Student loan interest is a significant aspect of financing higher education, shaping the overall cost and repayment journey for millions of borrowers. Understanding the complexities of student loan interest rates, types, and strategies for managing it effectively is crucial for financial well-being.

This comprehensive guide delves into the intricacies of student loan interest, providing insights into its impact on monthly payments, total loan costs, and long-term financial goals. We’ll explore different types of interest rates, eligibility for tax deductions, and the nuances of refinancing and consolidation.

Student Loan Interest Overview

:max_bytes(150000):strip_icc()/how-to-calculate-student-loan-interest-4772208_final-39fc8391e4e2462e91d1632c7f8abe72.png)

Student loan interest refers to the additional cost borrowers pay on top of the principal amount they borrowed. This interest accumulates over time and can significantly increase the total cost of repaying student loans.

Amount of Student Loan Interest Paid in the US

According to the Federal Reserve, Americans collectively owed approximately $1.78 trillion in student loan interest in 2022. This staggering amount highlights the significant financial burden that student loan interest places on borrowers.

Student loan interest rates can add up over time, making it difficult to pay off your debt. If you’re struggling to make payments, you may be eligible for student loan forgiveness through the supreme court student loan forgiveness program. This program allows you to have your student loans forgiven after making a certain number of payments, depending on your income and other factors.

To find out if you qualify, contact your loan servicer.

Types of Student Loan Interest

Understanding the types of student loan interest is crucial for making informed decisions about your education financing. There are two main categories of student loans based on interest: subsidized and unsubsidized.

Subsidized and Unsubsidized Student Loans, Student loan interest

- Subsidized Loans: The federal government pays the interest on subsidized loans while you’re in school at least half-time, during the six-month grace period after you leave school, and during periods of deferment.

- Unsubsidized Loans: You are responsible for paying the interest on unsubsidized loans from the moment they are disbursed. Interest that is not paid will be capitalized, meaning it will be added to the principal balance of your loan, increasing the total amount you owe.

Fixed and Variable Interest Rates

Student loan interest rates can be either fixed or variable.

- Fixed Interest Rates: The interest rate on your loan remains the same throughout the life of the loan, regardless of market fluctuations.

- Variable Interest Rates: The interest rate on your loan can change over time, based on a market index. This means that your monthly payments could increase or decrease over time.

Comparison of Subsidized and Unsubsidized Student Loans

| Feature | Subsidized Loans | Unsubsidized Loans |

|---|---|---|

| Interest Paid by | Federal government (while in school, during grace period, and during deferment) | Borrower (from the moment the loan is disbursed) |

| Interest Capitalization | No | Yes |

| Eligibility | Based on financial need | Not based on financial need |

Pros and Cons of Fixed and Variable Interest Rates

Fixed Interest Rates

- Pros: Predictable monthly payments, peace of mind knowing your interest rate won’t change

- Cons: May be higher than variable rates initially, less potential for savings if interest rates fall

Variable Interest Rates

- Pros: May be lower than fixed rates initially, potential for savings if interest rates fall

- Cons: Monthly payments can fluctuate, uncertainty about future interest rates

“Understanding student loan interest rates is essential for managing your student debt effectively. By comparing different types of loans and interest rates, you can make informed decisions that will save you money in the long run.” – Mark Kantrowitz, student loan expert

Explain how student loan interest accrues and its impact on the total cost of borrowing.

Student loan interest is a major factor that can significantly increase the total cost of borrowing for higher education. Interest accrues on student loans from the moment they are disbursed, even during periods of deferment or forbearance. This means that borrowers are paying interest on the initial loan amount, as well as on the accumulated interest, which can lead to a snowball effect and a higher overall cost of borrowing.

Impact on Total Cost

The impact of student loan interest on the total cost of borrowing can be substantial. For example, a borrower who takes out a $10,000 student loan with a 6% interest rate and a 10-year repayment term will end up paying a total of $16,425. This includes $6,425 in interest, which is more than half of the original loan amount.

Student Loan Interest Deduction

The student loan interest deduction is a tax break that allows eligible borrowers to deduct a portion of the interest they pay on their student loans. This deduction can reduce your taxable income, which can save you money on your taxes.

Student loan interest rates can be a heavy burden for borrowers, especially those who are struggling to make ends meet. Fortunately, there are several options available for student loan forgiveness debt relief, which can help borrowers reduce or eliminate their student loan debt.

For more information on student loan forgiveness debt relief, visit here . Student loan interest rates can vary depending on the type of loan and the borrower’s creditworthiness, so it is important to shop around for the best rates before taking out a student loan.

To be eligible for the student loan interest deduction, you must meet the following requirements:

- You must have paid interest on a qualified student loan during the tax year.

- Your filing status must be single, married filing jointly, or married filing separately.

- Your modified adjusted gross income (MAGI) must be below certain limits.

The amount of the deduction is limited to $2,500 per year. If your MAGI is above a certain limit, your deduction may be phased out.

To claim the student loan interest deduction, you must complete the IRS Form 1040 and attach Schedule I (Form 1040), Student Loan Interest Deduction.

The student loan interest deduction can save you a significant amount of money on your taxes. For example, if you pay $1,000 in student loan interest and your marginal tax rate is 25%, the deduction will save you $250 in taxes.

There have been no recent changes or updates to the student loan interest deduction.

| Requirement | Limit |

|---|---|

| MAGI | $85,000 for single filers |

| $170,000 for married couples filing jointly | |

| Deduction | $2,500 |

Explain the differences between refinancing and consolidation

Refinancing and consolidation are two common ways to manage student loan debt. While both options can help you lower your interest rates and monthly payments, there are some key differences between the two.

The weight of student loan interest can feel overwhelming, leaving many struggling to make ends meet. However, there is a glimmer of hope on the horizon with the recent announcement of biden student loan debt relief . While this initiative provides much-needed assistance, it’s important to remember that student loan interest will continue to accrue on any remaining balance.

Therefore, it’s crucial to explore all available options for managing your student loan debt effectively.

Refinancing

Refinancing involves taking out a new loan to pay off your existing student loans. This can be a good option if you have good credit and can qualify for a lower interest rate. Refinancing can also help you consolidate your loans into a single monthly payment.

Consolidation

Consolidation involves combining your existing student loans into a single loan with a weighted average interest rate. This can be a good option if you have multiple student loans with different interest rates. Consolidation can also help you simplify your monthly payments.

When it comes to student loans, understanding the interest rates is crucial. If you’re looking for a comprehensive guide to student loan interest, consider exploring Aidvantage Student Loan . This platform provides detailed information on interest rates, repayment options, and more.

With this knowledge, you can make informed decisions about your student loan repayment journey.

Government Assistance Programs for Student Loans

Government assistance programs can provide significant relief to borrowers struggling with student loan debt. These programs offer a range of options, including loan forgiveness, income-driven repayment plans, and interest rate reduction.

Eligibility Requirements

Eligibility for government assistance programs varies depending on the specific program. However, common eligibility requirements include:

- Being a U.S. citizen or permanent resident

- Having federal student loans

- Meeting income and/or debt-to-income ratio requirements

Application Procedures

To apply for government assistance programs, borrowers can typically submit an application online or by mail. The application process may involve providing documentation to verify income, employment, and other eligibility factors.

Loan Forgiveness Programs

Loan forgiveness programs provide complete or partial cancellation of student loan debt after a certain period of time or under specific circumstances. Common loan forgiveness programs include:

- Public Service Loan Forgiveness (PSLF): Forgives loans for borrowers who work in public service jobs for 10 years

- Teacher Loan Forgiveness: Forgives loans for teachers who work in low-income schools for 5 years

- Income-Driven Repayment (IDR) Forgiveness: Forgives loans for borrowers who make payments under an IDR plan for 20 or 25 years

Impact of Government Assistance Programs

Government assistance programs can have a significant impact on student loan debt and overall financial well-being. These programs can help borrowers reduce their monthly payments, qualify for loan forgiveness, and improve their credit scores.

Resources for Borrowers

Borrowers can learn more about government assistance programs and apply for them through the following resources:

- Federal Student Aid website: https://studentaid.gov/

- National Student Loan Data System (NSLDS): https://nslds.ed.gov/

- Loan servicer: The company that manages your student loans

Private Lenders and Interest Rates

When it comes to student loans, private lenders offer an alternative to federal loans. These lenders, such as banks, credit unions, and online lenders, provide loans with varying interest rates and terms. Understanding the factors that influence these rates is crucial for making informed decisions about your student loan financing.

Factors Influencing Interest Rates

Private lenders consider several factors when setting interest rates for student loans:

- Credit Score: A strong credit score indicates a lower risk of default, resulting in lower interest rates.

- Loan Amount: Larger loan amounts may carry higher interest rates due to the increased risk for the lender.

- Loan Term: Shorter loan terms typically have lower interest rates compared to longer terms.

- Collateral: Some private lenders offer loans secured by collateral, such as a home or vehicle, which can lead to lower interest rates.

- Cosigner: Adding a cosigner with a strong credit score can improve your chances of securing a lower interest rate.

Student Loan Forgiveness Programs

For individuals struggling with the burden of student loan debt, there are various student loan forgiveness programs that offer potential relief. These programs provide specific criteria and application processes, and understanding them can help borrowers explore options for reducing or eliminating their loan obligations.

Federal Student Loan Forgiveness Programs

The federal government offers several student loan forgiveness programs, including:

- Public Service Loan Forgiveness (PSLF): This program forgives student loans for borrowers who work full-time in public service jobs for 10 years while making 120 qualifying payments. Eligible employment includes teaching, nursing, social work, and government positions.

- Teacher Loan Forgiveness: This program provides up to $17,500 in loan forgiveness for teachers who work full-time for five consecutive years in low-income schools.

- Income-Driven Repayment (IDR) Plans: These plans offer lower monthly payments based on a borrower’s income and family size. After 20 or 25 years of making payments, any remaining loan balance may be forgiven.

Eligibility Requirements

Eligibility for student loan forgiveness programs varies depending on the specific program. Generally, borrowers must meet the following criteria:

- Have federal student loans

- Meet income and employment requirements

- Make qualifying payments on time

- Complete the required years of service or work

Application Process

The application process for student loan forgiveness programs involves submitting a completed application form and supporting documentation to the relevant organization or agency. The specific application process may vary depending on the program.

Negotiating Lower Interest Rates

Negotiating lower interest rates on student loans can save you a significant amount of money over the life of your loan. Here are some strategies for negotiating with lenders:

Research and Prepare

Before you contact your lender, do some research to compare interest rates from different lenders. This will give you a good idea of what you should be able to negotiate. You should also gather your financial information, such as your income, expenses, and credit score. This information will help you present a strong case to your lender.

Be Polite and Professional

When you contact your lender, be polite and professional. Explain that you are looking to lower your interest rate and provide your research to support your request. Be prepared to answer questions about your financial situation.

Be Willing to Compromise

It is unlikely that you will be able to get the lowest interest rate possible. Be willing to compromise and negotiate a rate that is fair for both you and the lender.

Be Persistent

Don’t give up if your lender initially says no. Be persistent and continue to negotiate. You may need to contact your lender several times before you are able to get a lower interest rate.

Here are some additional tips for negotiating a lower interest rate:

– Consider refinancing your loan with a private lender. Private lenders often offer lower interest rates than federal lenders.

– Ask your lender about any discounts or promotions that may be available.

– Make automatic payments. Many lenders offer a discount on your interest rate if you set up automatic payments.

– Improve your credit score. A higher credit score will qualify you for a lower interest rate.

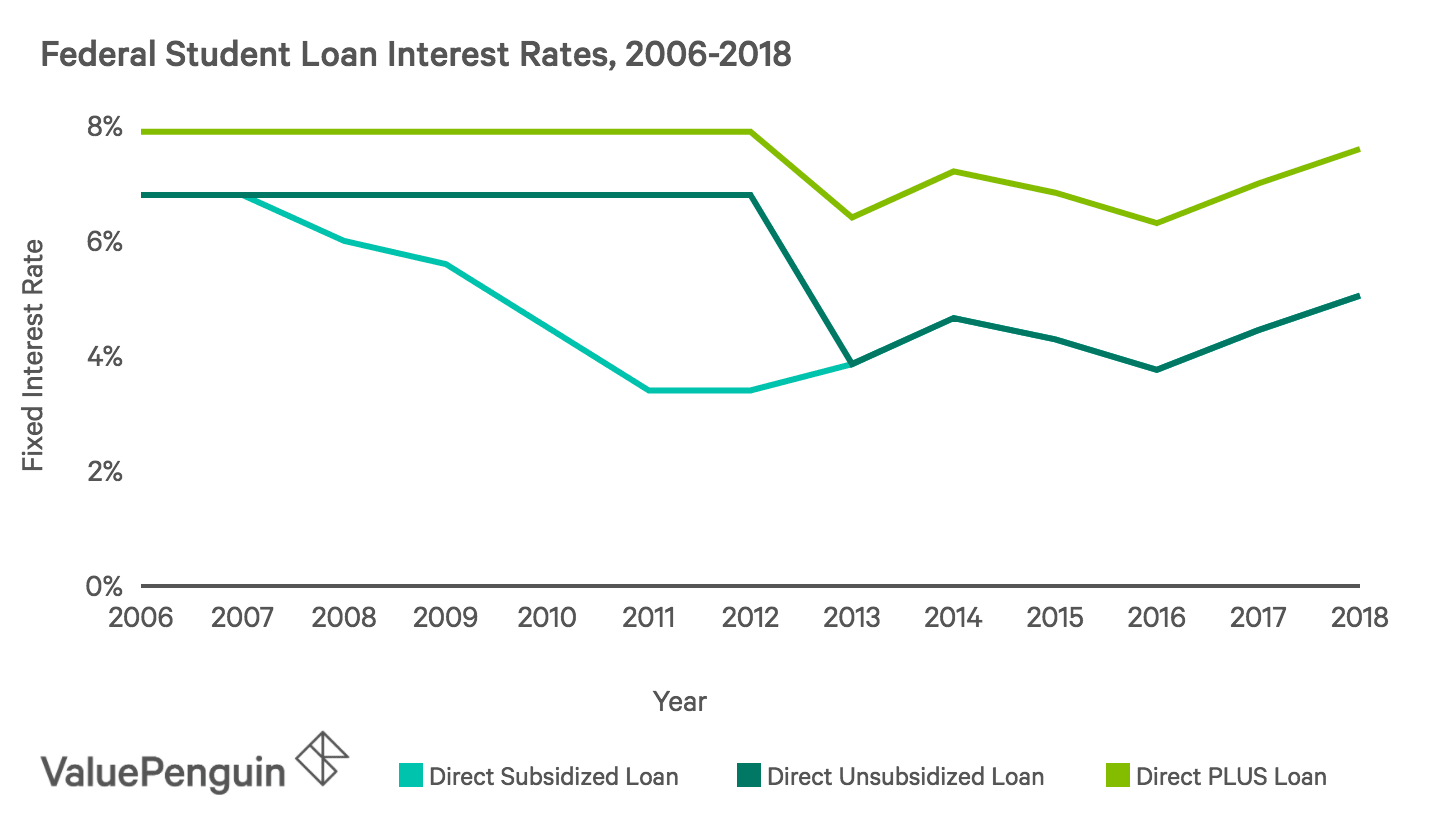

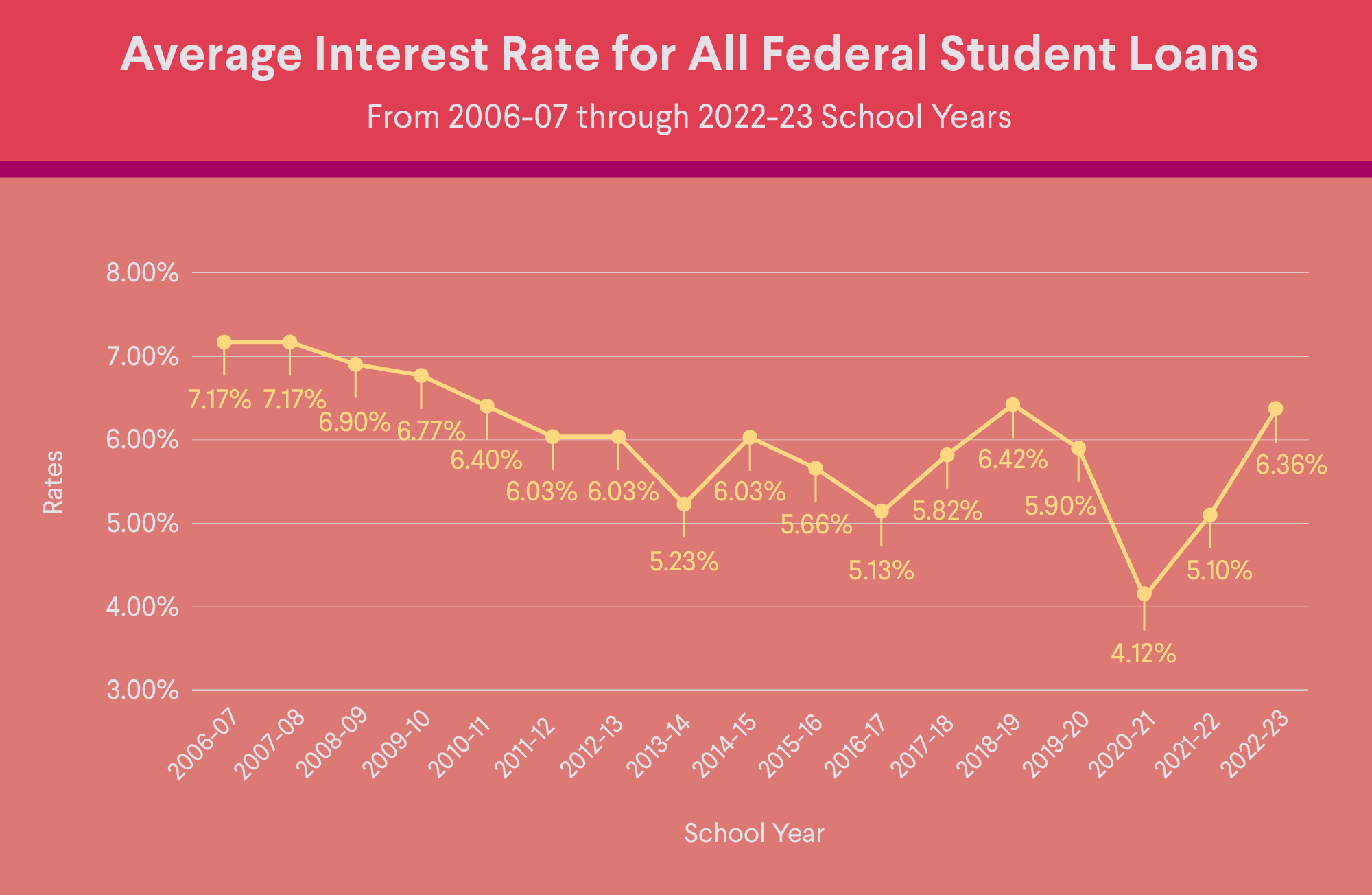

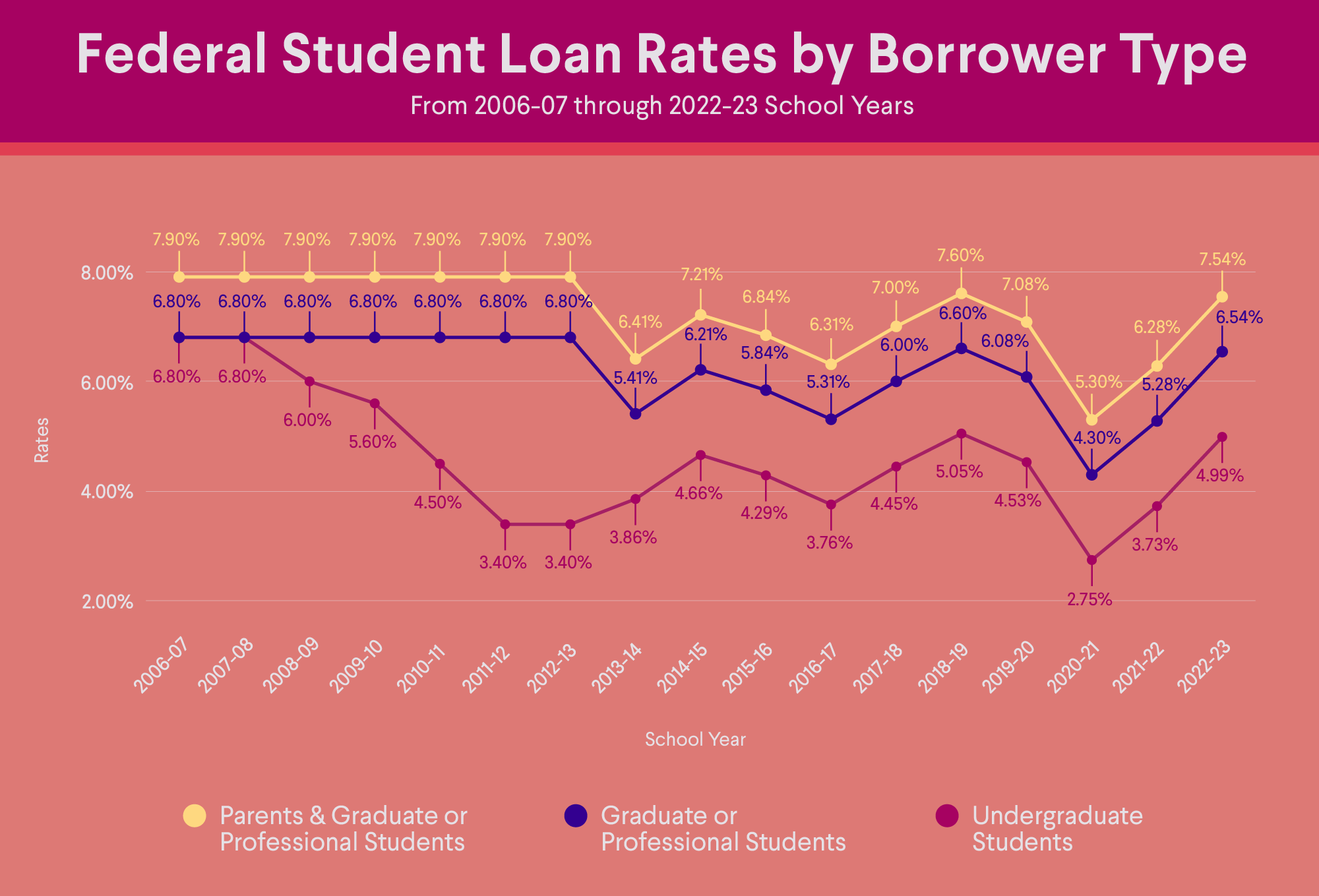

Historical Trends and Projections

Student loan interest rates have experienced fluctuations over the years, influenced by economic factors and government policies. Understanding historical trends and projections can help borrowers make informed decisions about their student loans.

Historically, student loan interest rates have generally followed trends in the overall economy. During periods of economic growth and low inflation, interest rates tend to be lower, while during periods of economic uncertainty and high inflation, interest rates tend to be higher.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by Congress and are typically lower than interest rates on private student loans. Federal student loan interest rates have remained relatively stable in recent years, with the current rates ranging from 4.99% to 7.54% for undergraduate loans and 6.54% to 7.54% for graduate loans.

Private Student Loan Interest Rates

Private student loan interest rates are set by individual lenders and can vary widely. Private student loan interest rates are typically higher than federal student loan interest rates and can range from 2% to 13% or more, depending on the lender, the borrower’s creditworthiness, and the loan terms.

Projections on Future Trends

Projections on future trends in student loan interest rates are uncertain and can be influenced by a variety of factors, including the overall economy, government policies, and the actions of the Federal Reserve.

Some experts predict that student loan interest rates will remain relatively stable in the near future, while others believe that interest rates could rise if the economy improves and inflation increases.

Impact on Economy and Society

Student loan interest has a significant impact on both the economy and society.

Economically, student loan interest can contribute to economic growth by increasing the number of educated individuals in the workforce. However, it can also lead to decreased consumer spending and investment, as borrowers may prioritize loan repayment over other expenses. Furthermore, high levels of student loan debt can hinder entrepreneurship and innovation, as individuals may be less likely to take risks or start businesses due to their financial obligations.

Social Implications

Socially, student loan debt and interest can have a number of negative consequences. It can lead to increased stress and anxiety, as well as financial hardship for borrowers. In addition, student loan debt can contribute to wealth inequality, as borrowers from low-income backgrounds may struggle to repay their loans, while borrowers from high-income backgrounds may be able to pay off their loans more easily.

Best Practices for Managing Student Loan Interest

Effectively managing student loan interest can save you a significant amount of money over the life of your loan. Here are some best practices to help you get started:

First, create a budget that includes your student loan payments. This will help you track your spending and ensure that you are able to make your payments on time. Second, consider making extra payments on your student loans whenever possible. Even small extra payments can help you pay down your debt faster and save on interest. Third, avoid defaulting on your student loans. Defaulting can damage your credit score and make it more difficult to qualify for other loans in the future.

Budgeting and Debt Repayment Strategies

Creating a budget is an essential part of managing your student loan debt. Your budget should include all of your income and expenses, including your student loan payments. Once you have created a budget, you can start to look for ways to save money and make extra payments on your student loans.

- Track your spending. Once you know where your money is going, you can start to make changes to save money.

- Cut back on unnecessary expenses. This could include things like eating out less often, shopping less, or canceling subscriptions.

- Make extra payments on your student loans. Even small extra payments can help you pay down your debt faster and save on interest.

Avoiding Default

Defaulting on your student loans can have serious consequences. If you default, your credit score will be damaged, and you may be subject to collection actions. In some cases, you may even be sued by your lender.

- Make your payments on time. This is the most important thing you can do to avoid default.

- Contact your lender if you are having trouble making your payments. Your lender may be able to work with you to create a payment plan that you can afford.

- Do not ignore your student loans. If you default, it will only make the situation worse.

Resources for Student Loan Interest Information

Navigating the complexities of student loan interest can be challenging. To help you make informed decisions, here are some reputable resources that provide accurate and up-to-date information.

These resources include websites, government agencies, and non-profit organizations that offer a range of services, from general information to personalized guidance.

Organization/Website Type Contact Information Description of Services

| Federal Student Aid | Government agency | Website | 1-800-433-3243 | Comprehensive information on all federal student loans, including interest rates, repayment options, and forgiveness programs. |

| National Student Loan Data System (NSLDS) | Government agency | Website | Provides access to your federal student loan data, including loan balances, interest rates, and repayment history. |

| Student Loan Servicing Alliance (SLSA) | Non-profit organization | Website | 1-888-820-5261 | Offers free counseling and resources to help borrowers manage their student loans, including information on interest rates and repayment options. |

| American Student Assistance | Non-profit organization | Website | 1-888-242-3300 | Provides free counseling and resources to help borrowers understand and manage their student loans, including information on interest rates and repayment options. |

| Consumer Financial Protection Bureau (CFPB) | Government agency | Website | 1-855-411-2372 | Provides information and resources on student loans, including interest rates, repayment options, and consumer protections. |

- Check with your loan servicer: Your loan servicer can provide specific information about your student loans, including interest rates, repayment options, and any available assistance programs.

- Consult with a financial advisor: A financial advisor can help you develop a personalized plan for managing your student loan debt, including strategies for minimizing interest charges.

- Stay informed: Regularly check reputable sources for the latest news and updates on student loan interest rates and policies.

Case Studies and Examples

Student loan interest can have a significant impact on the overall cost of borrowing. Case studies and examples can help illustrate the challenges and successes individuals face when managing student loan interest.

Case Study 1

Sarah graduated with a bachelor’s degree in 2010. She borrowed $40,000 in student loans with an interest rate of 6%. She made only the minimum payments on her loans for the first five years after graduation. As a result, her loan balance grew to over $45,000. Sarah realized that she was paying too much in interest and decided to refinance her loans to a lower interest rate. She was able to secure a new loan with an interest rate of 3%. This reduced her monthly payments and saved her thousands of dollars in interest over the life of the loan.

Case Study 2

John graduated with a master’s degree in 2015. He borrowed $100,000 in student loans with an interest rate of 8%. He was able to secure a high-paying job after graduation and made extra payments on his loans each month. As a result, he was able to pay off his loans in just seven years. John saved a significant amount of money in interest by making extra payments.

Lessons Learned

These case studies illustrate the importance of managing student loan interest. By refinancing to a lower interest rate or making extra payments, individuals can save thousands of dollars over the life of their loans. It is also important to understand the terms of your student loans and to make informed decisions about how to repay them.

Last Point

Managing student loan interest requires a proactive approach, informed decision-making, and a commitment to responsible financial habits. By understanding the options available, borrowers can navigate the complexities of student loan interest, optimize repayment strategies, and achieve their financial aspirations.

FAQ Guide

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans have interest paid by the government while you’re in school, while unsubsidized loans accrue interest from the start.

How can I reduce my student loan interest rates?

Refinancing or consolidating your loans may allow you to secure a lower interest rate.

Is student loan interest tax-deductible?

Yes, up to $2,500 in student loan interest can be deducted from your federal income taxes.

:max_bytes(150000):strip_icc()/how-to-calculate-student-loan-interest-4772208_final-39fc8391e4e2462e91d1632c7f8abe72.png?w=1500&resize=1500,1013&ssl=1)