Student loan relief has emerged as a crucial topic in the financial landscape, with millions of Americans seeking ways to manage their student loan debt. This comprehensive guide delves into the intricacies of student loan relief, empowering you with the knowledge and strategies to navigate your options effectively.

From understanding the different types of relief programs to exploring innovative approaches, this guide provides a holistic view of student loan relief, helping you make informed decisions and take control of your financial future.

Definition of Student Loan Relief

Student loan relief refers to a range of government programs and initiatives designed to assist borrowers in managing or repaying their student loans. These programs can provide various forms of financial aid, such as loan forgiveness, reduced interest rates, or extended repayment plans.

Types of Student Loan Relief Programs

There are several types of student loan relief programs available, each with its own eligibility criteria and benefits:

- Loan Forgiveness Programs: These programs provide complete or partial cancellation of student loan debt after a certain period of service or under specific circumstances, such as working in public service or teaching in low-income schools.

- Income-Driven Repayment Plans: These plans adjust monthly loan payments based on the borrower’s income and family size, making repayment more manageable for those with limited financial means.

- Loan Consolidation: This option allows borrowers to combine multiple student loans into a single loan with a weighted average interest rate, potentially reducing monthly payments.

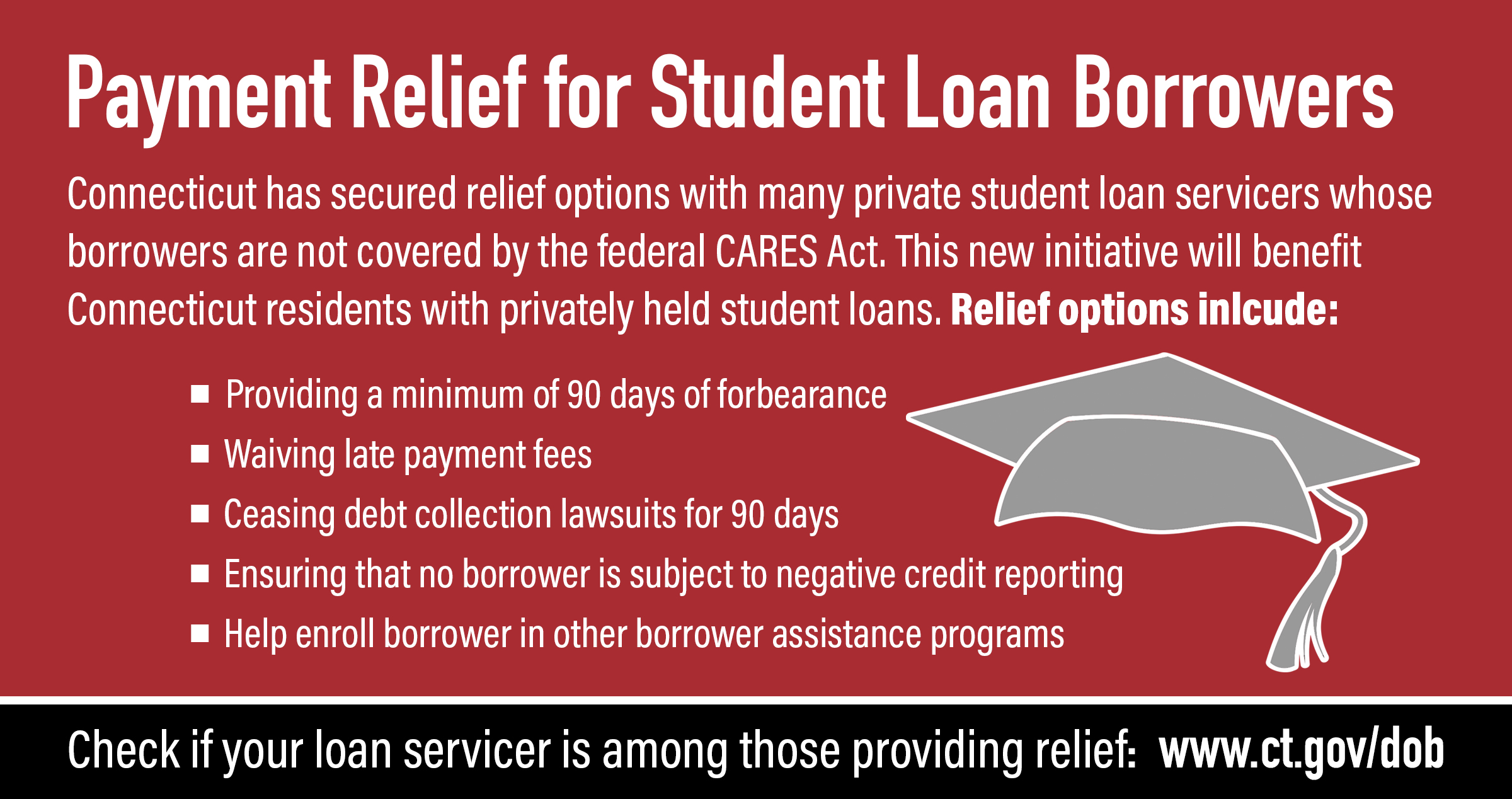

- Deferment and Forbearance: These programs allow borrowers to temporarily pause or reduce loan payments during periods of financial hardship or while pursuing certain educational or military obligations.

History of Student Loan Relief

The history of student loan relief in the United States is a long and complex one, with roots in the 1960s and 1970s. The first major student loan relief program was the Higher Education Act of 1965, which created the Federal Family Education Loan Program (FFELP). This program provided low-interest loans to students from low-income families.

In the 1970s, the government expanded student loan relief programs with the creation of the Pell Grant program and the Guaranteed Student Loan (GSL) program. These programs provided grants and loans to students from all income levels.

Impact of Student Loan Relief Programs

Student loan relief programs have had a significant impact on borrowers and the overall economy. These programs have helped to make college more affordable for millions of students, and they have also helped to reduce the overall burden of student debt.

One of the most significant impacts of student loan relief programs has been the reduction in the default rate on student loans. In the early 1990s, the default rate on student loans was over 20%. Today, the default rate is less than 10%.

Student loan relief programs have also helped to reduce the overall burden of student debt. In 2007, the average student loan debt was over $20,000. Today, the average student loan debt is less than $30,000.

Eligibility for Student Loan Relief

Determining eligibility for student loan relief programs involves assessing various factors, including income, debt level, and repayment history. These criteria help ensure that the relief is targeted to those who need it most.

To qualify for student loan relief, borrowers must typically meet certain income thresholds. These thresholds vary depending on the specific program and may be based on individual or household income. For example, the Public Service Loan Forgiveness program requires borrowers to work full-time in a public service job for at least 10 years while making qualifying payments on their student loans. To be eligible, borrowers must also have a federal student loan balance of less than $50,000.

In addition to income, debt level is also a factor in determining eligibility for student loan relief. Some programs, such as the Total and Permanent Disability Discharge, may forgive student loans for borrowers who are unable to work due to a disability. Other programs, such as the Perkins Loan Cancellation program, may provide loan forgiveness to borrowers who work in certain fields, such as teaching or nursing.

Repayment history is another factor that may be considered when determining eligibility for student loan relief. Borrowers who have made consistent and timely payments on their student loans may be more likely to qualify for relief programs. For example, the Income-Driven Repayment program allows borrowers to cap their monthly student loan payments at a percentage of their income. Borrowers who have made payments under an income-driven repayment plan for 20 or 25 years may be eligible for loan forgiveness.

Benefits of Student Loan Relief

Student loan relief can bring a myriad of benefits to both individuals and the economy as a whole. It has the potential to enhance financial stability, reduce the burden of debt, and foster economic growth.

One of the most significant benefits of student loan relief is its ability to improve financial stability for individuals. When borrowers are no longer burdened by heavy student loan payments, they have more disposable income to cover essential expenses, save for the future, and invest in their own financial well-being. This financial freedom can lead to greater peace of mind and a more secure financial future.

Reduced Debt Burden

Student loan relief can also significantly reduce the overall debt burden for individuals. By eliminating or reducing student loan debt, borrowers can free up a substantial amount of money that can be used to pay off other debts, purchase a home, or invest in their education or career. This reduction in debt can have a profound impact on individuals’ financial lives, allowing them to achieve their financial goals more quickly and easily.

Economic Growth

Student loan relief can also have a positive impact on the economy as a whole. When individuals have more disposable income, they are more likely to spend it on goods and services, which can stimulate economic growth. Additionally, reducing the burden of student loan debt can make it easier for individuals to start businesses, invest in their education, and pursue career opportunities that require additional training or certification. This can lead to increased productivity, innovation, and economic growth.

Challenges of Student Loan Relief

Student loan relief programs, while well-intentioned, face several challenges and limitations. These include:

- Increased government spending: Student loan forgiveness or repayment assistance can place a significant financial burden on the government. The cost of such programs must be carefully considered and weighed against other government priorities.

- Moral hazard: Student loan relief may create a moral hazard, where borrowers may take on more debt in the future, expecting that it will be forgiven or reduced in the future. This can lead to unsustainable levels of student debt and undermine the responsibility of borrowers.

Unintended Consequences

In addition to these challenges, student loan relief programs may also have unintended consequences. For example:

- Inflation: Forgiveness of a large amount of student debt could potentially lead to inflation, as the increased money supply may outpace the production of goods and services.

- Reduced incentives for higher education: If student loans are forgiven or made more affordable, it could reduce the incentive for students to pursue higher education, as they may perceive a lower return on investment.

Current State of Student Loan Relief

The current state of student loan relief in the United States is complex and evolving. The Biden administration has made student loan forgiveness a priority, and there have been a number of recent developments and policy changes related to this issue.

One of the most significant developments is the extension of the student loan payment pause, which was first implemented in March 2020 due to the COVID-19 pandemic. The payment pause has been extended several times and is currently set to expire on August 31, 2023. This has provided much-needed relief to millions of borrowers who have been struggling to make their payments.

In addition to the payment pause, the Biden administration has also announced a number of other student loan relief measures, including:

Debt Cancellation

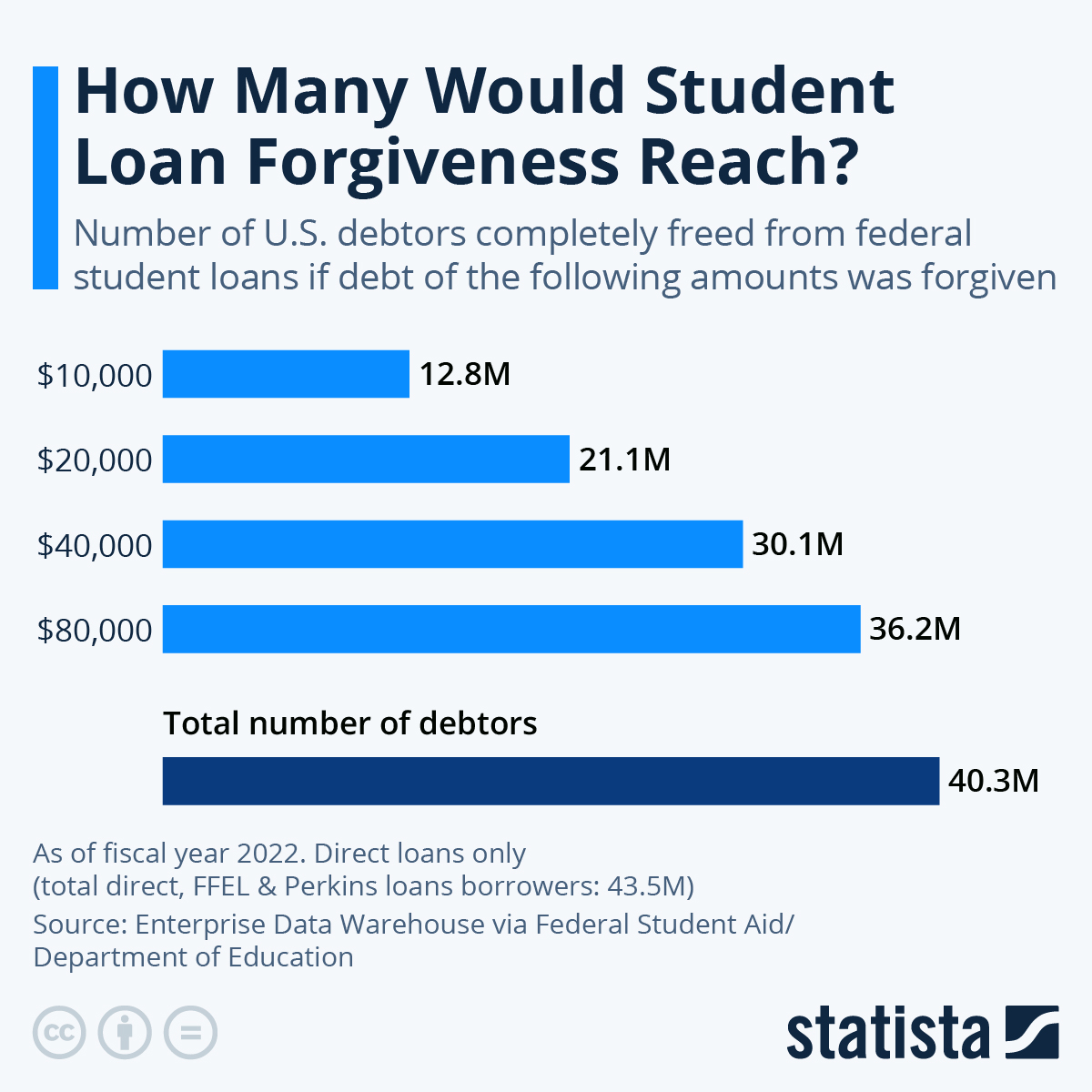

- Forgiveness of up to $10,000 in federal student loans for borrowers who earn less than $125,000 per year (or $250,000 for married couples).

- Forgiveness of up to $20,000 in federal student loans for borrowers who received Pell Grants.

Income-Driven Repayment

- Expansion of income-driven repayment plans, which allow borrowers to cap their monthly payments at a percentage of their income.

- Forgiveness of remaining student loan debt after 20 years of payments under income-driven repayment plans.

These measures are a significant step towards addressing the student loan crisis in the United States. However, it is important to note that they are still subject to legal challenges and may not ultimately be implemented.

– Explore potential future directions for student loan relief policy.

As the student loan crisis continues to grow, policymakers are exploring a range of potential future directions for student loan relief policy. One option is to expand the eligibility for existing relief programs, such as the Public Service Loan Forgiveness program or the Income-Driven Repayment program. Another option is to create new relief programs, such as a program that would forgive a certain amount of student debt for all borrowers or a program that would allow borrowers to refinance their student loans at a lower interest rate.

Policymakers are also considering a range of other options, such as increasing the amount of student debt that can be forgiven through bankruptcy, allowing borrowers to consolidate their student loans into a single loan with a lower interest rate, or providing more funding for student loan counseling and financial literacy programs.

Emerging trends and innovations in student loan relief programs

In recent years, there have been a number of emerging trends and innovations in student loan relief programs. One trend is the increasing use of technology to streamline the application process and make it easier for borrowers to access relief. For example, the Department of Education has launched a new online portal that allows borrowers to apply for multiple relief programs at once.

Another trend is the development of new repayment plans that are designed to make it easier for borrowers to repay their student loans. For example, the Department of Education has introduced a new Income-Driven Repayment plan that caps monthly payments at 10% of a borrower’s discretionary income.

Successful student loan relief programs and their impact

There are a number of successful student loan relief programs that have had a positive impact on borrowers. One example is the Public Service Loan Forgiveness program, which has forgiven over $10 billion in student debt for public service workers. Another example is the Income-Driven Repayment program, which has helped over 1 million borrowers reduce their monthly payments.

These programs have had a significant impact on the lives of borrowers. For example, a study by the Center for American Progress found that borrowers who participated in the Public Service Loan Forgiveness program were more likely to stay in public service jobs and less likely to default on their student loans.

Challenges and obstacles to implementing future student loan relief initiatives

There are a number of challenges and obstacles to implementing future student loan relief initiatives. One challenge is the cost of these initiatives. For example, a proposal to forgive all student debt would cost the federal government over $1 trillion.

Another challenge is the political opposition to student loan relief. Some policymakers argue that student loan relief is unfair to taxpayers who did not attend college or who have already paid off their student loans.

Table of Student Loan Relief Programs

Navigating the complexities of student loan repayment can be daunting. To assist you, we present a comprehensive table outlining various student loan relief programs, their eligibility criteria, benefits, and potential drawbacks. By understanding these options, you can make informed decisions about managing your student loan debt.

These programs offer a range of options to help borrowers reduce their monthly payments, qualify for loan forgiveness, or consolidate their loans. However, it’s important to carefully consider the eligibility requirements and potential drawbacks of each program to determine the best fit for your individual circumstances.

Eligibility Criteria

Eligibility for student loan relief programs varies depending on the program. Some programs, such as Public Service Loan Forgiveness, have specific requirements related to employment or income. Others, such as Income-Driven Repayment Plans, are based on financial need. It’s important to review the eligibility criteria carefully to determine if you qualify for a particular program.

Student loan relief is a topic of great interest to many Americans. Nelnet, a leading student loan servicer, has been at the forefront of this issue. The company has recently announced a series of measures to provide relief to borrowers, including reducing interest rates and extending repayment terms.

These measures have been welcomed by many, and they are expected to have a positive impact on the lives of millions of Americans. If you are a student loan borrower, it is important to stay informed about the latest developments in student loan relief.

You can find more information on Nelnet’s website, nelnet student loan .

Benefits

The benefits of student loan relief programs can be substantial. Some programs offer loan forgiveness, which can eliminate your student loan debt entirely. Others provide interest rate reductions or payment deferment, which can make your monthly payments more manageable. Understanding the benefits of each program can help you choose the option that best meets your needs.

Potential Drawbacks

While student loan relief programs can provide significant benefits, there are also potential drawbacks to consider. Some programs may have tax implications or impact your credit score. Others may extend the repayment period, which could result in paying more interest over time. It’s important to weigh the potential benefits and drawbacks carefully before enrolling in a student loan relief program.

Case Studies of Student Loan Relief

Student loan relief programs have had a profound impact on the lives of countless individuals, helping them overcome financial burdens and achieve their goals. Here are a few case studies that illustrate the transformative power of student loan relief:

One of the most significant benefits of student loan relief is the reduction of financial stress. Many individuals who have benefited from these programs have reported feeling a sense of relief and freedom from the weight of overwhelming debt. This can lead to improved mental health and well-being, as well as increased financial security.

Case Study: Sarah

Sarah is a single mother of two who graduated from college with over $100,000 in student loan debt. She worked hard to make her payments, but she struggled to keep up with the high interest rates and fees. After years of financial hardship, Sarah applied for and received loan forgiveness through the Public Service Loan Forgiveness program. This program forgives the remaining balance of federal student loans for individuals who work full-time in public service jobs for 10 years.

For Sarah, loan forgiveness meant a fresh start. She was able to use the money she had been spending on student loan payments to pay down other debts, save for her children’s education, and invest in her own future. She is now financially stable and has a brighter outlook on life.

Impact of Student Loan Relief on the Economy

Student loan relief programs have a significant impact on the economy. By reducing the financial burden of student debt, these programs can free up money that consumers can spend on other goods and services, leading to increased economic activity.

Potential Effects on GDP, Job Creation, and Overall Economic Growth

The potential effects of student loan relief on GDP, job creation, and overall economic growth are complex and uncertain. Some studies have found that student loan relief could lead to a modest increase in GDP, while others have found that the impact would be negligible. Similarly, some studies have found that student loan relief could lead to a small increase in job creation, while others have found that the impact would be too small to measure. The overall impact of student loan relief on economic growth is likely to depend on a variety of factors, including the size and scope of the relief program, the economic conditions at the time the program is implemented, and the behavior of consumers and businesses.

– Discuss the role of the government in providing student loan relief.

The government plays a critical role in providing student loan relief to borrowers facing financial hardship. By implementing various programs and policies, the government aims to make higher education more accessible and affordable for all students.

[detailed content here]

Ethical Considerations in Student Loan Relief

Student loan relief is a complex issue with many ethical considerations. Some argue that it is unfair to forgive student loans, as it would benefit those who have already made sacrifices to pay off their debts. Others argue that student loan relief is necessary to help struggling borrowers and to promote economic growth.

Fairness and Equity, Student loan relief

One of the main ethical concerns about student loan relief is whether or not it is fair. Some people argue that it is unfair to forgive student loans, as it would benefit those who have already made sacrifices to pay off their debts. They argue that these borrowers would be subsidizing the education of future students, who would not have to make the same sacrifices.

If you’re struggling with student loan debt, there’s good news. The government has recently announced several new programs to help borrowers. To stay up-to-date on the latest developments, check out student loan news . You’ll find information on everything from loan forgiveness to repayment plans.

Others argue that student loan relief is necessary to help struggling borrowers. They argue that the current system of student loans is unfair, as it often leaves borrowers with crushing debt that they cannot afford to repay. They argue that student loan relief would help to level the playing field and give borrowers a chance to succeed.

Impact on the Economy

Another ethical concern about student loan relief is its potential impact on the economy. Some argue that student loan relief would be a waste of money, as it would simply add to the national debt. Others argue that student loan relief would actually boost the economy, as it would free up money that borrowers could spend on other things, such as buying homes or starting businesses.

The economic impact of student loan relief is a complex issue that is difficult to predict. However, there is some evidence to suggest that student loan relief could have a positive impact on the economy. For example, a study by the Center for American Progress found that student loan relief could increase GDP by $100 billion over the next decade.

Student loan relief is a hot topic right now, and there are a lot of different opinions about it. Some people believe that student loan forgiveness is the best way to help borrowers, while others believe that it’s unfair to taxpayers.

The Biden administration has proposed a plan for student loan forgiveness, and it’s currently being debated in Congress. For more information on the latest developments, check out student loan forgiveness biden . Regardless of your opinion on student loan relief, it’s important to be informed about the issue so that you can make an informed decision about what you believe is the best course of action.

Role of Government

The role of government in providing student loan relief is another important ethical consideration. Some argue that the government should not be involved in student lending at all. They argue that the private sector is better equipped to provide student loans, and that government involvement only drives up the cost of college.

Others argue that the government has a responsibility to ensure that all students have access to affordable higher education. They argue that student loan relief is one way to make college more affordable and to help students succeed.

The role of government in providing student loan relief is a complex issue that is likely to continue to be debated for years to come.

Best Practices for Student Loan Relief

Student loan relief programs can be a lifeline for borrowers struggling to repay their debt. However, implementing and managing these programs effectively is crucial to ensure they achieve their intended goals. Here are some best practices to consider:

By following these best practices, policymakers and administrators can maximize the effectiveness and efficiency of student loan relief programs, ensuring that they provide meaningful assistance to borrowers in need.

Student loan relief has been a hot topic in recent months, with many borrowers wondering when they can expect to see their debt forgiven. While the exact date of when student loan forgiveness will be applied is still unknown, the Biden administration has proposed a plan that would forgive up to $20,000 in student debt for federal student loan borrowers.

The plan is currently being reviewed by the Department of Education, and it is expected to be finalized in the coming months. You can learn more about when student loan forgiveness will be applied by clicking here . Student loan relief is a complex issue, but the Biden administration’s plan is a step in the right direction.

Developing Effective Communication Strategies

Effective communication is essential to ensure that borrowers are aware of student loan relief options and can access them easily. Here are some strategies to consider:

- Use clear and concise language in all communication materials.

- Provide borrowers with multiple channels to access information, such as a dedicated website, hotline, and social media.

- Partner with organizations that serve borrowers, such as financial aid offices and community groups, to disseminate information.

- Regularly update communication materials to reflect changes in program eligibility and requirements.

Innovations in Student Loan Relief

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/L4LI4EI6CZGOFIL47BQVBCQJWA.jpg)

Student loan relief has been a topic of discussion for many years, and there have been a number of innovative approaches to the issue. These approaches have the potential to improve the delivery and effectiveness of student loan relief programs.

Technology-enabled solutions

Technology can play a key role in improving the delivery of student loan relief. For example, online platforms can be used to automate the process of applying for and receiving relief. This can make it easier for borrowers to access the relief they need. Additionally, data analytics can be used to identify borrowers who are most likely to benefit from relief. This can help to ensure that relief is targeted to those who need it most.

Future Research on Student Loan Relief

Research on student loan relief is crucial for understanding its effectiveness and identifying areas for improvement. Future research should focus on:

- Impact on Borrowers: Examining the long-term impact of student loan relief programs on borrowers’ financial well-being, educational attainment, and career trajectories.

- Program Design: Evaluating the effectiveness of different student loan relief program designs, such as income-driven repayment plans, loan forgiveness, and debt cancellation.

- Cost and Sustainability: Assessing the fiscal impact of student loan relief programs and exploring sustainable funding mechanisms to ensure their long-term viability.

- Equity and Access: Investigating how student loan relief programs can be tailored to address equity gaps and improve access to higher education for underserved populations.

- Policy Implications: Analyzing the potential policy implications of student loan relief programs, including their impact on higher education financing and the broader economy.

Future research should employ a mix of qualitative and quantitative methods, including surveys, longitudinal studies, economic modeling, and policy analysis.

Potential Research Questions

| Area | Topics | Methods |

|---|---|---|

| Impact on Borrowers | Effects on financial stability, educational outcomes, career advancement | Surveys, longitudinal studies |

| Program Design | Effectiveness of income-driven repayment plans, loan forgiveness, debt cancellation | Economic modeling, policy analysis |

| Cost and Sustainability | Fiscal impact, funding mechanisms | Economic modeling, policy analysis |

| Equity and Access | Impact on underserved populations, barriers to participation | Surveys, qualitative research |

| Policy Implications | Impact on higher education financing, broader economy | Policy analysis, economic modeling |

The findings of future research will inform policy decisions and improve the effectiveness of student loan relief programs, ultimately benefiting borrowers and the economy as a whole.

Ultimate Conclusion

Student loan relief is not just a financial aid; it’s an investment in your future. By understanding the available options and leveraging the strategies Artikeld in this guide, you can optimize your student loan repayment journey, reduce your financial burden, and unlock your full financial potential.

FAQ Overview

What are the different types of student loan relief programs?

There are various types of student loan relief programs, including loan forgiveness, income-driven repayment plans, and student loan consolidation.

How do I qualify for student loan relief?

Eligibility for student loan relief programs varies depending on the specific program. Generally, factors such as income, debt level, and repayment history are considered.

What are the benefits of student loan relief?

Student loan relief can provide numerous benefits, such as reducing monthly payments, qualifying for loan forgiveness, and improving overall financial stability.

What are the challenges of student loan relief?

Potential challenges of student loan relief include increased government spending, unintended consequences, and the potential impact on future loan eligibility.