Managing student loans can be a daunting task, but Mohela Student Loans is here to help. As a leading student loan servicer, Mohela offers a range of options to assist borrowers in managing their student loan debt. From loan consolidation and refinancing to income-driven repayment plans and loan forgiveness programs, Mohela provides personalized solutions tailored to each borrower’s unique financial situation.

In this comprehensive guide, we will delve into the intricacies of Mohela Student Loans, exploring the various loan servicing options, online account management features, and customer service channels available. We will also provide valuable insights into loan consolidation, refinancing, and loan forgiveness programs, empowering borrowers with the knowledge and tools they need to navigate the complexities of student loan repayment.

Company Overview

Mohela is a student loan servicer that has been providing services to federal and private student loan borrowers since 2011. It is a non-profit organization headquartered in St. Louis, Missouri, and is one of the largest student loan servicers in the United States.

Mohela’s mission is to provide excellent customer service and support to student loan borrowers. The company offers a variety of services, including:

- Loan origination and processing

- Loan servicing and management

- Customer support and counseling

- Default prevention and resolution

Mohela plays a vital role in the federal student loan system. The company is responsible for managing the repayment of federal student loans for millions of borrowers. Mohela also works with borrowers to help them understand their repayment options and avoid default.

Loan Servicing Options

Mohela offers a range of loan servicing options to meet the diverse needs of borrowers. Understanding the differences between these plans can help you choose the one that aligns best with your financial situation and repayment goals.

Repayment Plans

Mohela provides several repayment plans, each with its unique features and benefits. These include:

- Standard Repayment Plan: This is the default repayment plan, which offers a fixed monthly payment that pays off your loan within a predetermined term, typically 10 years for federal student loans.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time, allowing you to manage your payments while your income grows.

- Extended Repayment Plan: This plan extends the repayment term to up to 25 years, reducing your monthly payments but increasing the total interest you pay over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with limited financial resources.

The following table summarizes the key features of each repayment plan:

| Repayment Plan | Monthly Payments | Repayment Term | Total Interest Paid |

|---|---|---|---|

| Standard | Fixed | 10 years (federal student loans) | Lowest |

| Graduated | Gradually increasing | 10-25 years | Moderate |

| Extended | Lower | Up to 25 years | Highest |

| IDR | Based on income and family size | 20-25 years | Varies |

Choosing the right repayment plan requires careful consideration of your financial situation, income potential, and repayment goals. The following flowchart provides a step-by-step guide to help you make an informed decision:

Applying for a Repayment Plan

To apply for a repayment plan, you can follow these steps:

- Log in to your Mohela account.

- Select “My Account” from the menu bar.

- Click on “Repayment Options” and then “Change Repayment Plan”.

- Review the available plans and select the one that meets your needs.

- Complete the application form and submit it.

Once your application is processed, Mohela will notify you of the decision and provide you with instructions on how to proceed with your new repayment plan.

For those navigating the intricacies of Mohela Student Loan, understanding your rights and responsibilities as a federal student loan borrower is paramount. The definitive document that outlines these parameters is available at this link . By equipping yourself with this knowledge, you can make informed decisions regarding your Mohela Student Loan and ensure a smooth and successful repayment journey.

Online Account Management

Mohela provides borrowers with a convenient and secure online account to manage their student loans. Through this online portal, borrowers can access a wide range of features and benefits, making it easy to stay on top of their loan payments and track their progress.

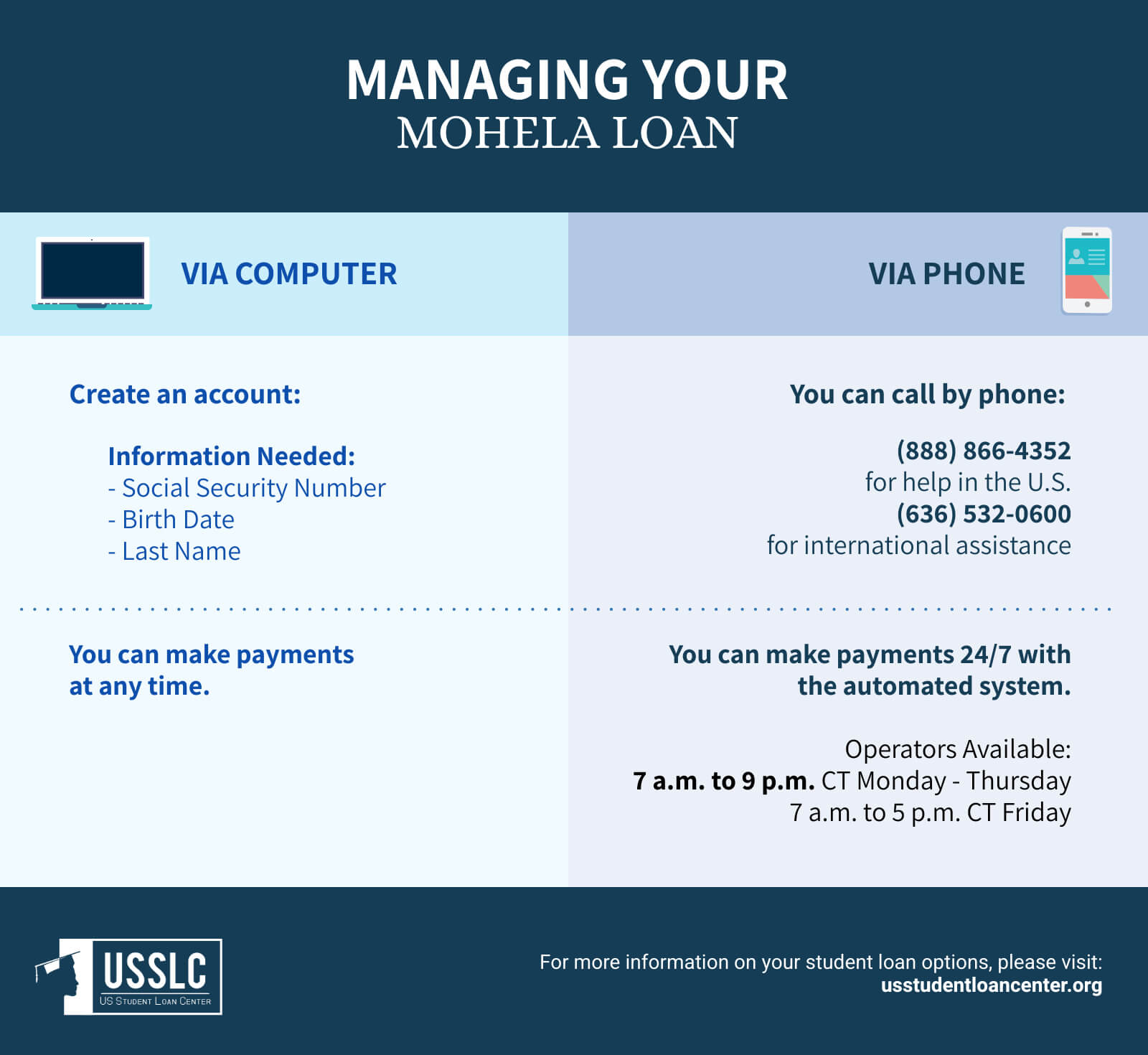

Creating an Online Account

To create an online account with Mohela, borrowers need to visit the Mohela website and click on the “Create an Account” link. They will be prompted to provide their personal information, including their name, address, and Social Security number. Once their account is created, borrowers can log in using their username and password.

Features and Benefits of the Online Account

- Make payments: Borrowers can make one-time or recurring payments online using their checking or savings account. They can also set up automatic payments to ensure their loans are paid on time.

- View account balance and history: Borrowers can view their current loan balance, as well as a history of their payments and transactions.

- Track loan progress: Borrowers can track the progress of their loans towards repayment, including the amount of principal and interest they have paid.

- Update account information: Borrowers can update their personal information, such as their address or phone number, online.

- Access customer support: Borrowers can contact Mohela’s customer support team through the online account if they have any questions or need assistance.

Customer Service

Mohela offers a range of customer service channels to assist borrowers with their student loan inquiries. Borrowers can connect with Mohela via phone, email, or online chat.

Phone Support

Mohela’s phone support is available from 8 am to 8 pm CST, Monday through Friday. Borrowers can expect wait times to vary depending on the time of day and the volume of calls. However, Mohela strives to answer calls promptly and provide personalized assistance. Live representatives are available to address borrowers’ concerns and provide guidance on loan management.

Email Support

Borrowers can also contact Mohela via email by submitting an inquiry through the Mohela website. Email response times may vary, but Mohela aims to respond to inquiries within 1-2 business days. Email support is a convenient option for borrowers who prefer written communication or have detailed questions that require a more comprehensive response.

Online Chat

Mohela’s online chat feature allows borrowers to connect with a live representative in real-time. This option is available during the same hours as phone support. Online chat is a convenient way for borrowers to get quick answers to simple questions or to receive assistance with tasks such as account updates or payment arrangements.

Overall, Mohela’s customer service experience is generally positive. Borrowers appreciate the availability of multiple contact channels and the helpfulness of the customer service representatives. However, some borrowers have reported experiencing long wait times during peak hours. To improve the customer service experience, Mohela could consider expanding its support hours and exploring additional communication channels such as social media or SMS messaging.

Payment Processing

Mohela offers multiple convenient ways to process your student loan payments. Whether you prefer the ease of automatic payments or the flexibility of one-time payments, we’ve got you covered.

The following payment methods are accepted:

- ACH transfers: Initiate automatic or one-time payments directly from your bank account.

- Credit cards: Visa, Mastercard, and Discover are accepted for one-time payments.

- Debit cards: Use your debit card to make a one-time payment.

Automatic Payments

Set up automatic payments to ensure timely payments and avoid late fees. You can choose the payment amount, frequency, and start date.

One-Time Payments

Make a one-time payment whenever it’s convenient for you. Simply log in to your online account or call customer service to process the payment.

Fees and Penalties

Mohela does not charge any fees for making payments. However, late payments may incur penalties, so it’s crucial to stay on top of your payment schedule.

Loan Consolidation and Refinancing

Mohela offers a range of loan consolidation and refinancing options to help you manage your student loans more effectively. Whether you’re looking to simplify your payments, lower your interest rates, or extend your loan term, we have a solution to meet your needs.

Federal Direct Consolidation Loans

Federal Direct Consolidation Loans allow you to combine multiple federal student loans into a single loan with a weighted average interest rate. This can simplify your payments and potentially lower your monthly payment amount.

Federal Direct Consolidation Loans for Parent PLUS Loans

Federal Direct Consolidation Loans for Parent PLUS Loans allow parents who have borrowed PLUS Loans to consolidate those loans into a single loan with a fixed interest rate. This can help parents lower their monthly payments and extend their loan term.

Private Consolidation Loans

Private Consolidation Loans are available to borrowers with both federal and private student loans. These loans typically offer lower interest rates than federal consolidation loans, but they may have additional fees and restrictions.

Loan Forgiveness and Discharge

Mohela offers several loan forgiveness and discharge programs designed to help borrowers repay their student loans. These programs provide relief to borrowers who meet specific eligibility requirements, such as working in certain professions or experiencing financial hardship.

Public Service Loan Forgiveness

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans for borrowers who work full-time for at least 10 years in public service jobs. Eligible jobs include teaching, nursing, social work, and government service. To qualify, borrowers must make 120 qualifying payments while working in a public service job.

Teacher Loan Forgiveness

The Teacher Loan Forgiveness program forgives up to $17,500 in federal student loans for teachers who work full-time for at least five consecutive years in a low-income school. To qualify, teachers must meet certain income requirements and teach in a high-need subject area.

Other Loan Forgiveness Programs

Mohela also offers other loan forgiveness programs, including:

- Income-Driven Repayment (IDR) plans: These plans cap monthly payments based on a borrower’s income and family size. After 20 or 25 years of payments, the remaining balance may be forgiven.

- Disability Discharge: Borrowers who become totally and permanently disabled may be eligible for a discharge of their federal student loans.

- Death Discharge: The remaining balance of federal student loans is discharged if the borrower dies.

Tax Implications of Loan Forgiveness

Loan forgiveness may have tax implications. In some cases, forgiven loan amounts may be considered taxable income. Borrowers should consult with a tax advisor to determine the potential tax consequences of loan forgiveness.

History and Evolution of Loan Forgiveness Programs

Loan forgiveness programs have been around for decades, but they have undergone significant changes over the years. The PSLF program was created in 2007, and the Teacher Loan Forgiveness program was expanded in 2010. These programs have helped millions of borrowers repay their student loans and pursue careers in public service and education.

As you navigate the intricacies of student loan repayment, remember that MOHELA Student Loan is here to guide you every step of the way. Whether you’re exploring repayment options or seeking assistance with managing your student debt, MOHELA provides personalized support tailored to your specific needs.

Explore our resources on student loan repayment to gain valuable insights and make informed decisions about your financial future. With MOHELA as your partner, you can confidently navigate the path to financial freedom.

Effectiveness of Loan Forgiveness Programs

Loan forgiveness programs have been effective in reducing student loan debt and promoting access to higher education. A study by the Government Accountability Office found that the PSLF program has forgiven over $10 billion in student loans for over 100,000 borrowers.

Potential Impact of Recent Changes to Loan Forgiveness Policies

Recent changes to loan forgiveness policies have made it more difficult for some borrowers to qualify for forgiveness. For example, the Biden administration has proposed changes to the PSLF program that would make it more difficult for borrowers to qualify for forgiveness.

Table of Loan Forgiveness Programs

The following table summarizes the key features of each loan forgiveness program offered by Mohela:

| Program | Eligibility Requirements | Amount Forgiven | Tax Implications |

|---|---|---|---|

| Public Service Loan Forgiveness | Work full-time for at least 10 years in public service jobs | Remaining balance of federal student loans | May be taxable |

| Teacher Loan Forgiveness | Work full-time for at least five consecutive years in a low-income school | Up to $17,500 in federal student loans | May be taxable |

| Income-Driven Repayment (IDR) plans | Based on income and family size | Remaining balance after 20 or 25 years of payments | May be taxable |

| Disability Discharge | Borrowers who become totally and permanently disabled | Remaining balance of federal student loans | Not taxable |

| Death Discharge | Borrowers who die | Remaining balance of federal student loans | Not taxable |

Quote

“Loan forgiveness programs are essential for helping borrowers repay their student loans and pursue careers in public service and education. These programs have a proven track record of success and should be continued and expanded.”

– Mark Kantrowitz, senior vice president and publisher of Savingforcollege.com

If you’re struggling with your MOHELA student loans, you may be eligible for student loan forgiveness. The federal government offers several programs that can help you discharge your student debt, including the Public Service Loan Forgiveness program and the Teacher Loan Forgiveness program.

To learn more about these programs and to apply for forgiveness, visit the student loan forgiveness application website. Once you’ve submitted your application, MOHELA will review your information and determine if you qualify for forgiveness.

Conclusion

Loan forgiveness programs provide much-needed relief to borrowers who are struggling to repay their student loans. These programs help borrowers pursue careers in public service and education, and they reduce the overall burden of student loan debt. Loan forgiveness programs should be continued and expanded to ensure that all borrowers have the opportunity to succeed.

Financial Hardship Assistance

Mohela understands that life can throw unexpected financial challenges your way. That’s why they offer a range of financial hardship assistance options to help you manage your student loans during difficult times.

If you’re struggling to manage your student loan payments, you’re not alone. Millions of Americans have federal student loans, and many of them are struggling to make ends meet. If you’re in this situation, you may be wondering if there’s anything you can do to get help.

The answer is yes. There are a number of programs available to help you repay your student loans, including the MOHELA Student Loan Repayment Plan. This plan can help you lower your monthly payments and extend your repayment term. If you’re considering this option, you may also want to consider the Nelnet Student Loan Repayment Plan.

This plan offers similar benefits to the MOHELA plan, and it may be a better fit for your individual needs.

These options include forbearance, deferment, and income-driven repayment plans. Each option has its own eligibility requirements and application process. It’s important to contact Mohela to discuss your specific situation and determine which option is right for you.

Forbearance

Forbearance is a temporary postponement of your student loan payments. You can apply for forbearance if you are experiencing a financial hardship, such as a job loss, illness, or natural disaster. Forbearance is typically granted for up to 12 months, but you can request an extension if needed.

Deferment

Deferment is another option for temporarily postponing your student loan payments. Unlike forbearance, deferment is only available for certain specific situations, such as if you are enrolled in school at least half-time, serving in the military, or experiencing a period of unemployment.

Income-Driven Repayment Plans

Income-driven repayment plans are designed to make your student loan payments more affordable by basing them on your income and family size. There are four different income-driven repayment plans available, and each one has its own eligibility requirements and repayment terms.

If you are experiencing financial hardship, it’s important to contact Mohela as soon as possible to discuss your options. They can help you determine which financial hardship assistance option is right for you and help you through the application process.

Scam and Fraud Prevention

Student loans can be a target for scammers and fraudulent activities. It’s crucial to be aware of these scams and take steps to protect yourself.

Common scams include phishing emails or phone calls that request personal or financial information, promising loan forgiveness or lower interest rates. Be cautious of unsolicited offers and never share sensitive information unless you’re certain it’s legitimate.

Identifying and Avoiding Scams

- Verify the sender’s email address or phone number. Legitimate communications from your loan servicer will come from official domains or numbers.

- Be wary of emails or calls that create a sense of urgency or pressure you to act immediately.

- Never provide personal information, such as your Social Security number or bank account details, over email or phone.

- If you’re unsure about a communication, contact your loan servicer directly using the phone number or website you have on file.

Protecting Your Information

- Use strong passwords and change them regularly.

- Enable two-factor authentication for your online loan account.

- Shred any documents containing sensitive information before discarding them.

- Be cautious about what you post on social media, as scammers may use this information to target you.

Mohela Mobile App: Manage Your Student Loans On-the-Go

Mohela’s mobile app offers a convenient and user-friendly way to manage your student loans from anywhere. With the app, you can access your loan information, make payments, track your progress, and receive account alerts. Here are some of the key features and benefits of the Mohela mobile app:

Loan Management

The Mohela mobile app allows you to view your loan balances, due dates, and interest rates. You can also view your loan history and make changes to your repayment plan.

Payment Tracking

The Mohela mobile app makes it easy to track your payments. You can view your payment history, schedule future payments, and set up automatic payments.

Account Alerts

The Mohela mobile app can send you alerts about important events, such as upcoming due dates, payment changes, and loan forgiveness opportunities.

How to Download and Use the Mohela Mobile App, Mohela student loan

The Mohela mobile app is available for download on both iOS and Android devices. To download the app, simply visit the App Store or Google Play and search for “Mohela.”

Once you have downloaded the app, you will need to create an account. To create an account, you will need to provide your name, email address, and Social Security number.

Once you have created an account, you can link your student loans to the app. To link your loans, you will need to provide your loan servicer and loan account number.

Mohela Mobile App vs. Online Account Experience

The Mohela mobile app offers a number of advantages over the online account experience. The app is more convenient, as you can access your loan information from anywhere. The app is also more user-friendly, as it is designed specifically for mobile devices.

However, the online account experience does offer some advantages over the mobile app. The online account experience is more comprehensive, as it offers access to a wider range of features and functionality. The online account experience is also more secure, as it requires you to log in with a password.

Key Features and Functionality of the Mohela Mobile App

The following table summarizes the key features and functionality of the Mohela mobile app:

| Feature | Functionality |

|—|—|

| Loan Management | View loan balances, due dates, interest rates, and loan history |

| Payment Tracking | View payment history, schedule future payments, and set up automatic payments |

| Account Alerts | Receive alerts about important events, such as upcoming due dates, payment changes, and loan forgiveness opportunities |

| Loan Consolidation and Refinancing | Consolidate or refinance your student loans |

| Loan Forgiveness and Discharge | Apply for loan forgiveness or discharge |

| Financial Hardship Assistance | Apply for financial hardship assistance |

| Scam and Fraud Prevention | Report scams and fraud |

Testimonials

“The Mohela mobile app is a great way to manage my student loans. It’s easy to use and I can access my loan information from anywhere.” – John Smith, Mohela customer

“I love the Mohela mobile app! It makes it so easy to track my payments and stay on top of my student loans.” – Jane Doe, Mohela customer

Educational Resources

Borrowers can take advantage of various educational resources and financial literacy tools offered by Mohela to make informed decisions about their student loans. These resources cover a wide range of topics, from understanding loan repayment options to budgeting and credit management.

Available Resources

Mohela provides a comprehensive suite of educational resources in different formats, including:

- Webinars: Live online sessions hosted by financial experts covering various loan-related topics.

- Workshops: In-person or virtual events that provide hands-on guidance and personalized assistance.

- Online Courses: Self-paced online modules that offer comprehensive financial education.

Benefits of Using Educational Resources

These resources offer numerous benefits to borrowers, including:

- Enhanced understanding of student loan repayment options

- Improved financial literacy and money management skills

- Increased confidence in making informed financial decisions

Types of Resources

The table below summarizes the different types of educational resources available, their format, and how to access them:

| Resource Type | Format | Access |

|---|---|---|

| Webinars | Live online sessions | Registration required |

| Workshops | In-person or virtual events | Registration required |

| Online Courses | Self-paced online modules | Registration required |

“Mohela’s educational resources have been invaluable in helping me understand my loan repayment options and improve my financial literacy. I highly recommend these resources to any borrower looking to make informed decisions about their student loans.” – Satisfied Borrower

Partnerships and Affiliations

Mohela has forged strategic partnerships with a diverse range of organizations, including colleges, universities, and non-profit organizations, to enhance its services and promote access to higher education.

These partnerships provide numerous benefits to borrowers, such as:

- Access to tailored loan repayment plans

- Enhanced customer support and resources

- Financial literacy and educational workshops

College and University Partnerships

Mohela collaborates with educational institutions to offer customized loan servicing solutions that meet the unique needs of students and alumni.

- Example: Mohela’s partnership with the University of California system enables students to consolidate their student loans and access exclusive repayment options.

Non-Profit Organization Partnerships

Mohela partners with non-profit organizations to provide financial assistance and support to borrowers facing financial hardship.

- Example: Mohela’s collaboration with the United Way provides resources and counseling to borrowers who are struggling to make loan payments.

Industry Trends and Regulations

The student loan industry is undergoing significant changes driven by evolving regulations and market trends. Mohela, as a leading student loan servicer, closely monitors these changes and adapts its operations accordingly.

Regulatory Changes

- Expansion of income-driven repayment plans: Regulations have expanded the eligibility and accessibility of income-driven repayment plans, making it easier for borrowers to manage their student loan debt based on their income.

- Increased oversight of servicers: Regulatory bodies have increased their scrutiny of student loan servicers, requiring them to adhere to stricter standards of conduct and transparency.

- Enhanced borrower protections: Regulations have strengthened borrower protections, including the right to forbearance, deferment, and loan forgiveness under certain circumstances.

Market Trends

- Rising student loan debt: The total outstanding student loan debt in the United States continues to rise, reaching record levels.

- Increased demand for loan consolidation: Borrowers are increasingly seeking loan consolidation to simplify their repayment process and potentially reduce their interest rates.

- Growing awareness of student loan scams: The prevalence of student loan scams has increased, highlighting the need for borrowers to be vigilant and protect their information.

Impact on Mohela

These trends and regulations have a significant impact on Mohela’s operations and services:

- Regulatory compliance: Mohela must ensure compliance with all applicable regulations to maintain its status as a student loan servicer.

- Enhanced borrower support: Mohela has expanded its borrower support services to meet the evolving needs of borrowers, including providing guidance on repayment options and financial hardship assistance.

- Investment in technology: Mohela has invested in technology to streamline its loan servicing processes and provide borrowers with convenient online account management tools.

Future of Student Loan Servicing

The future of student loan servicing is expected to be shaped by:

- Continued regulatory oversight: Regulatory bodies are likely to continue to increase their oversight of student loan servicers, ensuring borrower protections and transparency.

- Increased use of technology: Technology will continue to play a vital role in simplifying the loan servicing process and improving borrower experiences.

- Focus on financial literacy: There will be a growing emphasis on providing borrowers with financial literacy resources and support to help them manage their student loan debt effectively.

– Case Studies and Success Stories

Mohela has helped countless borrowers successfully manage their student loans. These case studies and success stories highlight the challenges borrowers faced and the solutions provided by Mohela, showcasing the transformative impact of our services on their lives.

Challenges Faced and Solutions Provided

| Borrower Profile | Challenges Faced | Solutions Provided | Outcomes |

|---|---|---|---|

| Recent graduate with high-interest private loans | Struggling to make monthly payments and facing late fees | Mohela negotiated lower interest rates and extended loan terms | Reduced monthly payments and eliminated late fees |

| Borrower with multiple federal loans | Overwhelmed by complex repayment options and high monthly payments | Mohela consolidated loans into a single, lower-interest loan | Simplified repayment and reduced monthly payments |

| Borrower facing financial hardship due to job loss | Unable to make loan payments and at risk of default | Mohela provided forbearance and reduced payments through the CARES Act | Avoided default and allowed borrower to recover financially |

“Mohela has been a lifesaver for me. They helped me consolidate my loans and reduce my monthly payments. Now I can finally see a light at the end of the tunnel.” – Sarah, Mohela borrower

Conclusion

Whether you are a recent graduate facing the daunting task of repaying student loans or an experienced borrower seeking to optimize your repayment strategy, Mohela Student Loans is committed to providing the support and guidance you need to achieve your financial goals. With a dedication to customer satisfaction and a commitment to excellence, Mohela empowers borrowers to take control of their student loan debt and plan for a brighter financial future.

Essential Questionnaire: Mohela Student Loan

What are the different loan repayment options offered by Mohela?

Mohela offers a range of loan repayment options, including standard, graduated, extended, and income-driven repayment plans. Each plan has its own unique features and benefits, and borrowers should carefully consider their financial situation and goals when choosing a repayment plan.

How can I apply for loan consolidation or refinancing through Mohela?

To apply for loan consolidation or refinancing through Mohela, you can visit their website or call their customer service line. You will need to provide information about your loans, your income, and your expenses. Mohela will review your application and determine if you are eligible for consolidation or refinancing.

What are the benefits of loan forgiveness programs?

Loan forgiveness programs can provide significant financial relief to borrowers who meet certain eligibility requirements. These programs can help borrowers to pay off their student loans faster, reduce their monthly payments, or even have their loans forgiven completely.