Navigating the complexities of student loan forgiveness can be a daunting task. This comprehensive guide will provide you with a clear understanding of the student loan forgiveness application process, empowering you to make informed decisions about your financial future.

Whether you’re a recent graduate facing a mountain of debt or an experienced professional seeking relief, this guide will equip you with the knowledge and tools you need to navigate the application process and potentially secure financial freedom.

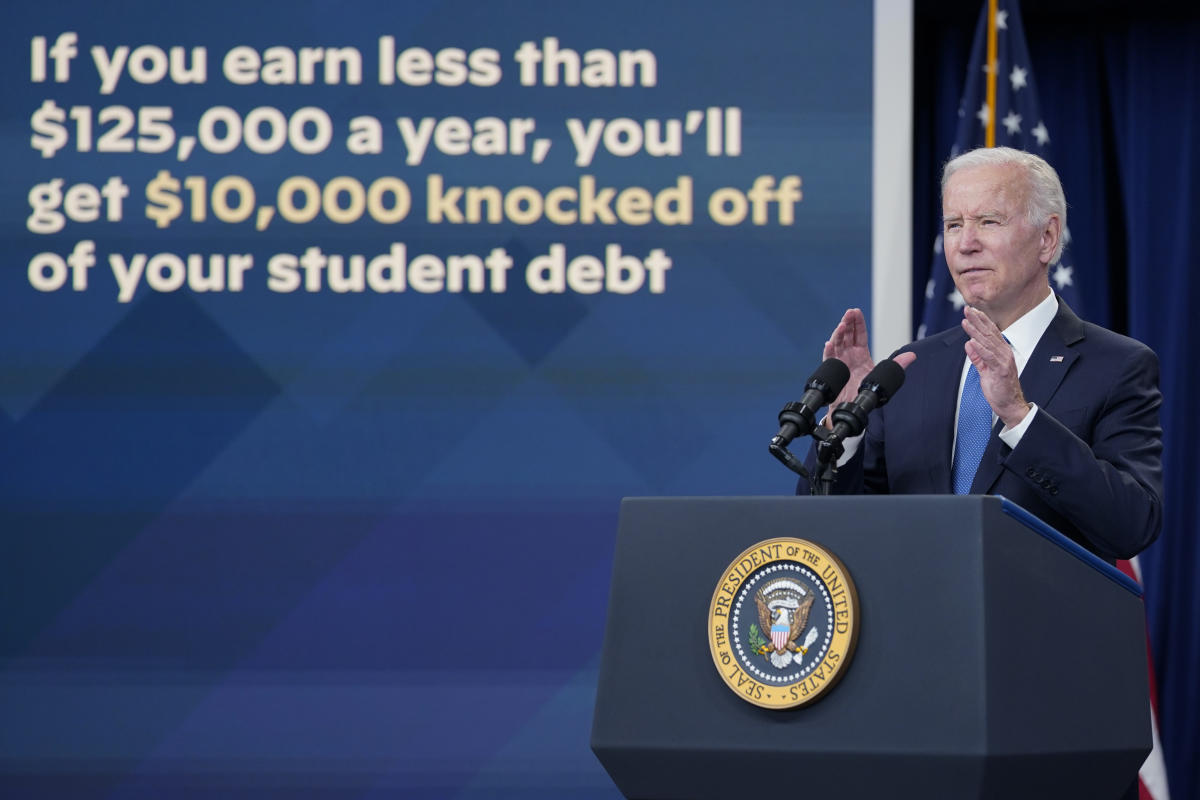

General Overview

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/F5TWQD5D3BBUTMJRNULOCNJWTA.jpg)

Student loan forgiveness is a government program that allows borrowers to have their federal student loans forgiven. The program is designed to help borrowers who are struggling to repay their loans and who meet certain eligibility criteria.

To be eligible for student loan forgiveness, borrowers must have made 120 qualifying payments on their loans while working full-time for a public service employer. Qualifying payments are payments that are made on time and in full. Borrowers must also have worked for a public service employer for at least 10 years.

The application process for student loan forgiveness is relatively straightforward. Borrowers can apply online or by mail. The application requires borrowers to provide information about their income, employment, and student loans.

Student loan forgiveness can provide significant financial benefits to borrowers. Forgiveness can save borrowers thousands of dollars in interest payments and can help them to get out of debt faster. However, forgiveness can also have some negative consequences, such as a reduction in credit scores and an increase in taxable income.

There are many different types of individuals who may be eligible for student loan forgiveness. Some common examples include teachers, nurses, social workers, and government employees.

The student loan forgiveness application process can be complex and time-consuming, but it’s an important step for many borrowers. If you’re struggling to repay your student loan , there are several forgiveness programs available that can help. These programs can provide partial or complete forgiveness of your student loan debt, depending on your eligibility.

It’s important to research the different programs and determine which one is right for you. The student loan forgiveness application process can be complex and time-consuming, but it’s an important step for many borrowers.

Eligibility Criteria

To be eligible for student loan forgiveness, borrowers must meet the following criteria:

- Have made 120 qualifying payments on their loans

- Have worked for a public service employer for at least 10 years

- Be employed by a public service employer at the time of forgiveness

Qualifying payments are payments that are made on time and in full. Payments made during periods of deferment or forbearance do not count towards forgiveness.

Public service employers include government agencies, non-profit organizations, and schools.

Borrowers who are not sure if they qualify for forgiveness can contact their loan servicer or visit the Federal Student Aid website.

Application Process

The application process for student loan forgiveness is relatively straightforward. Borrowers can apply online or by mail.

To apply online, borrowers will need to create an account on the Federal Student Aid website. Once they have created an account, they can log in and click on the “Apply for Forgiveness” link.

To apply by mail, borrowers can download the application from the Federal Student Aid website. The application can be mailed to the address listed on the form.

The application requires borrowers to provide information about their income, employment, and student loans.

The processing time for forgiveness applications can vary. However, most applications are processed within 60 days.

Benefits and Limitations

Student loan forgiveness can provide significant financial benefits to borrowers. Forgiveness can save borrowers thousands of dollars in interest payments and can help them to get out of debt faster.

However, forgiveness can also have some negative consequences. For example, forgiveness can reduce credit scores and increase taxable income.

It is important to weigh the benefits and limitations of forgiveness before applying.

Student loan forgiveness applications are now open, offering relief to those struggling with student debt. To qualify for student loan forgiveness , borrowers must meet certain income requirements and have made payments on their loans for a specified period. The application process is straightforward, but it’s important to submit your application by the deadline to avoid missing out on this opportunity.

Case Studies

There are many different types of individuals who have successfully obtained student loan forgiveness. Some common examples include:

- A teacher who worked for 10 years in a low-income school

- A nurse who worked for 10 years in a public hospital

- A social worker who worked for 10 years for a non-profit organization

These individuals were all able to have their student loans forgiven because they met the eligibility criteria for forgiveness.

Student loan forgiveness can have a significant impact on the financial well-being of borrowers. Forgiveness can help borrowers to save money, get out of debt, and achieve their financial goals.

Application Process

Applying for student loan forgiveness can be a daunting task, but it doesn’t have to be. We’ll guide you through the step-by-step process and provide detailed instructions on how to gather the necessary documents and information.

Eligibility Criteria

- Must have federal student loans.

- Must have worked full-time for 10 years in a public service job.

- Must have made 120 qualifying payments on your loans.

Required Documents

- Employment Verification Form

- Loan History Report

- Proof of Income

Application Steps

- Gather the required documents.

- Complete the PSLF Application Form.

- Submit the application to the U.S. Department of Education.

- Wait for the processing of your application.

- Receive notification of your eligibility and forgiveness amount.

Supporting Documentation

To ensure a thorough and efficient review process, it is crucial to provide accurate and complete documentation that supports your student loan forgiveness application. This documentation should provide evidence of your financial situation, business operations (if applicable), and compliance with relevant regulations.

Financial Statements

- Income statements: These statements show your revenue and expenses over a specific period, providing insights into your financial performance and profitability.

- Balance sheets: These statements provide a snapshot of your financial health at a specific point in time, showing your assets, liabilities, and equity.

- Cash flow statements: These statements track the movement of cash in and out of your business, helping you understand how you are generating and using your cash.

Business Plans

If you are applying for loan forgiveness based on business-related hardship, you should provide a comprehensive business plan that Artikels your business goals, strategies, and financial projections.

Tax Returns

Your tax returns provide valuable information about your income, expenses, and tax liability. They are essential for demonstrating your financial status and compliance with tax laws.

Student loan forgiveness applications are being reviewed, with the latest student loan forgiveness update indicating that over 8 million borrowers have already received debt relief. The application process remains open, and eligible borrowers are encouraged to apply as soon as possible to take advantage of this opportunity to reduce or eliminate their student loan debt.

Contracts

If your application is based on a contract or agreement, such as a forbearance or deferment agreement, you should provide copies of these documents.

Licenses and Permits

For certain types of loan forgiveness programs, you may need to provide evidence of your compliance with relevant licenses and permits. This may include licenses for operating a business or professional certifications.

Common Errors and Pitfalls

Applying for student loan forgiveness can be a daunting task, but it’s important to avoid common mistakes that could delay or even derail your application. Here are some of the most common errors and pitfalls to watch out for:

Incomplete or Incorrect Information

One of the most common mistakes applicants make is submitting an incomplete or incorrect application. This can happen for a number of reasons, such as forgetting to include a required document or making a mistake on the application form. To avoid this, carefully review the application requirements and make sure you have all the necessary materials before you submit your application.

Missing Deadlines

Another common pitfall is missing deadlines. The student loan forgiveness application process can be lengthy, so it’s important to keep track of all the deadlines and submit your application on time. To avoid missing a deadline, set a reminder for yourself or mark the deadline on your calendar.

Formatting Errors

Formatting errors can also delay or derail your application. The student loan forgiveness application has specific formatting requirements, such as using a certain font size and margins. To avoid formatting errors, refer to the application instructions and make sure your application is formatted accordingly.

Grammatical Errors

Grammatical errors can make your application look unprofessional and can also make it difficult for the reviewer to understand your application. To avoid grammatical errors, proofread your application carefully and have someone else review it for any errors.

Filing for student loan forgiveness is a complex process, and the recent news about the supreme court student loan debt relief only adds to the confusion. It’s important to understand that the supreme court’s decision does not mean that all student loans will be forgiven automatically.

Instead, it means that the court will review the Biden administration’s student loan forgiveness plan and determine whether it is legal. If the plan is upheld, it could provide significant relief to millions of student loan borrowers. However, it’s crucial to stay informed and follow the latest developments in the student loan forgiveness application process.

Lack of Preparation

Lack of preparation can also lead to errors and pitfalls in the student loan forgiveness application process. To avoid this, take the time to gather all the necessary materials and information before you start your application. You should also familiarize yourself with the application process and the requirements.

Application Status and Timeline

Once you submit your application, you can track its status online or by calling the designated customer service number. The processing time for applications can vary depending on the complexity of your case and the volume of applications being processed.

Typically, you can expect a decision within 60 to 90 days after submitting your application. If you have not received a decision within this timeframe, you can contact the customer service number for an update on your application status.

Checking Application Status Online

- Visit the designated website for checking application status.

- Enter your application ID and other required information.

- You will be able to view the current status of your application, such as “In Process,” “Approved,” or “Denied.”

Contacting Customer Service

- Call the designated customer service number for student loan forgiveness.

- Provide your application ID and personal information to the customer service representative.

- The representative will be able to provide you with an update on your application status and answer any questions you may have.

Describe the possible outcomes of an application, including approval, denial, and partial approval.

When you submit an application for student loan forgiveness, there are three possible outcomes: approval, denial, or partial approval. Each outcome has different implications for the applicant, and it is important to be prepared for all possibilities.

Approval, Student loan forgiveness application

If your application is approved, you will receive the requested amount of forgiveness. This means that your student loans will be discharged, and you will no longer be responsible for repaying them. Approval is the most favorable outcome, and it can have a significant positive impact on your financial situation.

Denial

If your application is denied, you will not receive any forgiveness. This means that you will still be responsible for repaying your student loans in full. Denial can be a disappointing outcome, but it is important to remember that there are other options available to you. You may be able to consolidate your loans, refinance them, or apply for a different forgiveness program.

Partial Approval

If your application is partially approved, you will receive only a portion of the requested forgiveness. This means that you will still be responsible for repaying a portion of your student loans. Partial approval can be a helpful outcome, as it can reduce your monthly payments and make your loans more manageable.

Alternative Options

If you’re struggling to repay your student loans, there are several alternative options available to you. These options can provide you with some relief from your monthly payments and help you get your student loans paid off faster.

It’s important to explore all of your options before making a decision. Each option has its own pros and cons, so it’s important to weigh the benefits and risks before making a choice.

Income-Driven Repayment Plans

Income-driven repayment plans are a type of student loan repayment plan that bases your monthly payments on your income and family size. This can make your payments more affordable if you have a low income.

- Pros: Lower monthly payments, potential for loan forgiveness after 20 or 25 years of payments

- Cons: You may end up paying more interest over the life of the loan, may not be eligible for all types of student loans

Loan Consolidation

Loan consolidation combines multiple student loans into a single loan with a single monthly payment. This can make it easier to manage your student loans and may qualify you for a lower interest rate.

- Pros: Simpler monthly payments, may qualify for a lower interest rate

- Cons: May not save you any money over the life of the loan, may not be eligible for all types of student loans

Student Loan Refinancing

Student loan refinancing is a type of loan that you can use to pay off your existing student loans. Refinancing can potentially lower your interest rate and monthly payments.

- Pros: Lower interest rate, lower monthly payments

- Cons: May not be eligible for all types of student loans, may have to pay a fee to refinance

Loan Forgiveness Programs

There are a number of loan forgiveness programs available, including Public Service Loan Forgiveness and Teacher Loan Forgiveness. These programs can forgive your student loans after a certain number of years of service in a qualifying profession.

- Pros: Potential for complete loan forgiveness

- Cons: May not be eligible for all types of student loans, may have to meet specific requirements to qualify

Resources and Support

Navigating the student loan forgiveness application process can be daunting, but there are numerous resources available to assist applicants. These organizations provide guidance, support, and expertise to ensure a smooth and successful application experience.

Financial advisors and counselors play a crucial role in helping applicants understand their options, prepare necessary documentation, and navigate the complexities of the application process. Their expertise can significantly increase the likelihood of a successful application.

Support Organizations

- National Student Legal Defense Network (NSLDN): Provides free legal assistance and resources to student loan borrowers.

- American Bar Association’s Student Loan Repayment Assistance Project: Offers pro bono legal services to low-income borrowers facing student loan debt.

- Student Debt Crisis Center: A non-profit organization that provides information, resources, and support to student loan borrowers.

Legal Considerations

Applying for student loan forgiveness has certain legal implications that you should be aware of. Understanding these implications can help you make informed decisions and avoid potential legal issues.

Importance of Legal Advice

Depending on your individual circumstances, it may be advisable to seek professional legal advice before submitting a student loan forgiveness application. An attorney can help you assess your eligibility, understand the terms and conditions of different forgiveness programs, and represent you if necessary.

Ethical Considerations

Student loan forgiveness raises ethical concerns that warrant exploration. One aspect to consider is the impact on taxpayers who may bear the financial burden of canceling student debt. Additionally, the potential economic consequences must be carefully weighed.

Impact on Taxpayers

Critics argue that forgiving student loans would shift the financial responsibility from borrowers to taxpayers, who may not have benefited directly from the education received. They contend that this could lead to higher taxes or cuts in government programs to offset the costs.

Impact on the Economy

Proponents of student loan forgiveness argue that it could stimulate the economy by freeing up funds that borrowers can spend on other goods and services. However, critics counter that it could lead to inflation if the demand for goods and services outpaces the supply.

Balancing Ethical Considerations

Balancing these ethical considerations requires careful analysis and informed decision-making. It is essential to weigh the potential benefits of student loan forgiveness against the potential risks and impacts on taxpayers and the economy.

Historical Context

Student loan forgiveness programs in the United States have a long and complex history. The first such program was established in 1965 as part of the Higher Education Act. This program provided forgiveness for student loans to teachers who worked in low-income schools. Since then, a number of other student loan forgiveness programs have been created, each with its own eligibility criteria and application process.

The evolution of student loan forgiveness programs in the United States has been driven by a number of factors, including the rising cost of college tuition, the increasing number of students who are taking on student loans, and the growing recognition of the burden that student loan debt can place on borrowers.

Key Events in the History of Student Loan Forgiveness

– 1965: The Higher Education Act establishes the first student loan forgiveness program, which provides forgiveness for student loans to teachers who work in low-income schools.

– 1976: The Public Service Loan Forgiveness Program (PSLF) is created to provide forgiveness for student loans to public service workers, such as teachers, nurses, and firefighters.

– 1998: The Income-Based Repayment (IBR) program is created to provide more affordable repayment options for student loan borrowers.

– 2007: The College Cost Reduction and Access Act expands the eligibility criteria for the PSLF program and creates the Teacher Loan Forgiveness Program.

– 2010: The Affordable Care Act creates the Public Service Loan Forgiveness (PSLF) program, which provides forgiveness for student loans to public service workers after 10 years of service.

– 2021: The American Rescue Plan Act of 2021 temporarily suspends payments on federal student loans and waives interest accrual through September 2021.

Table of Student Loan Forgiveness Programs

| Program | Eligibility Criteria | Application Process |

|—|—|—|

| Teacher Loan Forgiveness Program | Teachers who work in low-income schools | Submit an application to the U.S. Department of Education |

| Public Service Loan Forgiveness Program | Public service workers, such as teachers, nurses, and firefighters | Submit an application to the U.S. Department of Education |

| Income-Based Repayment (IBR) program | Student loan borrowers who meet certain income requirements | Submit an application to the U.S. Department of Education |

Political and Economic Factors Influencing Student Loan Forgiveness Programs

The development of student loan forgiveness programs in the United States has been influenced by a number of political and economic factors, including:

– The rising cost of college tuition has made it more difficult for students to pay for college without taking on student loans.

– The increasing number of students who are taking on student loans has led to a growing concern about the burden that student loan debt can place on borrowers.

– The recognition that student loan debt can have a negative impact on the economy has led to support for student loan forgiveness programs.

International Comparisons

Student loan forgiveness programs vary widely across countries, reflecting different approaches to higher education financing and social welfare. Let’s delve into the similarities and differences between programs in the United States, Canada, the United Kingdom, Australia, and New Zealand.

Eligibility Criteria

In the US, eligibility for federal student loan forgiveness programs typically requires meeting specific income thresholds, working in certain professions (e.g., teaching, public service), or making a certain number of qualifying payments. Canada’s student loan forgiveness program, on the other hand, is based on a combination of income and debt-to-income ratio. The UK has a “Plan 2” student loan repayment system, where borrowers repay a percentage of their income over a set period, with any remaining debt forgiven after 30 years. Australia and New Zealand have income-contingent loan repayment schemes, where borrowers repay a percentage of their income above a certain threshold.

Application Process

The application processes for student loan forgiveness programs also vary. In the US, borrowers must typically submit an application and provide documentation to verify their eligibility. In Canada, borrowers can apply online through the National Student Loans Service Centre. The UK’s Student Loans Company handles applications for Plan 2. Australia and New Zealand have automated systems for managing loan repayments, with forgiveness occurring automatically when certain conditions are met.

Outcomes

The outcomes of student loan forgiveness programs also differ. In the US, the amount of debt forgiven can vary depending on the program and the borrower’s circumstances. In Canada, borrowers who qualify for debt forgiveness can have their entire student loan balance forgiven. In the UK, borrowers who make all their repayments on time will have their remaining debt forgiven after 30 years. In Australia and New Zealand, borrowers who repay their loans in full within a certain period (e.g., 10 years) may be eligible for partial forgiveness.

Key Findings and Policy Implications

International comparisons of student loan forgiveness programs highlight the different approaches countries take to addressing the issue of student debt. While there is no one-size-fits-all solution, these programs can provide valuable lessons for policymakers. The US could consider expanding eligibility for forgiveness programs and streamlining the application process. Canada’s focus on debt-to-income ratio could be a useful model for ensuring that forgiveness is targeted to those who need it most. The UK’s Plan 2 system provides a balance between affordability and eventual debt forgiveness. Australia and New Zealand’s income-contingent repayment schemes offer flexibility and ensure that borrowers repay a fair share of their loans. By studying these programs, policymakers can develop more effective and equitable student loan forgiveness policies.

Case Studies: Student Loan Forgiveness Application

Student loan forgiveness programs can provide much-needed relief to borrowers struggling with their student debt. To understand how these programs work in practice, it’s helpful to examine case studies of individuals who have successfully applied for and received forgiveness.

Case Study: Sarah, a Public Service Worker

Sarah graduated from college with $50,000 in student debt. She worked as a social worker for 10 years, making payments on her loans but struggling to keep up. She applied for the Public Service Loan Forgiveness (PSLF) program and was approved after 120 qualifying payments. Sarah’s remaining student debt was forgiven, saving her over $30,000.

Case Study: John, a Disabled Veteran

John served in the military and sustained a disability that prevented him from working. He had $20,000 in student debt and was unable to make payments. He applied for the Total and Permanent Disability Discharge (TPD) program and was approved. John’s student debt was discharged, providing him with much-needed financial relief.

Case Study: Mary, a Teacher

Mary is a teacher who has been working in a low-income school for five years. She applied for the Teacher Loan Forgiveness program and was approved. Mary’s remaining student debt was forgiven, saving her over $15,000.

These case studies demonstrate that student loan forgiveness programs can be a valuable tool for borrowers who meet the eligibility requirements. By understanding the different programs available and the strategies that can be used to apply successfully, borrowers can increase their chances of obtaining relief from their student debt.

“Applying for student loan forgiveness was a long and challenging process, but it was worth it. I’m so grateful that I was able to get my student debt forgiven.” – Sarah

“I was so relieved when I found out that I was approved for TPD discharge. It’s a huge weight off my shoulders.” – John

“I’m so happy that I was able to get my student debt forgiven. It’s going to make a big difference in my life.” – Mary

Data Analysis

Analyzing data on student loan forgiveness applications can provide valuable insights into trends and patterns in the application process. This information can be useful for policy makers and stakeholders in evaluating the effectiveness of the program and making informed decisions about future policies.

For example, data analysis could reveal that certain groups of borrowers are more likely to apply for forgiveness, or that certain types of loans are more likely to be forgiven. This information could be used to target outreach efforts to underserved populations or to adjust the program’s eligibility criteria.

Data Sources

- Data on student loan forgiveness applications can be collected from a variety of sources, including the Department of Education, the Consumer Financial Protection Bureau, and private lenders.

- These data can include information on the number of applications received, the number of applications approved, the average amount of forgiveness granted, and the demographics of borrowers who apply for forgiveness.

Data Analysis Methods

- Data analysis methods that can be used to identify trends and patterns in student loan forgiveness applications include descriptive statistics, regression analysis, and cluster analysis.

- Descriptive statistics can be used to summarize the data and identify general trends, such as the average amount of forgiveness granted or the percentage of applications that are approved.

- Regression analysis can be used to examine the relationship between different variables, such as borrower demographics and the likelihood of forgiveness.

- Cluster analysis can be used to identify groups of borrowers who have similar characteristics, such as similar levels of debt or similar repayment histories.

Implications for Policy Makers and Stakeholders

The data analysis can provide valuable information for policy makers and stakeholders in evaluating the effectiveness of the student loan forgiveness program and making informed decisions about future policies.

For example, data analysis could reveal that the program is not reaching certain groups of borrowers who need it most. This information could be used to target outreach efforts to underserved populations or to adjust the program’s eligibility criteria.

Additionally, data analysis could reveal that the program is having a positive impact on borrowers’ financial well-being. This information could be used to justify continued funding for the program or to expand its reach.

Future Outlook

Student loan forgiveness programs in the United States are likely to evolve in the coming years, driven by ongoing policy debates and the evolving economic landscape. Here are some potential changes to eligibility criteria, application processes, and outcomes:

Expansion of Eligibility Criteria

Income: Expanding eligibility to include middle-income earners would increase access to forgiveness for borrowers with moderate debt.

Debt-to-income ratio: Lowering thresholds would provide enhanced relief for borrowers struggling with repayment.

Repayment history: Removing the requirement for timely payments would offer forgiveness opportunities to borrowers who have faced financial hardship.

Streamlining the Application and Approval Process

Technology could play a significant role in streamlining the application and approval process, making it easier for borrowers to access forgiveness. For instance, the use of data analytics and automation could expedite the review and approval of applications.

Impact on Borrowers and the Economy

Changes to student loan forgiveness programs could have a substantial impact on borrowers and the economy. Expanded eligibility and streamlined processes could provide much-needed relief to millions of borrowers, reducing their debt burden and improving their financial well-being. This could have positive ripple effects on the economy, boosting consumer spending and economic growth.

Example Scenario

In the next five years, the Biden administration expands the Public Service Loan Forgiveness (PSLF) program to include all public sector employees, regardless of their income or debt-to-income ratio. This change would significantly increase the number of borrowers eligible for forgiveness and provide much-needed relief to teachers, nurses, and other public servants.

Last Recap

Remember, student loan forgiveness is not a one-size-fits-all solution. By carefully considering your individual circumstances and exploring the available options, you can make an informed decision that aligns with your financial goals. Take the first step towards financial freedom today and explore the possibilities of student loan forgiveness.

Q&A

What are the eligibility requirements for student loan forgiveness?

Eligibility criteria vary depending on the specific program you’re applying for. Generally, you must meet income requirements, have a certain type of student loan, and demonstrate financial hardship.

How do I apply for student loan forgiveness?

The application process involves gathering supporting documentation, completing an application form, and submitting it to the relevant authority.

What are the potential benefits of student loan forgiveness?

Student loan forgiveness can provide significant financial relief, reduce monthly payments, and improve your overall financial well-being.

What are the potential drawbacks of student loan forgiveness?

Depending on your circumstances, student loan forgiveness may have tax implications or impact your credit score.

What are some alternative options to student loan forgiveness?

If you don’t qualify for student loan forgiveness, there are other repayment assistance programs and strategies you can explore.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/F5TWQD5D3BBUTMJRNULOCNJWTA.jpg?w=1440&resize=1440,810&ssl=1)