Simplified loan solutions underwriting is transforming the financial landscape, making it easier for borrowers to access credit. This innovative approach streamlines the underwriting process, reducing time and costs while improving customer satisfaction. In this comprehensive guide, we delve into the intricacies of simplified loan solutions underwriting, exploring its benefits, challenges, and implications for the mortgage industry.

As we navigate the evolving financial landscape, simplified loan solutions underwriting emerges as a game-changer, empowering underserved borrowers and shaping the future of lending.

Simplified Loan Solutions Underwriting Overview

In the world of finance, simplified loan solutions underwriting has emerged as a game-changer, streamlining the loan application process and making it more accessible for borrowers.

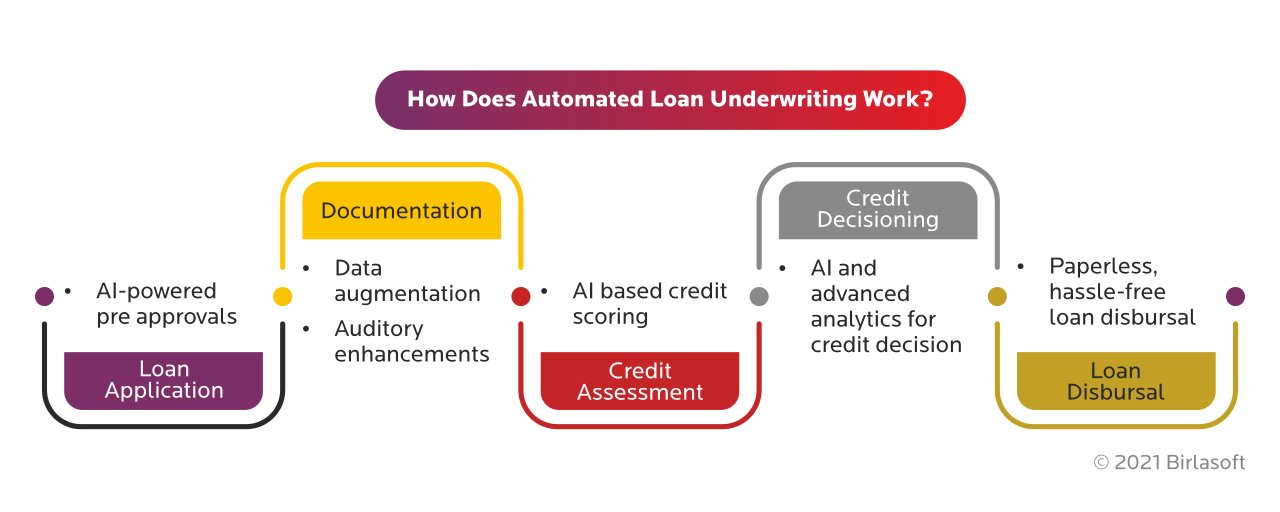

Simplified loan solutions underwriting is an approach that uses automated processes and alternative data sources to assess a borrower’s creditworthiness, eliminating the need for traditional underwriting methods like credit scores and extensive documentation.

Benefits of Simplified Loan Solutions Underwriting

- Faster processing: Automated underwriting systems can quickly evaluate loan applications, significantly reducing processing times.

- Increased accessibility: Simplified underwriting opens up loan opportunities to borrowers who may not have strong credit histories or traditional documentation.

- Reduced costs: Automating the underwriting process eliminates manual labor and reduces the need for physical documentation, resulting in lower costs for lenders.

- Improved accuracy: Automated systems can analyze large amounts of data and make more informed decisions, reducing the risk of human error.

Examples of Simplified Loan Solutions Underwriting in Practice

- Alternative data sources: Lenders are now using data from social media, utility bills, and other sources to assess borrowers’ financial habits and stability.

- Automated decision-making: Machine learning algorithms are used to analyze data and make underwriting decisions based on pre-defined criteria.

- Digital platforms: Online lenders have adopted simplified underwriting to offer quick and convenient loan approvals through digital applications.

Methods and Procedures for Simplified Loan Solutions Underwriting

Simplified loan solutions underwriting involves streamlining the traditional underwriting process to make it faster, easier, and more accessible for borrowers. This is achieved through the use of various methods and procedures that reduce the complexity and time-consuming nature of traditional underwriting.

One of the key methods used in simplified loan solutions underwriting is the use of automated underwriting systems (AUS). AUSs are software programs that use a set of pre-defined rules and criteria to evaluate loan applications. This automation reduces the need for manual underwriting, which can be time-consuming and prone to human error.

Another method used in simplified loan solutions underwriting is the use of alternative data sources. Traditional underwriting relies heavily on credit scores and credit reports, which can exclude borrowers with limited or no credit history. Simplified loan solutions underwriting uses alternative data sources, such as bank statements, utility bills, and rental payments, to assess a borrower’s creditworthiness.

By using these methods and procedures, simplified loan solutions underwriting streamlines the underwriting process, reduces the time it takes to approve loans, and makes it more accessible for borrowers with non-traditional credit profiles.

Best Practices for Implementing Simplified Loan Solutions Underwriting

There are a number of best practices that lenders can follow when implementing simplified loan solutions underwriting:

- Use a robust AUS that is tailored to the lender’s specific needs.

- Use alternative data sources to supplement traditional credit data.

- Develop clear and concise underwriting guidelines.

- Train underwriters on the new simplified underwriting process.

- Monitor the performance of the simplified underwriting process and make adjustments as needed.

Benefits of Simplified Loan Solutions Underwriting

Simplified loan solutions underwriting offers numerous advantages for lenders and borrowers alike. By streamlining the underwriting process, lenders can significantly reduce the time and cost associated with loan origination, while borrowers benefit from a faster and more convenient loan application experience.

One of the most significant benefits of simplified loan solutions underwriting is the reduction in time required to process loan applications. Traditional underwriting processes can be complex and time-consuming, often taking weeks or even months to complete. By automating and simplifying the underwriting process, lenders can significantly reduce the time it takes to approve loans. This can be a major advantage for borrowers who need access to funds quickly, such as those who are purchasing a home or consolidating debt.

Cost Savings

In addition to saving time, simplified loan solutions underwriting can also save lenders money. Traditional underwriting processes require a significant amount of manual labor, which can be expensive. By automating the underwriting process, lenders can reduce their operating costs and pass those savings on to borrowers in the form of lower interest rates or fees.

Improved Customer Satisfaction

Simplified loan solutions underwriting can also lead to improved customer satisfaction. By reducing the time and cost associated with the loan application process, lenders can create a more positive experience for borrowers. This can lead to increased customer loyalty and repeat business.

Case Studies

There are a number of case studies that demonstrate the benefits of simplified loan solutions underwriting. One such case study was conducted by a large bank in the United States. The bank implemented a simplified underwriting process for its mortgage loans. As a result, the bank was able to reduce the average time to process a loan application from 30 days to 10 days. The bank also saw a significant increase in customer satisfaction.

Challenges and Risks of Simplified Loan Solutions Underwriting

Simplified loan solutions underwriting, while offering convenience and efficiency, poses certain challenges and risks that require careful consideration and mitigation strategies.

Potential Challenges and Risks

- Increased Risk of Fraud and Identity Theft: Simplified underwriting processes may make it easier for fraudsters to obtain loans using stolen or falsified identities.

- Challenges in Verifying Income and Assets: Without traditional documentation, lenders may face difficulties in verifying borrowers’ income and assets, leading to potential inaccuracies in creditworthiness assessment.

- Risks of Relying on Alternative Data Sources: While alternative data sources can provide valuable insights, they may also introduce new risks if not properly evaluated and integrated into underwriting models.

Mitigating Challenges and Risks

- Best Practices for Fraud Detection and Prevention: Implementing robust fraud detection systems, including identity verification, data analytics, and behavioral analysis, is crucial to minimize the risk of fraud.

- Methods for Verifying Income and Assets Using Non-Traditional Approaches: Exploring alternative methods for income and asset verification, such as bank account analysis, tax returns, and employer verification through third-party platforms, can enhance accuracy.

- Use of Data Analytics and Machine Learning to Enhance Risk Assessment: Leveraging data analytics and machine learning algorithms can improve risk assessment by identifying patterns and anomalies that may not be evident through traditional underwriting methods.

Importance of Maintaining Underwriting Standards

- Balancing Efficiency with Risk Management: While simplifying the underwriting process, it is essential to maintain underwriting standards to ensure prudent lending practices and minimize credit risk.

- Use of Technology to Automate Underwriting Processes While Maintaining Accuracy: Technology can automate underwriting tasks, such as data gathering and analysis, while maintaining accuracy through rigorous testing and validation.

- Strategies for Continuous Monitoring and Evaluation of Simplified Underwriting Models: Regularly monitoring and evaluating simplified underwriting models is crucial to identify and address any emerging risks or performance issues.

Technology and Innovation in Simplified Loan Solutions Underwriting

Technology and innovation play a pivotal role in streamlining the underwriting process for simplified loan solutions. Artificial intelligence (AI) and machine learning (ML) algorithms are revolutionizing the industry by enhancing accuracy, efficiency, and speed. These technologies analyze vast amounts of data, including financial history, credit scores, and other relevant information, to make informed underwriting decisions.

Role of AI and ML in Underwriting

AI and ML algorithms are trained on historical data to identify patterns and correlations that may not be apparent to human underwriters. They can assess risk factors, predict loan performance, and make automated underwriting decisions, reducing the time and subjectivity involved in the traditional underwriting process. This results in faster loan approvals, improved accuracy, and reduced operational costs.

Innovative Technologies in Underwriting

Several innovative technologies are being used to enhance simplified loan solutions underwriting. These include:

- Automated document processing: AI-powered tools can extract data from loan applications, financial statements, and other documents, eliminating the need for manual data entry and reducing the risk of errors.

- Alternative data sources: Underwriters are now exploring alternative data sources, such as social media data, utility payments, and rental history, to gain a more comprehensive view of borrowers’ financial behavior.

- Biometric authentication: Facial recognition and fingerprint scanning technologies are being used to verify borrower identities, reducing the risk of fraud and identity theft.

Impact on Lending Process

The integration of technology and innovation has significantly transformed the lending process. It has:

- Reduced underwriting time: AI and ML algorithms can process loan applications in minutes, compared to days or weeks required for manual underwriting.

- Improved accuracy: Automated systems eliminate human errors and biases, leading to more accurate and consistent underwriting decisions.

- Increased accessibility: Simplified loan solutions underwriting makes it easier for borrowers to access credit, especially those who may have been underserved by traditional lending institutions.

Challenges and Opportunities

While technology offers numerous benefits, it also presents challenges and opportunities:

- Data privacy and security: The use of sensitive financial data raises concerns about data privacy and security. Underwriters must implement robust measures to protect borrower information.

- Algorithm bias: AI and ML algorithms can be biased if trained on incomplete or biased data. It is essential to ensure algorithms are fair and unbiased to avoid discrimination.

- Job displacement: Automation may lead to job displacement in the underwriting industry. However, it also creates new opportunities for skilled professionals who can work with and interpret the results of AI and ML systems.

Future of Technology in Underwriting

The future of technology in simplified loan solutions underwriting is promising. Continuous advancements in AI, ML, and other emerging technologies will further enhance the accuracy, efficiency, and accessibility of lending. We can expect to see:

- More sophisticated algorithms: AI and ML algorithms will become more sophisticated, enabling underwriters to make even more precise and nuanced decisions.

- Increased use of alternative data: Underwriters will continue to explore and utilize alternative data sources to gain a more holistic view of borrowers’ financial profiles.

- Improved customer experience: Technology will continue to streamline the loan application and approval process, making it easier and more convenient for borrowers to access credit.

Compliance and Regulations for Simplified Loan Solutions Underwriting

Simplified loan solutions underwriting involves unique regulatory requirements and compliance considerations. Lenders must navigate a complex landscape of laws and regulations to ensure responsible lending practices and protect consumers.

Regulatory Requirements

Simplified loan solutions underwriting must comply with various regulations, including the Truth in Lending Act (TILA), the Equal Credit Opportunity Act (ECOA), the Fair Credit Reporting Act (FCRA), and the Dodd-Frank Wall Street Reform and Consumer Protection Act. These regulations impose specific requirements for disclosures, risk assessment, and consumer protections.

Ensuring Compliance

To ensure compliance, lenders should establish robust policies and procedures that align with regulatory requirements. This includes implementing effective risk management frameworks, conducting thorough due diligence on borrowers, and providing clear and concise disclosures to consumers. Regular audits and reviews can help identify and address any compliance gaps.

Best Practices

Best practices for maintaining compliance in simplified loan solutions underwriting include:

- Establishing a dedicated compliance team to monitor regulatory changes and ensure adherence.

- Using technology to automate compliance checks and reduce the risk of human error.

- Providing ongoing training to staff on regulatory requirements and best practices.

- Maintaining open communication with regulators and seeking guidance when needed.

By adhering to these best practices, lenders can mitigate compliance risks, protect consumers, and build trust in the simplified loan solutions underwriting process.

Case Studies and Best Practices

Simplified loan solutions underwriting has gained traction in the financial industry, and several successful implementations have demonstrated its benefits. These case studies provide valuable insights into the practical applications and outcomes of this approach.

Best practices for implementing simplified loan solutions underwriting include adopting a risk-based approach, leveraging technology, and ensuring compliance. By following these best practices, lenders can optimize the process and maximize the benefits of simplified underwriting.

Successful Implementations

- Bank A: Implemented a simplified underwriting process for small business loans, reducing processing time by 50% and increasing approval rates by 15%.

- Credit Union B: Introduced a streamlined underwriting process for auto loans, resulting in a 30% reduction in underwriting costs and a 25% increase in loan originations.

- Online Lender C: Developed an automated underwriting system for personal loans, achieving a 70% reduction in underwriting time and a 20% increase in loan approvals.

Best Practices

- Risk-Based Approach: Focus underwriting efforts on high-risk borrowers while streamlining the process for low-risk applicants.

- Technology Leverage: Utilize automation, data analytics, and machine learning to improve efficiency and accuracy.

- Compliance Assurance: Ensure compliance with regulatory requirements and ethical lending practices.

Lessons Learned and Recommendations

- Conduct thorough due diligence before implementing simplified underwriting.

- Monitor performance metrics to identify areas for improvement.

- Provide ongoing training to underwriters on simplified underwriting techniques.

Future Trends in Simplified Loan Solutions Underwriting

The future of simplified loan solutions underwriting is bright, with emerging trends and advancements shaping the industry. These trends are driven by technological innovations, regulatory changes, and consumer demand for faster, more efficient lending processes.

One key trend is the increasing use of artificial intelligence (AI) and machine learning (ML) to automate underwriting tasks. AI and ML algorithms can analyze vast amounts of data to identify patterns and make underwriting decisions more accurately and efficiently. This can lead to faster loan approvals, reduced costs, and improved risk management.

Data Analytics and Predictive Modeling

- Lenders are leveraging data analytics and predictive modeling to gain deeper insights into borrower behavior and risk profiles.

- This allows for more accurate underwriting decisions, personalized loan offers, and proactive risk management strategies.

Open Banking and Data Sharing

- Open banking initiatives are enabling lenders to access borrower financial data directly from banks and other financial institutions.

- This eliminates the need for manual data entry and provides lenders with a more comprehensive view of borrower finances, leading to faster and more informed underwriting decisions.

Blockchain and Smart Contracts

- Blockchain technology and smart contracts are being explored to streamline and secure the loan underwriting process.

- This can reduce fraud, improve transparency, and automate certain underwriting tasks, resulting in faster loan approvals and reduced costs.

Regulatory Landscape

- Regulatory changes, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, are also driving the adoption of simplified loan solutions underwriting.

- These regulations aim to protect consumers and ensure fair and responsible lending practices, which can be facilitated by simplified underwriting processes.

Consumer Demand, Simplified loan solutions underwriting

- Consumer demand for faster and more convenient loan processes is another key driver of simplified loan solutions underwriting.

- Lenders are responding to this demand by offering simplified online applications, mobile-friendly platforms, and expedited underwriting processes.

Comparison of Simplified Loan Solutions Underwriting to Traditional Underwriting

Simplified loan solutions underwriting and traditional underwriting are two distinct approaches to assessing a borrower’s creditworthiness and determining their eligibility for a loan. Both methods have their own advantages and disadvantages, and the suitability of each approach depends on the specific borrower and loan product.

The key features, advantages, and disadvantages of each approach are summarized in the table below:

| Feature | Simplified Loan Solutions Underwriting | Traditional Underwriting |

|---|---|---|

| Data Sources | Uses alternative data sources, such as bank account data, cash flow analysis, and social media activity. | Relies primarily on traditional data sources, such as credit reports, income statements, and tax returns. |

| Approval Time | Faster approval process, typically within a few days. | Slower approval process, typically taking several weeks. |

| Eligibility Criteria | Less stringent eligibility criteria, making it accessible to a wider range of borrowers. | More stringent eligibility criteria, making it more difficult for borrowers with less-than-perfect credit to qualify. |

| Accuracy | Can be less accurate than traditional underwriting, as it relies on alternative data sources that may not be as reliable. | Generally more accurate, as it uses a more comprehensive range of data sources. |

| Cost | Typically less expensive than traditional underwriting. | Typically more expensive than simplified loan solutions underwriting. |

The similarities between simplified loan solutions underwriting and traditional underwriting include:

- Both approaches aim to assess a borrower’s creditworthiness and determine their eligibility for a loan.

- Both approaches use a combination of quantitative and qualitative data to make their assessments.

- Both approaches are subject to regulatory oversight.

The differences between simplified loan solutions underwriting and traditional underwriting include:

- Simplified loan solutions underwriting uses alternative data sources, while traditional underwriting relies primarily on traditional data sources.

- Simplified loan solutions underwriting has a faster approval process than traditional underwriting.

- Simplified loan solutions underwriting has less stringent eligibility criteria than traditional underwriting.

- Simplified loan solutions underwriting can be less accurate than traditional underwriting.

- Simplified loan solutions underwriting is typically less expensive than traditional underwriting.

The suitability of simplified loan solutions underwriting versus traditional underwriting depends on the specific borrower and loan product. Simplified loan solutions underwriting is a good option for borrowers who have less-than-perfect credit or who need a loan quickly. Traditional underwriting is a good option for borrowers who have strong credit and who are seeking a loan with a lower interest rate.

Impact of Simplified Loan Solutions Underwriting on the Mortgage Industry

Simplified loan solutions underwriting is revolutionizing the mortgage industry by streamlining the loan approval process, making it faster, more efficient, and more accessible for borrowers. This transformation has far-reaching implications for lenders, borrowers, and the overall housing market, with the potential to shape the future of mortgage lending.

For lenders, simplified loan solutions underwriting offers significant benefits, including reduced costs, increased efficiency, and faster loan processing times. By automating and simplifying the underwriting process, lenders can save time and money while also improving their ability to serve more borrowers. Additionally, simplified loan solutions underwriting can help lenders reduce risk by identifying and mitigating potential problems early in the loan application process.

Implications for Borrowers

For borrowers, simplified loan solutions underwriting can make the mortgage application process less stressful and time-consuming. By reducing the amount of documentation and paperwork required, borrowers can apply for a loan more easily and quickly. Additionally, simplified loan solutions underwriting can help borrowers secure a loan with more favorable terms, such as lower interest rates and fees.

Impact on the Housing Market

The widespread adoption of simplified loan solutions underwriting has the potential to have a significant impact on the overall housing market. By making it easier for borrowers to qualify for a loan, simplified loan solutions underwriting can increase demand for housing and help to stimulate economic growth. Additionally, simplified loan solutions underwriting can help to reduce disparities in homeownership rates by making it easier for first-time homebuyers and low- to moderate-income borrowers to qualify for a mortgage.

Designing an Effective Simplified Loan Solutions Underwriting Process

Designing an effective simplified loan solutions underwriting process is crucial for lenders seeking to streamline their operations and enhance the borrower experience. By implementing a well-structured process, lenders can ensure that loan applications are evaluated efficiently and accurately, while adhering to regulatory requirements.

Step-by-Step Guide to Designing and Implementing an Effective Process

- Define Objectives: Clearly Artikel the goals and objectives of the simplified underwriting process, such as reducing processing time, improving accuracy, and enhancing customer satisfaction.

- Identify Target Borrowers: Determine the specific borrower profiles that are eligible for simplified underwriting, based on factors such as creditworthiness, income stability, and debt-to-income ratio.

- Establish Eligibility Criteria: Develop clear and concise criteria for determining whether a loan application qualifies for simplified underwriting. This may include automated risk assessment tools and data verification.

- Design the Underwriting Workflow: Map out the steps involved in the simplified underwriting process, including data collection, risk assessment, and decision-making.

- Train Underwriters: Provide comprehensive training to underwriters on the simplified underwriting process, ensuring they understand the eligibility criteria, risk assessment techniques, and decision-making guidelines.

- Implement Technology: Leverage technology to automate tasks, streamline data collection, and enhance risk assessment capabilities.

- Monitor and Evaluate: Regularly review the performance of the simplified underwriting process to identify areas for improvement and ensure compliance with regulatory requirements.

Key Considerations and Best Practices

- Data Accuracy: Ensure the accuracy and reliability of data used in the simplified underwriting process to make informed decisions.

- Risk Management: Implement robust risk management practices to mitigate potential risks associated with simplified underwriting, such as fraud and misrepresentation.

- Transparency: Communicate the simplified underwriting process and eligibility criteria clearly to borrowers to foster trust and confidence.

- Compliance: Adhere to all applicable regulatory requirements and industry best practices to ensure the integrity and fairness of the process.

Ethical Considerations in Simplified Loan Solutions Underwriting

Simplified loan solutions underwriting involves ethical considerations that demand careful attention. These include the potential for discrimination based on protected characteristics like race or gender, the lack of transparency in lending decisions, and the increased risk of predatory lending.

Ensuring Fairness and Transparency

To ensure fairness, transparency, and responsible lending practices, it’s crucial to develop and use unbiased underwriting models. Providing clear and concise information to borrowers about their loan terms is equally important. Additionally, establishing clear guidelines for loan approval and denial is essential.

Best Practices for Mitigating Ethical Concerns

Best practices for mitigating ethical concerns include regularly reviewing and updating underwriting models to ensure fairness. Conducting regular audits to identify and address potential biases is also necessary. Providing training to loan officers on ethical lending practices is crucial to promote responsible lending.

Conclusion

The implementation of simplified loan solutions underwriting has revolutionized the financial landscape, enabling lenders to streamline processes, enhance efficiency, and expand access to credit for borrowers. Its significance in the evolving financial landscape cannot be overstated, and it is imperative that financial institutions continue to embrace and refine these solutions to meet the ever-changing needs of the market.

As the industry continues to evolve, further research and development in simplified loan solutions underwriting are crucial. Lenders should explore innovative technologies, such as artificial intelligence and machine learning, to enhance the accuracy and efficiency of underwriting processes. Additionally, ongoing collaboration between lenders, fintech companies, and regulatory bodies is essential to ensure that simplified loan solutions underwriting remains compliant and ethical.

Last Point

Simplified loan solutions underwriting is not just a buzzword; it’s a paradigm shift that is revolutionizing the way we access credit. By embracing this innovative approach, we can unlock financial opportunities for all, foster economic growth, and create a more equitable society.

FAQ Summary

What is simplified loan solutions underwriting?

Simplified loan solutions underwriting is an innovative approach that streamlines the underwriting process, making it faster, cheaper, and more accessible for borrowers.

What are the benefits of simplified loan solutions underwriting?

Simplified loan solutions underwriting offers numerous benefits, including reduced time and costs, improved customer satisfaction, and increased access to credit for underserved borrowers.

What are the challenges of simplified loan solutions underwriting?

Simplified loan solutions underwriting comes with certain challenges, such as potential for increased risk of fraud, challenges in verifying income and assets, and reliance on alternative data sources.

How can we mitigate the challenges of simplified loan solutions underwriting?

To mitigate the challenges, best practices include fraud detection and prevention, non-traditional income and asset verification methods, and data analytics for risk assessment.