Loan calculators are indispensable tools for anyone considering taking out a loan. Whether you’re planning to buy a home, finance a car, or consolidate debt, a loan calculator can help you estimate your monthly payments, interest charges, and total loan cost. In this comprehensive guide, we’ll delve into the world of loan calculators, exploring their purpose, functionality, and how they can empower you to make informed financial decisions.

Loan Types

Understanding the different types of loans available can help you make informed decisions about borrowing money. Each loan type has its own purpose, interest rates, repayment terms, and eligibility criteria.

Here are the most common types of loans:

Personal Loans

Personal loans are unsecured loans that can be used for a variety of purposes, such as debt consolidation, home renovations, or unexpected expenses. They typically have higher interest rates than secured loans, but they are easier to qualify for.

Mortgage Loans

Mortgage loans are secured loans that are used to purchase real estate. They are typically long-term loans with fixed or adjustable interest rates. The amount of money you can borrow for a mortgage loan will depend on your income, credit score, and the value of the property you are purchasing.

Auto Loans

Auto loans are secured loans that are used to purchase a vehicle. They are typically shorter-term loans than mortgage loans, and they have lower interest rates. The amount of money you can borrow for an auto loan will depend on your income, credit score, and the value of the vehicle you are purchasing.

Student Loans

Student loans are unsecured loans that are used to pay for college or other educational expenses. They are typically long-term loans with low interest rates. The amount of money you can borrow for a student loan will depend on your income, credit score, and the cost of your education.

| Loan Type | Purpose | Interest Rates | Repayment Terms | Eligibility Criteria |

|---|---|---|---|---|

| Personal Loans | Debt consolidation, home renovations, unexpected expenses | Higher than secured loans | Varies | Easier to qualify for |

| Mortgage Loans | Purchase real estate | Fixed or adjustable | Long-term | Income, credit score, property value |

| Auto Loans | Purchase a vehicle | Lower than personal loans | Shorter-term | Income, credit score, vehicle value |

| Student Loans | Pay for college or other educational expenses | Low | Long-term | Income, credit score, cost of education |

Loan Terms

Loan terms are the specific details of a loan agreement, including the interest rate, loan term, monthly payment, and other factors. These terms can significantly impact the affordability and overall cost of a loan.

One of the most important loan terms is the interest rate. This is the percentage of the loan amount that the borrower will pay over the life of the loan. A higher interest rate will result in higher monthly payments and a higher total cost of the loan. Conversely, a lower interest rate will result in lower monthly payments and a lower total cost of the loan.

Loan Term

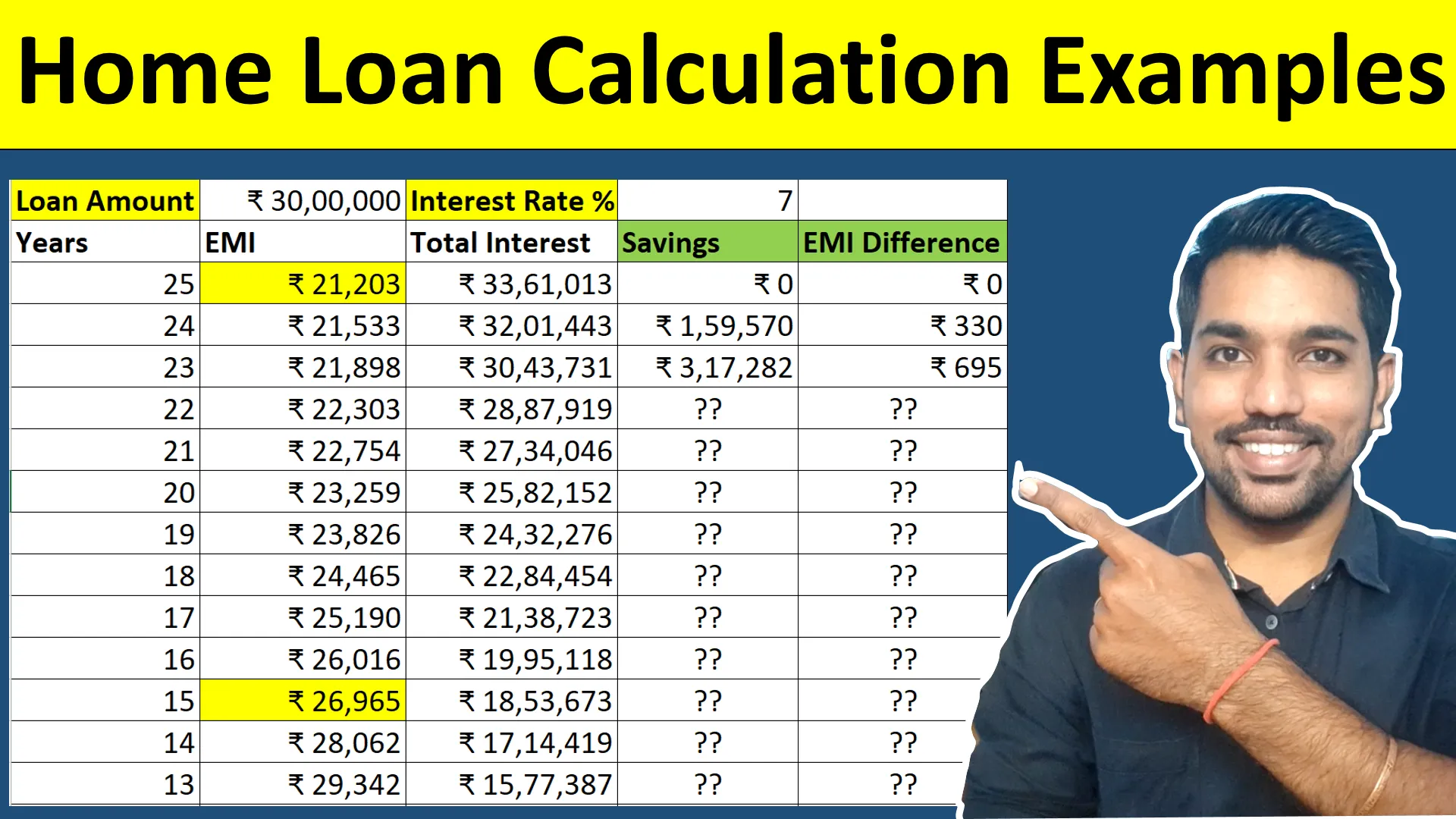

The loan term is the length of time that the borrower has to repay the loan. A shorter loan term will result in higher monthly payments, but a lower total cost of the loan. Conversely, a longer loan term will result in lower monthly payments, but a higher total cost of the loan.

Monthly Payment

The monthly payment is the amount of money that the borrower will pay each month to repay the loan. The monthly payment is determined by the loan amount, the interest rate, and the loan term. A higher monthly payment will result in a shorter loan term and a lower total cost of the loan. Conversely, a lower monthly payment will result in a longer loan term and a higher total cost of the loan.

Comparing Loan Terms

When comparing loan terms from different lenders, it is important to consider all of the factors discussed above. The best loan for one borrower may not be the best loan for another borrower. It is important to compare loan terms carefully and choose the loan that best meets your individual needs and financial situation.

Factors Affecting Loan Terms

There are a number of factors that can affect loan terms, including:

- Credit score

- Debt-to-income ratio

- Loan amount

- Loan purpose

- Collateral

Borrowers with higher credit scores and lower debt-to-income ratios will typically qualify for lower interest rates and better loan terms. Borrowers who are borrowing larger amounts of money or who are using the loan for a higher-risk purpose may also qualify for higher interest rates and less favorable loan terms.

Factors that Affect Loan Eligibility

Before granting a loan, lenders carefully evaluate your financial situation to determine your eligibility. Several factors influence this decision, including your credit score, income, and debt-to-income ratio.

Credit Score

Your credit score is a numerical representation of your credit history and behavior. It indicates your reliability in repaying debts and serves as a key indicator of your financial health. A higher credit score generally translates into better loan terms and interest rates.

Income

Your income is another crucial factor in determining your loan eligibility. Lenders want to ensure that you have sufficient income to repay the loan on time and in full. Your income can come from various sources, such as employment, self-employment, or investments.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) measures the percentage of your monthly income that goes towards debt payments. Lenders use this ratio to assess your ability to handle additional debt. A higher DTI can reduce your loan eligibility and increase the likelihood of loan rejection.

Calculating Debt-to-Income Ratio

To calculate your DTI, divide your total monthly debt payments by your gross monthly income. Multiply the result by 100 to express it as a percentage.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100

Loan Comparison: Loan Calculator

/calculating-the-intrinsic-value-of-perferred-stocks-58dc09de3df78c516271d210.jpg)

When comparing loan options, it’s essential to consider various factors that can significantly impact your financial situation. Interest rates, fees, and loan terms are crucial aspects that can make a substantial difference in the overall cost of the loan.

Interest Rates

Interest rates are the percentage of the loan amount that you pay to borrow the money. Comparing interest rates from different lenders is crucial as even a small difference can result in significant savings over the loan term. Fixed interest rates remain constant throughout the loan period, while variable interest rates fluctuate with market conditions.

| Lender | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Bank A | 5.50% | 4.75% – 6.25% |

| Bank B | 5.75% | 4.50% – 6.00% |

| Bank C | 5.25% | 4.25% – 5.75% |

Loan Application Process

Applying for a loan involves several steps that require careful preparation and attention to detail. Understanding the process and following tips can increase your chances of completing the application successfully.

Preparing for the Application

Before starting the application, gather necessary documents, such as financial statements, tax returns, and proof of identity. Review the lender’s eligibility criteria and loan terms to ensure you meet the requirements.

Completing the Application

Provide accurate and complete information on the application form. Disclose all relevant financial details, including income, expenses, and assets. Be truthful and transparent to build trust with the lender.

Submitting the Application

Submit the completed application along with supporting documents to the lender. Track the status of your application regularly and respond promptly to any requests for additional information.

Tips for Completing the Application Successfully

- Be organized and gather all required documents before starting.

- Read the application form carefully and understand the instructions.

- Provide clear and concise information, avoiding any ambiguities.

- Double-check the accuracy of all financial data and calculations.

- Seek professional advice from a financial advisor or tax preparer if needed.

Loan Repayment Options: Understanding How They Work

When it comes to repaying your loan, there are several options available. Each option has its own unique features, benefits, and drawbacks. Understanding how each option works can help you make an informed decision about which one is right for you.

The most common loan repayment options include:

- Fixed-rate loans

- Variable-rate loans

- Adjustable-rate loans

- Interest-only loans

- Balloon loans

Fixed-Rate Loans

With a fixed-rate loan, the interest rate remains the same throughout the life of the loan. This means that your monthly payments will also remain the same. Fixed-rate loans are a good option if you want to know exactly how much your monthly payments will be.

For example, if you have a $100,000 loan with a 5% interest rate and a 30-year term, your monthly payments will be $536.82. This amount will not change over the life of the loan.

Variable-Rate Loans

With a variable-rate loan, the interest rate can change over time. This means that your monthly payments can also change. Variable-rate loans are often tied to an index, such as the prime rate. When the index goes up, your interest rate will also go up. When the index goes down, your interest rate will also go down.

For example, if you have a $100,000 loan with a variable interest rate that is currently 5%, your monthly payments will be $536.82. However, if the prime rate goes up to 6%, your interest rate will also go up to 6%. This will increase your monthly payments to $572.20.

Adjustable-Rate Loans

Adjustable-rate loans (ARMs) are similar to variable-rate loans, but they have a fixed rate for a certain period of time. After the fixed-rate period ends, the interest rate can adjust periodically, usually every year or every five years.

For example, you might have an ARM with a 5% fixed rate for the first five years. After the five-year period ends, the interest rate will adjust to the current market rate. This could be higher or lower than the original 5% rate.

Interest-Only Loans

With an interest-only loan, you only pay the interest on the loan for a certain period of time. This can make your monthly payments lower than they would be with a traditional loan. However, once the interest-only period ends, you will have to start paying back the principal balance of the loan. This can lead to a significant increase in your monthly payments.

For example, if you have a $100,000 interest-only loan with a 5% interest rate and a 10-year term, your monthly payments will be $416.67. However, once the 10-year period ends, you will have to start paying back the principal balance of $100,000. This will increase your monthly payments to $1,066.67.

Balloon Loans

With a balloon loan, you make smaller monthly payments for a certain period of time. However, at the end of the loan term, you must pay off the remaining balance of the loan in one lump sum. Balloon loans can be a good option if you expect to have a large amount of money available at the end of the loan term.

For example, if you have a $100,000 balloon loan with a 5% interest rate and a 30-year term, your monthly payments will be $416.67. However, at the end of the 30-year period, you will have to pay off the remaining balance of $100,000.

Comparison of Loan Repayment Options

| Loan Type | Interest Rate | Repayment Term | Fees |

|---|---|---|---|

| Fixed-Rate Loan | Fixed | Fixed | May have origination fee |

| Variable-Rate Loan | Variable | Fixed | May have origination fee |

| Adjustable-Rate Loan | Fixed for a certain period, then variable | Fixed | May have origination fee |

| Interest-Only Loan | Fixed for a certain period, then interest only | Fixed | May have origination fee |

| Balloon Loan | Fixed | Fixed | May have origination fee and balloon payment at the end of the term |

Choosing the Best Loan Repayment Option

The best loan repayment option for you will depend on your individual circumstances and financial goals. If you want to know exactly how much your monthly payments will be, a fixed-rate loan may be a good option. If you are comfortable with the risk of your interest rate changing, a variable-rate loan may be a good option. If you need to keep your monthly payments low for a certain period of time, an interest-only loan or a balloon loan may be a good option.

It is important to compare the different loan repayment options and choose the one that is right for you. You should also consider the fees associated with each option and make sure that you can afford the monthly payments.

Loan Refinancing

Loan refinancing is a financial strategy that involves obtaining a new loan to replace an existing one. It is often used to secure a lower interest rate, reduce monthly payments, or consolidate multiple loans into a single one. Refinancing a loan can potentially save borrowers money and improve their financial situation.

To refinance a loan, you will need to apply for a new loan with a different lender. The new lender will evaluate your creditworthiness and financial situation to determine if you qualify for the loan. If approved, the new lender will pay off your existing loan and provide you with a new loan with different terms and conditions.

Calculating loans can be a daunting task, but with the help of online loan calculators, it’s now easier than ever. These tools provide a quick and convenient way to estimate monthly payments, interest rates, and loan terms. However, it’s important to remember that loan calculators are only estimates, and it’s always a good idea to consult with a financial professional to get a more accurate assessment of your borrowing options.

For those seeking a deeper understanding of the risk management involved in lending, the article Collateral Underwriter: A Risk Manager’ provides valuable insights into the role of collateral underwriters in assessing the creditworthiness of borrowers. With the right tools and knowledge, you can make informed decisions about your finances and navigate the loan process with confidence.

Benefits of Loan Refinancing

- Lower interest rates: Refinancing to a loan with a lower interest rate can reduce your monthly payments and save you money over the life of the loan.

- Reduced monthly payments: Refinancing to a loan with a longer term can lower your monthly payments, making it easier to manage your budget.

- Consolidation of multiple loans: Refinancing multiple loans into a single loan can simplify your finances and make it easier to track your payments.

– Discuss the consequences of loan default, including late fees, damage to credit score, and potential legal action.

Defaulting on a loan can have serious consequences, both financial and legal. It’s important to understand the potential risks before you take out a loan so that you can avoid defaulting if possible.

The most immediate consequence of defaulting on a loan is that you will be charged late fees. These fees can add up quickly, making it even more difficult to catch up on your payments. In addition, defaulting on a loan can damage your credit score. A damaged credit score can make it difficult to get approved for future loans, and it can also lead to higher interest rates on loans that you do qualify for.

In some cases, defaulting on a loan can also lead to legal action. If you default on a secured loan, such as a mortgage or car loan, the lender may be able to repossess the collateral. If you default on an unsecured loan, such as a personal loan or credit card debt, the lender may be able to sue you for the amount of the debt.

Options for avoiding default, Loan calculator

If you are struggling to make your loan payments, there are a number of options available to help you avoid default. These options include:

- Loan modification: This is a process of changing the terms of your loan to make it more affordable. Loan modifications can include reducing the interest rate, extending the loan term, or reducing the monthly payment.

- Forbearance: This is a temporary suspension of your loan payments. Forbearance can give you some breathing room to get back on your feet financially.

- Debt consolidation: This is a process of combining multiple debts into a single loan with a lower interest rate. Debt consolidation can make your monthly payments more affordable and help you get out of debt faster.

Loan Scams

Loan scams are fraudulent schemes designed to trick individuals into providing personal and financial information or parting with their hard-earned money. These scams can take various forms, from phishing emails to fake loan offers. It’s crucial to be aware of these scams and take steps to protect yourself from falling victim to them.

One common type of loan scam is the phishing scam. Scammers send emails or text messages that appear to be from legitimate lenders. These messages often contain links to fake websites that look identical to the real thing. Once you click on the link and enter your personal information, the scammers can use it to steal your identity or access your bank account.

Another common type of loan scam is the fake loan offer. Scammers advertise loans with incredibly low interest rates or no credit checks. These offers are often too good to be true and should be treated with caution. If you’re considering a loan offer, be sure to do your research and only borrow from reputable lenders.

Tips for Avoiding Loan Scams

Here are some tips to help you avoid falling victim to loan scams:

- Never click on links in emails or text messages from unknown senders.

- Be wary of loan offers that seem too good to be true.

- Only borrow from reputable lenders.

- Never provide your personal information to a lender you don’t trust.

- If you’re unsure whether a loan offer is legitimate, contact the lender directly.

Real-Life Loan Scams

Here are some real-life examples of loan scams:

- In 2020, a scammer posing as a representative from a well-known bank sent phishing emails to potential victims. The emails contained links to a fake website that looked identical to the bank’s real website. Once victims entered their personal information, the scammer was able to steal their identities and access their bank accounts.

- In 2021, a scammer advertised loans with incredibly low interest rates on social media. Victims who applied for the loans were asked to pay a “processing fee” upfront. Once the victims paid the fee, the scammer disappeared with their money.

Table of Loan Scams

The following table summarizes the different types of loan scams and their characteristics:

| Type of Scam | Characteristics |

|---|---|

| Phishing | Scammers send emails or text messages that appear to be from legitimate lenders. These messages often contain links to fake websites that look identical to the real thing. |

| Fake Loan Offer | Scammers advertise loans with incredibly low interest rates or no credit checks. These offers are often too good to be true and should be treated with caution. |

| Advance Fee Loan | Scammers ask victims to pay a “processing fee” or “advance fee” before they can receive the loan. Once the victims pay the fee, the scammer disappears with their money. |

| Identity Theft | Scammers use stolen personal information to apply for loans in the victim’s name. This can damage the victim’s credit score and lead to financial problems. |

Script for a Short Video on How to Avoid Loan Scams

Narrator: Loan scams are a serious problem, but you can protect yourself by being aware of the different types of scams and taking steps to avoid them.

Scene 1: A person receives an email from a scammer posing as a representative from a well-known bank. The email contains a link to a fake website that looks identical to the bank’s real website.

Narrator: This is a phishing scam. Never click on links in emails or text messages from unknown senders.

Scene 2: A person sees an ad for a loan with an incredibly low interest rate. The ad is on social media.

Narrator: This is a fake loan offer. Be wary of loan offers that seem too good to be true.

Scene 3: A person is talking to a scammer on the phone. The scammer is asking the person to pay a “processing fee” before they can receive the loan.

Narrator: This is an advance fee loan scam. Never pay any fees upfront for a loan.

Scene 4: A person is talking to a scammer in person. The scammer is asking the person for their personal information.

Narrator: This is an identity theft scam. Never provide your personal information to a lender you don’t trust.

Narrator: By following these tips, you can protect yourself from loan scams and keep your hard-earned money safe.

Loan Glossary

Understanding loan terminology is crucial for making informed financial decisions. This glossary provides clear and concise definitions of key loan-related terms, organized alphabetically for easy reference.

By familiarizing yourself with these terms, you can better navigate the loan application process, compare different loan options, and manage your loan effectively.

Terms

- Amortization: The process of gradually reducing the principal balance of a loan through regular payments.

- Annual Percentage Rate (APR): The total cost of borrowing, including interest and fees, expressed as an annual percentage.

- Collateral: An asset pledged as security for a loan, which the lender can seize if the loan is not repaid.

- Credit Score: A numerical representation of your creditworthiness, used by lenders to assess your risk and determine loan eligibility.

- Default: Failure to make timely loan payments, which can result in late fees, damage to your credit score, and potential legal action.

- Down Payment: A lump sum payment made upfront when taking out a loan, which reduces the amount you borrow.

- Interest: The charge paid for borrowing money, typically expressed as a percentage of the principal balance.

- Loan Term: The length of time over which a loan is repaid, typically expressed in years or months.

- Maturity Date: The date on which the loan is fully repaid.

- Origination Fee: A one-time fee charged by the lender for processing the loan application.

- Principal: The amount of money borrowed, excluding interest and fees.

- Refinance: Obtaining a new loan to pay off an existing loan, typically with more favorable terms.

“Understanding loan terms is essential for making informed decisions about borrowing money. It empowers you to compare different loan options, negotiate favorable terms, and manage your debt effectively.”

– Financial Expert

Loan Case Studies

Loans play a significant role in personal finance, providing access to funds for various purposes. To gain a practical understanding, let’s delve into real-world examples of how loans have been used, highlighting both the successes and challenges encountered.

Home Loans

Home loans are a common type of loan used to purchase a property. In many cases, they have enabled individuals and families to achieve their dream of homeownership. However, it’s important to consider the long-term financial implications and ensure affordability before committing to a mortgage.

Business Loans

Business loans can be crucial for entrepreneurs and small business owners to start or expand their ventures. They provide access to capital for investments in equipment, inventory, or marketing campaigns. However, securing business loans can be challenging, and it’s essential to demonstrate a solid business plan and financial track record.

Navigating the world of loans can be a daunting task, but with the help of a loan calculator, you can simplify the process. These tools provide a clear understanding of your loan options and monthly payments. However, if you’re looking for a more comprehensive solution, Simplified Loan Solutions Underwriting offers a streamlined underwriting process that makes loan approvals faster and easier.

Whether you’re a first-time homebuyer or refinancing an existing loan, a loan calculator can help you make informed decisions throughout the journey.

Education Loans

Education loans help students finance their higher education. While they offer opportunities for career advancement, it’s important to manage these loans responsibly. High student loan debt can burden graduates with monthly payments and impact their financial well-being in the long run.

Loan Calculators

Loan calculators are online tools that can help you estimate the monthly payments, interest rates, and loan terms for a variety of loan types. They are a valuable resource for anyone who is considering taking out a loan, as they can help you make informed decisions about the best loan for your needs.

There are many different types of loan calculators available, each designed to meet the specific needs of different borrowers. Some of the most common types of loan calculators include:

Mortgage Calculators

- Calculate the monthly payments, interest rates, and loan terms for a mortgage loan.

- Help you determine how much you can afford to borrow.

- Compare different mortgage options.

Auto Loan Calculators

- Calculate the monthly payments, interest rates, and loan terms for an auto loan.

- Help you determine how much you can afford to spend on a car.

- Compare different auto loan options.

Personal Loan Calculators

- Calculate the monthly payments, interest rates, and loan terms for a personal loan.

- Help you determine how much you can afford to borrow.

- Compare different personal loan options.

Student Loan Calculators

- Calculate the monthly payments, interest rates, and loan terms for a student loan.

- Help you determine how much you can afford to borrow.

- Compare different student loan options.

Loan calculators are easy to use. Simply enter the loan amount, interest rate, and loan term into the calculator, and it will calculate the monthly payments and other loan details. Some loan calculators also allow you to compare different loan options side-by-side, which can help you make the best decision for your needs.

| Type of Loan Calculator | Features |

|---|---|

| Mortgage Calculator | Calculates monthly payments, interest rates, and loan terms for a mortgage loan. |

| Auto Loan Calculator | Calculates monthly payments, interest rates, and loan terms for an auto loan. |

| Personal Loan Calculator | Calculates monthly payments, interest rates, and loan terms for a personal loan. |

| Student Loan Calculator | Calculates monthly payments, interest rates, and loan terms for a student loan. |

Loan calculators are a valuable resource for anyone who is considering taking out a loan. They can help you make informed decisions about the best loan for your needs and can save you time and money in the long run.

Here is a code snippet that demonstrates how to use a loan calculator API:

“`

// Import the loan calculator library

import loan_calculator

// Create a loan calculator object

loan_calculator = loan_calculator.LoanCalculator()

// Set the loan amount

loan_amount = 100000

// Set the interest rate

interest_rate = 5.0

// Set the loan term

loan_term = 30

// Calculate the monthly payment

monthly_payment = loan_calculator.calculate_monthly_payment(loan_amount, interest_rate, loan_term)

// Print the monthly payment

print(“The monthly payment is:”, monthly_payment)

“`

Here are some resources for learning more about loan calculators:

Loan Market Trends

The loan market is constantly evolving, with new trends emerging all the time. These trends can have a significant impact on both borrowers and lenders. Here are some of the most important loan market trends to watch for in 2023:

One of the most significant loan market trends in recent years has been the rise of online lending. Online lenders have made it easier than ever for borrowers to get loans, regardless of their credit history or financial situation. This has led to increased competition among lenders, which has resulted in lower interest rates and more flexible loan terms for borrowers.

Increased Demand for Personal Loans

The demand for personal loans has been increasing in recent years, as more and more people are using them to consolidate debt, finance home improvements, or cover unexpected expenses. Personal loans are typically unsecured, which means they do not require collateral. This makes them a good option for borrowers with bad credit or no credit history.

Loan Industry Regulations

The loan industry is heavily regulated to protect consumers from predatory lending practices. These regulations ensure that borrowers understand the terms of their loans and are able to repay them without undue hardship.

Federal Regulations

- The Truth in Lending Act (TILA) requires lenders to disclose the terms of a loan, including the interest rate, fees, and repayment schedule, before the borrower signs the loan agreement.

- The Equal Credit Opportunity Act (ECOA) prohibits lenders from discriminating against borrowers based on race, color, religion, national origin, sex, marital status, age, or disability.

- The Fair Debt Collection Practices Act (FDCPA) protects borrowers from abusive debt collection practices.

State Regulations

In addition to federal regulations, many states have their own laws that regulate the loan industry. These laws vary from state to state, but they typically include provisions that:

- Limit the amount of interest that lenders can charge.

- Require lenders to provide borrowers with a written loan agreement.

- Prohibit lenders from engaging in unfair or deceptive practices.

How These Regulations Protect Consumers

These regulations protect consumers by ensuring that they are aware of the terms of their loans and are able to repay them without undue hardship. They also prevent lenders from engaging in predatory lending practices that can trap borrowers in a cycle of debt.

Loan Resources

Borrowers and lenders can find valuable information and support from various resources. These resources provide guidance, education, and tools to help individuals make informed decisions about loans.

The following list includes websites, books, and other helpful materials that can assist borrowers and lenders in navigating the loan process:

Websites

- Consumer Financial Protection Bureau (CFPB): Provides comprehensive information on various loan types, consumer rights, and financial planning.

- Federal Deposit Insurance Corporation (FDIC): Offers resources on bank loans, deposit insurance, and financial literacy.

- National Credit Union Administration (NCUA): Provides information on credit unions, loan products, and financial education.

- Bankrate: Compares loan rates and provides financial advice.

- LendingTree: An online marketplace that connects borrowers with lenders.

Books

- The Complete Idiot’s Guide to Getting a Mortgage by Matthew Krantz

- The Everything Guide to Loans by Joe Messinger

- Personal Finance for Dummies by Eric Tyson

Other Resources

- Financial counseling agencies: Provide free or low-cost financial advice and guidance.

- Community development organizations: Offer financial literacy programs and assistance with loan applications.

- Government-backed loan programs: Provide loans with favorable terms for specific purposes, such as education or homeownership.

Wrap-Up

Understanding how loan calculators work and using them effectively can significantly impact your financial well-being. By leveraging these tools, you can make informed choices about your borrowing options, optimize your repayment strategies, and ultimately achieve your financial goals. So, whether you’re a first-time borrower or a seasoned loan veteran, embrace the power of loan calculators and unlock the key to financial success.

Common Queries

What types of loan calculators are available?

There are various types of loan calculators, including mortgage calculators, auto loan calculators, personal loan calculators, and student loan calculators.

How can I use a loan calculator to compare different loan options?

Loan calculators allow you to input different loan parameters, such as loan amount, interest rate, and loan term, to compare monthly payments, total interest charges, and total loan costs.

What factors affect the accuracy of a loan calculator?

The accuracy of a loan calculator depends on the accuracy of the information you input, including the loan amount, interest rate, and loan term. It’s essential to use the most up-to-date information available.