Biden student loan – President Biden’s student loan forgiveness plan is a groundbreaking initiative that aims to provide much-needed relief to millions of borrowers. This comprehensive guide will delve into the key provisions, eligibility requirements, potential impact, and ongoing discussions surrounding this historic plan.

The plan’s central goal is to alleviate the crushing burden of student debt, which has hindered countless individuals from pursuing their dreams and achieving financial stability. By offering substantial forgiveness amounts and streamlining the application process, the Biden administration hopes to make a meaningful difference in the lives of student loan borrowers.

Biden’s Student Loan Forgiveness Plan

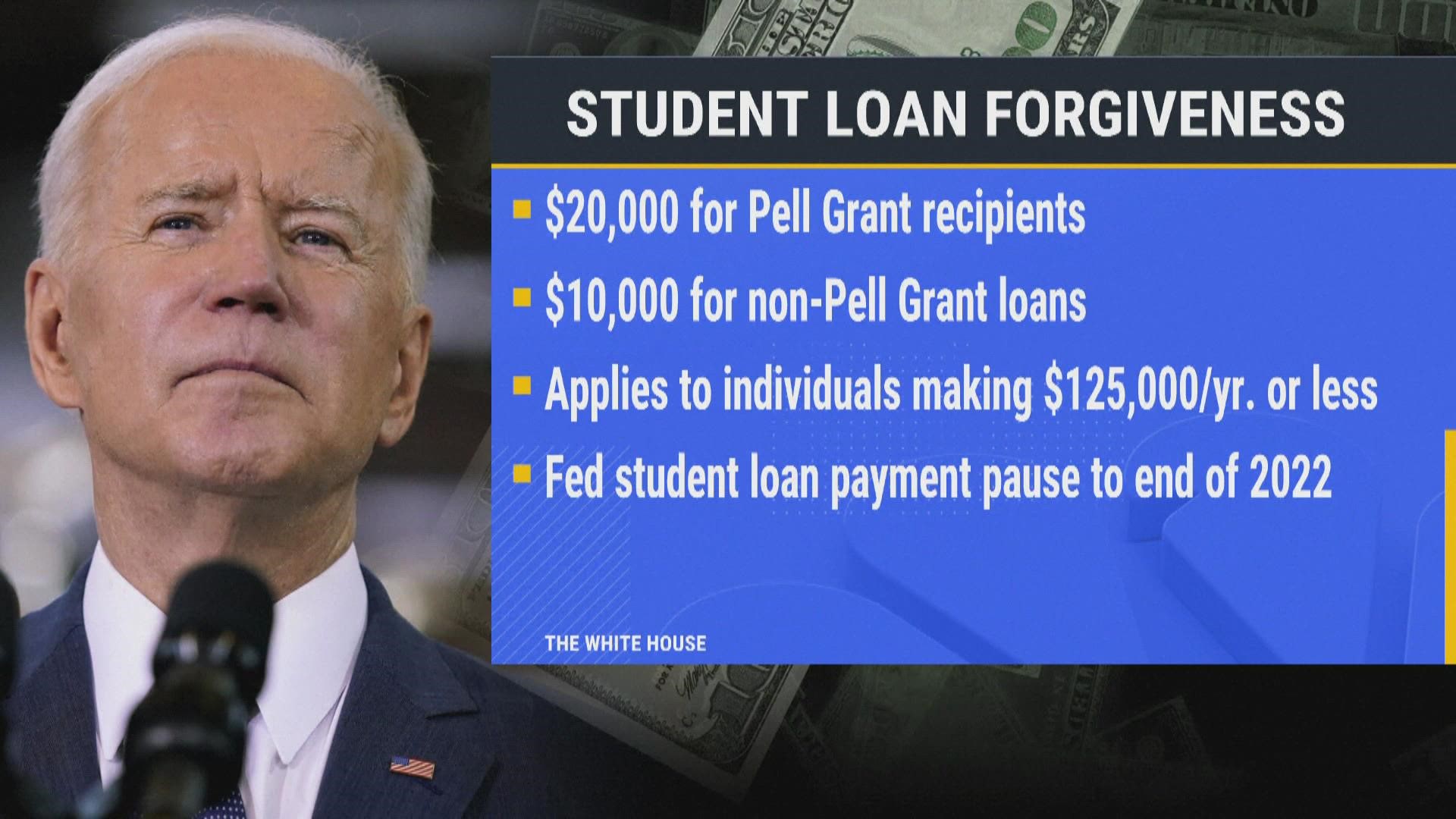

President Biden has proposed a plan to forgive up to $10,000 in federal student loan debt for borrowers who earn less than $125,000 per year, or $250,000 for married couples who file taxes jointly. The plan would also forgive up to $20,000 in debt for borrowers who received Pell Grants, which are need-based grants for low-income students.

The plan has been met with mixed reactions. Some argue that it is a necessary step to help borrowers who are struggling to repay their loans, while others argue that it is unfair to taxpayers who have already paid off their loans or who did not attend college.

Eligibility Requirements

To be eligible for the plan, borrowers must meet the following requirements:

- Have federal student loans

- Earn less than $125,000 per year, or $250,000 for married couples who file taxes jointly

- Have received a Pell Grant (for $20,000 forgiveness)

Application Process

The application process for the plan has not yet been announced. However, the Department of Education is expected to release more information in the coming weeks.

Potential Impact

The plan is expected to have a significant impact on the economy. The Congressional Budget Office estimates that the plan will cost $300 billion over the next 10 years. However, the plan is also expected to boost the economy by increasing consumer spending and reducing the amount of money that borrowers are paying on their loans.

Comparison to Other Proposals

The plan is similar to other student loan forgiveness proposals that have been made in recent years. However, the plan is more generous than most other proposals, as it would forgive a larger amount of debt and would be available to a wider range of borrowers.

Impact on Borrowers

The impact of Biden’s student loan forgiveness plan on borrowers is multifaceted, with both potential benefits and drawbacks to consider. Here’s an analysis of the plan’s potential effects on borrowers:

Benefits for Borrowers

One of the most significant benefits of the plan is the potential for substantial debt relief for eligible borrowers. The forgiveness of up to $10,000 in federal student loans for borrowers earning less than $125,000 (or $250,000 for married couples) could significantly reduce the financial burden of student debt for many individuals.

For some borrowers, this debt relief could free up monthly cash flow, allowing them to allocate funds towards other financial goals such as saving for a home, starting a business, or investing in their retirement. It could also improve their credit scores, making it easier to qualify for loans or credit cards with more favorable terms.

Drawbacks and Limitations

While the plan offers potential benefits for many borrowers, there are also some drawbacks and limitations to consider:

- Exclusions: The plan does not provide relief for all student loan borrowers. Private student loans and federal loans taken out for graduate or professional school are not eligible for forgiveness under this plan.

- Limited Amount: The forgiveness amount of up to $10,000 may not be sufficient to fully eliminate student loan debt for all borrowers, especially those with higher loan balances.

- Income Threshold: The income threshold for eligibility means that higher-earning borrowers may not receive any debt relief under this plan.

Examples of Fund Usage

If eligible borrowers receive the full $10,000 in debt forgiveness, they could use the forgiven funds in various ways, including:

- Debt Repayment: Applying the forgiven funds towards other outstanding debts, such as credit card debt or personal loans, could help reduce overall debt burden and improve financial stability.

- Savings: Setting aside the forgiven funds in a savings account could provide a financial cushion for emergencies or future expenses, such as a down payment on a house or a child’s education.

- Investments: Investing the forgiven funds in stocks, bonds, or mutual funds could potentially generate long-term financial growth and wealth accumulation.

Economic Impact

Biden’s student loan forgiveness plan is expected to have a significant economic impact, both in the short term and the long term. In the short term, the plan is likely to provide a boost to consumer spending, as borrowers who have their loans forgiven will have more money available to spend on other goods and services. This could help to stimulate economic growth and create jobs.

In the long term, the plan could have a positive impact on economic growth and productivity. By reducing the burden of student debt, borrowers will be able to invest more in their education and training, which could lead to higher earnings and increased productivity. Additionally, the plan could help to reduce income inequality, as it is expected to benefit low- and middle-income borrowers disproportionately.

Inflation

One potential concern about the plan is that it could lead to inflation. If the government forgives a large amount of student debt, it will need to borrow more money to finance its spending. This could lead to higher interest rates, which could in turn lead to higher prices for goods and services.

Interest Rates

The plan could also have an impact on interest rates. If the government borrows more money to finance the plan, it could lead to higher interest rates. This could make it more expensive for businesses to borrow money to invest and grow, which could slow economic growth.

Labor Market

The plan could also have an impact on the labor market. If borrowers have more money available to spend, they may be more likely to leave their jobs and start their own businesses or pursue other opportunities. This could lead to a shortage of workers in some industries, which could drive up wages and lead to higher inflation.

Federal Budget

The plan is also expected to have a significant impact on the federal budget. The government will need to borrow more money to finance the plan, which will increase the national debt. This could lead to higher interest payments on the debt, which could crowd out other government spending.

Economic Growth, Biden student loan

The plan could also have a positive impact on economic growth. By reducing the burden of student debt, borrowers will be able to invest more in their education and training, which could lead to higher earnings and increased productivity. Additionally, the plan could help to reduce income inequality, as it is expected to benefit low- and middle-income borrowers disproportionately.

Distributional Effects

The plan is expected to have a disproportionate impact on low- and middle-income borrowers. These borrowers are more likely to have student debt, and they are also more likely to benefit from the plan’s forgiveness provisions. The plan is also expected to have a positive impact on racial and ethnic minorities, as these groups are disproportionately represented among student loan borrowers.

Political Implications

President Biden’s student loan forgiveness plan is a politically charged issue, with both supporters and detractors weighing in on its potential impact. The plan has been met with praise from some who argue that it will provide much-needed relief to borrowers struggling with student debt. Others have criticized the plan, arguing that it is unfair to taxpayers who have already paid off their student loans or who did not attend college.

The plan is likely to have a significant impact on the upcoming midterm elections. Democrats are hoping that the plan will energize their base and help them win control of Congress. Republicans, on the other hand, are likely to use the plan as a campaign issue, arguing that it is a waste of taxpayer money.

Potential Impact on the Midterm Elections

- The plan could energize Democratic voters, who are more likely to have student debt than Republican voters.

- The plan could also help Democrats win over independent voters, who are often swing voters in elections.

- Republicans are likely to use the plan as a campaign issue, arguing that it is a waste of taxpayer money.

Comparison to Other Plans

President Biden’s student loan forgiveness plan has been compared to several other proposals that have been put forward in recent years. These plans vary in terms of their eligibility criteria, forgiveness amounts, and implementation timelines.

One of the key differences between Biden’s plan and other proposals is the income limit. Biden’s plan would only forgive loans for borrowers who earn less than $125,000 per year (or $250,000 for married couples). This income limit is lower than the income limits proposed in some other plans, which would have forgiven loans for borrowers who earn up to $150,000 per year (or $300,000 for married couples).

Another key difference between Biden’s plan and other proposals is the amount of forgiveness that would be provided. Biden’s plan would forgive up to $10,000 in federal student loan debt for borrowers who meet the income requirements. This is less than the amount of forgiveness that would be provided under some other plans, which would have forgiven up to $50,000 in debt.

Finally, Biden’s plan would be implemented through executive action, while other proposals would require congressional approval. This means that Biden’s plan could be implemented more quickly than other proposals, but it could also be more vulnerable to legal challenges.

Eligibility

The following table compares the eligibility criteria for Biden’s student loan forgiveness plan to the eligibility criteria for other proposals:

| Plan | Income Limit | Loan Types | Repayment History |

|---|---|---|---|

| Biden’s Plan | Less than $125,000 per year (or $250,000 for married couples) | Federal student loans | No requirement |

| Proposal 1 | Less than $150,000 per year (or $300,000 for married couples) | Federal and private student loans | No requirement |

| Proposal 2 | No income limit | Federal student loans | Must have made at least 120 qualifying payments |

As the table shows, Biden’s plan has the most restrictive eligibility criteria. Borrowers who earn more than $125,000 per year (or $250,000 for married couples) would not be eligible for forgiveness under Biden’s plan, even if they have federal student loans.

Forgiveness Amounts

The following table compares the forgiveness amounts offered by Biden’s student loan forgiveness plan to the forgiveness amounts offered by other proposals:

| Plan | Forgiveness Amount |

|---|---|

| Biden’s Plan | Up to $10,000 |

| Proposal 1 | Up to $50,000 |

| Proposal 2 | Full forgiveness |

As the table shows, Biden’s plan offers the smallest forgiveness amount. Borrowers who have federal student loans would only be eligible for up to $10,000 in forgiveness under Biden’s plan.

Implementation

Biden’s student loan forgiveness plan would be implemented through executive action. This means that Biden could implement the plan without congressional approval. However, the plan could be more vulnerable to legal challenges than a plan that was approved by Congress.

Biden’s recent announcement on student loan forgiveness has sparked a wave of excitement among borrowers. If you’re curious about how much you might qualify for, a student loan calculator can provide valuable insights. Simply enter your loan details and the calculator will estimate your potential savings under the new plan.

With this information, you can make informed decisions about your student loan repayment strategy and take advantage of the relief offered by the Biden administration.

Other student loan forgiveness proposals would require congressional approval. This means that these plans would have to be passed by both the House of Representatives and the Senate before they could be implemented. The approval process could take months or even years.

Biden’s student loan relief has been a topic of much discussion, with many speculating about the potential impact of joe biden student loan forgiveness . While the details of the plan are still being finalized, it is clear that the Biden administration is committed to addressing the issue of student loan debt.

The Biden student loan plan is a step in the right direction, and it will be interesting to see how it unfolds in the coming months.

Legal Challenges

Biden’s student loan forgiveness plan faces potential legal challenges from various parties. These challenges could arise due to concerns over the plan’s legality, its impact on the economy, and its fairness to taxpayers who have already repaid their student loans.

Legal Arguments Against the Plan

Opponents of the plan argue that it exceeds the authority granted to the President under the Higher Education Relief Opportunities for Students Act of 2003. They contend that the Act does not give the President the power to cancel student debt on a broad scale.

Biden’s student loan forgiveness plan has been a hot topic lately, and for good reason. Many borrowers are struggling to repay their student loans, and the plan could provide much-needed relief. To stay up-to-date on the latest developments, check out our article on the student loan forgiveness update . The article covers everything you need to know about the plan, including who is eligible, how to apply, and what the potential benefits are.

So if you’re a student loan borrower, be sure to check it out.

Additionally, critics argue that the plan is unfair to taxpayers who have already repaid their student loans or who chose not to attend college due to the high cost of education. They argue that forgiving student debt would create a moral hazard, encouraging individuals to take on more debt in the future with the expectation that it will be forgiven.

Legal Arguments in Favor of the Plan

Supporters of the plan argue that it is a necessary and reasonable exercise of the President’s authority under the Higher Education Relief Opportunities for Students Act of 2003. They contend that the Act gives the President broad authority to take action to address the financial hardship caused by the COVID-19 pandemic.

Additionally, supporters argue that the plan is fair and equitable. They note that many student loan borrowers have been struggling to repay their debts for years, and that the plan would provide much-needed relief to these individuals.

Biden’s student loan relief plan has been a topic of much debate. While some argue that it is a necessary step to help struggling borrowers, others worry about the potential cost to taxpayers. However, the Biden student loan forgiveness program could provide much-needed relief to millions of Americans who are struggling to repay their student loans.

Ultimately, the decision of whether or not to support the plan is a complex one that requires careful consideration of all the potential benefits and drawbacks.

Likelihood of Successful Legal Challenges

The likelihood of successful legal challenges to Biden’s student loan forgiveness plan is uncertain. The courts will need to weigh the legal arguments for and against the plan and determine whether the President has the authority to implement it.

If the courts find that the plan is illegal, it could be blocked or overturned. However, if the courts find that the plan is legal, it will likely be allowed to proceed.

Alternatives to Forgiveness

While student loan forgiveness remains a popular and hotly debated topic, it’s essential to consider alternative solutions to address the student debt crisis. These alternatives aim to make higher education more affordable, reduce the burden of debt, and improve the repayment process.

Income-Driven Repayment Plans

- Allow borrowers to repay loans based on their income and family size.

- Pros: Lower monthly payments, potential loan forgiveness after a certain period.

- Cons: Can extend the repayment period, may not be available to all borrowers.

Debt Refinancing

- Borrowers can consolidate and refinance their student loans into a new loan with a lower interest rate.

- Pros: Lower monthly payments, potential savings on interest.

- Cons: May require a good credit score, can lead to higher total interest paid if the repayment period is extended.

Public Service Loan Forgiveness

- Forgives student loans for borrowers who work in public service jobs, such as teaching, nursing, or social work.

- Pros: Encourages individuals to pursue public service careers.

- Cons: Strict eligibility requirements, long repayment period.

Recommendations for Policymakers

- Expand eligibility and improve access to income-driven repayment plans.

- Increase funding for public service loan forgiveness programs.

- Explore debt refinancing options that are accessible to a wider range of borrowers.

Long-Term Implications

Biden’s student loan forgiveness plan has sparked discussions about its potential long-term consequences. While the plan offers immediate relief to borrowers, its impact on future student loan borrowing, repayment, and higher education remains uncertain.

Impact on Future Borrowing and Repayment

One concern is that the forgiveness plan could encourage future students to borrow more, assuming that their loans will eventually be forgiven. This could lead to an increase in overall student loan debt, as students may be less cautious about taking on large loans. Additionally, the plan could create a moral hazard, where borrowers may default on their loans, expecting them to be forgiven in the future.

Implications for Higher Education

The plan may also have broader implications for higher education. If students anticipate loan forgiveness, they may be less willing to pay full tuition, leading to decreased revenue for colleges and universities. This could result in higher tuition costs for future students or a reduction in the quality of education.

Public Opinion

The Biden administration’s student loan forgiveness plan has garnered mixed reactions from the public. While some individuals support the initiative, others express concerns or outright opposition.

Those in favor of the plan argue that it provides much-needed relief to borrowers struggling with student debt. They contend that the high cost of education has created a financial burden for many individuals, hindering their ability to pursue other financial goals or contribute fully to the economy.

Demographics and Political Affiliations

Polls indicate that the plan enjoys stronger support among younger Americans, particularly those who have recently graduated or are still in college. This demographic group tends to carry the largest student loan balances and faces significant financial challenges as they enter the workforce.

In terms of political affiliations, the plan receives more favorable views from Democrats than Republicans. However, there is a notable divide within the Republican party, with some members expressing support for the plan due to its potential economic benefits.

Historical Context

Student loan forgiveness has a complex history in the United States, with various attempts and outcomes over the years. Past proposals have ranged from targeted relief programs to comprehensive debt cancellation.

One notable example is the Public Service Loan Forgiveness (PSLF) program, established in 2007. PSLF provides loan forgiveness to individuals who work in public service professions, such as teachers, nurses, and firefighters, after making 120 qualifying payments.

Similarities and Differences

Biden’s student loan forgiveness plan shares some similarities with past proposals, such as focusing on providing relief to low- and middle-income borrowers. However, it also has distinct features, including the one-time cancellation of up to $20,000 in debt for Pell Grant recipients.

Global Comparisons

In addition to the United States, several other countries have implemented student loan forgiveness programs. These programs vary in their eligibility criteria, forgiveness amounts, and repayment terms. Some common approaches include:

Income-Based Repayment Plans

These plans allow borrowers to make monthly payments based on their income and family size. After a certain number of years of payments, the remaining balance of the loan is forgiven.

Debt Forgiveness After a Certain Number of Years of Service

This approach forgives student loans for borrowers who work in certain public service professions, such as teaching, nursing, or social work. The number of years of service required for forgiveness varies by program.

Complete Debt Forgiveness

Some countries offer complete debt forgiveness to all borrowers who meet certain eligibility criteria, such as having a certain level of student loan debt or having attended a particular type of institution.

Economic Modeling

Economic modeling is crucial for understanding the potential impact of Biden’s student loan forgiveness plan. These models simulate the plan’s effects on student loan borrowers, the economy, and the federal budget. They provide valuable insights into the plan’s feasibility and potential consequences.

Sensitivity Analyses

Sensitivity analyses assess the impact of different assumptions on the model’s outcomes. By varying key parameters, such as the number of borrowers who qualify for forgiveness or the interest rate on federal student loans, analysts can gauge the plan’s robustness and identify potential risks.

Impact on Borrowers

Economic models estimate the impact of student loan forgiveness on borrowers’ financial well-being. They consider factors such as the reduction in monthly loan payments, the increase in disposable income, and the potential for borrowers to invest or save more money.

Impact on the Economy

Models also assess the plan’s macroeconomic effects. They estimate the impact on GDP, employment, and inflation. The forgiveness of student loans could stimulate consumer spending and economic growth, but it could also put upward pressure on interest rates and inflation.

Impact on the Federal Budget

Economic models estimate the cost of the student loan forgiveness plan to the federal budget. They consider the direct cost of forgiving loans, as well as the indirect cost of reduced tax revenue from borrowers who no longer have to make loan payments.

Cost-Benefit Analysis

Biden’s student loan forgiveness plan has been a topic of much debate, with proponents and opponents arguing over its potential benefits and costs. To assess the plan’s impact, a comprehensive cost-benefit analysis is necessary.

Quantifying the benefits of the plan is challenging, as they extend beyond direct financial relief to borrowers. The plan aims to reduce the burden of student debt, which can hinder economic growth by limiting consumer spending and investment. It also seeks to promote equity by addressing the racial wealth gap, as Black and Hispanic borrowers disproportionately carry student debt.

Economic Impact

- Increased consumer spending: Relieved from student debt payments, borrowers may have more disposable income, boosting consumer spending and economic growth.

- Stimulated investment: With reduced debt, borrowers may be more likely to invest in businesses, homes, or education, further contributing to economic growth.

- Reduced income inequality: By targeting low- and middle-income borrowers, the plan aims to reduce income inequality and promote economic mobility.

Costs of the Plan

- Federal budget deficit: The plan’s estimated cost of $1.6 trillion would increase the federal budget deficit, potentially leading to higher interest rates or reduced spending in other areas.

- Inflation: Increased consumer spending resulting from debt relief could potentially contribute to inflationary pressures.

- Moral hazard: Critics argue that forgiving student loans may encourage future borrowers to take on more debt, anticipating future forgiveness.

Trade-offs

Implementing Biden’s student loan forgiveness plan involves trade-offs. The potential benefits of increased economic growth and reduced income inequality must be weighed against the costs of a higher budget deficit and potential inflationary pressures. Additionally, concerns about moral hazard must be considered.

– Develop policy recommendations based on the analysis of Biden’s student loan forgiveness plan.

The Biden administration’s student loan forgiveness plan has been met with mixed reactions. Some borrowers have welcomed the plan as a much-needed relief, while others have criticized it as being too costly and unfair to those who have already repaid their loans. To improve the plan and address potential challenges, the following policy recommendations are proposed:

1. Expand eligibility for forgiveness. The current plan only forgives up to $10,000 in federal student loans for borrowers who earn less than $125,000 per year (or $250,000 for married couples). This income threshold could be raised to make the plan more equitable and ensure that more borrowers benefit from it.

2. Provide more generous forgiveness amounts. The current plan only forgives up to $10,000 in federal student loans. This amount could be increased to provide more meaningful relief to borrowers, especially those who have high levels of debt.

3. Include private student loans in the forgiveness program. The current plan only forgives federal student loans. Private student loans are not included, even though they can be just as burdensome for borrowers.

4. Make the forgiveness program permanent. The current plan is a one-time event. It would be more effective if it were made permanent so that future borrowers could also benefit from it.

5. Increase funding for higher education. The Biden administration’s student loan forgiveness plan is a temporary solution to the problem of student loan debt. In the long term, it is important to increase funding for higher education so that students can afford to attend college without taking on large amounts of debt.

Timeline and Implementation: Biden Student Loan

President Biden’s student loan forgiveness plan has been met with both praise and criticism. One of the key concerns raised by critics is the timeline for implementation. The plan is complex, and there are a number of steps that need to be taken before forgiveness can be applied to borrowers’ accounts.

Key Milestones and Deadlines

The Department of Education has not yet released a detailed timeline for the implementation of the plan. However, based on the information that is available, we can estimate the following key milestones and deadlines:

- Application launch date: The application for student loan forgiveness is expected to launch in early October 2023.

- Deadline for submitting applications: The deadline for submitting applications is expected to be December 31, 2023.

- Date for processing applications to begin: The Department of Education will begin processing applications in early 2024.

- Date for forgiveness to be applied: Forgiveness is expected to be applied to borrowers’ accounts in mid-2024.

Challenges and Opportunities

The implementation of Biden’s student loan forgiveness plan will present a number of challenges. One of the biggest challenges will be processing the large volume of applications. The Department of Education estimates that it will receive up to 40 million applications for forgiveness. This will be a significant undertaking, and it is possible that there will be delays in processing applications.

Another challenge will be ensuring that all eligible borrowers receive forgiveness. The application process will be complex, and it is possible that some borrowers will miss the deadline or make mistakes on their applications. The Department of Education will need to take steps to ensure that all eligible borrowers have the opportunity to receive forgiveness.

Despite the challenges, there are also a number of opportunities associated with the implementation of the plan. One opportunity is to streamline the application process. The Department of Education can use technology to automate tasks and make it easier for borrowers to apply for forgiveness.

Another opportunity is to provide clear and concise information to borrowers. The Department of Education can create a website and other resources to help borrowers understand the plan and apply for forgiveness.

Role of Different Stakeholders

The implementation of Biden’s student loan forgiveness plan will involve a number of different stakeholders. These stakeholders include:

- The Department of Education: The Department of Education will be responsible for overseeing the implementation of the plan. This will include developing the application process, processing applications, and applying forgiveness to borrowers’ accounts.

- Loan servicers: Loan servicers will be responsible for communicating with borrowers about the plan and processing applications for forgiveness.

- Borrowers: Borrowers will need to apply for forgiveness and provide the necessary documentation to support their applications.

Potential Roadblocks and Solutions

There are a number of potential roadblocks to the implementation of Biden’s student loan forgiveness plan. These roadblocks include:

- Delays in processing applications: The Department of Education estimates that it will take up to six months to process applications for forgiveness. This could lead to delays in borrowers receiving forgiveness.

- Errors on applications: Borrowers may make mistakes on their applications, which could lead to delays in processing or even denial of forgiveness.

- Fraud and abuse: There is the potential for fraud and abuse in the implementation of the plan. Borrowers may try to apply for forgiveness for loans that are not eligible, or they may try to submit fraudulent documentation.

The Department of Education can take a number of steps to overcome these roadblocks. These steps include:

- Streamlining the application process: The Department of Education can use technology to automate tasks and make it easier for borrowers to apply for forgiveness.

- Providing clear and concise information to borrowers: The Department of Education can create a website and other resources to help borrowers understand the plan and apply for forgiveness.

- Working with loan servicers to identify and prevent fraud: The Department of Education can work with loan servicers to identify and prevent fraud. This may involve using data analytics to identify suspicious applications and conducting audits of loan servicers.

Epilogue

The Biden student loan forgiveness plan is a complex and multifaceted initiative that has sparked both excitement and controversy. As the plan continues to evolve and face legal challenges, it remains to be seen how it will ultimately impact borrowers, the economy, and the future of higher education. However, one thing is clear: this plan represents a bold attempt to address the student debt crisis and provide a lifeline to millions of Americans.

FAQ Insights

Who is eligible for Biden’s student loan forgiveness?

To be eligible, borrowers must meet certain income requirements and have federal student loans that were disbursed before July 1, 2022.

How much student loan debt will be forgiven?

The amount of forgiveness varies depending on the type of loan and the borrower’s income. Pell Grant recipients can receive up to $20,000 in forgiveness, while other borrowers are eligible for up to $10,000.

How do I apply for Biden’s student loan forgiveness?

The application process is expected to open in early October 2023. Borrowers can apply online through the Federal Student Aid website.