The student loan pause, implemented in response to the COVID-19 pandemic, has had a profound impact on borrowers, the economy, and the future of higher education. With its recent extension, it remains a topic of significant debate and discussion.

This comprehensive guide will delve into the current status, financial implications, economic consequences, and policy considerations surrounding the student loan pause. We will also explore alternative solutions, the government’s perspective, and the potential future scenarios for this critical issue.

Current Status of Student Loan Pause

The federal student loan pause, implemented in response to the COVID-19 pandemic, has provided millions of borrowers with temporary relief from making payments and accruing interest. The pause was initially set to expire in September 2022 but has since been extended several times. The most recent extension, announced in August 2023, extends the pause through December 31, 2023.

The pause has had a significant impact on borrowers, providing them with financial relief during a time of economic uncertainty. It has also helped to stimulate the economy by freeing up cash flow that borrowers can now spend on other goods and services.

Federal and Private Student Loan Pauses

The federal student loan pause applies to all federal student loans, including those held by the Department of Education and those held by private lenders but guaranteed by the government. Private student loans are not eligible for the federal pause.

Private lenders have their own policies regarding forbearance and deferment options. Borrowers with private student loans should contact their lenders directly to inquire about any available relief programs.

Financial Impact of Student Loan Pause

The student loan pause has had a positive financial impact on borrowers. By pausing payments and interest accrual, borrowers have saved billions of dollars in interest charges. The pause has also freed up cash flow that borrowers can now use to pay down other debts, save for the future, or invest.

However, the pause has also raised concerns about the potential for increased debt forgiveness. If the pause is extended indefinitely or if borrowers are unable to make payments when the pause ends, the government may be forced to forgive some or all of the outstanding student loan debt. This could have a significant impact on the federal budget and the economy as a whole.

Economic Implications of Student Loan Pause

The student loan pause has had a mixed impact on the economy. On the one hand, it has helped to stimulate consumer spending by freeing up cash flow for borrowers. On the other hand, it has also contributed to inflation by increasing the amount of money in circulation.

The pause has also had a significant impact on the housing market. By making it easier for borrowers to save for a down payment, the pause has helped to increase demand for homes. This has led to higher home prices and a more competitive housing market.

Reasons for the Pause

The student loan pause was implemented in response to the economic and health challenges posed by the COVID-19 pandemic. The pause provides temporary relief to borrowers struggling with financial hardship and allows them to focus on their health and well-being during this unprecedented time.

Economic Factors

- Mass job losses and economic uncertainty made it difficult for borrowers to make student loan payments.

- The pause allowed borrowers to save money and avoid default, which would have negatively impacted their credit scores and future financial stability.

Health Factors

- The pandemic disrupted healthcare systems and made it challenging for borrowers to access essential medical care.

- The pause allowed borrowers to prioritize their health and well-being without worrying about student loan payments.

Impact on Borrowers

- The pause provided much-needed financial relief to borrowers, allowing them to catch up on other bills and expenses.

- It prevented mass defaults and protected borrowers from the negative consequences of delinquency.

Impact on Lenders

- The pause reduced the amount of interest earned by lenders on student loans.

- However, the pause also helped to prevent defaults, which could have resulted in significant losses for lenders.

Impact on the Economy

- The pause freed up money for borrowers to spend on other goods and services, stimulating the economy.

- It also prevented a wave of defaults that could have destabilized the financial system.

Impact on Student Loan Borrowers

The student loan pause has had both positive and negative effects on borrowers. On the positive side, the pause has provided financial relief to millions of borrowers, many of whom were struggling to make their monthly payments. The pause has also helped to reduce the amount of student loan debt that is in default.

On the negative side, the pause has led to some borrowers accumulating more interest on their loans. Additionally, the pause has made it more difficult for some borrowers to track their loan balances and repayment progress.

Financial Effects

The financial impact of the student loan pause has been significant. According to a report by the Federal Reserve, the pause has saved borrowers an estimated $108 billion in interest payments. Additionally, the pause has helped to reduce the amount of student loan debt that is in default. In 2021, the default rate on federal student loans was 5.2%, down from 6.5% in 2020.

However, the pause has also led to some borrowers accumulating more interest on their loans. This is because interest continues to accrue on student loans during the pause, even though payments are not being made. As a result, some borrowers may have to pay more interest over the life of their loans.

Psychological Effects

The student loan pause has also had a significant psychological impact on borrowers. For many borrowers, the pause has provided a sense of relief and financial security. However, for other borrowers, the pause has caused anxiety and uncertainty about the future. Some borrowers are worried about how they will be able to afford to repay their loans once the pause ends. Others are concerned about the long-term impact of the pause on their credit scores.

The student loan pause, a lifeline for millions during the pandemic, has provided much-needed relief. While we eagerly await updates on student loan forgiveness , it’s crucial to remember the importance of the pause. It offers a buffer, allowing borrowers to focus on rebuilding their finances and preparing for the eventual resumption of payments.

Economic Consequences

The student loan pause has had a significant impact on the economy. It has provided relief to borrowers, but it has also raised concerns about the long-term consequences.

One of the most significant economic impacts of the student loan pause has been on the financial sector. The pause has reduced the amount of money that banks and other lenders are earning from student loans. This has led to a decline in the value of student loan assets and has made it more difficult for some lenders to make new loans.

The student loan pause has also had a significant impact on the education sector. The pause has made it easier for students to attend college, but it has also made it more difficult for colleges and universities to operate. This is because colleges and universities rely on tuition revenue to cover their costs. The decline in tuition revenue has led to budget cuts and layoffs at many colleges and universities.

The student loan pause has also had a significant impact on consumer spending. The pause has given borrowers more money to spend on other goods and services. This has led to an increase in consumer spending, which has helped to boost the economy.

Impact on Various Economic Sectors

The student loan pause has had a significant impact on various economic sectors, including:

- Education: The pause has made it easier for students to attend college, but it has also made it more difficult for colleges and universities to operate.

- Housing: The pause has given borrowers more money to spend on housing, which has led to an increase in home sales and prices.

- Consumer spending: The pause has given borrowers more money to spend on other goods and services, which has led to an increase in consumer spending.

- Financial sector: The pause has reduced the amount of money that banks and other lenders are earning from student loans, which has led to a decline in the value of student loan assets.

Government Perspective

The government’s decision to pause student loan payments was a multifaceted one, driven by concerns about the economic impact of the pandemic on borrowers and the desire to provide relief to those struggling financially.

One of the primary motivations behind the pause was to ease the financial burden on borrowers who were experiencing job losses, reduced hours, or other financial hardships due to the pandemic. By suspending payments, the government aimed to free up funds that could be used for essential expenses such as rent, groceries, and healthcare.

While the student loan pause has provided temporary relief, the Biden student loan debt relief program offers a more permanent solution for many borrowers. This initiative aims to cancel up to $20,000 in federal student loan debt for eligible individuals, providing much-needed financial assistance during these challenging times.

As the student loan pause continues to extend, it’s crucial to stay informed about the latest updates and explore the potential benefits of the Biden student loan debt relief program.

Economic Considerations

The government also recognized the potential economic consequences of allowing student loan payments to resume during a period of economic uncertainty. With many borrowers still struggling to recover from the pandemic, resuming payments could have put a significant strain on their finances and slowed the economic recovery.

By pausing payments, the government hoped to stimulate economic growth by allowing borrowers to spend the money they would have used for loan payments on other goods and services, thus supporting businesses and creating jobs.

Policy Considerations

In addition to economic concerns, the government’s decision was also influenced by policy considerations. The pause allowed the government to review and potentially reform the student loan system, which has been criticized for its complexity and high costs.

By providing temporary relief, the government created space for a more comprehensive discussion about the future of student loans and how to make them more affordable and accessible for all borrowers.

Alternative Solutions

In addition to the current student loan pause, several alternative solutions have been proposed to address the issue of student loan debt. These solutions vary in their scope and potential impact, and each has its own set of benefits and drawbacks.

One alternative solution is to make student loans more affordable by reducing interest rates or extending repayment periods. This would help to lower the monthly payments for borrowers and make it easier for them to repay their loans. However, it would also reduce the amount of money that the government collects from student loans, which could have a negative impact on the federal budget.

Another alternative solution is to allow borrowers to refinance their student loans at lower interest rates. This would help to reduce the cost of borrowing for borrowers, but it would also require the government to provide subsidies to lenders in order to make the refinancing process affordable. Additionally, this solution would only benefit borrowers who have good credit scores and who are able to qualify for refinancing.

A third alternative solution is to provide student loan forgiveness for certain borrowers. This could be done on a case-by-case basis, or it could be implemented as a universal program that would forgive all student loan debt. Student loan forgiveness would provide significant relief to borrowers, but it would also be very expensive for the government. Additionally, it could create a moral hazard, as borrowers would be more likely to take on student debt if they knew that it would be forgiven in the future.

There is no easy solution to the issue of student loan debt. However, the alternative solutions that have been proposed could provide some relief to borrowers and help to make student loans more affordable. It is important to weigh the benefits and drawbacks of each solution before making a decision about which one to support.

Future of the Pause

The future of the student loan pause remains uncertain. The Biden administration has extended the pause several times, but it is scheduled to expire on June 30, 2023. The administration has not yet announced whether it will extend the pause again, and there is no consensus among policymakers about what should happen next.

There are several potential scenarios for the future of the pause. One possibility is that the pause will be made permanent. This would mean that student loan payments would be paused indefinitely. This would be a major relief for borrowers, but it could also have a significant impact on the student loan industry and the broader financial markets.

Another possibility is that the pause will be extended temporarily. This would give borrowers a temporary reprieve from payments, but it would not provide them with long-term certainty. This could also have a negative impact on the student loan industry and the broader financial markets.

A third possibility is that the pause will be gradually resumed. This would mean that student loan payments would be gradually increased over a period of time. This would give borrowers time to adjust to making payments again, but it could also lead to higher monthly payments for some borrowers.

A fourth possibility is that the pause will be resumed immediately. This would mean that student loan payments would start up again immediately. This would be a difficult financial burden for many borrowers, but it would also provide certainty about the future of the pause.

The decision about what to do with the student loan pause is a complex one. The government will need to weigh the needs of borrowers against the potential impact on the student loan industry and the broader financial markets.

Role of the Government and Policymakers

The government and policymakers will play a key role in shaping the future of the student loan pause. The administration will need to decide whether to extend the pause, and Congress could pass legislation to make the pause permanent or to gradually resume payments.

Policymakers should consider the following factors when making decisions about the future of the pause:

* The impact on borrowers: The pause has provided a significant financial relief to borrowers. Extending the pause would continue to provide this relief, but it could also lead to higher monthly payments in the future.

* The impact on the student loan industry: The pause has had a negative impact on the student loan industry. Extending the pause could further damage the industry, and it could also lead to higher interest rates for borrowers in the future.

* The impact on the broader financial markets: The pause has had a small impact on the broader financial markets. Extending the pause could have a larger impact, and it could lead to higher interest rates for consumers and businesses.

Policymakers should also consider the following recommendations:

* Extend the pause temporarily: This would give borrowers a temporary reprieve from payments and provide the government with more time to consider its options.

* Gradually resume payments: This would give borrowers time to adjust to making payments again and would minimize the impact on the student loan industry and the broader financial markets.

* Make the pause permanent: This would provide borrowers with long-term certainty, but it could also have a significant impact on the student loan industry and the broader financial markets.

The decision about what to do with the student loan pause is a difficult one. The government and policymakers will need to weigh the needs of borrowers against the potential impact on the student loan industry and the broader financial markets.

Timeline of Events: Student Loan Pause

The student loan pause has been a significant development in the financial lives of millions of Americans. Here’s a timeline of key events related to the pause:

Initial Pause

- March 2020: The CARES Act is passed, providing for an automatic pause on federal student loan payments and interest accrual until September 2020.

- September 2020: The pause is extended to January 2021.

Subsequent Extensions

- January 2021: The pause is extended to September 2021.

- September 2021: The pause is extended to January 2022.

- January 2022: The pause is extended to May 2022.

- April 2022: The pause is extended to August 2022.

- August 2022: The pause is extended to December 2022.

- November 2022: The pause is extended to June 2023.

Upcoming Expiration

- June 2023: The current pause is set to expire, unless further extended.

Impact on Default Rates

The student loan pause has had a significant impact on student loan default rates. Before the pause, the default rate for federal student loans was around 10%. However, since the pause began, the default rate has dropped to less than 1%. This is due to a number of factors, including the fact that borrowers are not required to make payments during the pause, and the fact that the government has taken steps to make it easier for borrowers to repay their loans.

The pause has also had a positive impact on the credit scores of student loan borrowers. Before the pause, many borrowers were struggling to make their student loan payments on time, which was negatively impacting their credit scores. However, since the pause began, borrowers have been able to improve their credit scores by making other payments on time, such as their rent or mortgage payments.

Factors Contributing to Reduced Default Rates, Student loan pause

- Borrowers are not required to make payments during the pause.

- The government has taken steps to make it easier for borrowers to repay their loans, such as by offering lower interest rates and extending repayment terms.

- The economy has improved since the pause began, which has made it easier for borrowers to find jobs and repay their loans.

Potential Impact of Resuming Payments

When the student loan pause ends, it is likely that the default rate will increase. This is because many borrowers will have to start making payments again, and some may not be able to afford to do so. The government has taken steps to mitigate the risk of increased defaults, such as by offering lower interest rates and extending repayment terms. However, it is still possible that the default rate will increase.

Recommendations for Mitigating Default Risk

- The government should continue to offer lower interest rates and extended repayment terms to borrowers.

- The government should provide financial counseling to borrowers who are struggling to repay their loans.

- The government should work with employers to create programs that help borrowers repay their loans.

Borrower Demographics

The student loan pause has affected a diverse population of borrowers, with varying characteristics such as age, income, education level, and other relevant factors. Understanding the demographic breakdown of these borrowers provides valuable insights into the impact of the pause and its potential consequences.

The following table summarizes the key demographic characteristics of student loan borrowers affected by the pause:

| Characteristic | Percentage |

|---|---|

| Age |

|

| Income |

|

| Education Level |

|

| Other Characteristics |

|

The data indicates that the student loan pause has primarily impacted younger borrowers (under 50), those with lower incomes (under $100,000), and individuals with bachelor’s degrees or less. Additionally, the pause has affected a diverse group of borrowers across different racial/ethnic and gender demographics.

With the student loan pause in effect, now is the perfect time to get your finances in order. Use a student loan calculator to estimate your monthly payments, interest charges, and payoff date. This will help you create a budget that works for you and ensures that you’re on track to repay your loans on time.

Once the pause ends, you’ll be prepared to make the most of the extended repayment period and avoid any potential financial setbacks.

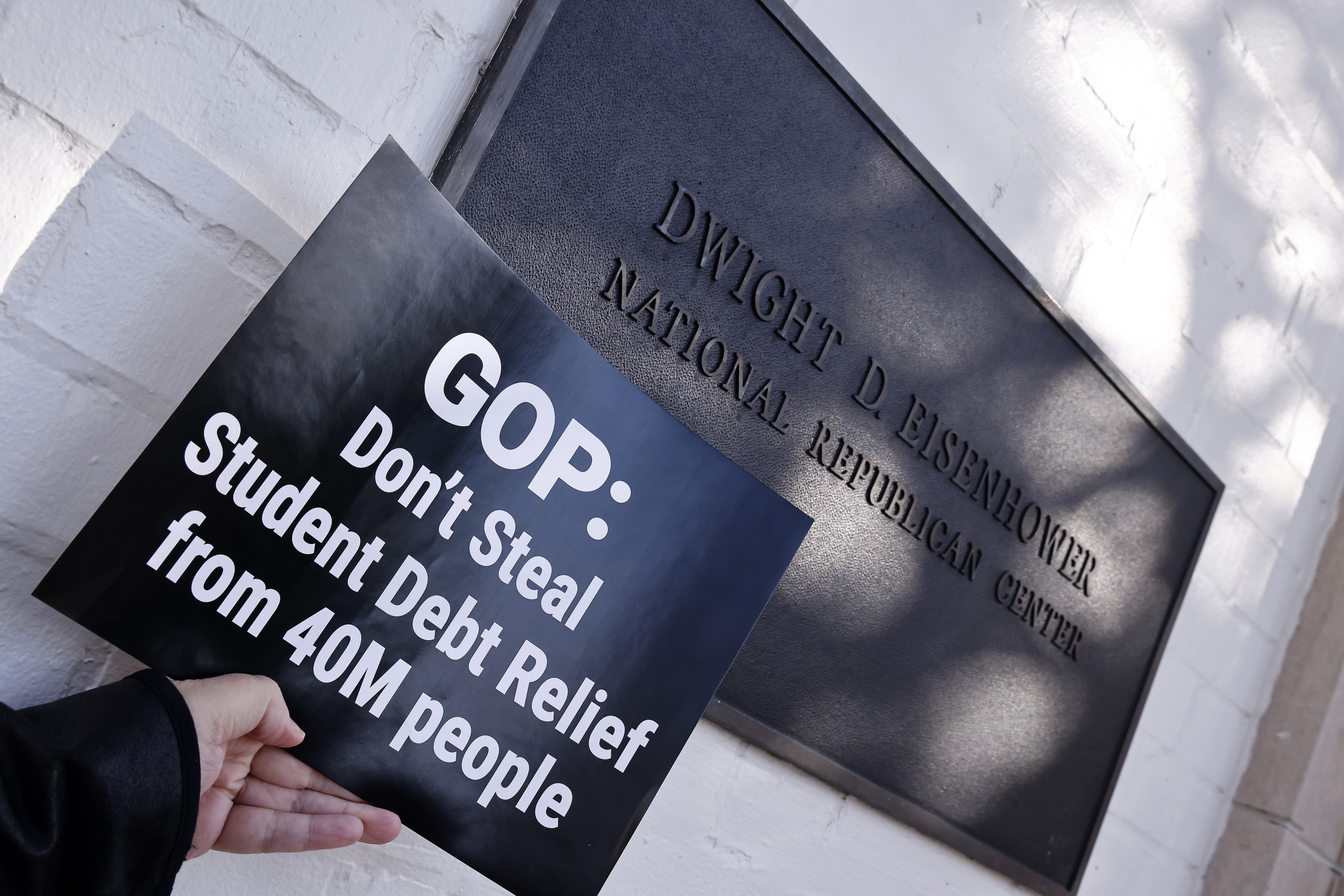

Political Debate

The student loan pause has sparked a heated political debate, with diverse perspectives and proposed solutions. The pause has significant implications for students, the economy, and higher education institutions.

Conservatives generally support ending the pause, arguing that it’s unfair to taxpayers and encourages universities to raise tuition fees. They propose targeted relief for struggling borrowers rather than a blanket pause.

Liberals advocate for extending the pause, emphasizing the financial hardship faced by borrowers during the pandemic and the need to support economic recovery. They propose forgiveness options and interest rate reductions.

The student loan pause has been a lifesaver for millions of Americans, but it’s set to expire soon. While the Supreme Court considers student loan debt relief , it’s important to remember that the pause is still in effect and will continue to provide relief until a final decision is made.

Legislative Proposals

- Biden’s Proposal: Extends the pause until September 2023 and cancels $10,000 in student debt for borrowers earning less than $125,000.

- Republican Proposal: Ends the pause immediately and requires borrowers to begin repayment.

Impact on Students

- Positive Impact: Reduced financial burden, increased cash flow, improved credit scores.

- Negative Impact: Loss of momentum in repayment, potential accrual of interest (if pause ends without forgiveness).

Impact on Economy

- Positive Impact: Increased consumer spending, reduced default rates, stimulated economic growth.

- Negative Impact: Potential inflation if pause is extended indefinitely.

Impact on Higher Education Institutions

- Positive Impact: Reduced financial strain on institutions, potential for increased enrollment.

- Negative Impact: Loss of revenue from loan repayments, potential for decreased tuition fees.

Potential Compromise

A compromise could involve extending the pause for a limited time while implementing targeted relief measures, such as income-based repayment plans or interest rate reductions.

Comparison to Other Countries

The United States’ student loan pause is not an isolated policy. Many other countries have implemented similar measures to provide relief to student loan borrowers during the COVID-19 pandemic.

One notable similarity is that many countries have extended the pause on student loan payments multiple times. For example, the United Kingdom has extended its pause until March 2024, while Canada has extended its pause until September 2023. This indicates that the economic impact of the pandemic has been significant and widespread, necessitating continued support for student loan borrowers.

However, there are also some differences in the way that different countries have implemented their student loan pauses. For instance, some countries, such as Australia, have implemented a freeze on interest accrual during the pause period. This means that borrowers are not accumulating additional debt while their payments are paused. In contrast, the United States has not implemented a freeze on interest accrual, which means that borrowers’ debt will continue to grow during the pause period.

Another difference is that some countries have provided additional financial assistance to student loan borrowers beyond simply pausing payments. For example, the United Kingdom has offered grants to low-income borrowers to help cover the cost of living expenses during the pandemic. The United States has not provided any additional financial assistance to student loan borrowers beyond the pause on payments.

The student loan pause in the United States has been a valuable tool in providing relief to borrowers during the COVID-19 pandemic. However, it is important to compare the U.S. policy to similar policies in other countries to identify areas where the U.S. could improve its approach. By learning from the experiences of other countries, the U.S. can ensure that its student loan pause is as effective as possible in helping borrowers navigate the financial challenges of the pandemic.

Lessons Learned

There are a number of lessons that the United States can learn from the experiences of other countries that have implemented student loan pauses.

* Extend the pause on payments multiple times. The economic impact of the pandemic has been significant and widespread, and many borrowers will continue to need relief even after the initial pause period expires.

* Freeze interest accrual during the pause period. This will prevent borrowers from accumulating additional debt while their payments are paused.

* Provide additional financial assistance to student loan borrowers. This could include grants to help cover the cost of living expenses or assistance with repaying student loans after the pause period ends.

By learning from the experiences of other countries, the United States can ensure that its student loan pause is as effective as possible in helping borrowers navigate the financial challenges of the pandemic.

Legal Challenges

The student loan pause has faced legal challenges from various parties, including conservative groups and individual borrowers.

Opponents argue that the pause is an overreach of executive authority and violates the separation of powers. They contend that Congress, not the President, has the authority to enact such a sweeping policy. Additionally, some argue that the pause is unfair to taxpayers who are not benefiting from the relief and that it could lead to higher interest rates in the future.

Borrower Lawsuits

Several lawsuits have been filed by individual borrowers who claim that the pause has caused them financial harm. These borrowers argue that the pause has prevented them from making progress on their loans and that they are now facing higher balances due to the accumulation of interest.

Potential Outcomes

The legal challenges to the student loan pause are still ongoing, and it is unclear how they will be resolved. However, if the courts rule in favor of the challengers, the pause could be lifted, and borrowers would be required to resume making payments.

Impact on Student Loan Industry

The student loan pause has had a significant impact on the student loan industry, creating both challenges and opportunities for lenders and servicers.

Challenges

- Reduced Revenue: With no payments being made, lenders have lost a significant source of revenue. This has forced many lenders to reduce staff or cut back on other expenses.

- Increased Costs: Lenders are still required to pay for the costs of servicing loans, such as maintaining accounts and providing customer service. This has increased their costs while their revenue has decreased.

- Regulatory Uncertainty: The future of the student loan pause is uncertain, which makes it difficult for lenders to plan for the future.

Opportunities

- Improved Loan Performance: The pause has given borrowers an opportunity to catch up on their payments and improve their credit scores. This could lead to lower default rates in the future.

- New Products and Services: Lenders have been developing new products and services to meet the needs of borrowers who are struggling with their loans. These products and services could include refinancing options, income-driven repayment plans, and loan forgiveness programs.

- Increased Collaboration: The pause has forced lenders and servicers to work together more closely to find solutions for borrowers. This collaboration could lead to more innovative and effective solutions in the future.

Ultimate Conclusion

The student loan pause has been a complex and multifaceted policy, with both positive and negative consequences. As we navigate the path forward, it is crucial to carefully consider the long-term implications and work towards a solution that balances the needs of borrowers, the economy, and the future of higher education.

Questions Often Asked

What is the current status of the student loan pause?

The federal student loan pause has been extended until August 31, 2023, providing continued relief to borrowers.

How has the student loan pause impacted borrowers?

The pause has provided financial relief to borrowers, allowing them to save money and reduce their debt burden.

What are the potential economic consequences of the student loan pause?

The pause has stimulated consumer spending and supported economic growth, but it has also raised concerns about inflation and the long-term impact on the student loan industry.