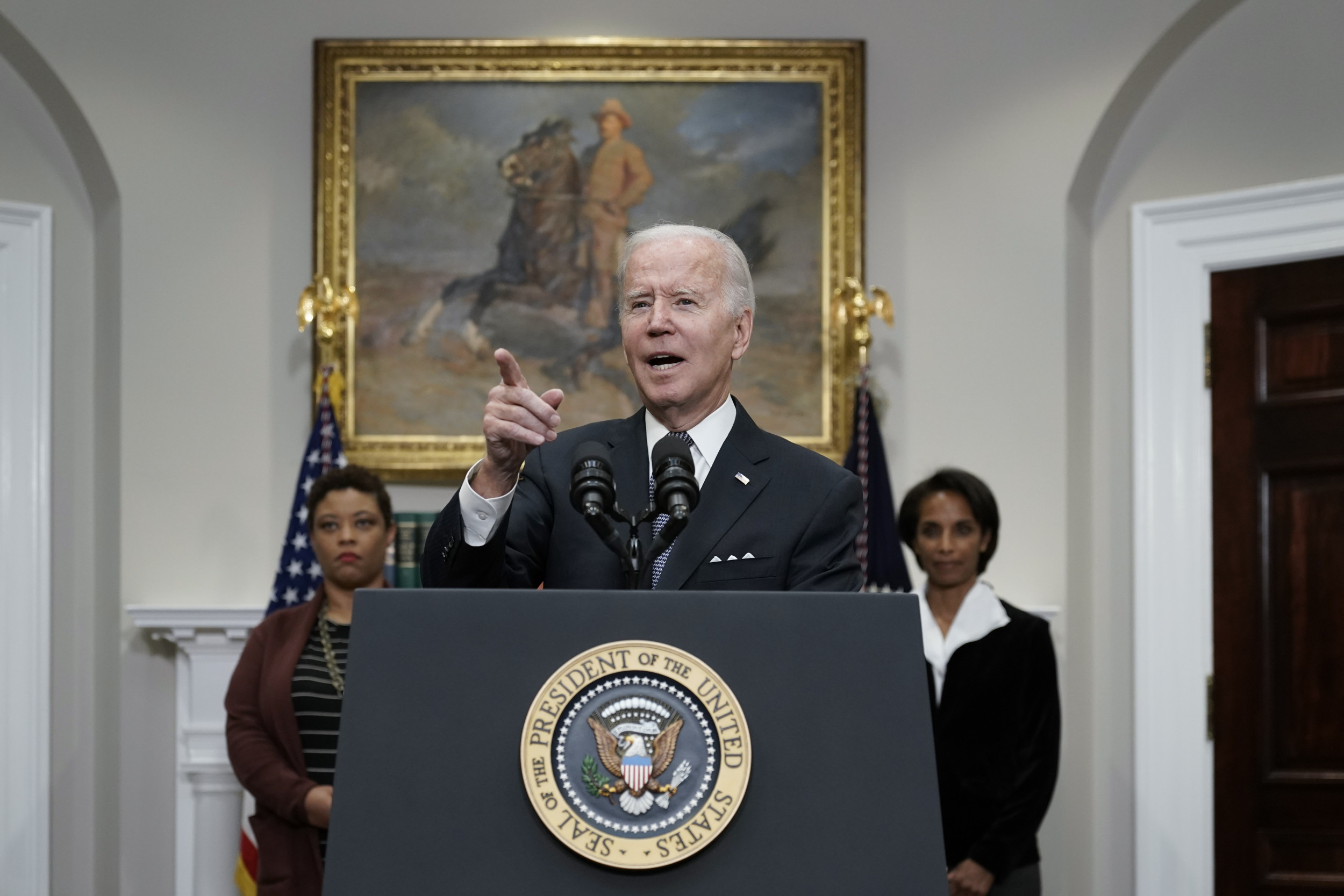

Student loan forgiveness biden – Student loan forgiveness has emerged as a contentious topic in recent years, with President Biden’s recent announcement reigniting the debate. This comprehensive guide delves into the intricacies of Biden’s student loan forgiveness plan, exploring its potential impact on borrowers, the economy, and the future of higher education.

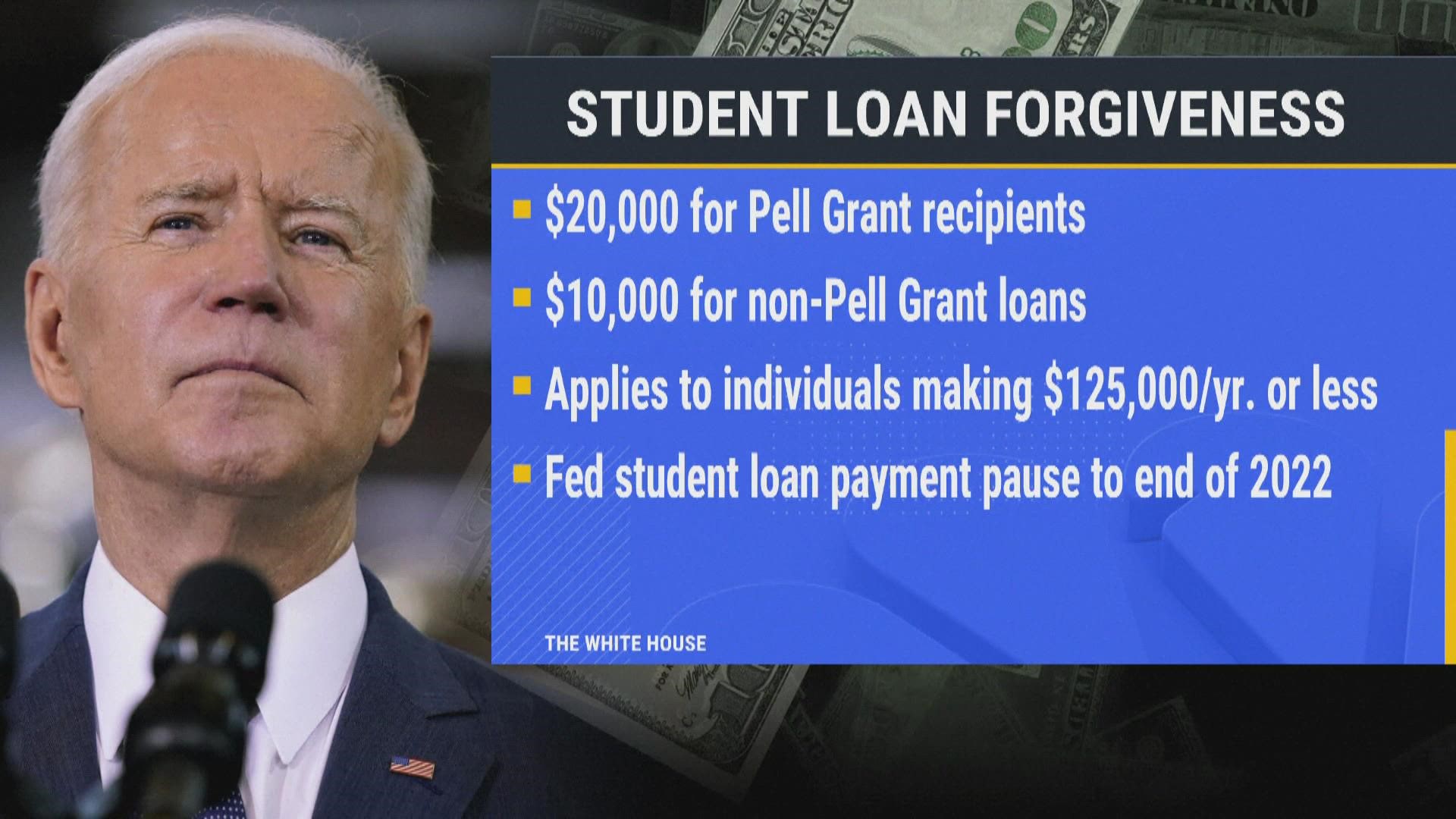

Biden’s plan proposes to cancel up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year. The plan also includes provisions for borrowers who have already made significant payments on their loans and for those who have defaulted on their loans.

– Biden’s Proposal

President Biden’s student loan forgiveness plan aims to provide relief to millions of borrowers struggling with student debt. The plan includes several key components:

- Loan Forgiveness Amounts: The plan will forgive up to $10,000 in federal student loan debt for borrowers earning less than $125,000 per year, or $250,000 for married couples filing jointly.

- Income Thresholds: The income thresholds for eligibility are based on the borrower’s income in 2020 or 2021. Borrowers who earn above the income thresholds will not be eligible for loan forgiveness.

- Types of Loans Covered: The plan covers federal student loans, including Direct Loans, FFEL Loans, and Perkins Loans. Private student loans are not eligible for forgiveness.

The plan is estimated to cost the federal government around $300 billion over the next ten years. The impact on the economy is expected to be minimal, with a potential small increase in inflation. However, the plan is likely to have a significant impact on the lives of millions of borrowers, who will be able to save money on their monthly loan payments and potentially pay off their loans sooner.

Arguments for Forgiveness

Student loan forgiveness has gained traction as a potential solution to the growing student loan debt crisis. Proponents of forgiveness argue that it would provide much-needed relief to millions of borrowers, stimulate the economy, and address issues of economic inequality and racial disparities.

Forgiveness could significantly reduce the financial burden on borrowers, freeing up funds for other expenses such as housing, healthcare, and retirement savings. This increased financial flexibility could boost consumer spending and economic growth. Additionally, forgiveness could help close the racial wealth gap, as Black and Latino borrowers disproportionately carry higher levels of student debt.

Successful Forgiveness Programs

- Norway: In 2001, Norway implemented a student loan forgiveness program that canceled up to 50% of outstanding debt for borrowers who made 10 years of on-time payments.

- Finland: Finland offers student loan forgiveness for borrowers who work in certain high-need professions, such as teaching and nursing.

Arguments Against Forgiveness

Opponents of student loan forgiveness raise concerns about fairness and its potential impact on taxpayers. They argue that forgiving student debt would be unfair to those who have already repaid their loans or those who chose not to attend college due to the cost. Additionally, they contend that forgiving student debt would increase the national debt and require taxpayers to foot the bill.

Impact on Taxpayers

Opponents of student loan forgiveness argue that it would be unfair to taxpayers who have already repaid their loans or those who chose not to attend college due to the cost. They argue that forgiving student debt would reward those who made risky financial decisions by taking on large amounts of debt and would penalize those who were more responsible.

According to a study by the Brookings Institution, forgiving all federal student debt would cost taxpayers $1.6 trillion. This would increase the national debt and require taxpayers to pay higher taxes or reduce government spending in other areas.

Political Implications: Student Loan Forgiveness Biden

Biden’s student loan forgiveness plan has significant political implications, both in the short term and long term. In the short term, the plan could boost Democratic turnout in the upcoming midterm elections. It could also help Democrats appeal to young voters, who are a key demographic in the party’s base. In the long term, the plan could reshape the debate over higher education and the role of the federal government in providing financial assistance to students.

The plan has been met with mixed reactions from Republicans. Some Republicans have criticized the plan as being too expensive and unfair to taxpayers who did not attend college. Others have argued that the plan will do little to address the underlying problems with the higher education system. However, some Republicans have also expressed support for the plan, arguing that it will help to reduce the burden of student debt on young Americans.

Key Stakeholders

- Students: Students are the primary beneficiaries of the student loan forgiveness plan. The plan will provide them with much-needed relief from the burden of student debt.

- Taxpayers: Taxpayers will ultimately be responsible for paying for the student loan forgiveness plan. Some taxpayers may be concerned about the cost of the plan, while others may support it as a way to help students.

- Higher education institutions: Higher education institutions could be affected by the student loan forgiveness plan in a number of ways. The plan could lead to a decrease in the number of students who take out student loans, which could in turn lead to a decrease in tuition revenue. However, the plan could also lead to an increase in the number of students who attend college, which could in turn lead to an increase in tuition revenue.

- The federal government: The federal government will be responsible for implementing and administering the student loan forgiveness plan. The plan could have a significant impact on the federal budget, as well as on the role of the federal government in providing financial assistance to students.

Economic Impact

Student loan forgiveness has the potential to have a significant economic impact. It could stimulate economic growth by increasing consumer spending and reducing household debt.

Consumer Spending

Forgiveness would free up billions of dollars that borrowers could spend on other goods and services. This would boost consumer spending, which is a major driver of economic growth. A study by the Roosevelt Institute found that student loan forgiveness could increase GDP by $86 billion to $108 billion over the next decade.

Household Debt

Student loan debt is a major source of household debt in the United States. The average borrower owes more than $30,000 in student loans. This debt can make it difficult for borrowers to buy homes, start businesses, or save for retirement. Forgiveness would reduce household debt, freeing up more money for other investments. A study by the Center for American Progress found that student loan forgiveness could reduce household debt by $1.5 trillion.

Alternatives to Forgiveness

While student loan forgiveness is a widely discussed solution to the student loan debt crisis, it is not the only option. Several alternative solutions have been proposed, each with its own advantages and disadvantages.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly loan payments based on a borrower’s income and family size. This can make it easier for borrowers to repay their loans while still meeting their other financial obligations.

Pros:

- Lower monthly payments for borrowers with lower incomes

- Can help prevent default and improve credit scores

- Available for both federal and private student loans

Cons:

- Can extend the repayment period, resulting in more interest paid over time

- May not be available to all borrowers

- Can be complex and difficult to manage

Interest Rate Reductions

Reducing interest rates on student loans can make them more affordable for borrowers. This can be done through legislation or by refinancing loans with a private lender.

Pros:

- Lower monthly payments

- Can save money on interest over the life of the loan

- Can make loans more manageable for borrowers

Cons:

- May not be as effective as other solutions, such as forgiveness or IDR plans

- Can be difficult to qualify for private refinancing

- May not be available to all borrowers

Public Opinion

Public opinion on student loan forgiveness is complex and multifaceted. Polling data and social media sentiment indicate a range of perspectives, influenced by factors such as personal financial experiences, political ideology, and generational differences.

Polls and Surveys

According to a 2023 survey by the Pew Research Center, 64% of Americans support some form of student loan forgiveness. This includes 79% of Democrats and 43% of Republicans. A 2022 poll by the National Education Association found that 72% of teachers support student loan forgiveness for educators.

President Biden’s recent announcement regarding student loan forgiveness has sparked a flurry of excitement among borrowers. While the specifics of the plan are still being finalized, many are seeking clarity on the potential impact on their individual situations. To assist with this, numerous online tools, such as the student loan calculator , have emerged to provide personalized estimates.

These calculators can help borrowers determine the potential savings under different repayment options and explore strategies to minimize their overall loan burden. As the implementation of student loan forgiveness progresses, these tools will continue to play a vital role in empowering borrowers to make informed decisions about their financial futures.

Social Media Sentiment

On social media, discussions about student loan forgiveness often reflect the polarization of public opinion. Proponents of forgiveness argue that it would provide much-needed relief to struggling borrowers and stimulate the economy. Opponents argue that it would be unfair to taxpayers who have already paid off their loans and could lead to higher inflation.

Demographic and Political Trends

Younger Americans are more likely to support student loan forgiveness than older Americans. This is likely due to the fact that younger generations have higher levels of student debt and are more likely to have difficulty repaying it.

Political ideology also plays a role in public opinion on student loan forgiveness. Democrats are more likely to support forgiveness than Republicans, with a 2023 Gallup poll finding that 83% of Democrats and 37% of Republicans approve of the idea.

– Create a timeline of key events in the history of student loan forgiveness in the United States.

Student loan forgiveness has been a topic of debate in the United States for several decades. The first major student loan forgiveness program was created in 1965, and since then, there have been several other programs that have provided forgiveness to millions of borrowers.

Key Events in the History of Student Loan Forgiveness in the United States

- 1965: The Higher Education Act of 1965 created the first major student loan forgiveness program in the United States. This program provided forgiveness to borrowers who worked in certain public service jobs, such as teaching and nursing.

- 1976: The Income Contingent Loan (ICL) program was created to provide forgiveness to borrowers who had difficulty repaying their loans. This program was later replaced by the Income-Based Repayment (IBR) program in 1995.

- 1998: The Public Service Loan Forgiveness (PSLF) program was created to provide forgiveness to borrowers who worked in public service jobs for at least 10 years. This program has been expanded several times since its creation.

- 2007: The College Cost Reduction and Access Act of 2007 created the TEACH Grant program, which provides forgiveness to borrowers who teach in high-need schools.

- 2010: The Affordable Care Act of 2010 expanded the PSLF program to include borrowers who work in certain healthcare professions.

- 2015: The Student Aid and Fiscal Responsibility Act of 2015 made several changes to the student loan forgiveness programs, including expanding the IBR program and creating a new Pay As You Earn (PAYE) program.

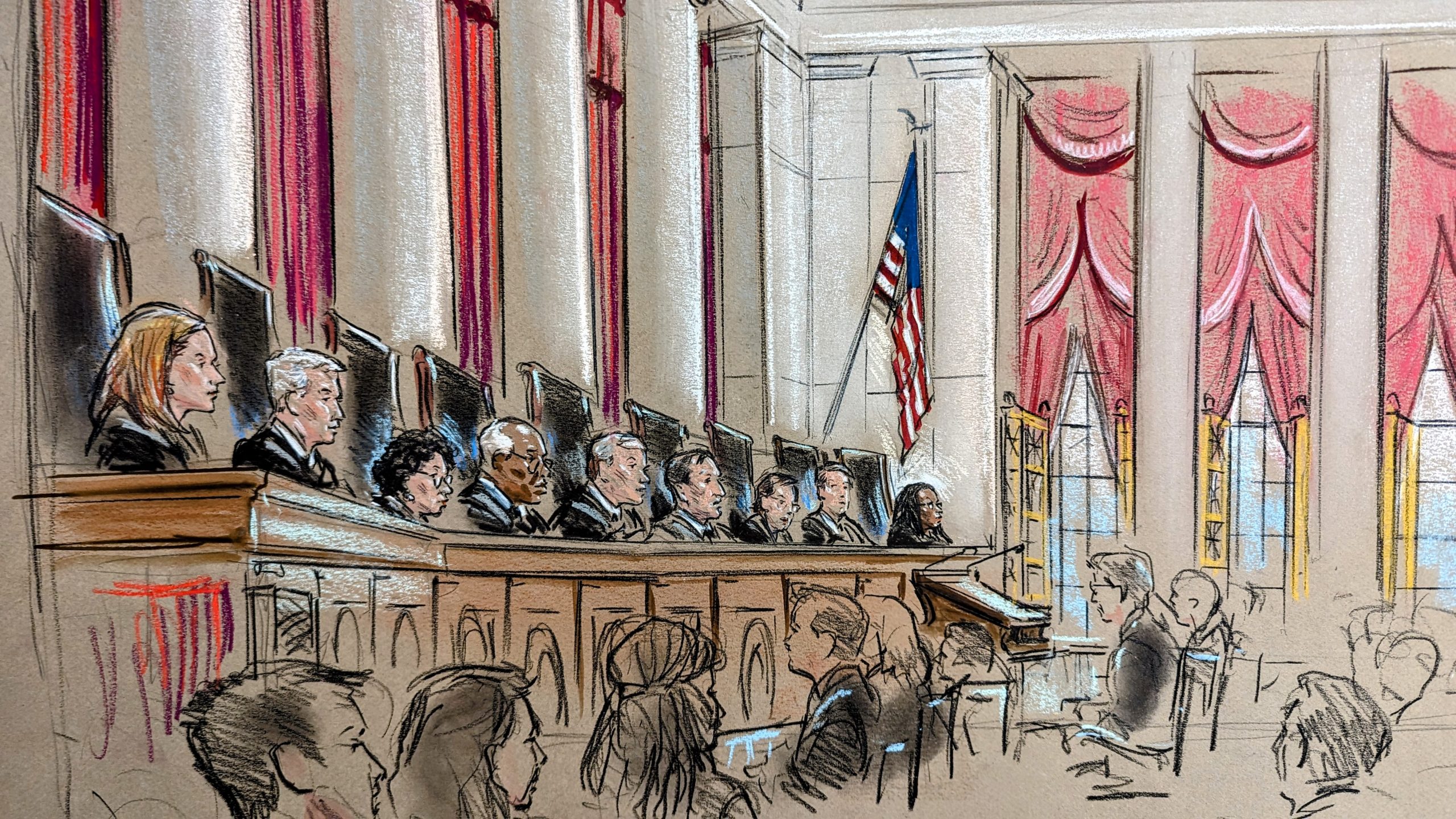

Legal Challenges

The legality of President Biden’s student loan forgiveness plan has been a subject of debate since its announcement. Several legal challenges have been filed, arguing that the plan is unconstitutional and exceeds the authority granted to the executive branch.

Constitutional Issues

One of the primary legal challenges to the plan is that it violates the separation of powers doctrine. Critics argue that the plan is an exercise of legislative power that should be reserved for Congress, not the executive branch. They contend that the President does not have the authority to unilaterally cancel student debt without congressional approval.

Another constitutional argument raised against the plan is that it violates the Due Process Clause of the Fifth Amendment. This clause prohibits the government from depriving individuals of property without due process of law. Critics argue that the plan would deprive student loan servicers of their property interest in the loans without providing them with a fair hearing or other due process protections.

Statutory Issues

In addition to constitutional challenges, the plan has also been challenged on statutory grounds. One argument is that the plan violates the Higher Education Relief Opportunities for Students (HEROES) Act of 2003. This act gives the Secretary of Education the authority to modify or waive student loans in response to a national emergency. Critics argue that the current COVID-19 pandemic does not constitute a national emergency that would justify the broad cancellation of student debt under the HEROES Act.

Another statutory argument raised against the plan is that it violates the Administrative Procedure Act (APA). The APA requires federal agencies to follow certain procedures when making rules and regulations. Critics argue that the Department of Education failed to follow these procedures when implementing the plan, rendering it invalid.

Likelihood of Success

The likelihood of success for the legal challenges to the plan is uncertain. The courts will need to weigh the arguments of both sides and determine whether the plan is constitutional and authorized by statute. It is possible that the courts could uphold the plan, strike it down, or remand it to the Department of Education for further review.

Potential Impact

If the legal challenges to the plan are successful, it could have a significant impact on its implementation. The courts could block the plan from taking effect, or they could require the Department of Education to make changes to the plan in order to address the legal concerns raised. This could delay or even prevent the plan from being implemented as intended.

Implementation Challenges

Implementing student loan forgiveness on a large scale presents several practical challenges. These include identifying eligible borrowers, managing the application process, preventing fraud, and ensuring the program is implemented fairly and efficiently.

Amidst the ongoing debate surrounding student loan forgiveness under the Biden administration, many borrowers are exploring alternative solutions to alleviate their financial burden. The save student loan plan offers a comprehensive approach to tackling this issue, providing borrowers with a range of options to reduce their debt and improve their financial well-being.

While the administration continues to consider the broader implications of student loan forgiveness, initiatives like the save student loan plan empower borrowers to take proactive steps towards financial stability.

One of the key challenges is identifying eligible borrowers. The government would need to develop a system to verify borrowers’ income, debt levels, and other factors to determine their eligibility for forgiveness. This process could be complex and time-consuming, especially for borrowers with multiple loans from different lenders.

Application Process

Managing the application process is another significant challenge. The government would need to create a system for borrowers to apply for forgiveness, review their applications, and make decisions on their eligibility. This process could be overwhelming, especially if there is a large number of applications. The government would need to ensure that the application process is efficient and fair, and that borrowers are not unduly burdened by the process.

Although President Biden’s recent student loan forgiveness announcement has brought relief to many borrowers, those who are not eligible for forgiveness may still need to consider student loan repayment options. By exploring various repayment plans, consolidating loans, or seeking refinancing, individuals can manage their student debt effectively.

As the student loan forgiveness program continues to unfold, it is crucial to stay informed about the latest updates and explore alternative repayment strategies to ensure financial stability.

Preventing Fraud

Preventing fraud is also a major concern. There is a risk that individuals could try to fraudulently obtain forgiveness by submitting false or misleading information. The government would need to implement strong safeguards to prevent fraud and ensure that only eligible borrowers receive forgiveness.

Timeline for Implementation

Developing a realistic timeline for implementation is crucial. The government would need to establish clear milestones and deadlines for each stage of the implementation process, including identifying eligible borrowers, managing the application process, and preventing fraud. This timeline would help ensure that the program is implemented on time and within budget.

Communication Plan

A comprehensive communication plan is essential to inform borrowers about the program and the application process. The government would need to develop a variety of communication channels, including a dedicated website, social media, and public service announcements, to reach borrowers and provide them with clear and accurate information about the program.

Potential Roadblocks and Contingency Plans

Identifying potential roadblocks to implementation and developing contingency plans is also important. The government should anticipate potential challenges and develop plans to address them. For example, the government should consider the possibility of a large number of applications and develop contingency plans to ensure that the application process is not overwhelmed.

As the conversation surrounding student loan forgiveness intensifies, President Biden’s stance on the matter has come into sharp focus. His proposed biden student loan forgiveness plan has sparked widespread debate, with advocates highlighting its potential to alleviate financial burdens and critics questioning its feasibility.

As the issue continues to dominate headlines, it is crucial to delve into the intricacies of student loan forgiveness and its implications for both borrowers and the broader economy.

Communication and Outreach

Informing borrowers about student loan forgiveness is essential to ensure they can access the relief they’re eligible for. A comprehensive communication and outreach plan should be designed to reach all affected individuals.

The plan should include clear and concise messaging that explains the eligibility criteria, application process, and potential benefits of forgiveness. Target audiences should include all borrowers, regardless of their loan status or income level.

Reaching Underserved Communities

Reaching underserved communities is crucial to ensure that everyone who is eligible for forgiveness knows about the program. Strategies for reaching these communities could include:

- Partnering with community organizations and local leaders to spread the word.

- Conducting outreach events in underserved areas.

- Providing materials in multiple languages.

- Using social media and other online platforms to reach borrowers.

Education and Financial Literacy

To empower student loan borrowers and equip them with the knowledge and skills necessary to manage their debt effectively, a comprehensive educational campaign promoting financial literacy is crucial. This campaign should encompass a range of initiatives aimed at enhancing borrowers’ understanding of budgeting, debt management, and investing.

Interactive workshops and webinars can provide a platform for borrowers to engage with financial experts and receive personalized guidance on topics such as creating a budget, managing multiple debts, and exploring investment options. These interactive sessions can foster a deeper understanding of financial concepts and empower borrowers to make informed decisions about their finances.

Comprehensive Resources

A comprehensive website and social media presence can serve as a valuable resource hub for student loan borrowers. This online platform should provide access to a wealth of information, including articles, videos, and downloadable materials on various aspects of financial literacy. By leveraging digital channels, borrowers can conveniently access the resources they need to navigate their financial journey.

Partnerships and Outreach

Collaborations with schools and financial institutions can extend the reach of financial literacy programs and counseling services to student loan borrowers. Schools can incorporate financial literacy modules into their curriculum, while financial institutions can offer tailored counseling sessions and workshops to help borrowers manage their debt and achieve their financial goals.

Evaluation and Improvement

Regular evaluations of the educational campaign’s effectiveness are essential to ensure its impact and identify areas for improvement. Feedback from participants and data analysis can inform adjustments to the campaign’s content, delivery methods, and outreach strategies. By incorporating feedback and research findings, the campaign can continuously evolve to meet the evolving needs of student loan borrowers.

Data Collection and Analysis

To ensure the effective implementation and impact of student loan forgiveness, a robust system for data collection and analysis is essential. This system will enable the tracking of key metrics, providing valuable insights for future policy decisions.

Key metrics to be monitored include the number of borrowers who receive forgiveness, the average amount forgiven, and the impact on household debt. This data will provide a comprehensive understanding of the program’s reach and effectiveness.

Data Utilization, Student loan forgiveness biden

The collected data will serve as a foundation for informed decision-making. By analyzing the impact of student loan forgiveness on borrowers and the economy, policymakers can refine and tailor future policies to maximize their effectiveness.

Monitoring and Evaluation

To ensure the effectiveness of the student loan forgiveness program, a comprehensive plan for monitoring and evaluation is crucial. This plan should include:

Key Performance Indicators (KPIs)

Identifying key performance indicators (KPIs) to measure the program’s impact on student debt reduction, economic outcomes, and other relevant factors is crucial. These KPIs will serve as benchmarks for assessing the program’s success and making necessary adjustments.

Evaluation Timeline

Establishing a timeline for evaluation, with regular intervals for data collection and analysis, is essential. This timeline will provide a structured approach to monitoring the program’s progress and identifying areas for improvement.

Data-Driven Adjustments

Using findings to make data-driven adjustments and improve the program over time ensures its ongoing effectiveness and efficiency. Regular evaluations will inform decision-making and allow for timely adjustments to maximize the program’s impact.

Stakeholder Reporting

Regularly reporting evaluation results to stakeholders, including students, policymakers, and the public, ensures transparency and accountability. This communication fosters trust and confidence in the program’s implementation and outcomes.

Last Recap

The potential impact of Biden’s student loan forgiveness plan is far-reaching. It could provide much-needed relief to millions of borrowers who are struggling to repay their student loans. It could also stimulate the economy by freeing up money that borrowers can spend on other goods and services.

However, the plan has also drawn criticism from some who argue that it is too expensive and that it will benefit borrowers who do not need it. Others argue that the plan does not go far enough and that it should cancel all student loan debt.

Helpful Answers

Who is eligible for student loan forgiveness under Biden’s plan?

Borrowers who earn less than $125,000 per year are eligible for up to $10,000 in student loan forgiveness. Borrowers who have already made significant payments on their loans may be eligible for up to $20,000 in forgiveness.

What types of loans are covered by Biden’s plan?

Biden’s plan covers federal student loans, including Direct Loans, Stafford Loans, and PLUS Loans. Private student loans are not covered.

How do I apply for student loan forgiveness under Biden’s plan?

The application process for student loan forgiveness under Biden’s plan has not yet been announced. The U.S. Department of Education is expected to release more information in the coming weeks.