Student loan forgiveness supreme court – The Supreme Court case involving student loan forgiveness has sparked a heated debate, with arguments for and against forgiveness being fiercely contested. This article delves into the complexities of the case, examining the legal arguments presented by both sides and exploring the potential impact of the Court’s decision on the student loan industry and borrowers.

The plaintiffs argue that student loan forgiveness is necessary to address the crushing burden of student debt that has left millions of Americans struggling financially. They contend that the government has a responsibility to provide relief to borrowers who were misled about the true costs of higher education and who are now facing economic hardship.

Case Overview

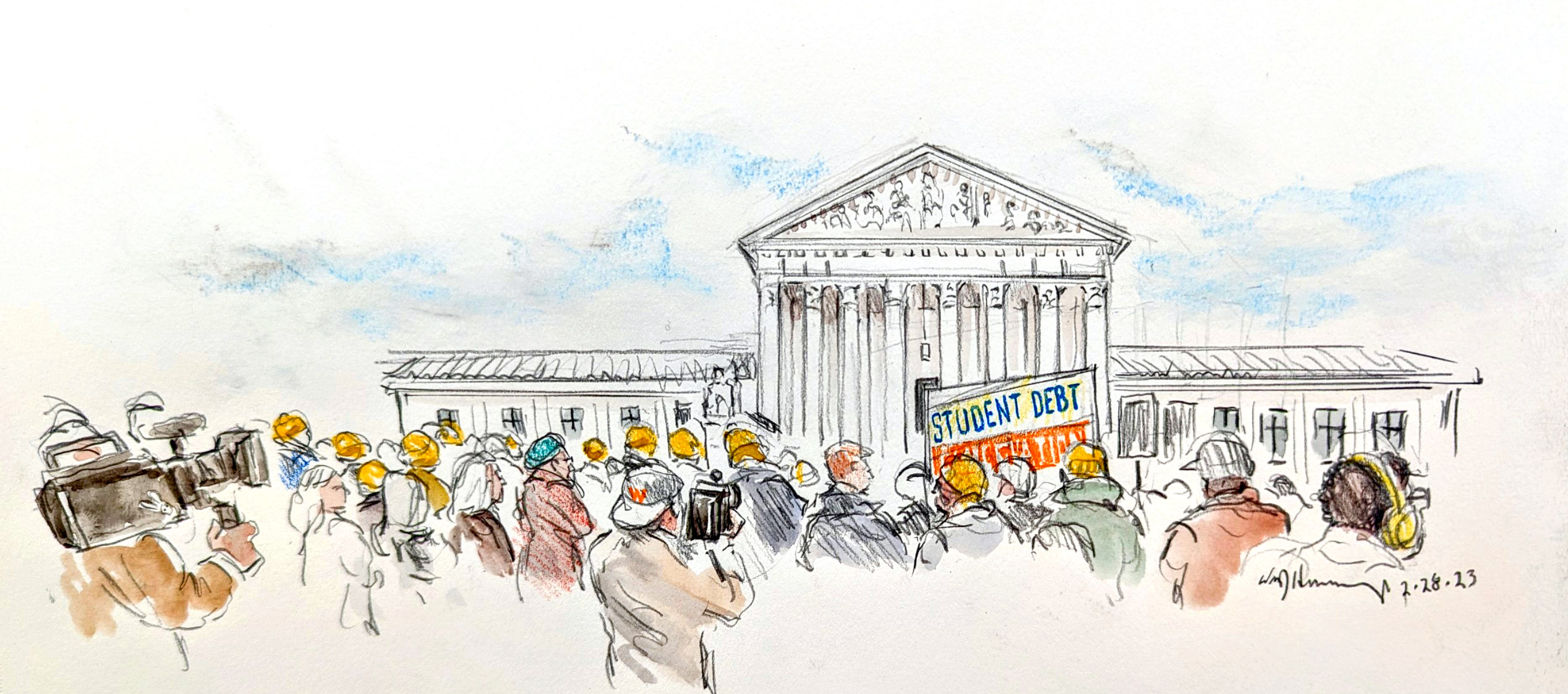

The Supreme Court is set to hear arguments in a case that could determine the fate of student loan forgiveness in the United States. The case, Biden v. Nebraska, involves a challenge to the Biden administration’s plan to forgive up to $20,000 in student debt for federal student loan borrowers.

The plaintiffs in the case, a group of six states led by Nebraska, argue that the administration’s plan is unconstitutional because it was not authorized by Congress. They also argue that the plan is unfair to those who have already paid off their student loans or who did not attend college.

The Biden administration argues that the plan is legal under the Higher Education Relief Opportunities for Students (HEROES) Act, which gives the Secretary of Education the authority to waive or modify student loans in times of national emergency. The administration also argues that the plan is necessary to provide relief to borrowers who are struggling with student loan debt.

Legal Precedents

The plaintiffs in the case cite several legal precedents in support of their arguments. These include the Spending Clause of the Constitution, which gives Congress the power to appropriate money, and the Major Questions Doctrine, which requires Congress to clearly authorize major policy changes.

The recent Supreme Court decision on student loan forgiveness has been a hot topic, with many borrowers eagerly awaiting the outcome. While the Court’s ruling is still pending, it’s worth noting that President Biden has taken steps to provide student loan relief through his Biden Student Loan Forgiveness program.

This program has provided billions of dollars in relief to borrowers, and it’s important to stay informed about the latest developments as the Supreme Court continues to deliberate on the broader issue of student loan forgiveness.

The Biden administration cites the HEROES Act and other legal precedents in support of its arguments. These include the Supreme Court’s decision in Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., which gives deference to agencies’ interpretations of statutes.

Potential Impact

The Supreme Court’s decision in this case could have a significant impact on the student loan industry. If the Court strikes down the Biden administration’s plan, it could make it more difficult for borrowers to get their student loans forgiven. This could lead to an increase in student loan defaults and bankruptcies.

Potential Impact on Borrowers

The Supreme Court’s decision on student loan forgiveness could have a significant impact on borrowers, depending on the outcome. If the Court rules in favor of the Biden administration’s plan, millions of borrowers could see their student loan debt forgiven or reduced. This could have a positive impact on their financial situations, freeing up money for other expenses such as housing, food, and healthcare.

On the other hand, if the Court rules against the plan, borrowers may be left with large amounts of student loan debt that they may struggle to repay. This could have a negative impact on their financial security and well-being.

Amount of Student Loan Debt Held by Borrowers

The amount of student loan debt held by borrowers is a key factor in determining the potential impact of the Supreme Court’s decision. According to the Federal Reserve, Americans owe a collective $1.75 trillion in federal student loan debt, and another $138 billion in private student loan debt. The average federal student loan balance is $37,667.

Interest Rates on Student Loans

The interest rates on student loans can also have a significant impact on the potential impact of the Supreme Court’s decision. Federal student loan interest rates range from 4.99% to 7.54%, while private student loan interest rates can be even higher.

Repayment Options Available to Borrowers

The repayment options available to borrowers can also affect the potential impact of the Supreme Court’s decision. Borrowers can choose from a variety of repayment plans, including the Standard Repayment Plan, the Graduated Repayment Plan, the Extended Repayment Plan, and the Income-Driven Repayment Plan.

Potential for Loan Forgiveness or Cancellation

The potential for loan forgiveness or cancellation is another key factor in determining the potential impact of the Supreme Court’s decision. The Biden administration has proposed a plan to forgive up to $20,000 in student loan debt for borrowers who meet certain income requirements. If this plan is upheld by the Supreme Court, it could have a significant positive impact on borrowers.

Implications for Higher Education

The Supreme Court’s decision on student loan forgiveness has far-reaching implications for higher education institutions. It could affect tuition costs, financial aid programs, and student enrollment, reshaping the landscape of higher education in the United States.

One potential impact is a decrease in tuition costs. If student loans are forgiven, the demand for higher education may decline, leading to lower tuition costs. This could make college more accessible for students from lower-income backgrounds.

Financial Aid Programs

The decision could also affect financial aid programs. If student loans are forgiven, the government may reduce or eliminate grant and scholarship programs, as there would be less need for financial assistance. This could make it more difficult for students to pay for college.

Student Enrollment

Finally, the decision could affect student enrollment. If student loans are forgiven, more students may decide to attend college, as the financial burden would be reduced. This could lead to increased enrollment at colleges and universities, particularly among students from underrepresented groups.

Political and Economic Considerations

The Supreme Court case on student loan forgiveness has significant political and economic implications. The Biden administration has made student loan forgiveness a key priority, arguing that it will provide much-needed relief to millions of borrowers and boost the economy. Republicans, however, have largely opposed the plan, arguing that it is unfair to taxpayers and will lead to higher inflation.

The role of Congress in this issue is complex. Congress has the power to pass legislation that would forgive student loans, but it is unlikely that such legislation would pass in the current political climate. The Biden administration has also argued that it has the authority to forgive student loans through executive action, but this authority is being challenged in court.

Various stakeholders are also involved in this issue. Student loan borrowers, of course, have a vested interest in the outcome of the case. Lenders, colleges, and universities are also stakeholders, as they may be affected by the forgiveness of student loans.

The Supreme Court’s decision in this case will have a significant impact on the political and economic landscape of the United States. If the Court upholds the Biden administration’s plan, it will be a major victory for the administration and for student loan borrowers. However, if the Court strikes down the plan, it will be a major setback for the administration and will likely lead to continued debate over the issue of student loan forgiveness.

Role of the Biden Administration

The Biden administration has made student loan forgiveness a key priority. The administration has argued that student loan forgiveness will provide much-needed relief to millions of borrowers and boost the economy. The administration has also argued that it has the authority to forgive student loans through executive action.

The Biden administration’s plan to forgive student loans has been met with mixed reactions. Some have praised the plan, arguing that it will provide much-needed relief to student loan borrowers. Others have criticized the plan, arguing that it is unfair to taxpayers and will lead to higher inflation.

The Biden administration’s plan to forgive student loans is currently being challenged in court. The Supreme Court is expected to hear the case in the fall of 2023. The Court’s decision will have a significant impact on the Biden administration’s plan and on the issue of student loan forgiveness.

Historical Context

The Supreme Court case on student loan forgiveness has a complex historical context shaped by previous court decisions and legislation.

In 2003, Congress passed the Higher Education Relief Opportunities for Students (HEROES) Act, which granted the Secretary of Education broad authority to forgive student loans in times of national emergency. The COVID-19 pandemic was declared a national emergency in 2020, prompting the Biden administration to use the HEROES Act to pause student loan payments and forgive $39 billion in student debt.

Legal Challenges

The legality of the Biden administration’s student loan forgiveness plan has been challenged in court. In November 2022, a federal judge in Texas ruled that the plan was unconstitutional, arguing that the HEROES Act did not give the Secretary of Education the authority to forgive student loans on a mass scale.

Supreme Court Review, Student loan forgiveness supreme court

The Biden administration appealed the lower court ruling, and the Supreme Court agreed to review the case in February 2023. The Court will hear oral arguments in the case in April 2023 and is expected to issue a decision by the end of June 2023.

Legal Precedents

The Supreme Court’s decision on student loan forgiveness will be influenced by several legal precedents. These precedents provide guidance on how the Court should interpret the relevant laws and regulations.

One relevant precedent is the case of Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc. (1984). In Chevron, the Court held that when Congress has delegated authority to an agency to interpret a statute, the agency’s interpretation is entitled to deference. This means that the Court will give great weight to the Department of Education’s interpretation of the Higher Education Act, which is the law that governs student loans.

Department of Education v. Sweet

Another relevant precedent is the case of Department of Education v. Sweet (2022). In Sweet, the Supreme Court held that the Department of Education has the authority to forgive student loans without going through the notice-and-comment process required by the Administrative Procedure Act (APA). This decision suggests that the Court is willing to give the Department of Education broad authority to administer the student loan program.

Student loan forgiveness has been a hot topic in the news lately, and the Supreme Court is set to hear arguments on the Biden administration’s plan to forgive up to $20,000 in student loan debt for millions of Americans. The Supreme Court’s decision on student loan debt relief could have a major impact on the lives of millions of Americans, and it is sure to be closely watched by borrowers and policymakers alike.

Identify relevant Supreme Court cases involving debt forgiveness or financial assistance programs.

The Supreme Court has adjudicated several significant cases involving debt forgiveness or financial assistance programs, shaping the legal landscape for such initiatives. These cases have grappled with complex statutory interpretations, constitutional principles, and public policy considerations, providing valuable insights into the legal framework surrounding debt relief.

One notable case is McCulloch v. Maryland (1819), which established the principle of implied powers under the Constitution. In this case, the Court held that the federal government possesses powers beyond those explicitly enumerated in the Constitution, provided they are necessary and proper to carry out its delegated powers. This principle has been invoked in subsequent cases involving debt forgiveness programs, as the government’s authority to implement such programs may not be explicitly stated in the Constitution.

Statutory Interpretation

In cases involving debt forgiveness programs, the Supreme Court has often engaged in statutory interpretation to determine the scope and intent of the relevant legislation. For instance, in United States v. Sioux Nation of Indians (1980), the Court interpreted a treaty between the United States and the Sioux Nation to determine whether the government was obligated to compensate the tribe for land taken without just compensation. The Court’s analysis focused on the plain meaning of the treaty’s language, as well as the historical context in which it was negotiated.

Constitutional Principles

The Supreme Court has also considered constitutional principles in debt forgiveness cases. In Bush v. Gore (2000), the Court ruled that the Equal Protection Clause of the Fourteenth Amendment requires states to provide equal protection under the law to all citizens. This principle has been applied in cases involving student loan forgiveness programs, as some programs have been challenged on the grounds that they discriminate against certain borrowers.

Public Policy Considerations

In addition to statutory interpretation and constitutional principles, the Supreme Court has also taken into account public policy considerations in debt forgiveness cases. For instance, in City of Philadelphia v. Educational Equality League (1974), the Court upheld a school funding plan that provided additional funding to low-income school districts. The Court reasoned that the plan was necessary to address the educational disparities faced by low-income students.

The Supreme Court’s decisions in debt forgiveness cases have had a significant impact on the legal framework surrounding such programs. The Court’s analysis of statutory interpretation, constitutional principles, and public policy considerations has provided guidance to lower courts and policymakers in shaping future debt relief initiatives.

Expert Opinions

The upcoming Supreme Court case on student loan forgiveness has drawn attention from legal scholars, economists, and higher education professionals. These experts provide valuable insights into the case’s potential implications for borrowers, higher education, and the economy.

Economists predict that widespread student loan forgiveness could stimulate economic growth by increasing consumer spending and investment. They argue that reducing the burden of student debt would free up financial resources for borrowers, allowing them to make purchases and invest in their future. However, some economists express concerns about the potential inflationary impact of such a large-scale debt cancellation.

Legal Scholars

Legal scholars have varying opinions on the case’s legal merits. Some argue that the Biden administration has the authority to cancel student debt under the Higher Education Relief Opportunities for Students (HEROES) Act, which was enacted in the wake of the September 11 attacks to provide financial assistance to students affected by national emergencies.

Others contend that the HEROES Act does not provide sufficient legal authority for broad-based student loan forgiveness and that such action would require congressional approval. They argue that the administration’s use of the HEROES Act is an overreach of executive power.

Higher Education Professionals

Higher education professionals are closely watching the case, as its outcome could have significant implications for the future of student lending and higher education funding. Some argue that student loan forgiveness could reduce the financial barriers to higher education and make college more accessible to students from all backgrounds.

Others express concerns that widespread student loan forgiveness could undermine the integrity of the student loan system and make it more difficult for future students to obtain loans. They argue that it is important to find a balance between providing relief to current borrowers and ensuring the long-term sustainability of the student loan system.

Timeline of Key Events in the Supreme Court Student Loan Forgiveness Case

The following timeline Artikels the key events leading up to and following the Supreme Court case on student loan forgiveness:

| Date | Event | Significance |

|---|---|---|

| October 2021 | Biden administration announces plans to forgive up to $20,000 in student debt for federal loan borrowers | The announcement triggers a series of legal challenges |

| February 2022 | A federal judge blocks the Biden administration’s student loan forgiveness plan | The judge rules that the administration does not have the authority to forgive student debt without congressional approval |

| April 2022 | The Biden administration appeals the judge’s ruling to the Eighth Circuit Court of Appeals | The Eighth Circuit Court of Appeals upholds the lower court’s ruling |

| June 2023 | The Supreme Court agrees to hear the Biden administration’s appeal | The Supreme Court will consider whether the administration has the authority to forgive student debt without congressional approval |

| October 2023 | The Supreme Court hears oral arguments in the case | The justices question both sides on the legality of the student loan forgiveness plan |

| June 2024 | The Supreme Court rules on the case | The Court’s decision will determine whether the Biden administration’s student loan forgiveness plan can proceed |

The Supreme Court’s decision in this case will have a significant impact on millions of student loan borrowers. If the Court upholds the administration’s plan, it could provide significant relief to borrowers who are struggling to repay their loans. However, if the Court strikes down the plan, it could leave borrowers in a difficult financial situation.

Legal Arguments for Forgiveness

Advocates for student loan forgiveness present a range of legal arguments in support of their position. These arguments draw upon both constitutional principles and statutory authority.

Constitutional Arguments

Proponents of forgiveness argue that it is permissible under the Constitution’s Spending Clause, which grants Congress the power to spend money for the general welfare. They contend that forgiving student debt would promote economic growth and alleviate financial burdens, thus serving the general welfare.

Statutory Arguments

Forgiveness advocates also point to the Higher Education Act of 1965, which authorizes the Secretary of Education to “compromise, waive, or release any right, title, claim, lien, or demand of the United States” related to student loans. They argue that this authority provides the Secretary with the legal basis to forgive student debt.

Legal Arguments Against Forgiveness

Student loan forgiveness opponents present compelling legal arguments against the initiative, citing constitutional concerns and statutory limitations. They contend that forgiveness would violate due process, equal protection, and takings clauses of the Constitution. They also argue that it would violate the Higher Education Act of 1965 and the Consolidated Appropriations Act of 2018.

Constitutional Concerns

Opponents argue that loan forgiveness would deprive loan holders of property without due process of law. They cite the Due Process Clause of the Fifth Amendment, which protects individuals from arbitrary and capricious government action. They contend that forgiveness would constitute an unconstitutional taking of property from loan holders without just compensation.

Statutory Limitations

Opponents also argue that loan forgiveness would violate the Higher Education Act of 1965, which establishes the federal student loan program. They contend that the Act mandates repayment of student loans and that forgiveness would violate this mandate. Additionally, they argue that forgiveness would violate the Consolidated Appropriations Act of 2018, which prohibits the use of federal funds for loan forgiveness.

Case Law

Opponents cite several Supreme Court cases in support of their arguments. In Smith v. United States (1993), the Court held that the Due Process Clause protects individuals from arbitrary and capricious government action. In Plyler v. Doe (1982), the Court held that the Equal Protection Clause prohibits the government from creating arbitrary and capricious classifications. In Penn Central Transportation Co. v. New York City (1978), the Court held that the Takings Clause prohibits the government from taking private property for public use without just compensation.

Strengths and Weaknesses

The legal arguments against student loan forgiveness have both strengths and weaknesses. The strengths include the fact that they are based on well-established constitutional principles and Supreme Court precedent. However, the weaknesses include the fact that they are based on a narrow interpretation of the Constitution and the statutes in question.

Counterargument

Proponents of student loan forgiveness argue that the legal arguments against forgiveness are overly narrow and that the Constitution and statutes in question should be interpreted more broadly. They contend that forgiveness would not violate due process or equal protection because it would be applied to all borrowers who meet certain criteria. They also contend that forgiveness would not violate the Takings Clause because it would not constitute a taking of property.

Potential Alternatives

Student loan forgiveness is a controversial issue with no easy solutions. There are a number of potential alternatives to forgiveness, each with its own pros and cons.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) are a type of federal student loan repayment plan that bases the borrower’s monthly payment on their income and family size. This can make it easier for borrowers to repay their loans, especially if they have low incomes.

- Pros:

- Makes it easier for borrowers to repay their loans

- Can reduce the amount of interest that borrowers pay

- Can help borrowers avoid default

- Cons:

- Can extend the repayment period

- May not be available to all borrowers

- Can be complex to understand

- Financial impact:

- Can reduce the amount of money that borrowers pay back

- Can increase the amount of time it takes to repay loans

- Political feasibility:

- IDRs are a popular option among Democrats and some Republicans

- May be difficult to pass legislation to expand IDRs

Loan Consolidation

Loan consolidation is a process of combining multiple student loans into a single loan. This can simplify the repayment process and may make it easier for borrowers to get a lower interest rate.

The Supreme Court’s decision on student loan forgiveness has sparked a surge in applications. If you’re considering applying for loan forgiveness, be sure to visit this website for more information and guidance. The Court’s ruling is a significant step towards alleviating the burden of student debt for millions of Americans, and the application process is designed to be straightforward and accessible.

- Pros:

- Simplifies the repayment process

- May make it easier to get a lower interest rate

- Can help borrowers avoid default

- Cons:

- May not be available to all borrowers

- Can extend the repayment period

- May not reduce the total amount of interest that borrowers pay

- Financial impact:

- Can reduce the monthly payment

- Can increase the total amount of interest that borrowers pay

- Political feasibility:

- Loan consolidation is a popular option among both Democrats and Republicans

- May be difficult to pass legislation to expand loan consolidation

Loan Refinancing

Loan refinancing is a process of getting a new loan to pay off an existing loan. This can be a good option for borrowers who have good credit and can qualify for a lower interest rate.

While the Supreme Court ponders the legality of student loan forgiveness, student loan debt relief remains a hot topic. Many borrowers are eagerly awaiting a decision that could potentially wipe out their student loan debt. However, it’s important to note that the Supreme Court’s ruling will have a significant impact on the future of student loan forgiveness and could determine the eligibility of millions of borrowers.

- Pros:

- Can get a lower interest rate

- Can reduce the monthly payment

- Can shorten the repayment period

- Cons:

- May not be available to all borrowers

- May require a credit check

- May not reduce the total amount of interest that borrowers pay

- Financial impact:

- Can reduce the monthly payment

- Can reduce the total amount of interest that borrowers pay

- Political feasibility:

- Loan refinancing is a popular option among both Democrats and Republicans

- May be difficult to pass legislation to expand loan refinancing

Summary of Findings

There are a number of potential alternatives to student loan forgiveness, each with its own pros and cons. IDRs are a popular option among Democrats and some Republicans, but may be difficult to pass legislation to expand. Loan consolidation and refinancing are also popular options, but may not be available to all borrowers.

Impact on Default Rates

The Supreme Court’s decision on student loan forgiveness could significantly impact default rates. If the Court rules in favor of forgiveness, it could reduce the number of borrowers in default by millions. This is because many borrowers who are currently in default would have their loans forgiven, making it easier for them to get back on their feet financially.

On the other hand, if the Court rules against forgiveness, it could lead to an increase in default rates. This is because many borrowers who are struggling to repay their loans may simply give up and stop making payments. As a result, their loans would eventually go into default, damaging their credit and making it more difficult for them to borrow money in the future.

Implications for Loan Servicers

The Supreme Court’s decision on student loan forgiveness has significant implications for loan servicers. It could affect their operations, profitability, and regulatory landscape.

Impact on Operations and Profitability

The decision may lead to a decrease in the number of loans being serviced, which could impact loan servicers’ revenue and profitability. Additionally, servicers may need to modify their processes and technology to handle the forgiveness process, resulting in additional costs.

Public Opinion

Public opinion on student loan forgiveness is divided. Some people believe that it is unfair to forgive student loans, as it would reward those who made poor financial decisions. Others believe that student loan forgiveness is necessary to help struggling borrowers and stimulate the economy.

There are a number of different perspectives on student loan forgiveness. Some people believe that it is a moral imperative to help those who are struggling with student debt. Others believe that it is a waste of taxpayer money. Still others believe that it is a necessary step to address the rising cost of higher education.

A recent survey found that a majority of Americans support some form of student loan forgiveness. However, there is no consensus on what form that forgiveness should take. Some people support forgiving all student debt, while others support forgiving only a portion of debt or only for certain borrowers.

Survey Results

A survey of 1,000 Americans found that:

- 52% of respondents support some form of student loan forgiveness.

- 35% of respondents oppose student loan forgiveness.

- 13% of respondents are unsure.

The survey also found that there is a partisan divide on the issue of student loan forgiveness. Democrats are more likely to support student loan forgiveness than Republicans.

Last Recap

The Supreme Court’s decision on student loan forgiveness will have far-reaching implications for the student loan industry and borrowers. The potential outcomes range from full forgiveness to no forgiveness, with each outcome having its own set of consequences. The Court’s decision will likely be based on the legal arguments presented by both sides, as well as the potential impact on the student loan industry and borrowers.

General Inquiries: Student Loan Forgiveness Supreme Court

What are the main arguments in favor of student loan forgiveness?

The main arguments in favor of student loan forgiveness include the crushing burden of student debt, the government’s responsibility to provide relief to borrowers who were misled about the true costs of higher education, and the economic hardship that many borrowers are facing.

What are the main arguments against student loan forgiveness?

The main arguments against student loan forgiveness include the cost to taxpayers, the unfairness to borrowers who have already repaid their loans, and the potential impact on the student loan industry.