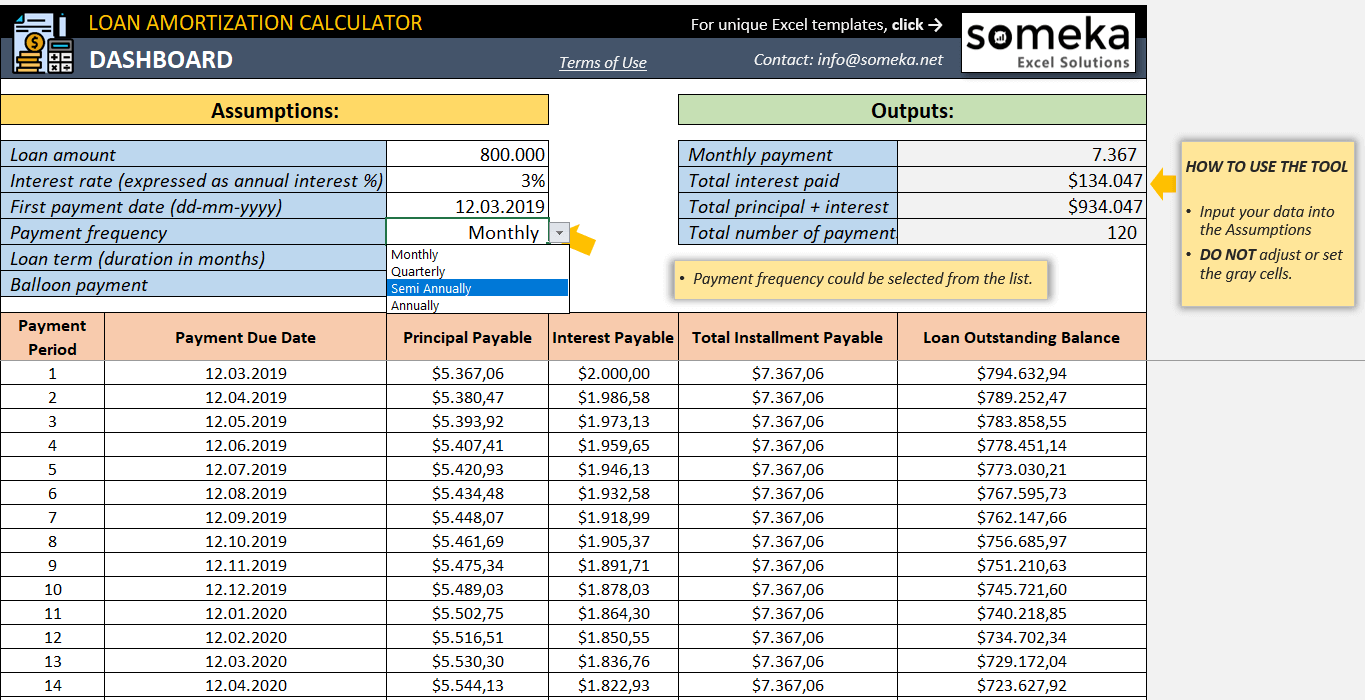

Student loan repayment calculators are online tools designed to assist borrowers in understanding their loan repayment options and estimating their monthly payments. These calculators utilize various factors, such as loan amount, interest rate, loan term, and repayment plan, to provide personalized repayment schedules.

Types of Student Loan Repayment Calculators

There are several types of student loan repayment calculators available, each with its unique features and capabilities:

- Standard Repayment Calculator: Calculates monthly payments based on a fixed repayment term, typically 10 or 25 years.

- Extended Repayment Calculator: Extends the repayment term beyond the standard period, resulting in lower monthly payments but higher total interest paid.

- Graduated Repayment Calculator: Gradually increases monthly payments over the repayment period, making them more manageable in the early years.

- Income-Driven Repayment Calculator: Considers the borrower’s income and family size to determine monthly payments, which may be lower than other repayment plans.

Input Parameters

Input parameters are the foundation of any student loan repayment calculator. They provide the necessary information to generate accurate and reliable repayment plans.

The most common input parameters include:

- Loan Amount: The total amount borrowed for the student loan.

- Interest Rate: The annual percentage rate charged on the loan.

- Loan Term: The length of time over which the loan will be repaid.

- Repayment Method: The specific way in which the loan will be repaid, such as standard, graduated, or extended.

Accurate input data is crucial for reliable results. Inaccurate data can lead to repayment plans that are unrealistic or unsustainable, potentially leading to financial difficulties down the road.

Importance of Accurate Input Data

The importance of accurate input data cannot be overstated. Even a small error in any of the input parameters can significantly affect the calculated repayment plan.

For example, if the loan amount is underestimated, the monthly payment amount will be too low, leading to a longer repayment period and higher total interest paid. Conversely, if the loan amount is overestimated, the monthly payment amount will be too high, potentially creating financial hardship.

Are you looking for a tool to help you manage your student loan debt? A student loan repayment calculator can help you estimate your monthly payments, interest charges, and payoff date. If you’re struggling to repay your loans, you may want to consider seeking relief from the supreme court student loan debt relief program.

Regardless of your situation, a student loan repayment calculator can be a valuable resource for managing your debt.

Similarly, an inaccurate interest rate or loan term can lead to unrealistic repayment plans. An incorrect repayment method can also have a significant impact on the total cost of the loan.

Data Types

The following table summarizes the typical input parameters and their corresponding data types:

| Parameter | Data Type |

|---|---|

| Loan Amount | Currency |

| Interest Rate | Percentage |

| Loan Term | Years |

| Repayment Method | Text |

Calculation Methods

Student loan repayment calculators employ various calculation methods to estimate your monthly payments and repayment timeline. Each method has its advantages and drawbacks, depending on your specific loan terms and financial situation.

The two primary calculation methods are the simple interest method and the compound interest method.

Simple Interest Method

The simple interest method calculates interest on the principal loan amount only. This method is straightforward and easy to understand. However, it doesn’t account for the compounding effect of interest, which can lead to higher overall interest payments over the life of the loan.

Compound Interest Method

The compound interest method calculates interest on both the principal loan amount and the accumulated interest. This method more accurately reflects how interest accrues on most student loans. However, it can result in higher monthly payments and a longer repayment period compared to the simple interest method.

Repayment Options

Student loans offer multiple repayment options, catering to varying financial situations. Understanding these options is crucial for choosing the plan that best aligns with your budget and goals. Student loan repayment calculators can simplify this process by comparing different repayment plans and estimating monthly payments, interest paid, and total repayment time.

Standard Repayment Plan

The Standard Repayment Plan is a fixed-term plan with a set monthly payment and repayment period of 10 years for undergraduate loans and 25 years for graduate loans. This plan ensures that your loan is paid off by the end of the repayment term.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This plan can be beneficial if you expect your income to increase in the future.

Extended Repayment Plan

The Extended Repayment Plan offers a longer repayment period, up to 25 years for undergraduate loans and 30 years for graduate loans. This plan results in lower monthly payments but higher total interest paid over the life of the loan.

Income-Driven Repayment Plans

Income-Driven Repayment Plans base your monthly payments on your income and family size. These plans can significantly reduce your monthly payments, making them more affordable if you have a low income. However, they may extend the repayment period and result in paying more interest overall.

Interest Rates and Fees

Interest rates and fees significantly impact the total cost of student loan repayment. Higher interest rates result in more interest charges, increasing the overall amount you pay. Fees, such as origination fees and late payment penalties, further add to the cost of borrowing.

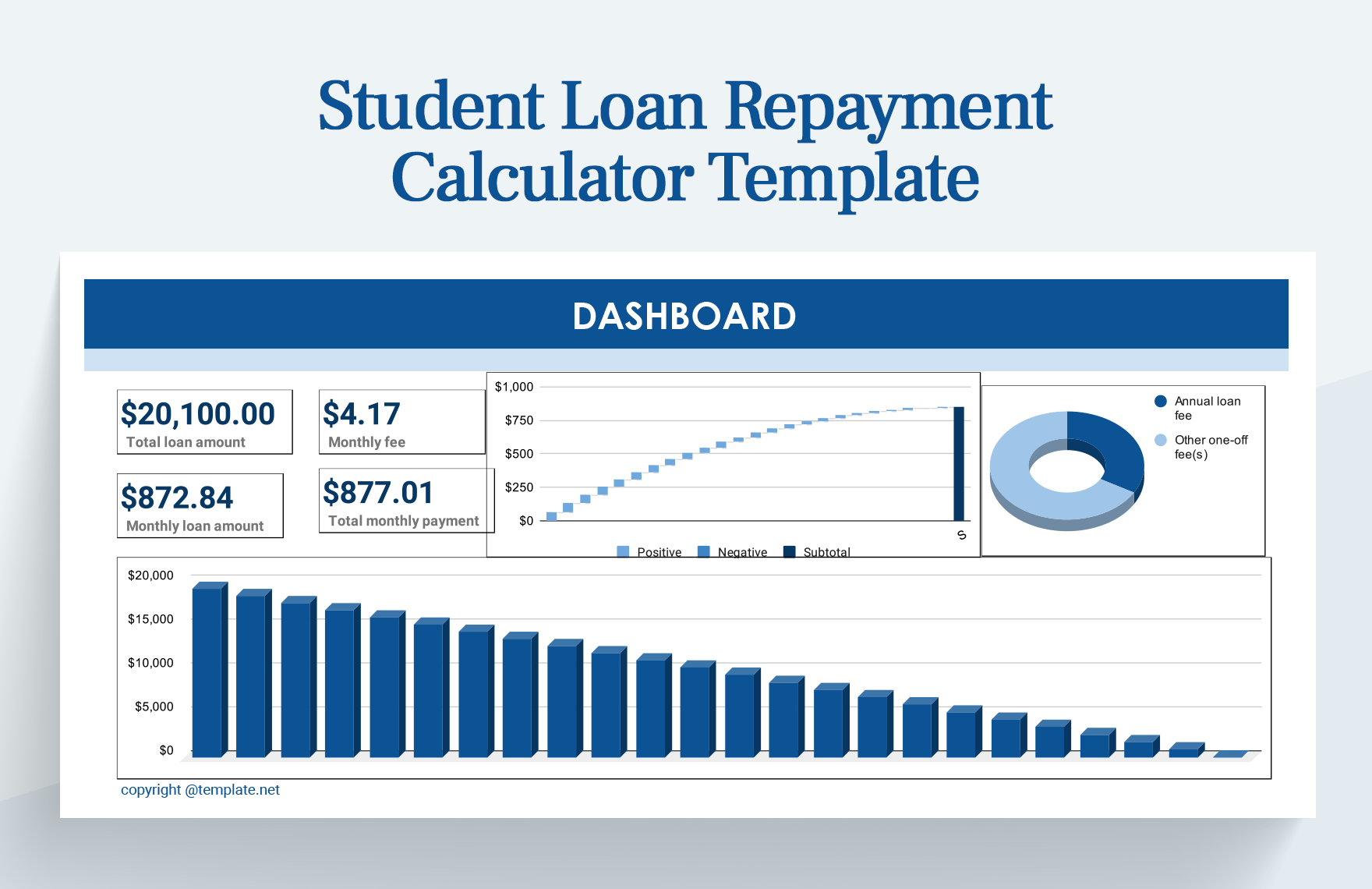

Using Calculators to Estimate Costs

Loan calculators are valuable tools for estimating interest charges and total repayment costs. These calculators typically require information such as the loan amount, interest rate, and loan term. By providing these details, you can get an estimate of your monthly payments and the total amount of interest you will pay over the life of the loan.

– Explain how loan term and duration impact monthly payments and overall repayment.

The loan term, or duration, is the length of time you have to repay your loan. It’s typically measured in months or years. The shorter the loan term, the higher your monthly payments will be, but you’ll pay less interest overall. The longer the loan term, the lower your monthly payments will be, but you’ll pay more interest overall.

Impact on Monthly Payments

The loan term has a direct impact on your monthly payments. The shorter the loan term, the higher your monthly payments will be. This is because you’re paying off the loan in a shorter amount of time, so you have to make larger payments each month. The longer the loan term, the lower your monthly payments will be. This is because you’re spreading the payments out over a longer period of time, so you can make smaller payments each month.

Impact on Overall Repayment

The loan term also has an impact on the overall amount of interest you’ll pay on your loan. The shorter the loan term, the less interest you’ll pay overall. This is because you’re paying off the loan more quickly, so you have less time to accrue interest. The longer the loan term, the more interest you’ll pay overall. This is because you’re spreading the payments out over a longer period of time, so you have more time to accrue interest.

Prepayment and Extra Payments

Prepaying or making extra payments on student loans offers significant benefits. It can shorten the loan term, reduce the total interest paid, and improve your financial standing. Loan calculators can help you determine the potential savings and optimize your repayment strategy.

Impact on Loan Term and Interest Paid

Extra payments directly reduce the loan balance, which in turn lowers the interest accrued each month. As a result, the loan can be paid off sooner, potentially saving thousands of dollars in interest charges. For example, if you have a $10,000 loan with a 6% interest rate and a 10-year term, making an extra payment of $100 per month could shorten the loan term by 2 years and save you over $1,000 in interest.

Credit Score and Debt-to-Income Ratio

Making extra payments on student loans can positively impact your credit score. Timely payments demonstrate responsible credit behavior, which can raise your score. Additionally, reducing your loan balance lowers your debt-to-income ratio, which is a key factor in qualifying for other loans or financial products.

Table: Cost of Loan with and without Extra Payments

| Scenario | Total Cost of Loan | Interest Paid | Loan Term |

|---|---|---|---|

| Without Extra Payments | $12,000 | $2,000 | 10 years |

| With Extra Payments of $100 per Month | $10,000 | $1,000 | 8 years |

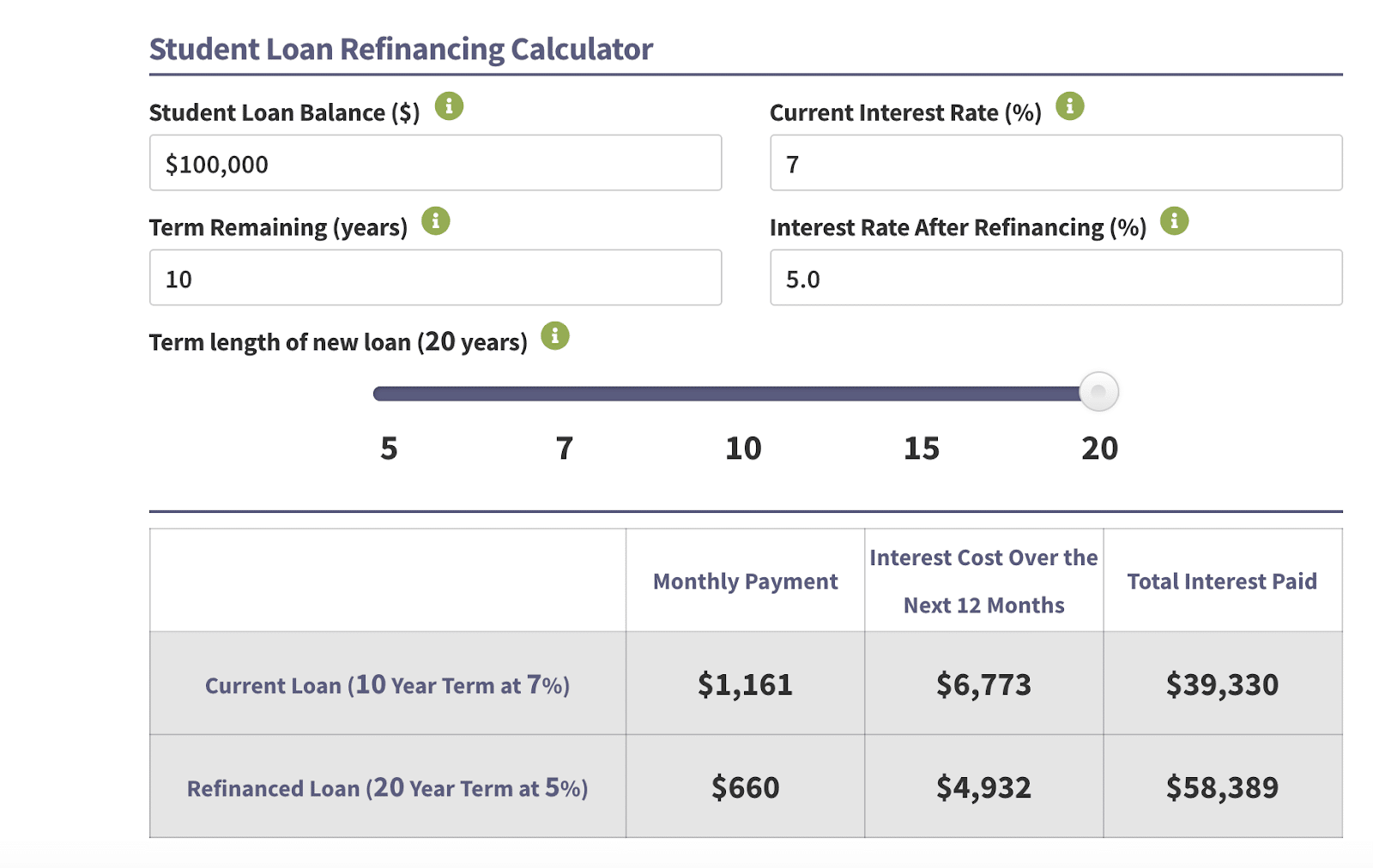

Refinancing and Consolidation

Student loan refinancing and consolidation are two strategies that can help you manage your student debt more effectively. Refinancing involves taking out a new loan to pay off your existing loans, while consolidation combines multiple loans into a single loan. Both options can offer benefits such as lower interest rates, reduced monthly payments, and extended loan terms.

Calculators for Evaluating Refinancing and Consolidation

Student loan repayment calculators can help you evaluate the potential benefits and risks of refinancing or consolidating your loans. These calculators take into account factors such as your current interest rates, loan balances, and desired repayment term to estimate your new monthly payments and overall repayment costs. By comparing the results of different scenarios, you can make an informed decision about whether refinancing or consolidation is right for you.

Personalized Repayment Plans

Student loan repayment calculators offer a valuable tool for creating personalized repayment plans tailored to individual circumstances. These calculators empower borrowers to explore various repayment options and make informed decisions about managing their student debt.

If you’re still repaying your student loans, a student loan repayment calculator can help you estimate your monthly payments and track your progress. With the recent news about Biden’s student loan forgiveness , it’s more important than ever to stay on top of your student loan payments.

A repayment calculator can help you determine if you qualify for forgiveness and plan your repayment strategy accordingly.

Factors to Consider When Customizing a Repayment Plan

When customizing a repayment plan, it’s essential to consider several key factors that influence the monthly payments and overall repayment timeline. These factors include:

- Loan amount: The total amount of student debt owed.

- Interest rate: The percentage charged on the outstanding loan balance.

- Loan term: The duration over which the loan is repaid.

- Income: The borrower’s monthly or annual income.

- Expenses: The borrower’s monthly or annual living expenses.

- Financial goals: The borrower’s short-term and long-term financial objectives.

Understanding the impact of these factors on the repayment plan is crucial for making informed decisions.

Sample Script for a Financial Advisor Explaining Personalized Repayment Plans to a Client

Financial Advisor: “Hello [client’s name], I’m here today to discuss personalized repayment plans for your student loans. We’ll explore various options and create a plan that aligns with your unique financial situation.”

“First, let’s gather information about your loan amount, interest rate, and loan term. We’ll also discuss your income, expenses, and financial goals.”

“Once we have this information, I’ll use a student loan repayment calculator to generate personalized repayment plans. We can compare different scenarios and choose the one that best suits your needs.”

“Remember, the goal is to create a plan that minimizes the overall cost of your loans while maximizing your financial flexibility.”

Tax Implications

Student loan repayments can impact taxes in several ways. Interest paid on federal student loans is tax-deductible, up to a certain amount. This means that you can reduce your taxable income by the amount of interest you pay on your student loans, which can save you money on your taxes.

To take advantage of this deduction, you must itemize your deductions on your tax return. You can use a tax calculator to estimate the amount of your potential tax savings.

Using Calculators to Estimate Tax Savings or Deductions

There are a number of online calculators that can help you estimate your potential tax savings from student loan interest deductions. These calculators typically ask for information about your income, filing status, and the amount of interest you paid on your student loans.

Once you have entered this information, the calculator will estimate the amount of your tax savings. You can then use this information to decide whether it is worth it to itemize your deductions on your tax return.

Accessibility and User Experience

When it comes to student loan repayment calculators, accessibility and user-friendly design are paramount. A well-designed calculator should be easy to navigate, understand, and use for individuals with diverse abilities and backgrounds.

Some key accessibility features to consider include:

- Screen reader compatibility

- Keyboard navigation

- Color contrast

- Clear and concise language

Calculators that meet these criteria ensure that all users can access and benefit from the information they provide.

Calculating student loan repayment can be daunting, but using a student loan repayment calculator can make it easier. If you’re looking for the latest student loan news and updates, visit student loan news . There, you’ll find information on repayment plans, loan forgiveness programs, and more.

Once you have a better understanding of your repayment options, you can use a student loan repayment calculator to create a personalized repayment plan that works for you.

Examples of Well-Designed Calculators, Student loan repayment calculator

Here are some examples of well-designed student loan repayment calculators:

- Federal Student Aid Repayment Estimator: This calculator is provided by the U.S. Department of Education and offers a comprehensive range of options for estimating student loan repayments.

- NerdWallet Student Loan Calculator: This calculator is known for its user-friendly interface and provides detailed information on repayment plans and interest rates.

- Bankrate Student Loan Calculator: This calculator offers a variety of features, including the ability to compare different repayment options and see how extra payments can impact your overall repayment.

These calculators are designed to be accessible and easy to use for all individuals, regardless of their abilities or backgrounds.

Impact of Accessibility on User Experience

Accessibility plays a crucial role in enhancing the user experience of student loan repayment calculators. When a calculator is accessible, it empowers users to make informed decisions about their student loans and repayment options.

For individuals with disabilities, accessible calculators provide equal access to information and tools that can help them manage their student loans effectively. By removing barriers to access, these calculators promote inclusivity and ensure that everyone can benefit from the resources available.

In conclusion, accessibility and user-friendly design are essential for student loan repayment calculators. By incorporating these features, calculators can empower all users to make informed decisions about their student loans and achieve their financial goals.

Case Studies and Examples

Student loan repayment calculators have proven to be invaluable tools for individuals navigating the complexities of student loan repayment. Here are some real-world examples of how these calculators have made a significant impact on financial decisions:

One study found that individuals who used a student loan repayment calculator were more likely to make extra payments on their loans, which resulted in significant savings over the life of the loan. Another study showed that calculators helped borrowers choose the repayment plan that best suited their financial situation, leading to lower monthly payments and faster repayment.

Example 1

Jane, a recent college graduate with $50,000 in student loan debt, used a repayment calculator to explore her options. The calculator showed her that if she made extra payments of $100 per month, she could save over $10,000 in interest and pay off her loan five years earlier.

Example 2

John, a medical resident with a high-interest student loan, used a repayment calculator to compare different repayment plans. The calculator helped him choose an income-driven repayment plan that reduced his monthly payments by over $500, allowing him to focus on building his career without being burdened by excessive student loan payments.

Additional Features and Resources

Beyond the core functionality of calculating repayment plans, student loan repayment calculators can offer additional features and resources to enhance their usefulness. These features provide users with more comprehensive insights, personalized support, and access to valuable information.

By integrating additional tools and resources, student loan repayment calculators become more than just number-crunching tools. They evolve into comprehensive financial planning aids, empowering users to make informed decisions about their student loan management.

As you navigate the complexities of student loan repayment, it’s essential to arm yourself with the right tools. A student loan repayment calculator can provide valuable insights into your repayment options. While navigating the repayment process, it’s equally crucial to stay informed about potential student loan forgiveness programs.

These programs can offer financial relief and make repayment more manageable. By utilizing a student loan repayment calculator and staying abreast of forgiveness options, you can effectively manage your student debt and achieve your financial goals.

Comparison Tools

Comparison tools allow users to evaluate multiple repayment options side-by-side. This enables them to compare the monthly payments, interest charges, and total repayment amounts associated with different plans. By visualizing the impact of different choices, users can make more informed decisions about the best repayment strategy for their financial situation.

Personalized Recommendations

Some calculators offer personalized recommendations based on individual circumstances. They consider factors such as income, debt-to-income ratio, and credit history to tailor repayment plans that are aligned with each user’s financial goals and constraints. These personalized recommendations provide users with a clear roadmap for managing their student loans effectively.

Integration with Financial Planning Tools

Integrating student loan repayment calculators with budgeting apps or investment platforms offers a holistic view of one’s financial situation. Users can track their loan payments alongside other financial commitments, such as expenses, savings, and investments. This comprehensive view helps users make informed decisions about allocating their resources and prioritizing their financial goals.

Educational Resources

Many calculators provide access to educational resources, such as articles, videos, or webinars, on student loan management. These resources offer valuable insights into topics such as understanding interest rates, managing multiple loans, and exploring loan forgiveness programs. By providing educational content, calculators empower users to become more knowledgeable and confident in managing their student loans.

Last Recap

Remember, student loan repayment is not a one-size-fits-all endeavor. Our calculator empowers you to explore different repayment options, compare scenarios, and make informed decisions that suit your individual circumstances. Whether you’re seeking to minimize interest payments, shorten your loan term, or simply gain a clearer understanding of your loan’s trajectory, our calculator is your trusted companion. Take control of your student loan journey today and unlock the financial clarity you deserve.

FAQ Overview: Student Loan Repayment Calculator

How does the student loan repayment calculator work?

Our calculator uses advanced algorithms to analyze your loan details, including loan amount, interest rate, loan term, and repayment method. Based on these inputs, it calculates your monthly payments, total interest paid, and total amount repaid over the life of your loan.

Can I compare different repayment options using the calculator?

Absolutely! Our calculator allows you to compare various repayment plans side-by-side. This feature empowers you to evaluate the pros and cons of each option, enabling you to choose the plan that best aligns with your financial goals and preferences.

What if I want to make extra payments on my loan?

Our calculator can also factor in extra payments, helping you estimate the potential savings on interest and the reduction in your loan term. By exploring different extra payment scenarios, you can optimize your repayment strategy and achieve your financial goals faster.