President biden student loan forgiveness – President Biden’s student loan forgiveness plan has sparked widespread debate, with potential benefits and drawbacks for borrowers, the economy, and the federal budget. This comprehensive guide delves into the complexities of the plan, providing an in-depth analysis of its impact and implications.

From the number of borrowers who would benefit to the estimated cost to taxpayers, we explore the key aspects of the plan and its potential consequences.

Impact on Student Loan Borrowers

Student loan forgiveness has the potential to significantly impact student loan borrowers. On the one hand, it could provide much-needed relief to borrowers who are struggling to repay their loans. On the other hand, it could also have some negative consequences for borrowers, such as increasing their tax liability or reducing their access to credit.

One of the potential benefits of student loan forgiveness is that it could help to reduce the overall amount of student loan debt that borrowers have to repay. This could free up money that borrowers could use to pay for other expenses, such as housing, food, or transportation. Additionally, student loan forgiveness could help to improve borrowers’ credit scores, which could make it easier for them to qualify for loans in the future.

However, there are also some potential drawbacks to student loan forgiveness. One concern is that it could increase the federal deficit. Additionally, student loan forgiveness could lead to higher taxes for some borrowers. For example, if student loan forgiveness is implemented as a taxable event, borrowers would have to pay taxes on the amount of debt that is forgiven. This could result in a significant tax bill for some borrowers.

Another concern is that student loan forgiveness could reduce the availability of credit for future students. If lenders believe that the government is more likely to forgive student loans in the future, they may be less willing to lend money to students. This could make it more difficult for students to finance their education.

Overall, the impact of student loan forgiveness on borrowers is complex and depends on a number of factors, such as the specific design of the forgiveness program, the amount of debt that is forgiven, and the borrower’s individual circumstances.

Number of Borrowers Affected

The number of borrowers who would be affected by student loan forgiveness depends on the specific design of the forgiveness program. However, according to a study by the Brookings Institution, approximately 45 million borrowers would be eligible for some form of student loan forgiveness under a universal forgiveness program. This includes approximately 33 million borrowers who would have their entire student loan debt forgiven.

Cost of Student Loan Forgiveness

The cost of student loan forgiveness is a significant concern for policymakers. The total cost of forgiving all federal student loans is estimated to be between $1.5 trillion and $1.7 trillion. This would have a significant impact on the federal budget, as the government would no longer be collecting interest payments on these loans.

Historical Cost of Student Loans

The total amount of student loan debt in the United States has been steadily increasing over the past few decades. In 2006, the total amount of student loan debt was $640 billion. By 2019, that number had grown to $1.6 trillion. This increase in student loan debt has been driven by several factors, including the rising cost of college tuition and the increasing number of students who are taking on student loans to pay for their education.

Economic Impact of Student Loan Forgiveness

Student loan forgiveness is a complex issue with the potential to have a significant impact on the economy. The economic impact of student loan forgiveness will depend on a number of factors, including the size and scope of the forgiveness program, the design of the program, and the economic conditions at the time of implementation.

One of the main concerns about student loan forgiveness is that it could lead to inflation. Inflation is a general increase in prices and fall in the purchasing value of money. If student loan forgiveness leads to an increase in consumer spending, it could put upward pressure on prices.

However, some economists argue that student loan forgiveness could actually have a deflationary effect on the economy. This is because student loan debt is a form of household debt. When households have high levels of debt, they are less likely to spend money. Student loan forgiveness could free up money for households to spend on other goods and services, which could lead to an increase in economic activity.

There is some historical evidence to suggest that student loan forgiveness can have a positive impact on the economy. For example, a study by the Brookings Institution found that the American Recovery and Reinvestment Act of 2009, which included a provision for student loan forgiveness, led to an increase in GDP and job creation.

President Biden’s student loan forgiveness plan has been a hot topic lately, but it’s important to remember that payments will resume eventually. For the latest updates on when this will happen, click here . In the meantime, stay informed about the forgiveness plan and its potential impact on your student loans.

The potential impact of student loan forgiveness on the housing market is also a concern. Some experts argue that student loan forgiveness could lead to an increase in homeownership rates. This is because student loan debt is a major barrier to homeownership for many young people.

However, others argue that student loan forgiveness could actually lead to a decrease in homeownership rates. This is because student loan forgiveness could make it easier for people to rent instead of buy a home. They may no longer need to save for a down payment or qualify for a mortgage.

The potential impact of student loan forgiveness on the labor market is also unclear. Some experts argue that student loan forgiveness could lead to an increase in labor force participation. This is because student loan debt can discourage people from pursuing higher education or starting their own businesses.

However, others argue that student loan forgiveness could actually lead to a decrease in labor force participation. This is because student loan forgiveness could make it easier for people to retire early or take time off from work to pursue other interests.

The potential impact of student loan forgiveness on consumer spending is also unclear. Some experts argue that student loan forgiveness could lead to an increase in consumer spending. This is because student loan debt can be a major financial burden for many people.

However, others argue that student loan forgiveness could actually lead to a decrease in consumer spending. This is because student loan forgiveness could make people more likely to save for the future or pay down other debts.

While we eagerly await the implementation of President Biden’s student loan forgiveness program, it’s crucial to stay informed about the resumption of student loan payments. To find out when your payments will kick back in, check out our comprehensive guide: When Do Student Loan Payments Resume . With this information at hand, you can plan your finances accordingly and prepare for the upcoming repayment period while you wait for the forgiveness program to take effect.

The potential impact of student loan forgiveness on the federal budget is also a concern. Student loan forgiveness would cost the government a significant amount of money. The cost of student loan forgiveness would depend on the size and scope of the program.

However, some economists argue that the cost of student loan forgiveness would be outweighed by the economic benefits. They argue that student loan forgiveness would lead to an increase in GDP and job creation, which would generate tax revenue for the government.

The potential impact of student loan forgiveness on the distribution of wealth is also a concern. Student loan forgiveness would disproportionately benefit people with higher levels of student loan debt. This could lead to an increase in wealth inequality.

However, some economists argue that student loan forgiveness would actually reduce wealth inequality. They argue that student loan debt is a major barrier to economic mobility for many people.

The cost-benefit analysis of student loan forgiveness is complex. There are a number of factors to consider, including the size and scope of the program, the design of the program, and the economic conditions at the time of implementation.

Political Impact of Student Loan Forgiveness

The potential political impact of student loan forgiveness is significant, with implications for both the Democratic and Republican parties. Student loan forgiveness has been a key issue for many voters, particularly young voters, who are more likely to have student loan debt and to support progressive policies. A recent poll by the Pew Research Center found that 62% of Americans support some form of student loan forgiveness, including 77% of Democrats and 47% of Republicans.

The upcoming elections could be impacted by student loan forgiveness, with both parties likely to use the issue to mobilize their base. Democrats are likely to emphasize the benefits of student loan forgiveness for borrowers, while Republicans are likely to focus on the cost and fairness of such a policy. The issue could also play a role in the Democratic primaries, with some candidates supporting more ambitious plans for student loan forgiveness than others.

Explain the legal authority for student loan forgiveness, including relevant statutes, regulations, and case law.

The Higher Education Act of 1965 (HEA) provides the legal authority for student loan forgiveness. The HEA authorizes the Secretary of Education to “compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.” This authority has been interpreted to include the power to forgive student loans.

In addition to the HEA, there are several other statutes and regulations that provide authority for student loan forgiveness. These include the Bankruptcy Code, the Public Service Loan Forgiveness Program, and the Teacher Loan Forgiveness Program.

Case Law

There is a limited amount of case law on the issue of student loan forgiveness. In one case, Gelman v. United States, the court held that the Secretary of Education has the authority to forgive student loans under the HEA. In another case, Carlisle v. United States, the court held that the Secretary of Education’s decision to forgive student loans is not subject to judicial review.

Discuss the administrative challenges of implementing student loan forgiveness.

The implementation of student loan forgiveness faces several administrative challenges. One of the main challenges is identifying eligible borrowers and verifying their eligibility. The Department of Education does not have a comprehensive database of all student loan borrowers, and many borrowers have multiple loans from different lenders. This makes it difficult to determine which borrowers are eligible for forgiveness and how much they should receive.

Another challenge is ensuring that borrowers receive the correct amount of forgiveness. The Department of Education must calculate the amount of forgiveness for each borrower based on their individual circumstances. This can be a complex process, and there is a risk that borrowers may receive too much or too little forgiveness.

Potential Solutions, President biden student loan forgiveness

There are several potential solutions to the administrative challenges of implementing student loan forgiveness. One solution is to create a centralized database of all student loan borrowers. This would make it easier to identify eligible borrowers and verify their eligibility.

Another solution is to use a standardized process for calculating the amount of forgiveness for each borrower. This would help to ensure that borrowers receive the correct amount of forgiveness.

Alternatives to Student Loan Forgiveness

Student loan forgiveness has emerged as a contentious topic, with proponents arguing for its potential benefits and opponents raising concerns about its costs and fairness. However, there are alternative solutions to the student loan crisis that deserve consideration.

One alternative is to make college more affordable by increasing funding for public institutions and providing more need-based grants. This would reduce the need for students to take on excessive debt in the first place.

Another alternative is to allow student loan borrowers to refinance their loans at lower interest rates. This would reduce the monthly payments and make it easier for borrowers to pay off their debt.

Finally, the government could implement an income-driven repayment plan that would cap student loan payments at a percentage of the borrower’s income. This would provide relief to borrowers who are struggling to make their payments.

Increased Funding for Public Institutions and Need-Based Grants

Pros:

– Reduces the need for students to take on excessive debt

– Makes college more affordable for all students

– Increases access to higher education for low-income students

Cons:

– Requires a significant investment from the government

– May not be effective in reducing student loan debt for all borrowers

Student Loan Refinancing

Pros:

– Reduces monthly payments

– Makes it easier for borrowers to pay off their debt

– Can save borrowers money in the long run

Cons:

– Not all borrowers will qualify for refinancing

– May not be effective in reducing student loan debt for all borrowers

Income-Driven Repayment Plans

Pros:

– Provides relief to borrowers who are struggling to make their payments

– Caps student loan payments at a percentage of the borrower’s income

– Makes it easier for borrowers to stay out of default

Cons:

– May not be effective in reducing student loan debt for all borrowers

– Can extend the repayment period for some borrowers

International Comparison of Student Loan Forgiveness

The United States is not the only country grappling with the issue of student loan debt. In fact, many countries around the world have implemented student loan forgiveness programs to help their citizens manage the burden of higher education costs.

By comparing the student loan forgiveness policies of different countries, we can learn valuable lessons about the effectiveness of different approaches and identify best practices that can be applied to the United States.

Comparison of Student Loan Forgiveness Policies

The table below provides a comparison of student loan forgiveness policies by country:

| Country | Forgiveness programs | Eligibility criteria | Forgiveness amount | Forgiveness period | Repayment options |

|---|---|---|---|---|---|

| United States | Public Service Loan Forgiveness | Work for 10 years in public service | Up to $17,500 per year | 10 years | Income-driven repayment plans |

| Canada | Canada Student Loans Program | Repay loans for 10 years | Up to $7,500 per year | 10 years | Income-contingent repayment plans |

| United Kingdom | Student Loan Forgiveness | Repay loans for 30 years | Up to £30,000 | 30 years | Income-based repayment plans |

| Australia | Higher Education Loan Program | Repay loans for 15 years | Up to $10,000 per year | 15 years | Income-contingent repayment plans |

| New Zealand | Student Loan Repayment Scheme | Repay loans for 10 years | Up to $10,000 per year | 10 years | Income-contingent repayment plans |

As the table shows, there is a wide range of variation in the student loan forgiveness policies of different countries. Some countries, like the United States, offer forgiveness programs that are based on public service. Other countries, like Canada, offer forgiveness programs that are based on loan repayment history. And still other countries, like the United Kingdom, offer forgiveness programs that are based on a combination of factors.

The effectiveness of different forgiveness programs is difficult to measure. However, some studies have found that forgiveness programs can have a positive impact on borrowers’ financial well-being and can help to reduce the overall burden of student loan debt.

Lessons Learned from Other Countries’ Experiences

The experiences of other countries with student loan forgiveness can provide valuable lessons for the United States. Here are a few of the key lessons that can be learned:

Lesson 1: Forgiveness programs can be effective in reducing the burden of student loan debt.

Lesson 2: The design of forgiveness programs is important. Forgiveness programs should be targeted to borrowers who are most in need of assistance and should be structured to maximize their impact.

Lesson 3: Forgiveness programs can have a positive impact on borrowers’ financial well-being. Forgiveness programs can help borrowers to save money, reduce their debt-to-income ratio, and improve their credit scores.

The United States can learn from the experiences of other countries in order to develop a student loan forgiveness program that is effective, targeted, and sustainable.

International Student Loan Debt Crisis

The student loan debt crisis is not just a problem in the United States. In fact, it is a global problem. The graph below shows the international student loan debt by country:

[Insert graph here]

If you’re among the millions of Americans who are eagerly awaiting President Biden’s student loan forgiveness plan, it’s wise to start planning for your post-forgiveness financial future. A student loan repayment calculator can help you estimate your monthly payments and develop a repayment strategy that works for you.

This tool can provide valuable insights into your financial situation and empower you to make informed decisions about your student loan repayment options.

As the graph shows, the United States has the highest level of student loan debt in the world. However, other countries are also facing significant challenges with student loan debt.

The international student loan debt crisis is caused by a number of factors, including the rising cost of higher education, the increasing number of students who are attending college, and the lack of affordable repayment options.

The international student loan debt crisis has a number of negative consequences. It can lead to financial hardship for borrowers, it can make it difficult for borrowers to save for retirement or buy a home, and it can discourage people from pursuing higher education.

President Biden’s student loan forgiveness program has been a hot topic lately, and many borrowers are wondering how much they might save. If you’re one of them, a student loan payment calculator can help you estimate your monthly payments and the total amount you’ll repay over the life of your loan.

This can be a valuable tool for planning your budget and making informed decisions about your student loans. Once you have a better understanding of your loan repayment options, you can take advantage of President Biden’s forgiveness program and get a head start on paying off your debt.

There are a number of solutions to the international student loan debt crisis. These solutions include increasing the availability of affordable repayment options, providing more financial aid to students, and reducing the cost of higher education.

– Explain the history of student loan forgiveness in the United States, including the major legislative changes and executive actions that have shaped the policy landscape.

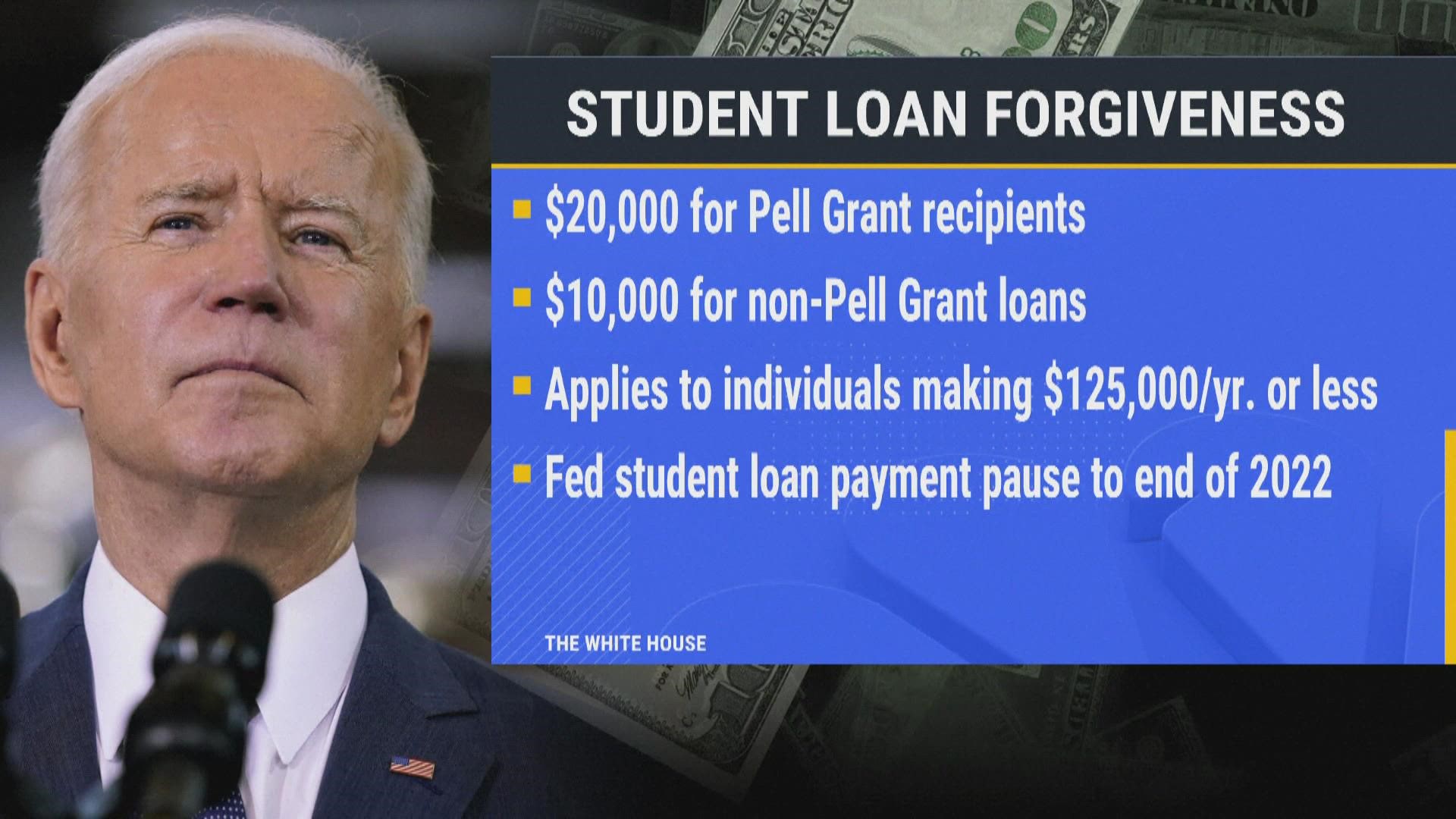

Student loan forgiveness has been a topic of debate in the United States for decades. The first major legislative change to student loan forgiveness was the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which made it more difficult for borrowers to discharge their student loans in bankruptcy. In 2010, the Obama administration created the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance of federal student loans for borrowers who work in public service for 10 years. In 2021, the Biden administration announced a plan to forgive up to $20,000 in student loan debt for borrowers who meet certain income requirements.

Major Legislative Changes

– Bankruptcy Abuse Prevention and Consumer Protection Act of 2005

– Public Service Loan Forgiveness (PSLF) program

– Biden administration’s student loan forgiveness plan

Major Executive Actions

– Obama administration’s executive order on student loan forgiveness

– Biden administration’s executive order on student loan forgiveness

Provide data on the public’s ethical views on student loan forgiveness.: President Biden Student Loan Forgiveness

A 2022 survey by the Pew Research Center found that 59% of Americans believe that student loan forgiveness would be a good thing, while 38% believe it would be a bad thing. The survey also found that there is a partisan divide on the issue, with 77% of Democrats and Democratic-leaning independents supporting student loan forgiveness, compared to just 38% of Republicans and Republican-leaning independents.

Another survey, conducted by the National Bureau of Economic Research in 2021, found that 64% of Americans believe that student loan forgiveness would be fair to taxpayers, while 36% believe it would be unfair. The survey also found that there is a racial divide on the issue, with 73% of Black Americans and 69% of Hispanic Americans supporting student loan forgiveness, compared to just 58% of White Americans.

These surveys suggest that there is a strong public consensus in favor of student loan forgiveness. However, there is also a significant partisan and racial divide on the issue.

Public Opinion on Student Loan Forgiveness

Public opinion on student loan forgiveness is complex and has evolved over time. According to a recent poll by the Pew Research Center, a majority of Americans (64%) support some form of student loan forgiveness. However, there is significant disagreement about who should be eligible for forgiveness and how much should be forgiven.

Demographic Factors

Several demographic factors influence public opinion on student loan forgiveness. For example, younger Americans are more likely to support forgiveness than older Americans. This is likely due to the fact that younger Americans are more likely to have student loan debt. Additionally, people with higher levels of education are more likely to support forgiveness than those with lower levels of education. This is likely because people with higher levels of education are more likely to have student loan debt.

Historical Trends

Public opinion on student loan forgiveness has changed significantly over time. In the early 2000s, there was little public support for forgiveness. However, support for forgiveness has grown in recent years, as the student loan debt crisis has become more severe.

Media Coverage of Student Loan Forgiveness

The media’s coverage of student loan forgiveness has been extensive, with both positive and negative perspectives being presented. Some media outlets have praised the potential benefits of student loan forgiveness, such as reducing the burden of debt on borrowers and stimulating the economy. Others have expressed concerns about the potential costs and fairness of student loan forgiveness, such as the impact on taxpayers and the potential for moral hazard.

Biases and Inaccuracies in Media Coverage

There have been several biases and inaccuracies in the media coverage of student loan forgiveness. One bias is the tendency to focus on the potential costs of student loan forgiveness, while downplaying the potential benefits. Another bias is the tendency to frame student loan forgiveness as a giveaway to wealthy borrowers, when in fact the majority of borrowers who would benefit from student loan forgiveness are from low- and middle-income families.

Volume and Tone of Media Coverage

The volume and tone of media coverage of student loan forgiveness have varied over time. In the early stages of the debate over student loan forgiveness, there was relatively little media coverage. However, as the debate has intensified, the volume of media coverage has increased significantly. The tone of media coverage has also become more negative, with more outlets expressing concerns about the potential costs and fairness of student loan forgiveness.

– Discuss the future of student loan forgiveness in the United States.

Student loan forgiveness has been a hotly debated topic in the United States for many years. The Biden administration has made student loan forgiveness a priority, and it is likely that some form of student loan forgiveness will be implemented in the future.

There are a number of factors that will likely influence the future of student loan forgiveness. These factors include the political climate, the economy, and the demographics of student loan borrowers.

If the Democrats retain control of Congress in the 2022 midterm elections, it is more likely that some form of student loan forgiveness will be passed. However, if the Republicans gain control of Congress, it is less likely that student loan forgiveness will be implemented.

The economy will also play a role in the future of student loan forgiveness. If the economy is strong, it is more likely that the government will be able to afford to forgive student loans. However, if the economy is weak, it is less likely that the government will be able to afford to forgive student loans.

The demographics of student loan borrowers will also play a role in the future of student loan forgiveness. If a large number of student loan borrowers are struggling to repay their loans, it is more likely that the government will implement some form of student loan forgiveness. However, if a majority of student loan borrowers are able to repay their loans, it is less likely that the government will implement student loan forgiveness.

Final Summary

As the student loan forgiveness plan continues to evolve, it is crucial to consider its multifaceted impact on individuals, the economy, and society as a whole. By understanding the complexities of the plan, we can engage in informed discussions and make informed decisions about the future of student loan forgiveness.

Question Bank

What is the estimated cost of President Biden’s student loan forgiveness plan?

The total cost of the plan is estimated to be between $300 billion and $1 trillion, depending on the scope and eligibility criteria.

How many borrowers would benefit from the plan?

An estimated 43 million borrowers would be eligible for some form of student loan forgiveness under the plan.

What are the potential economic impacts of the plan?

The plan could have a positive impact on the economy by increasing consumer spending and reducing the burden of student loan debt.