The Student Loan Save Plan is an invaluable tool for managing your student loan debt and achieving financial freedom. This comprehensive guide will provide you with all the information you need to understand the different types of plans available, the benefits they offer, and how to choose the right plan for your individual needs.

With rising student loan debt becoming a major financial burden for millions of Americans, the Student Loan Save Plan has emerged as a lifeline for those seeking to navigate the complexities of student loan repayment. By providing a structured approach to saving and managing your debt, this plan can help you reduce interest charges, improve your credit score, and achieve your financial goals.

– Student Loan Save Plan Overview

Student loan save plans are a great way to save money on your student loans. They can help you pay off your loans faster, reduce the amount of interest you pay, and improve your credit score.

There are many different types of student loan save plans available, so it’s important to compare them before choosing one. Some of the most common types of plans include:

Types of Student Loan Save Plans

- Debt Consolidation Loans: These loans combine multiple student loans into a single loan with a lower interest rate. This can save you money on your monthly payments and help you pay off your loans faster.

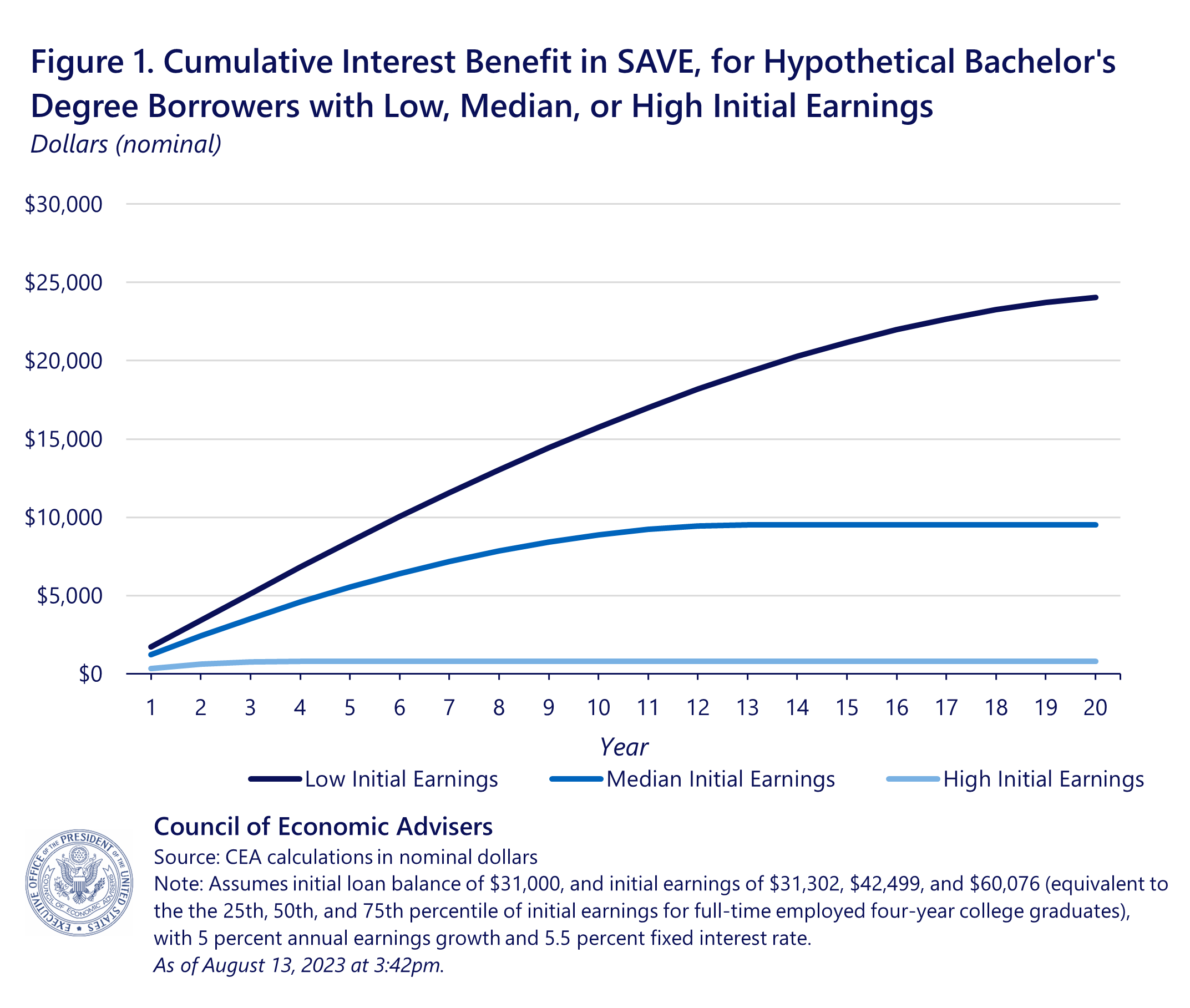

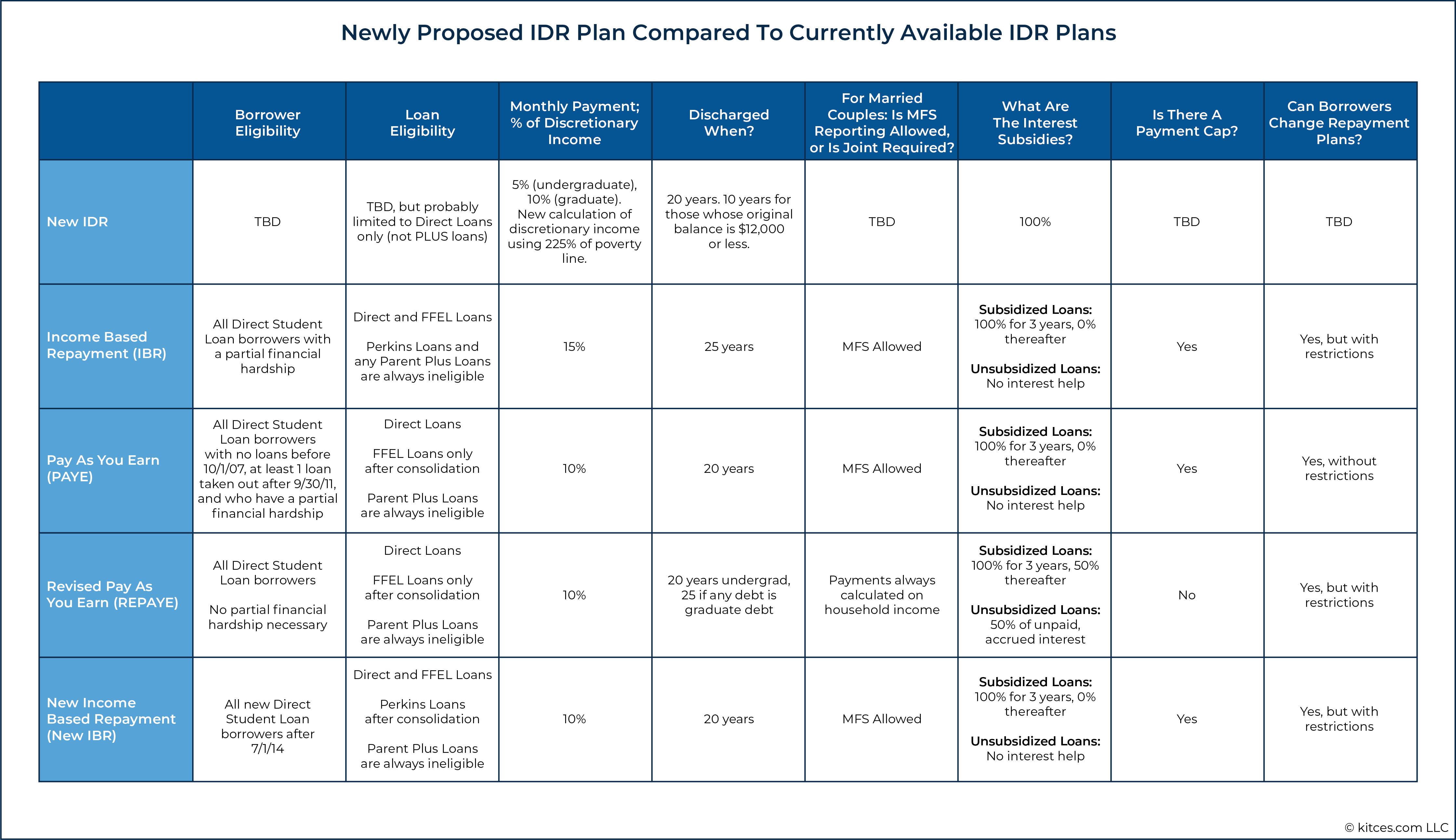

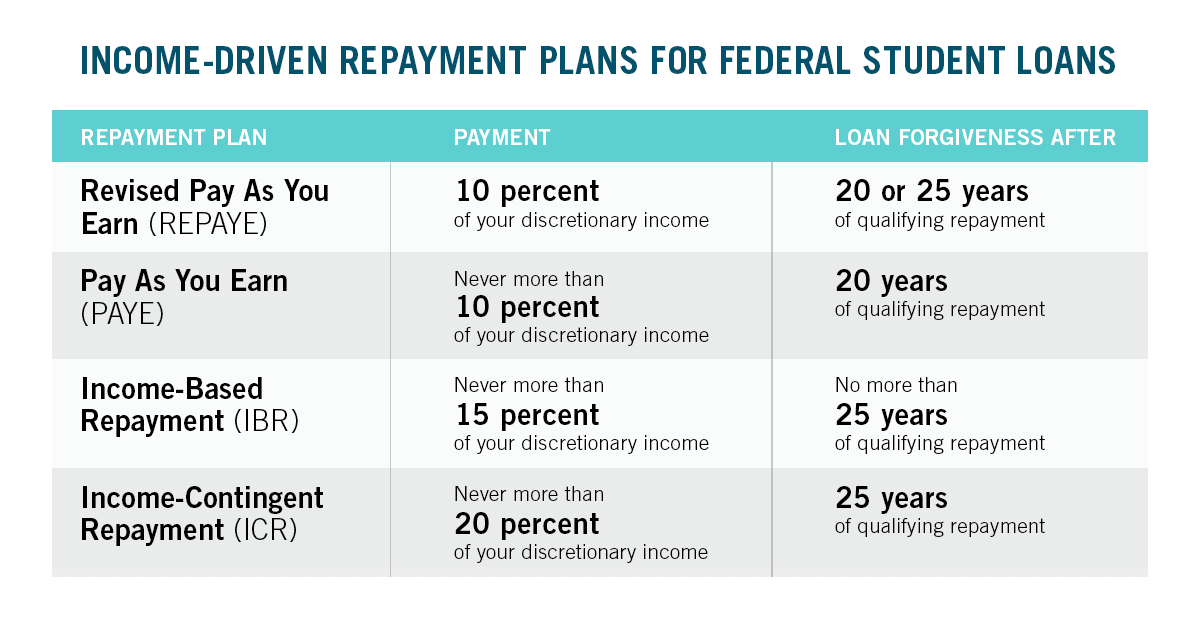

- Income-Driven Repayment Plans: These plans base your monthly payments on your income and family size. This can make your payments more affordable if you have a low income.

- Loan Forgiveness Programs: These programs forgive all or part of your student loans after you meet certain requirements, such as working in a public service job.

Comparing Student Loan Save Plans

When comparing student loan save plans, it’s important to consider the following factors:

- Interest rate: The interest rate on your plan will determine how much you pay in interest over the life of the loan.

- Monthly payment: The monthly payment on your plan will determine how much you can afford to pay each month.

- Loan term: The loan term on your plan will determine how long it will take you to pay off your loans.

- Fees: Some plans have fees associated with them, such as origination fees or prepayment penalties.

The best student loan save plan for you will depend on your individual circumstances. It’s important to compare the different plans available and choose the one that best meets your needs.

| Plan Type | Interest Rate | Monthly Payment | Loan Term | Fees |

|---|---|---|---|---|

| Debt Consolidation Loan | Varies | Varies | 5-20 years | Origination fees, prepayment penalties |

| Income-Driven Repayment Plan | Varies | Based on income | 20-25 years | No fees |

| Loan Forgiveness Program | 0% | 0 | 10-20 years | No fees |

Eligibility and Requirements

To participate in a student loan save plan, you must meet certain eligibility criteria and provide the necessary documents and information. These requirements vary depending on the specific plan and lender, but there are some general guidelines that apply to most plans.

Generally, you must be a U.S. citizen or permanent resident, have a valid Social Security number, and be enrolled in an eligible educational institution. You may also need to meet certain income or credit requirements.

Required Documents and Information

When you apply for a student loan save plan, you will need to provide the following documents and information:

- Proof of identity (e.g., driver’s license, passport)

- Proof of enrollment (e.g., student ID card, tuition statement)

- Proof of income (e.g., pay stubs, tax returns)

- Credit history (e.g., credit report, credit score)

You can submit these documents and information online, by mail, or in person. The lender will review your application and determine whether you are eligible for the plan.

Eligibility Criteria and Required Documents Summary

| Eligibility Criteria | Required Documents |

|---|---|

| U.S. citizen or permanent resident | Proof of identity (e.g., driver’s license, passport) |

| Valid Social Security number | Proof of Social Security number (e.g., Social Security card) |

| Enrolled in an eligible educational institution | Proof of enrollment (e.g., student ID card, tuition statement) |

| Meet certain income or credit requirements | Proof of income (e.g., pay stubs, tax returns), Credit history (e.g., credit report, credit score) |

Frequently Asked Questions (FAQs)

- Who is eligible for a student loan save plan?

- What documents and information do I need to provide to apply for a student loan save plan?

- How do I submit the required documents and information?

- What happens after I submit my application?

To be eligible for a student loan save plan, you must meet certain eligibility criteria, such as being a U.S. citizen or permanent resident, having a valid Social Security number, and being enrolled in an eligible educational institution.

You will need to provide proof of identity, proof of enrollment, proof of income, and credit history.

You can submit the required documents and information online, by mail, or in person.

To ease the burden of student loans, a student loan save plan can provide a strategic approach to manage your finances. While recent news about student loan forgiveness biden offers a glimmer of hope, it’s crucial to remember that a save plan is still essential.

By setting aside funds regularly, you can prepare for future payments and potentially reduce the overall cost of your student debt.

The lender will review your application and determine whether you are eligible for the plan.

Plan Features

Student loan save plans provide flexible and advantageous options for managing student loan debt. These plans offer various features that cater to different financial situations and repayment goals.

Key features to consider when choosing a plan include:

Interest Rates

- Interest rates vary depending on the plan and lender.

- Some plans offer fixed interest rates, while others have variable rates that fluctuate with market conditions.

- Fixed rates provide stability, while variable rates may offer lower rates initially but could increase over time.

Repayment Terms

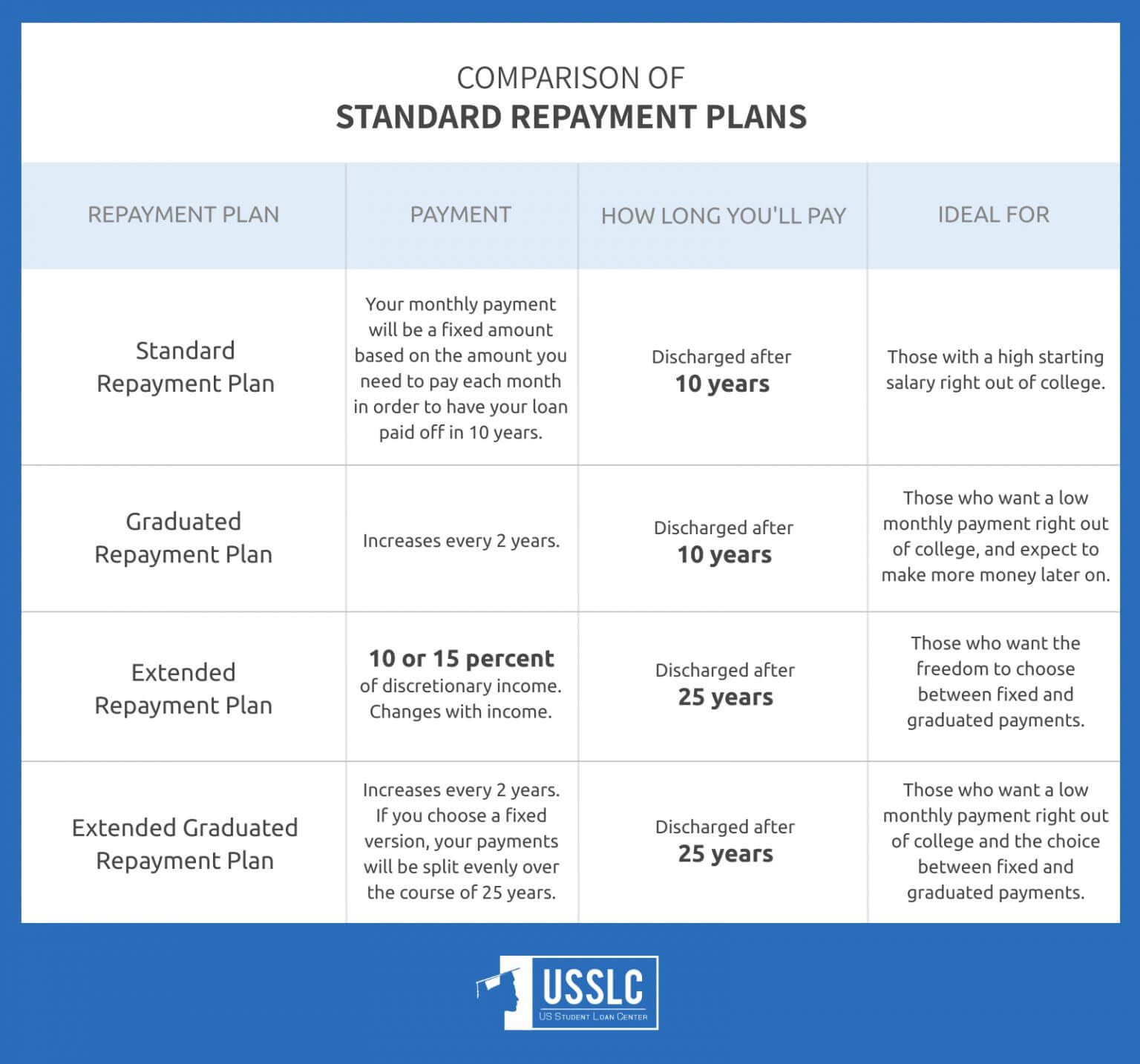

- Repayment terms determine the length of time you have to repay your loan.

- Shorter terms generally result in higher monthly payments but lower total interest paid.

- Longer terms reduce monthly payments but increase the overall interest cost.

Tax Benefits

- Some student loan save plans offer tax benefits, such as deductions or credits.

- These benefits can reduce your taxable income, saving you money on taxes.

- Tax benefits vary depending on the plan and your individual tax situation.

– Provide a detailed list of the benefits of enrolling in a student loan save plan.

Student loan save plans offer numerous advantages to individuals seeking to manage their student loan debt effectively. These plans provide a structured approach to saving money, reducing interest payments, and improving credit scores, ultimately leading to financial freedom.

By enrolling in a student loan save plan, individuals can reap the following benefits:

- Lower interest rates: Student loan save plans often negotiate lower interest rates with lenders, resulting in significant savings over the life of the loan.

- Reduced monthly payments: Plans can help lower monthly payments, making it easier to manage student loan debt and free up cash flow for other financial goals.

- Shorter loan terms: By consolidating multiple loans or making additional payments, save plans can help shorten loan terms, reducing the overall cost of borrowing.

- Improved credit scores: Consistent on-time payments through a save plan can positively impact credit scores, making it easier to qualify for lower interest rates on future loans.

- Access to financial counseling: Many save plans offer access to financial counseling, providing guidance and support in managing student loan debt and overall finances.

Considerations for Choosing a Plan

Choosing the right student loan save plan is crucial to maximizing your savings and minimizing your debt. Here are some key factors to consider:

- Interest rates: The interest rate charged on your student loan save plan will determine how much you pay in interest over time. Compare rates from different providers to find the lowest rate available.

- Fees: Some student loan save plans charge fees, such as account maintenance fees or early withdrawal penalties. Be sure to factor these fees into your decision.

- Repayment options: Choose a plan that offers repayment options that fit your budget and financial goals. Some plans offer flexible repayment terms, while others require fixed monthly payments.

Types of Student Loan Save Plans

There are several different types of student loan save plans available, each with its own features and benefits.

| Type of Plan | Features | Benefits |

|---|---|---|

| 529 Plan | Tax-advantaged savings plan specifically designed for education expenses | Tax-free growth of investments, tax-free withdrawals for qualified education expenses |

| Coverdell ESA | Tax-advantaged savings account for education expenses | Tax-free growth of investments, tax-free withdrawals for qualified education expenses |

| Roth IRA | Tax-advantaged retirement savings account | Tax-free growth of investments, tax-free withdrawals in retirement |

| Traditional IRA | Tax-advantaged retirement savings account | Tax-deductible contributions, tax-deferred growth of investments |

Checklist for Comparing Student Loan Save Plans

When comparing student loan save plans, be sure to ask the following questions:

- What is the interest rate?

- Are there any fees?

- What are the repayment options?

- What is the minimum investment required?

- What are the tax implications?

Pros and Cons of Different Student Loan Save Plans

Each type of student loan save plan has its own advantages and disadvantages.

529 Plans

* Pros: Tax-advantaged savings, tax-free withdrawals for qualified education expenses

* Cons: Limited investment options, penalties for non-qualified withdrawals

Coverdell ESAs

* Pros: Tax-advantaged savings, tax-free withdrawals for qualified education expenses

* Cons: Lower contribution limits than 529 plans, penalties for non-qualified withdrawals

Roth IRAs

* Pros: Tax-free growth of investments, tax-free withdrawals in retirement

* Cons: Income limits for contributions, penalties for early withdrawals

Traditional IRAs

* Pros: Tax-deductible contributions, tax-deferred growth of investments

* Cons: Required minimum distributions in retirement, penalties for early withdrawals

How to Enroll in a Plan

Enrolling in a student loan save plan is a straightforward process that can be completed online or offline. Here’s a step-by-step guide to help you get started:

Online Enrollment

Step 1: Visit the website of your preferred student loan save plan provider.

The weight of student loan debt can feel overwhelming, but with a well-structured save plan, you can gradually chip away at it. The Biden student loan initiative provides valuable options for federal loan borrowers, including income-driven repayment plans and potential loan forgiveness.

By exploring these options and implementing a tailored save plan, you can create a path to financial freedom and reduce the burden of student loan debt.

Step 2: Create an account and provide your personal and financial information.

Step 3: Select the plan that best meets your needs and budget.

Step 4: Set up automatic payments from your bank account.

Step 5: Review and submit your application.

Offline Enrollment

Step 1: Contact your student loan servicer or a participating financial institution.

Step 2: Request an enrollment form and complete it.

Step 3: Submit the form to your servicer or financial institution.

Step 4: Set up automatic payments from your bank account.

Requirements for Enrollment, Student loan save plan

- Be the primary borrower on the student loan.

- Have a steady income.

- Meet the minimum credit score requirements (if applicable).

Benefits of Enrolling

- Lower your monthly payments.

- Save money on interest.

- Pay off your loan faster.

- Improve your credit score.

Enrollment Process Summary

| Step | Online | Offline |

|---|---|---|

| Create an account | Yes | No |

| Provide personal information | Yes | Yes |

| Select a plan | Yes | No |

| Set up automatic payments | Yes | Yes |

| Submit an application | Yes | Yes |

“Enrolling in a student loan save plan was the best decision I ever made. I was able to lower my monthly payments and save thousands of dollars on interest. I highly recommend it to anyone who wants to get out of debt faster.” – Sarah, satisfied customer

Call to Action

Don’t wait any longer to start saving on your student loans. Enroll in a student loan save plan today and take control of your financial future.

Managing Your Plan

Once you’ve enrolled in a student loan save plan, managing it effectively is crucial to maximize its benefits. This involves making regular contributions, tracking your progress, and adjusting your plan as needed.

One key strategy is to set up automatic contributions from your bank account. This ensures that you’re contributing consistently, even during busy times. You can also set up reminders or use budgeting apps to stay on track with your payments.

Tracking Your Progress

Regularly review your account statements and online portal to monitor your progress. This will help you identify areas where you can improve your savings or make adjustments to your plan. By tracking your progress, you can stay motivated and make informed decisions about your student loan repayment strategy.

Planning for your student loan repayment can be daunting, but it’s crucial to secure your financial future. As the student loan forgiveness supreme court case progresses, it’s essential to explore options for managing your student debt. Consider consolidating loans, refinancing for lower interest rates, or exploring income-driven repayment plans that adjust your monthly payments based on your income.

These strategies can help you save money and pay off your student loans sooner.

Tax Implications

Student loan save plans offer tax benefits that can help you save money on your student loans. Contributions to a student loan save plan are made on a pre-tax basis, which means that they are deducted from your income before taxes are calculated. This can result in significant tax savings, especially if you are in a high tax bracket.

Withdrawals from a student loan save plan are also tax-free if they are used to repay qualified student loans. This means that you can use the money in your student loan save plan to pay down your student loans without having to pay taxes on it.

Contributions

Contributions to a student loan save plan are made on a pre-tax basis, which means that they are deducted from your income before taxes are calculated. This can result in significant tax savings, especially if you are in a high tax bracket. For example, if you are in the 25% tax bracket and you contribute $1,000 to a student loan save plan, you will save $250 in taxes.

Withdrawals

Withdrawals from a student loan save plan are tax-free if they are used to repay qualified student loans. This means that you can use the money in your student loan save plan to pay down your student loans without having to pay taxes on it. However, if you withdraw money from a student loan save plan for any other purpose, you will have to pay taxes on the withdrawal.

Refinancing and Consolidation

Refinancing and consolidating student loans can be viable options for individuals enrolled in a student loan save plan. These strategies can offer potential benefits such as lower interest rates, reduced monthly payments, and simplified loan management.

Student loan save plans are a great way to make sure you have the money to pay off your student loans. If you have federal student loans, you may be eligible for a variety of repayment plans, including income-driven repayment plans and loan forgiveness programs.

You can learn more about federal student loans here . No matter what type of student loan you have, there are a number of things you can do to save money and make sure you can afford your payments.

Refinancing involves obtaining a new loan with a lower interest rate to replace existing student loans. This can result in significant savings over the loan term, especially for those with good credit scores.

Consolidation combines multiple student loans into a single loan with a weighted average interest rate. While it does not necessarily lower the overall interest rate, it can simplify loan management by having only one monthly payment to track.

Considerations

- Refinancing may not be suitable for everyone, as it can lead to higher interest rates for those with poor credit scores.

- Consolidation may not provide significant financial benefits if the weighted average interest rate is similar to the rates on the existing loans.

- Both refinancing and consolidation can impact eligibility for certain loan forgiveness programs.

Default and Delinquency

Defaulting or becoming delinquent on student loan save plan payments can have serious consequences. It’s crucial to understand these consequences and take steps to avoid them.

Consequences of Default and Delinquency

- Damage to credit score: Defaulting on your student loan can severely damage your credit score, making it difficult to obtain future loans, credit cards, and other financial products.

- Difficulty obtaining future loans: Lenders may be hesitant to approve loans to individuals with a history of default or delinquency.

- Wage garnishment: In some cases, your wages may be garnished to repay your defaulted student loan.

- Tax refund seizure: The government may seize your tax refund to cover defaulted student loan debt.

Steps to Avoid Default and Delinquency

- Make payments on time: This is the most important step to avoid default. Set up automatic payments or reminders to ensure you never miss a due date.

- Contact your loan servicer if you are having trouble making payments: If you are struggling to make your payments, contact your loan servicer immediately. They may be able to offer you options such as income-driven repayment plans or deferment/forbearance.

- Explore repayment options: There are a variety of repayment options available, including income-driven repayment plans, extended repayment plans, and graduated repayment plans. Explore these options to find one that fits your budget.

Table: Consequences and Avoidance Steps

| Consequences of Default and Delinquency | Steps to Avoid |

|---|---|

| Damage to credit score | Make payments on time |

| Difficulty obtaining future loans | Contact your loan servicer if you are having trouble making payments |

| Wage garnishment | Explore repayment options |

| Tax refund seizure | Make payments on time |

Resources for Getting Help with Student Loan Debt

Case Studies

Real-world examples illustrate the effectiveness of student loan save plans in assisting individuals in managing their student loan debt. These case studies highlight the specific benefits and challenges faced by these individuals, providing valuable insights into the impact of these plans.

Case Study 1: Sarah, Age 25, Teacher

- Student loan debt: $50,000

- Amount saved through student loan save plan: $10,000

- Benefits of using a student loan save plan: Reduced monthly payments, lower interest rates, and the opportunity to save for other financial goals.

- Challenges faced when using a student loan save plan: Limited income and the need to balance other financial obligations.

Sarah, a dedicated teacher, struggled with the burden of student loan debt. Through a student loan save plan, she was able to lower her monthly payments, freeing up funds for essential expenses and long-term savings.

Case Study 2: David, Age 30, Software Engineer

- Student loan debt: $75,000

- Amount saved through student loan save plan: $25,000

- Benefits of using a student loan save plan: Consolidated multiple loans into a single payment, reduced overall interest charges, and provided a structured approach to debt repayment.

- Challenges faced when using a student loan save plan: Strict eligibility requirements and potential penalties for missed payments.

David, a successful software engineer, faced a daunting amount of student loan debt. By enrolling in a student loan save plan, he was able to simplify his repayment process, save thousands of dollars in interest, and gain peace of mind.

Expert Opinions

Financial experts emphasize the importance of student loan save plans as a valuable tool for managing student debt effectively. These plans offer numerous benefits, including the potential for lower interest rates, flexible repayment options, and access to loan forgiveness programs.

Latest Trends and Best Practices

The student loan save plan industry is constantly evolving, with new trends and best practices emerging to meet the changing needs of borrowers. One notable trend is the increasing popularity of income-driven repayment plans, which allow borrowers to adjust their monthly payments based on their income. Another trend is the rise of refinancing and consolidation options, which can help borrowers secure lower interest rates and simplify their repayment process.

Frequently Asked Questions (FAQs)

Student loan save plans can be a valuable tool for managing student loan debt. However, it’s important to understand the ins and outs of these plans before you enroll. Here are some frequently asked questions about student loan save plans:

What are the eligibility requirements for a student loan save plan?

To be eligible for a student loan save plan, you must be:

- A U.S. citizen or permanent resident

- Enrolled at least half-time in an accredited college or university

- Making satisfactory academic progress

- Not in default on any federal student loans

What are the benefits of enrolling in a student loan save plan?

There are many benefits to enrolling in a student loan save plan, including:

- Lower interest rates on your student loans

- Fixed interest rates, which can protect you from rising interest rates

- Lower monthly payments

- No application fees

- No origination fees

- No prepayment penalties

How do I enroll in a student loan save plan?

To enroll in a student loan save plan, you must contact your loan servicer. Your loan servicer will provide you with an application form and instructions on how to complete it.

What are the tax implications of enrolling in a student loan save plan?

The interest you pay on your student loans is tax-deductible. However, the interest you save by enrolling in a student loan save plan is not tax-deductible.

Can I refinance or consolidate my student loans if I’m enrolled in a student loan save plan?

Yes, you can refinance or consolidate your student loans if you’re enrolled in a student loan save plan. However, you may lose the benefits of your save plan if you do so.

What happens if I default on my student loans while I’m enrolled in a student loan save plan?

If you default on your student loans while you’re enrolled in a student loan save plan, you may lose the benefits of your save plan. You may also be subject to collection actions, such as wage garnishment or seizure of your assets.

Additional Resources

If you’re looking for more information about student loan save plans, here are some additional resources that can help:

The following websites provide detailed information about student loan save plans, including eligibility requirements, plan features, and how to enroll:

Websites

Articles

These articles provide in-depth analysis and insights into student loan save plans:

- Forbes: What Is A Student Loan Save Plan And How Does It Work?

- U.S. News: What Is a Student Loan SAVE Plan?

- The Balance: Student Loan SAVE Plan: What It Is and How It Works

Organizations

The following organizations offer counseling and assistance with student loan repayment, including information about student loan save plans:

- National Foundation for Credit Counseling

- Student Loan Borrower Assistance

- U.S. Department of Education

Ending Remarks: Student Loan Save Plan

Whether you’re just starting to repay your student loans or have been struggling to make ends meet, the Student Loan Save Plan can help you take control of your debt and secure your financial future. By following the guidance provided in this comprehensive guide, you can make informed decisions about your student loan repayment strategy and unlock the power of the Student Loan Save Plan.

Query Resolution

What is the Student Loan Save Plan?

The Student Loan Save Plan is a structured approach to saving and managing your student loan debt. It involves setting aside a portion of your income each month into a dedicated savings account, which is then used to make extra payments on your student loans.

How does the Student Loan Save Plan work?

The Student Loan Save Plan works by reducing the amount of interest you pay on your student loans. When you make extra payments, the additional funds are applied to the principal balance of your loans, which reduces the amount of interest you owe over time.

What are the benefits of the Student Loan Save Plan?

The Student Loan Save Plan offers several benefits, including reducing the amount of interest you pay, improving your credit score, and helping you achieve your financial goals faster.

How do I choose the right Student Loan Save Plan for me?

There are several different types of Student Loan Save Plans available, each with its own unique features and benefits. The best plan for you will depend on your individual circumstances and financial goals.

How do I enroll in the Student Loan Save Plan?

Enrolling in the Student Loan Save Plan is easy. You can contact your loan servicer or visit their website to learn more about the program and how to enroll.