Student loan debt relief supreme court – The Supreme Court is set to hear arguments in a case that could have major implications for student loan debt relief. The case, brought by a group of student loan borrowers, challenges the Biden administration’s plan to forgive up to $20,000 in student debt for federal student loan borrowers.

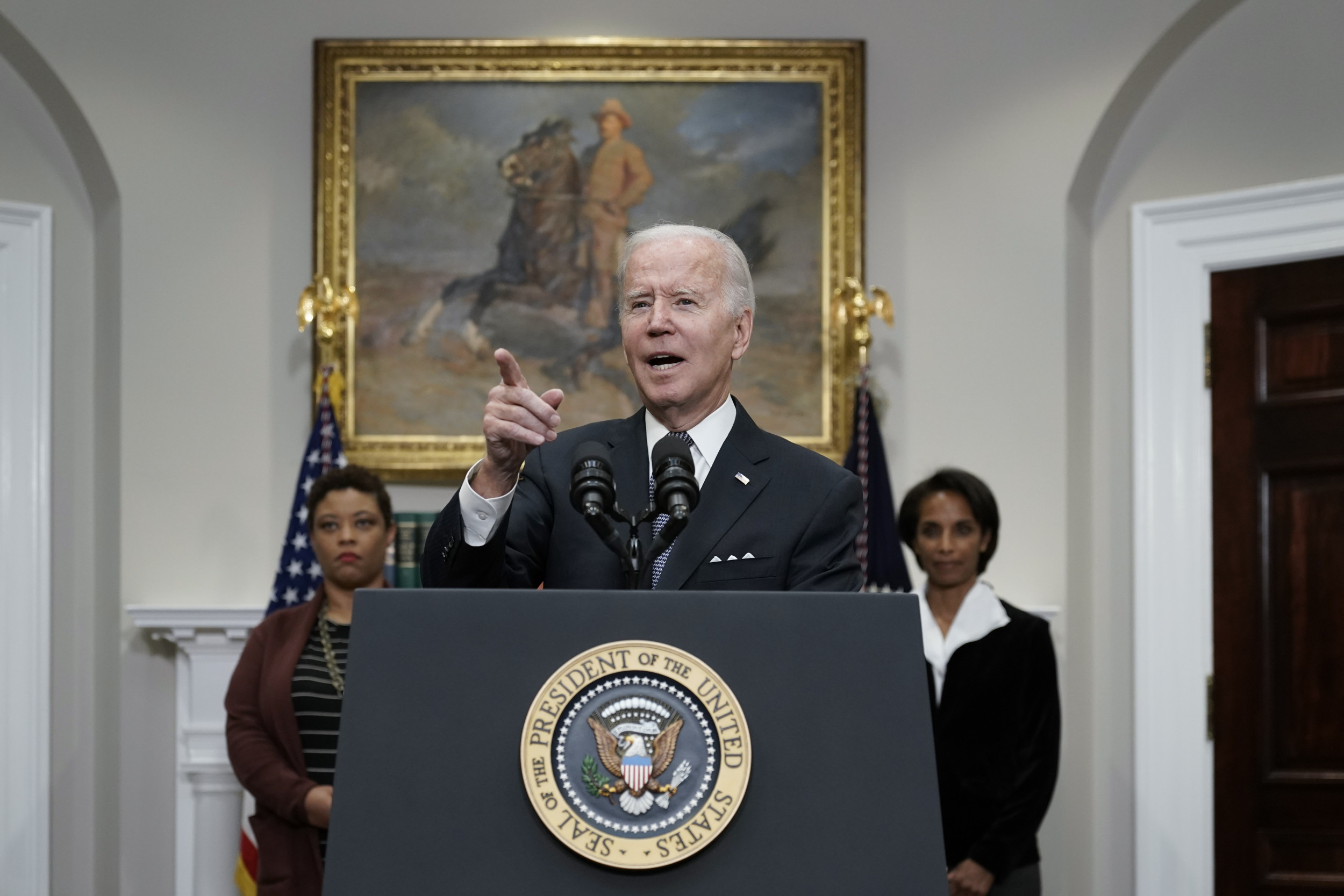

The Biden administration argues that the plan is legal and necessary to provide relief to borrowers who are struggling with student loan debt. Opponents of the plan argue that it is illegal and unfair to taxpayers who have already paid off their student loans.

Case Overview: Student Loan Debt Relief Supreme Court

The case of Biden v. Nebraska is a Supreme Court case that will determine the legality of President Biden’s student loan debt relief plan. The plan, announced in August 2022, would forgive up to $20,000 in federal student loan debt for borrowers who meet certain income requirements. The case is being brought by six Republican-led states, who argue that the plan is unconstitutional and would harm their states’ economies.

The case is significant because it could have a major impact on the lives of millions of Americans. If the plan is upheld, it would provide significant relief to borrowers who are struggling to repay their student loans. However, if the plan is struck down, it would leave many borrowers in financial distress.

Legal Arguments

The plaintiffs in the case argue that the Biden administration does not have the authority to forgive student loan debt without congressional approval. They argue that the plan violates the separation of powers doctrine and the Appropriations Clause of the Constitution.

The Biden administration argues that it has the authority to forgive student loan debt under the Higher Education Relief Opportunities for Students Act of 2003 (HEROES Act). The HEROES Act gives the Secretary of Education the authority to waive or modify student loan requirements in response to a national emergency. The Biden administration argues that the COVID-19 pandemic constitutes a national emergency and that the student loan debt relief plan is necessary to address the financial hardship caused by the pandemic.

Procedural History

The case was filed in October 2022 in the U.S. District Court for the Eastern District of Missouri. The district court ruled in favor of the plaintiffs and blocked the Biden administration from implementing the student loan debt relief plan. The Biden administration appealed the ruling to the Eighth Circuit Court of Appeals, which upheld the district court’s ruling.

The Biden administration then appealed the case to the Supreme Court, which agreed to hear the case in February 2023. The Supreme Court is expected to issue a ruling in the case by the end of June 2023.

Arguments for Student Loan Debt Relief

The Biden administration has proposed a plan to provide student loan debt relief to millions of Americans. The plan would forgive up to $10,000 in student loan debt for borrowers who earn less than $125,000 per year, and up to $20,000 for borrowers who received Pell Grants.

The administration argues that student loan debt relief is necessary to address the growing student loan debt crisis. The average student loan debt balance is now over $30,000, and many borrowers are struggling to repay their loans. Student loan debt relief would provide much-needed financial relief to these borrowers and help them achieve their financial goals.

The administration also argues that student loan debt relief is legal. The Higher Education Act of 1965 gives the Secretary of Education the authority to forgive student loans in certain circumstances. The administration believes that the current student loan debt crisis meets the criteria for loan forgiveness.

Opponents of student loan debt relief argue that it is unfair to taxpayers who have already repaid their student loans. They also argue that student loan debt relief would be too expensive and would not effectively address the underlying causes of the student loan debt crisis.

The strength of the arguments for student loan debt relief is unclear. The Biden administration has a strong legal case for loan forgiveness, but it is possible that the courts will disagree. The administration also has a strong policy case for loan forgiveness, but it is possible that Congress will not agree to fund the program.

The ultimate success of the Biden administration’s student loan debt relief plan will depend on the outcome of the legal and political battles that are sure to follow.

Arguments Against Student Loan Debt Relief

Opponents of student loan debt relief argue that it is unfair to taxpayers who have already repaid their loans or who have chosen not to pursue higher education due to the cost. They also contend that it would be a costly and ineffective way to address the problem of student loan debt.

These arguments are supported by legal precedents and policy considerations. For example, the Supreme Court has ruled that the government has a legitimate interest in collecting debts owed to it, and that student loans are a form of debt. Additionally, the Congressional Budget Office has estimated that student loan debt relief would cost taxpayers trillions of dollars.

However, there are also weaknesses to these arguments. For example, it is not clear that taxpayers would actually be harmed by student loan debt relief. In fact, some economists argue that it could actually stimulate the economy by freeing up money that borrowers could spend on other goods and services.

Economic Impact, Student loan debt relief supreme court

The economic impact of student loan debt relief is a complex issue. Some economists argue that it would have a positive impact on the economy by freeing up money that borrowers could spend on other goods and services. Others argue that it would have a negative impact by increasing the deficit and reducing the amount of money available for other government programs.

The Congressional Budget Office has estimated that student loan debt relief would cost taxpayers trillions of dollars. However, it is important to note that this is just an estimate, and the actual cost could be lower or higher. Additionally, it is important to consider the potential economic benefits of student loan debt relief, such as increased consumer spending and economic growth.

Consequences for Higher Education

Student loan debt relief could have a significant impact on the higher education system. Some argue that it would lead to increased tuition costs, as colleges and universities would no longer be able to rely on student loan revenue. Others argue that it would make college more affordable for students, as they would not have to worry about the burden of student loan debt.

It is difficult to say for sure what the impact of student loan debt relief would be on the higher education system. However, it is important to consider the potential consequences before making a decision.

Ethical Implications

Student loan debt relief raises a number of ethical issues. One issue is fairness to those who have already repaid their loans or who have chosen not to pursue higher education due to the cost. Another issue is the potential impact on the higher education system.

It is important to weigh the potential benefits of student loan debt relief against the potential ethical concerns before making a decision.

Legal Precedents

The Supreme Court’s decision on student loan debt relief will be influenced by a number of legal precedents. These precedents include cases that have addressed the authority of the executive branch to cancel student debt, the scope of the Higher Education Act, and the limits of judicial review.

Case Interpretation

The Supreme Court will need to interpret these precedents in light of the specific facts of the case before it. In particular, the Court will need to consider whether the Biden administration has the authority to cancel student debt under the Higher Education Act and whether the HEROES Act gives the administration the authority to cancel student debt during a national emergency.

Areas of Ambiguity

There are a number of potential areas of ambiguity or uncertainty in the law that could affect the Supreme Court’s decision. For example, it is unclear whether the Higher Education Act gives the executive branch the authority to cancel student debt. Additionally, it is unclear whether the HEROES Act gives the administration the authority to cancel student debt during a national emergency.

Historical Context

The Supreme Court’s decision will also be influenced by the historical context of the precedents. For example, the Court will need to consider the fact that the Higher Education Act has been amended several times since it was first enacted in 1965. Additionally, the Court will need to consider the fact that the HEROES Act was passed in response to the COVID-19 pandemic.

Impact of Recent Changes

The Supreme Court’s decision will also be influenced by any recent changes or developments in the law. For example, the Court will need to consider the fact that the Biden administration has recently issued new regulations on student loan forgiveness. Additionally, the Court will need to consider the fact that several states have filed lawsuits challenging the Biden administration’s student loan forgiveness program.

Binding Precedents

Some of the precedents that the Supreme Court will consider are binding on the Court. This means that the Court must follow the precedents in its decision. Other precedents are persuasive but not binding. This means that the Court may consider the precedents in its decision, but it is not required to follow them.

Persuasive Authority

The persuasive authority of the precedents will depend on a number of factors, including the age of the precedent, the level of the court that issued the precedent, and the reasoning of the precedent. The Supreme Court will give more weight to precedents that are recent, that were issued by a higher court, and that are well-reasoned.

Dissenting and Concurring Opinions

The Supreme Court will also consider any dissenting or concurring opinions in the precedents. Dissenting opinions are opinions that are written by judges who disagree with the majority opinion. Concurring opinions are opinions that are written by judges who agree with the majority opinion but for different reasons. The Supreme Court may find the reasoning in dissenting or concurring opinions persuasive, even if it does not agree with the ultimate conclusion of the precedent.

Policy Considerations

The Supreme Court’s decision on student loan debt relief has significant policy implications that will impact the overall level of student loan debt, the availability and affordability of higher education, and the federal budget and the economy.

Impact on Student Loan Debt

The ruling could potentially reduce the overall level of student loan debt in the United States by forgiving billions of dollars in loans. This would provide significant financial relief to millions of borrowers, freeing up their income for other expenses such as housing, healthcare, and childcare. However, it could also lead to increased borrowing in the future if students perceive that their loans will be forgiven.

Impact on Higher Education

The decision may also affect the availability and affordability of higher education. If student loans become less accessible or more expensive, it could deter some students from pursuing higher education. This could have a negative impact on the workforce and the economy as a whole. On the other hand, if student loan debt relief makes higher education more affordable, it could encourage more students to pursue degrees, leading to a more educated workforce.

Impact on the Federal Budget and Economy

Student loan debt relief could have a significant impact on the federal budget. Forgiving billions of dollars in loans would reduce the amount of money the government collects in loan repayments. This could lead to increased deficits and debt. However, it could also stimulate the economy by freeing up borrowers’ income for other spending.

Historical Evolution of Student Loan Debt

Student loan debt has become a major issue in the United States in recent decades. The total amount of student loan debt outstanding has grown from $250 billion in 1995 to over $1.7 trillion today. This growth has been driven by a number of factors, including rising tuition costs, increased borrowing by students, and a decrease in the availability of grants and scholarships.

Role of Federal and State Governments

The federal government plays a major role in regulating and supporting higher education. The government provides billions of dollars in grants and loans to students each year. It also sets interest rates on student loans and regulates the student loan industry. State governments also play a role in higher education, providing funding to public colleges and universities and setting policies for student financial aid.

Impact of Student Loan Debt on Individuals, Families, and the Workforce

Student loan debt can have a significant impact on individuals, families, and the workforce. Borrowers with high levels of student loan debt may have difficulty finding jobs, buying homes, or starting families. They may also be more likely to default on their loans, which can damage their credit and make it difficult to obtain other types of credit. Student loan debt can also have a negative impact on the workforce, as borrowers may be less likely to pursue higher-paying jobs that require additional education or training.

Potential Outcomes

The Supreme Court’s decision in the student loan debt relief case will have significant implications for millions of Americans struggling with student loan debt. The potential outcomes of the case include:

- The Court upholds the Biden administration’s plan: If the Court upholds the plan, up to 43 million borrowers could see their student loan debt forgiven or reduced. This would be a major victory for the Biden administration and would provide much-needed relief to borrowers who are struggling to repay their student loans.

- The Court strikes down the Biden administration’s plan: If the Court strikes down the plan, it would be a major setback for the Biden administration and would leave millions of borrowers without the relief they need. It could also lead to further legal challenges to the plan.

- The Court sends the case back to the lower courts: If the Court sends the case back to the lower courts, it would likely result in further delays in the implementation of the plan. It could also give the Biden administration an opportunity to revise the plan in a way that addresses the Court’s concerns.

The legal and policy implications of each outcome are complex. If the Court upholds the plan, it would be a major victory for the Biden administration and would provide much-needed relief to borrowers who are struggling to repay their student loans. However, it could also lead to legal challenges from states and other parties who argue that the plan is unconstitutional.

If the Court strikes down the plan, it would be a major setback for the Biden administration and would leave millions of borrowers without the relief they need. It could also lead to further legal challenges to the plan and could make it more difficult for the Biden administration to implement other student loan relief programs in the future.

If the Court sends the case back to the lower courts, it would likely result in further delays in the implementation of the plan. It could also give the Biden administration an opportunity to revise the plan in a way that addresses the Court’s concerns. However, it is also possible that the lower courts could reach different conclusions on the legality of the plan, which could lead to further confusion and uncertainty for borrowers.

The Supreme Court’s decision in the student loan debt relief case is likely to have a significant impact on millions of Americans. The potential outcomes of the case are complex and could have far-reaching implications for the future of student loan debt relief.

Historical Context

The history of student loan debt in the United States can be traced back to the 1950s, when the federal government began offering low-interest loans to students attending college. These loans were designed to help make higher education more accessible to students from all socioeconomic backgrounds. However, as the cost of college has risen over time, so too has the amount of student loan debt that students are taking on.

In recent years, there has been a growing movement to cancel student loan debt. Proponents of this movement argue that student loan debt is a major burden on borrowers, and that it is preventing them from achieving their full economic potential. They also argue that canceling student loan debt would stimulate the economy by freeing up money that borrowers could spend on other goods and services.

While the Supreme Court deliberates on student loan debt relief, borrowers seeking financial relief may consider exploring Simplified Loan Solutions Underwriting . This innovative platform streamlines the underwriting process, making it easier to qualify for loans with favorable terms. By leveraging technology and data-driven analysis, Simplified Loan Solutions Underwriting empowers borrowers to access the funding they need to navigate the complexities of student loan debt repayment.

Opponents of canceling student loan debt argue that it would be unfair to taxpayers who have already paid off their own student loans. They also argue that it would be too expensive, and that it would encourage colleges and universities to raise tuition prices even further.

The current case before the Supreme Court is the latest chapter in the long history of student loan debt in the United States. The Court’s decision in this case could have a significant impact on the future of student loan debt in the country.

Evolution of Policies and Attitudes Towards Student Loan Debt

The federal government’s policies towards student loan debt have evolved over time. In the early days of the student loan program, the government was relatively lenient in its lending practices. However, as the amount of student loan debt grew, the government began to tighten its lending standards.

In recent years, there has been a growing movement to cancel student loan debt. This movement has been fueled by the rising cost of college and the increasing burden of student loan debt on borrowers.

The current case before the Supreme Court is the latest chapter in the long history of student loan debt in the United States. The Court’s decision in this case could have a significant impact on the future of student loan debt in the country.

How the Current Case Fits into this Historical Context

The current case before the Supreme Court is the latest chapter in the long history of student loan debt in the United States. The Court’s decision in this case could have a significant impact on the future of student loan debt in the country.

If the Court rules in favor of the plaintiffs, it could lead to the cancellation of billions of dollars in student loan debt. This would be a major victory for the movement to cancel student loan debt, and it would have a significant impact on the lives of millions of borrowers.

However, if the Court rules against the plaintiffs, it would be a setback for the movement to cancel student loan debt. It would also mean that the burden of student loan debt would continue to grow, and it would make it more difficult for students to afford college.

While the Supreme Court weighs the fate of student loan debt relief, it’s crucial to explore financial options that can alleviate the burden of debt. Consider using a Car Loan Calculator to optimize your car loan payments, saving you money and freeing up cash flow.

As the Supreme Court’s decision looms, it’s essential to prepare for potential financial implications and seek ways to manage student loan debt effectively.

– Economic Impact

Student loan debt relief has the potential to have a significant economic impact on individuals, businesses, and the overall economy. By reducing or eliminating student loan debt, the government could free up billions of dollars that could be spent on other goods and services, leading to increased economic growth. However, there are also potential risks associated with student loan debt relief, such as the cost to taxpayers and the potential for inflation.

Individuals

For individuals, student loan debt relief could have a major impact on their financial well-being. Reducing or eliminating student loan debt could free up money that could be used to pay down other debts, save for a down payment on a house, or invest in a business. This could lead to increased financial security and improved quality of life for many Americans.

Businesses

Student loan debt relief could also have a positive impact on businesses. By reducing or eliminating student loan debt, the government could free up billions of dollars that could be spent on goods and services, leading to increased demand for products and services. This could lead to increased economic growth and job creation.

Overall Economy

The overall economic impact of student loan debt relief is likely to be positive. By reducing or eliminating student loan debt, the government could free up billions of dollars that could be spent on other goods and services, leading to increased economic growth. However, there are also potential risks associated with student loan debt relief, such as the cost to taxpayers and the potential for inflation.

Political Impact

The Supreme Court’s decision on student loan debt relief has the potential to significantly impact the political landscape. A ruling in favor of debt relief could boost the popularity of President Biden and the Democratic Party, particularly among younger voters who have been disproportionately affected by student debt. It could also galvanize support for progressive policies aimed at addressing economic inequality.

Conversely, a ruling against debt relief could energize Republicans and conservative voters, who generally oppose government intervention in the economy. It could also make it more difficult for Democrats to win elections in the future, as they would be seen as out of touch with the concerns of working-class Americans.

Implications for Future Policy Decisions

The Supreme Court’s decision on student loan debt relief could have implications for future policy decisions on the issue. A ruling in favor of debt relief could set a precedent for future government action to address student debt, such as expanding income-driven repayment plans or providing additional subsidies for student loans. A ruling against debt relief, on the other hand, could make it more difficult for the government to take action on student debt in the future.

Social Impact

Student loan debt relief has the potential to significantly impact society. By reducing the financial burden of student loans, individuals may have greater access to higher education and career opportunities. This could lead to a more educated and skilled workforce, which can contribute to economic growth and innovation.

Equity and Distributional Issues

However, it’s important to consider potential equity and distributional issues associated with student loan debt relief. Some individuals may argue that relief is unfair to those who have already paid off their student loans or who chose not to pursue higher education due to the cost. Additionally, there may be concerns about the impact of debt relief on the overall federal budget deficit.

Timeline of Events

The case of student loan debt relief has seen a series of key events that have shaped its progression. These events have included filings, hearings, and decisions, each of which has played a significant role in determining the case’s trajectory.

One of the most significant events in the case was the initial filing of the lawsuit by a group of student loan borrowers in 2020. This filing set the stage for the legal challenge to the Biden administration’s plan to cancel student debt.

Key Filings

- August 24, 2022: Six Republican-led states file a lawsuit against the Biden administration’s student loan forgiveness plan, arguing that it is unconstitutional and would harm their states’ tax revenues.

- September 29, 2022: The Biden administration asks the Supreme Court to block a lower court order that had temporarily halted the student loan forgiveness program.

- October 13, 2022: The Supreme Court agrees to hear the case and sets oral arguments for February 28, 2023.

Key Hearings

- February 28, 2023: The Supreme Court hears oral arguments in the case.

Key Decisions

- June 30, 2023: The Supreme Court rules on the case.

The upcoming milestones and deadlines that may influence the case’s trajectory include the Supreme Court’s decision, which is expected in late June or early July 2023.

Expert Opinions

Legal scholars, economists, and policy analysts have expressed diverse opinions on the case of student loan debt relief. These opinions offer valuable insights into the legal and policy issues at play, shaping the understanding of the case and its potential implications.

Among legal experts, there is consensus that the Biden administration has the authority to cancel student debt through executive action. However, there is disagreement on the scope of this authority and whether it extends to the broad cancellation proposed by the administration.

The recent Supreme Court hearing on student loan debt relief has brought the issue of loan repayment to the forefront. For those seeking guidance on understanding and managing their loan obligations, Loan Calculator: A Comprehensive Guide to Understanding and Using Loan Calculators offers a valuable resource.

This comprehensive guide provides clear explanations of loan terms, interest rates, and repayment options, empowering individuals to make informed decisions about their student loan debt.

Legal Scholars

- John Malcolm, Professor of Law at George Mason University: “The Higher Education Act gives the Secretary of Education broad authority to modify or discharge student loans, which provides a legal basis for the administration’s actions.”

- Richard Revesz, Dean Emeritus of New York University School of Law: “The administration’s plan raises legal concerns as it may exceed the authority granted by the Higher Education Act and could face challenges in court.”

Economists

Economists generally agree that student loan debt relief would have a positive impact on the economy by increasing consumer spending and reducing financial burdens on borrowers. However, there is debate about the long-term effects of debt cancellation on the overall economy.

As the Supreme Court deliberates over the legality of President Biden’s student loan debt relief program, the complexities of risk management come to the forefront. Just as Collateral Underwriters assess and mitigate financial risks, so too must policymakers weigh the potential consequences of their decisions.

The Supreme Court’s ruling will undoubtedly have a profound impact on the lives of millions of Americans and shape the future of higher education financing.

- Mark Zandi, Chief Economist at Moody’s Analytics: “Student loan debt relief would provide a significant boost to the economy, increasing GDP by $100 billion over the next decade.”

- Jason Furman, former Chairman of the Council of Economic Advisers: “While debt cancellation would provide short-term relief, it could lead to higher inflation and increase the cost of college in the long run.”

Policy Analysts

Policy analysts have highlighted the potential benefits of student loan debt relief for addressing racial and economic disparities. However, they also raise concerns about the fairness and equity of the proposed plan.

- Persis Yu, Director of the National Consumer Law Center: “Student loan debt cancellation would disproportionately benefit low-income borrowers and borrowers of color, who face significant financial burdens due to student debt.”

- Howard Gleckman, Senior Fellow at the Urban Institute: “The administration’s plan is too broad and may not effectively target those who are most in need of relief.”

Overall, expert opinions on student loan debt relief reflect a range of perspectives on the legal, economic, and policy implications of the case. These opinions contribute to a deeper understanding of the issues at stake and provide valuable insights for policymakers and the public.

Resources

To further explore the intricacies of the student loan debt relief case, we have compiled a comprehensive list of valuable resources that provide diverse perspectives and in-depth analysis.

These resources, categorized for your convenience, will empower you with the necessary knowledge to delve deeper into the legal, economic, and societal implications of this landmark case.

Legal Documents

- Supreme Court Case Document: Biden v. Nebraska, No. 22-596 (2023) – The official case document outlining the legal arguments and rulings.

- Memorandum Opinion: Biden v. Nebraska, No. 22-596 (8th Cir. 2022) – The Eighth Circuit Court of Appeals’ decision upholding the student loan forgiveness program.

- Biden-Harris Student Debt Relief Plan: The White House’s official announcement and details of the student loan forgiveness program.

Wrap-Up

The Supreme Court’s decision in this case will have a major impact on the future of student loan debt relief. If the Court upholds the Biden administration’s plan, it will provide much-needed relief to millions of student loan borrowers. However, if the Court strikes down the plan, it will be a major setback for the Biden administration’s efforts to address the student loan debt crisis.

Essential FAQs

What is the Biden administration’s plan for student loan debt relief?

The Biden administration’s plan would forgive up to $20,000 in student debt for federal student loan borrowers.

Who is challenging the Biden administration’s plan?

The Biden administration’s plan is being challenged by a group of student loan borrowers.

What are the arguments for and against the Biden administration’s plan?

The Biden administration argues that the plan is legal and necessary to provide relief to borrowers who are struggling with student loan debt. Opponents of the plan argue that it is illegal and unfair to taxpayers who have already paid off their student loans.