What document explains your rights and responsibilities as a federal student loan borrower? – Navigating the complexities of federal student loans can be daunting, but understanding your rights and responsibilities as a borrower is crucial. This comprehensive guide will delve into the key document that Artikels your obligations and entitlements, empowering you to make informed decisions and manage your student debt effectively.

Master Promissory Note

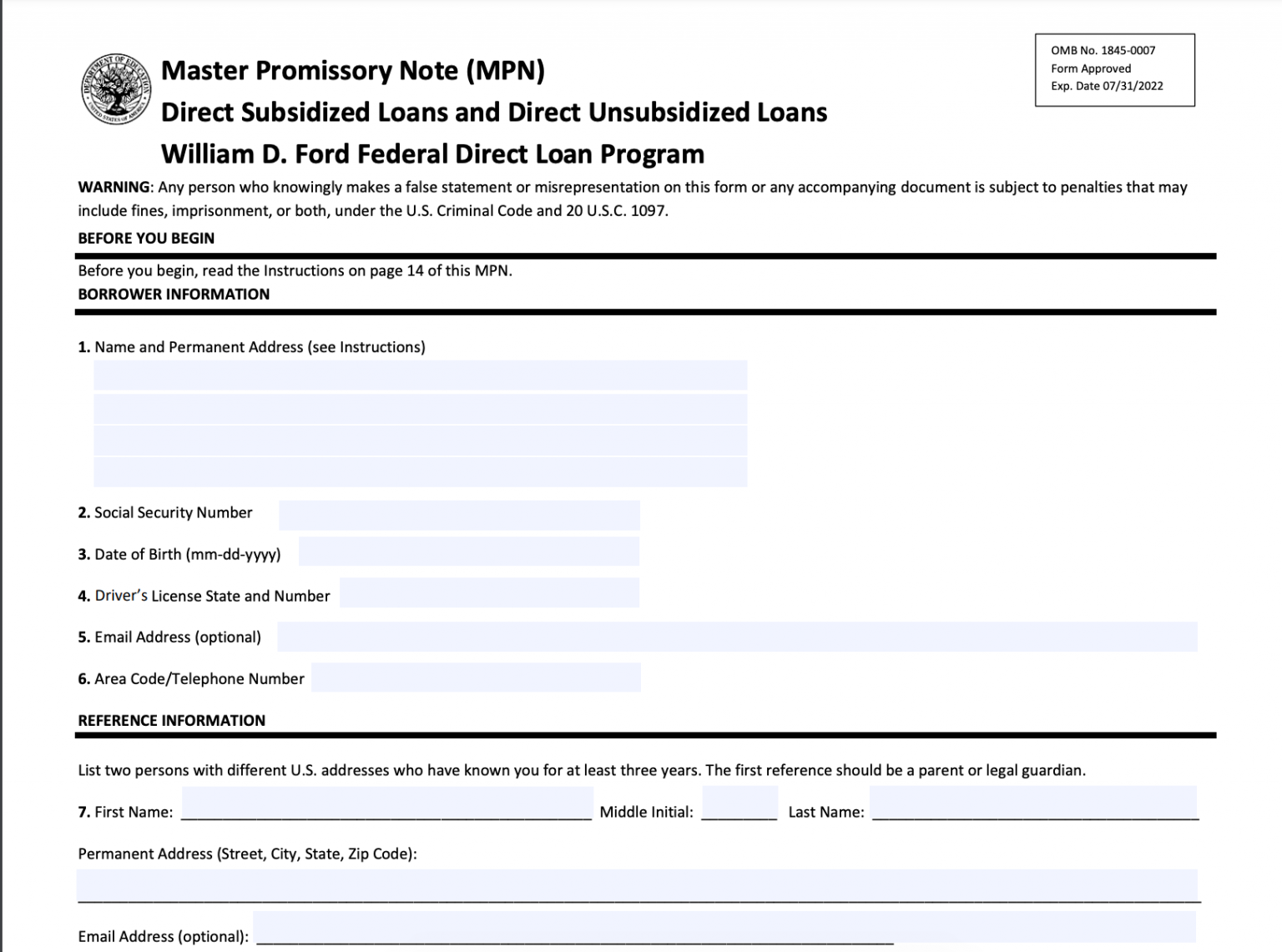

The Master Promissory Note (MPN) is a legal document that Artikels the terms and conditions of your federal student loans. It’s important to understand and fulfill the obligations Artikeld in the MPN to maintain your eligibility for federal student loans and avoid any potential consequences.

Key Terms and Conditions

The MPN includes essential information such as:

- The amount of your loan

- The interest rate on your loan

- The repayment period for your loan

- Your rights and responsibilities as a borrower

Entrance Counseling

Entrance counseling is a mandatory requirement for all first-time federal student loan borrowers. It’s an educational session that helps you understand your rights and responsibilities as a loan recipient.

If you’re a federal student loan borrower, it’s important to understand your rights and responsibilities. These are outlined in a document called the Master Promissory Note (MPN). The MPN explains the terms of your loan, including the interest rate, repayment period, and default consequences.

It’s also worth noting the recent developments in student loan forgiveness biden . If you have any questions about your student loans, be sure to contact your loan servicer. They can help you understand your rights and responsibilities and ensure that you’re on track to repay your loans.

During entrance counseling, you’ll learn about various topics, including:

- Different types of federal student loans

- Loan repayment options

- Interest rates and fees

- Managing student debt

- Consequences of defaulting on your loans

Completing entrance counseling is crucial because it helps you make informed decisions about your student loans. By understanding your repayment options and responsibilities, you can avoid potential financial pitfalls and ensure you’re on track to repay your loans successfully.

Failing to complete entrance counseling may result in:

- Delay in receiving your loan funds

- Inability to access certain loan benefits

- Negative impact on your credit score

Loan Agreement

A loan agreement is a legally binding contract between you and the lender that Artikels the terms and conditions of your federal student loan. It specifies the amount of money you’re borrowing, the interest rate, the repayment terms, and any fees associated with the loan. Understanding the terms of your loan agreement is crucial to ensure you can repay your loan on time and avoid default.

Key Provisions of a Loan Agreement

The key provisions of a loan agreement typically include:

- Loan amount: The total amount of money you’re borrowing.

- Interest rate: The percentage of the loan amount that you’ll be charged in interest each year.

- Repayment terms: The length of time you have to repay the loan and the amount of your monthly payments.

- Fees: Any fees associated with the loan, such as an origination fee or a late payment fee.

Understanding and Negotiating Your Loan Agreement

Before you sign a loan agreement, it’s important to carefully review the terms and make sure you understand them. If you have any questions, don’t hesitate to ask the lender for clarification. You may also want to consider having an attorney review the agreement before you sign it.

In some cases, you may be able to negotiate the terms of your loan agreement. For example, you may be able to negotiate a lower interest rate or a longer repayment period. However, it’s important to remember that the lender is not obligated to negotiate with you, so don’t be surprised if they decline your request.

Consequences of Defaulting on a Loan Agreement

If you fail to make your loan payments on time, you will be in default on your loan agreement. This can have serious consequences, including:

- Damage to your credit score: Defaulting on a loan can damage your credit score, making it more difficult to get approved for future loans or credit cards.

- Wage garnishment: The lender may be able to garnish your wages to collect the money you owe.

- Tax refund offset: The lender may be able to offset your tax refund to collect the money you owe.

Options for Borrowers in Default, What document explains your rights and responsibilities as a federal student loan borrower?

If you find yourself in default on your loan agreement, there are a number of options available to you. These options include:

- Loan rehabilitation: This program allows you to bring your loan out of default by making a series of on-time payments.

- Loan consolidation: This program allows you to combine multiple federal student loans into a single loan with a lower interest rate and a longer repayment period.

- Loan forgiveness: In some cases, you may be eligible for loan forgiveness if you meet certain criteria, such as working in a public service job.

Repayment Plan Options

Federal student loans offer various repayment plans to cater to different financial situations and goals. These plans vary in terms of monthly payments, repayment period, and eligibility criteria. Understanding the available options and their implications is crucial for borrowers to make informed decisions and manage their student loan debt effectively.

To understand your rights and responsibilities as a federal student loan borrower, refer to the loan agreement. It outlines the terms and conditions of the loan, including the repayment plan and interest rates. For more information on student loan repayment, visit student loan repayment . The loan agreement serves as a guide throughout the repayment process, ensuring you meet your obligations and protect your rights.

Factors to consider when choosing a repayment plan include:

- Monthly budget and cash flow

- Total loan amount and interest rate

- Income and expected future earnings

- Financial goals and priorities

Standard Repayment Plan

The Standard Repayment Plan is the default option for federal student loans. It offers a fixed monthly payment and a repayment period of 10 years for undergraduate loans and 25 years for graduate loans. This plan is suitable for borrowers with stable income and who prioritize paying off their loans quickly.

Graduated Repayment Plan

The Graduated Repayment Plan provides lower monthly payments initially, which gradually increase over time. The repayment period is extended to 10 years for undergraduate loans and 25 years for graduate loans. This plan can be beneficial for borrowers with limited income at the start of their careers but expect their earnings to grow in the future.

Extended Repayment Plan

The Extended Repayment Plan offers lower monthly payments than the Standard Repayment Plan, but the repayment period is extended to 25 years for undergraduate loans and 30 years for graduate loans. This plan is suitable for borrowers with high loan balances or limited income who need more time to repay their debt.

Income-Driven Repayment (IDR) Plans

IDR Plans adjust monthly payments based on the borrower’s income and family size. They offer flexible repayment options and can significantly reduce monthly payments for borrowers with low income or high debt-to-income ratios. There are four main types of IDR Plans:

- Pay As You Earn (PAYE) Plan

- Revised Pay As You Earn (REPAYE) Plan

- Income-Based Repayment (IBR) Plan

- Income-Contingent Repayment (ICR) Plan

IDR Plans can extend the repayment period to 20 or 25 years, and any remaining balance after the repayment period may be forgiven.

Loan Forgiveness Programs

Certain federal student loans may be eligible for loan forgiveness programs, such as:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Income-Driven Repayment Loan Forgiveness

These programs offer loan forgiveness to borrowers who meet specific eligibility requirements, such as working in certain professions or making a certain number of on-time payments under an IDR Plan.

Deferment and Forbearance

Federal student loans provide options like deferment and forbearance to help borrowers manage repayment challenges. These measures temporarily pause or reduce loan payments, offering flexibility during periods of financial hardship or specific life events.

Eligibility and Application Process

Deferment:

– Eligibility: Enrolled at least half-time in an eligible school, serving in active military duty, experiencing economic hardship, or facing other qualifying circumstances.

– Application: Contact your loan servicer and submit the necessary documentation to verify eligibility.

Forbearance:

– Eligibility: Facing financial hardship or other extenuating circumstances that make repayment difficult.

– Application: Contact your loan servicer and explain your situation. They will assess your eligibility and determine the appropriate forbearance period.

Impact on Loan Repayment

Deferment:

– Interest does not accrue during the deferment period.

– Principal balance remains the same.

– May extend the loan repayment period.

Forbearance:

– Interest continues to accrue during the forbearance period.

– Principal balance increases due to accrued interest.

– May not extend the loan repayment period.

Key Differences

Deferment

– Pauses loan payments and interest accrual.

– Eligibility based on specific circumstances.

– May extend the loan repayment period.

Forbearance

– Reduces or pauses loan payments but interest continues to accrue.

– Eligibility based on financial hardship or extenuating circumstances.

– May not extend the loan repayment period.

| Eligibility | Interest Accrual | Impact on Repayment Period | |

|---|---|---|---|

| Deferment | Specific circumstances | No | May extend |

| Forbearance | Financial hardship or extenuating circumstances | Yes | May not extend |

How to Apply

1. Contact your loan servicer.

2. Provide documentation to verify your eligibility (for deferment).

3. Explain your financial hardship or extenuating circumstances (for forbearance).

4. Submit the completed application.

Common Reasons for Deferment and Forbearance

– Enrolled in school

– Active military duty

– Economic hardship

– Medical expenses

– Family emergencies

Pros and Cons

Pros:

– Provides financial relief during periods of hardship.

– Prevents default and damage to credit score.

Cons:

– May extend the loan repayment period (deferment only).

– Interest may continue to accrue (forbearance only).

FAQs

Q: Can I apply for both deferment and forbearance?

A: Yes, but not simultaneously.

Q: How long can I be in deferment or forbearance?

A: Varies depending on the circumstances and loan type.

Q: Will my credit score be affected?

A: No, as long as you make payments on time during and after the deferment or forbearance period.

Loan Forgiveness Programs

Loan forgiveness programs provide a way for federal student loan borrowers to have their remaining debt discharged after meeting certain requirements. These programs are designed to help borrowers who have difficulty repaying their loans due to financial hardship or other circumstances.

There are several different loan forgiveness programs available, each with its own eligibility criteria and application process. Some of the most common programs include:

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of federal student loans for borrowers who work full-time in public service for 10 years.

- Teacher Loan Forgiveness: This program forgives up to $17,500 in federal student loans for teachers who work full-time for five consecutive years in a low-income school.

- Income-Driven Repayment (IDR) Plans: These plans cap monthly loan payments at a percentage of the borrower’s income. After 20 or 25 years of payments, any remaining balance is forgiven.

- Total and Permanent Disability (TPD) Discharge: This program discharges the remaining balance of federal student loans for borrowers who are unable to work due to a total and permanent disability.

The eligibility criteria and application process for each loan forgiveness program vary. Borrowers who are interested in applying for loan forgiveness should contact their loan servicer for more information.

Loan forgiveness can have a significant impact on a borrower’s financial obligations. By having their loans forgiven, borrowers can save thousands of dollars in interest and principal payments. This can free up money for other financial goals, such as buying a home, starting a family, or saving for retirement.

Default and Consequences

In the context of federal student loans, default refers to the failure to make scheduled loan payments for a period of 270 days or more. This triggers serious consequences that can severely impact a borrower’s financial standing.

Consequences of default include:

- Wage garnishment: The government can seize a portion of your wages to repay the defaulted loan.

- Tax refund offset: Your federal and state tax refunds can be withheld and applied to the defaulted loan.

- Damaged credit score: Defaulting on a federal student loan will negatively impact your credit score, making it difficult to obtain future loans or credit at favorable rates.

- Loss of eligibility for federal student aid: You will lose eligibility for future federal student loans, grants, and work-study programs.

- Legal action: The government may take legal action against you to collect the defaulted loan, including filing a lawsuit.

Steps to Avoid Default

To avoid default, it’s crucial to make your loan payments on time. If you’re facing financial difficulties, contact your loan servicer immediately to discuss options such as:

- Loan forbearance: This allows you to temporarily pause or reduce your loan payments.

- Loan deferment: This allows you to postpone your loan payments for a period of time.

- Income-driven repayment plan: This adjusts your monthly payments based on your income and family size.

Options for Borrowers in Default, What document explains your rights and responsibilities as a federal student loan borrower?

If you have already defaulted on your federal student loan, there are still options available to you:

- Loan rehabilitation: This allows you to regain eligibility for federal student aid by making a series of on-time payments.

- Loan consolidation: This combines multiple defaulted loans into a single loan with a new interest rate and repayment term.

Impact on Credit Score and Financial Standing

Defaulting on a federal student loan can have a significant negative impact on your credit score and overall financial standing. A low credit score can make it difficult to obtain future loans, credit cards, or even housing.

Additionally, defaulting on a student loan can lead to wage garnishment and tax refund offsets, which can further strain your finances.

Rights and Responsibilities of Borrowers

As a federal student loan borrower, you have certain rights and responsibilities that you should be aware of. These rights and responsibilities are Artikeld in your Master Promissory Note (MPN) and Entrance Counseling materials.

Your rights as a borrower include the right to information about your loans, fair treatment, and dispute resolution. You also have the responsibility to make timely payments, understand your loan terms, and seek assistance when needed.

Borrower’s Rights

- The right to receive information about your loans, including the amount you borrowed, the interest rate, and the repayment terms.

- The right to be treated fairly by your loan servicer.

- The right to dispute any decisions made about your loans.

Borrower’s Responsibilities

- The responsibility to make timely payments on your loans.

- The responsibility to understand the terms of your loans.

- The responsibility to seek assistance when you are having trouble making payments.

It is important to exercise your rights and fulfill your responsibilities as a borrower. By doing so, you can ensure that you are getting the most out of your student loans and that you are avoiding any potential problems.

How to Exercise Your Rights and Fulfill Your Responsibilities

There are a number of ways to exercise your rights and fulfill your responsibilities as a borrower. Here are a few tips:

- Keep track of your loan information. This includes the amount you borrowed, the interest rate, and the repayment terms.

- Make timely payments on your loans. You can set up automatic payments to ensure that you never miss a payment.

- Understand the terms of your loans. If you have any questions about your loans, contact your loan servicer.

- Seek assistance when you are having trouble making payments. There are a number of programs available to help you if you are having trouble making payments on your student loans.

By following these tips, you can ensure that you are exercising your rights and fulfilling your responsibilities as a borrower.

Key Rights and Responsibilities of Borrowers

| Rights | Responsibilities |

|---|---|

| The right to receive information about your loans | The responsibility to make timely payments on your loans |

| The right to be treated fairly by your loan servicer | The responsibility to understand the terms of your loans |

| The right to dispute any decisions made about your loans | The responsibility to seek assistance when you are having trouble making payments |

Resources for Borrowers

- Federal Student Aid: https://studentaid.gov/

- National Student Loan Data System: https://nslds.ed.gov/

- Student Loan Ombudsman: https://studentaid.gov/feedback-ombudsman/student-loans/

Sample Letter to Dispute a Loan Decision

Your Name

Your Address

Your City, State, Zip Code

Date

Loan Servicer Name

Loan Servicer Address

Loan Servicer City, State, Zip Code

Dear Loan Servicer,

I am writing to dispute a recent decision made about my student loans. On [date], I received a notice that [state the decision being disputed]. I believe that this decision is incorrect for the following reasons:

- [State your reasons for disputing the decision.]

I request that you review my dispute and make a decision within [number] days. I would also like to request a copy of the documentation that supports your decision.

Thank you for your time and consideration.

Sincerely,

Your Signature

Your Typed Name

– Explain the purpose and significance of the Federal Student Aid website for federal student loan borrowers.

The Federal Student Aid (FSA) website is an invaluable resource for federal student loan borrowers, providing a comprehensive platform to manage their loans, access critical information, and make informed decisions about their financial future.

Borrowers of federal student loans should be familiar with the document that outlines their rights and responsibilities. This document is especially crucial for those facing student loan debt , as it provides valuable information on repayment options and potential relief programs.

Understanding the contents of this document can empower borrowers to make informed decisions and navigate the complexities of student loan repayment.

This user-friendly website offers a wealth of information and tools, empowering borrowers to take control of their student loans and navigate the complexities of loan repayment.

Navigating the Website

The FSA website is designed with user experience in mind, making it easy for borrowers to find the information they need. The intuitive interface and clear navigation menu allow borrowers to quickly access key sections, including:

- Loan information and account details

- Repayment options and calculators

- Deferment and forbearance programs

- Loan forgiveness programs

- Default prevention resources

Loan Servicer Responsibilities

Your loan servicer is the company that manages your federal student loans. They are responsible for processing your payments, providing you with account information, and assisting you with repayment options. It’s important to maintain open communication with your loan servicer to ensure that your loans are being managed correctly and that you are aware of all of your repayment options.

When it comes to understanding your rights and responsibilities as a federal student loan borrower, there’s a document that holds all the answers. This comprehensive guide outlines everything you need to know about managing your student loan , including repayment options, interest rates, and potential consequences for default.

By thoroughly reviewing this document, you can gain a clear understanding of your financial obligations and make informed decisions about your student loan journey.

Types of Services Provided

Loan servicers provide a variety of services to borrowers, including:

- Processing payments

- Providing account information

- Assisting with repayment options

- Answering questions about your loans

- Helping you to avoid default

Importance of Communication

It is important to maintain open communication with your loan servicer. This will help to ensure that your loans are being managed correctly and that you are aware of all of your repayment options. You should contact your loan servicer if you have any questions about your loans or if you are having difficulty making your payments.

Consumer Financial Protection Bureau (CFPB)

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in protecting the rights of federal student loan borrowers. Established in 2010, the CFPB is a federal agency dedicated to ensuring fairness and transparency in the financial marketplace.

The CFPB provides a range of resources and assistance to student loan borrowers, including complaint handling, financial education, and advocacy. The bureau empowers borrowers to understand their rights and responsibilities, and to navigate the complexities of student loan repayment.

Contacting the CFPB

Borrowers can contact the CFPB by phone at (855) 411-2372 or by submitting an online complaint form at www.consumerfinance.gov/complaint. The CFPB also has a dedicated Student Loan Ombudsman who can provide personalized assistance and guidance to borrowers experiencing difficulties with their student loans.

Types of Complaints Handled

The CFPB handles a wide range of complaints related to student loans, including:

- Problems with loan servicers

- Unfair or deceptive practices

- Difficulties with repayment plans

- Denials of loan forgiveness or discharge

- Identity theft or fraud

Filing a Complaint

To file a complaint with the CFPB, borrowers can visit the bureau’s website at www.consumerfinance.gov/complaint or call (855) 411-2372. The complaint form requires borrowers to provide basic information about themselves, their loan, and the issue they are experiencing.

The CFPB will review the complaint and may contact the borrower for additional information. The bureau will then investigate the complaint and take appropriate action, such as mediating a resolution between the borrower and the lender or taking enforcement action against the lender.

Resources for Student Loan Borrowers

| Resource | Description |

|---|---|

| Complaint handling | Borrowers can file complaints about student loan servicers or lenders with the CFPB. |

| Financial education | The CFPB provides a variety of resources to help borrowers understand their student loans and manage their debt, including online tools, workshops, and publications. |

| Advocacy | The CFPB advocates for the rights of student loan borrowers and works to ensure that lenders are held accountable for unfair or deceptive practices. |

“Protecting student loan borrowers is a top priority for the CFPB,” said Rohit Chopra, Director of the CFPB. “We are committed to ensuring that borrowers have access to fair and affordable repayment options, and that they are treated fairly by their lenders.”

Legal Assistance and Resources

Navigating student loan debt can be complex, especially when facing challenges or disputes. Federal student loan borrowers have access to legal assistance and resources to help them understand their rights and options.

Legal services available to student loan borrowers include:

- Debt counseling: Provides guidance on managing student loan debt, including repayment options, consolidation, and loan forgiveness programs.

- Representation in court: Legal representation in cases involving student loan disputes, such as lawsuits filed by loan servicers or the government.

- Negotiating with creditors: Assistance in negotiating with loan servicers or creditors to modify loan terms, reduce interest rates, or settle debts.

To access legal assistance, borrowers can contact the following organizations:

- Legal Aid Society: Provides free or low-cost legal services to low-income individuals, including assistance with student loan issues.

- National Consumer Law Center (NCLC): Offers resources and information on student loan debt, including a directory of legal aid organizations.

- American Bar Association’s Pro Bono Center: Connects borrowers with pro bono attorneys who provide free legal services.

Seeking legal assistance can provide valuable support for student loan borrowers facing difficulties. Legal professionals can help borrowers understand their rights, protect their interests, and find solutions to their student loan debt challenges.

Student Loan Ombudsman: What Document Explains Your Rights And Responsibilities As A Federal Student Loan Borrower?

The Student Loan Ombudsman is an independent office within the U.S. Department of Education that helps resolve disputes between federal student loan borrowers and their loan servicers. The Ombudsman can assist with a variety of issues, including:

– Repayment disputes

– Loan forgiveness applications

– Default resolution

If you are having problems with your federal student loans, you can contact the Student Loan Ombudsman by calling 1-877-557-2599 or by submitting a complaint online at StudentAid.gov.

Types of Issues

The Student Loan Ombudsman can help with a variety of issues, including:

– Repayment disputes: If you are having trouble making your student loan payments, the Ombudsman can help you explore your options for repayment, such as income-driven repayment plans and deferment or forbearance.

– Loan forgiveness applications: If you believe you qualify for loan forgiveness, the Ombudsman can help you with the application process.

– Default resolution: If you have defaulted on your student loans, the Ombudsman can help you get back on track and avoid wage garnishment or other collection actions.

Additional Resources and Information

Navigating the complexities of federal student loan management can be daunting. However, there’s no need to face these challenges alone. A wealth of resources and information is available to guide you every step of the way. From online portals to expert assistance, these tools empower you to make informed decisions about your student loans and secure your financial future.

[detailed content here]

End of Discussion

By familiarizing yourself with the Master Promissory Note and other essential documents, you can ensure that your rights are protected and your responsibilities are fulfilled. Remember, knowledge is power, and it can help you navigate the student loan repayment process with confidence and financial success.

Query Resolution

What is the Master Promissory Note?

The Master Promissory Note is a legal document that Artikels the terms and conditions of your federal student loan, including the amount borrowed, interest rate, repayment period, and your obligations as a borrower.

What are my responsibilities as a federal student loan borrower?

As a borrower, you are responsible for making timely payments, understanding the terms of your loan, and seeking assistance when needed. You also have the right to receive information about your loan, fair treatment, and dispute resolution.

What should I do if I have questions or concerns about my student loan?

If you have any questions or concerns about your student loan, you should contact your loan servicer or the Federal Student Aid website. You can also seek legal assistance or contact the Student Loan Ombudsman for guidance.